StoneCo: Don’t Overthink – It’s A Fintech Growth Stock (NASDAQ:STNE)

Kutay Tanir

StoneCo Investors Suffered A Hammering

StoneCo Ltd. (NASDAQ:STNE) investors were stunned in March 2024 when the leading Brazilian fintech company released its fourth-quarter earnings report. This led to a steep plunge in STNE, notwithstanding its relatively attractive valuation. As a result, bearish sentiments threatened to force a steeper decline as STNE bears questioned its banking or fintech thesis. However, the fears have proved to be unfounded as buying sentiments have remained resilient, as dip-buyers returned aggressively and bought the initial selloff.

Accordingly, STNE found robust support at the $15 level, corroborating the support zone since STNE started consolidating at a similar level in December 2023. StoneCo’s recent earnings release led to investors’ concerns about its go-to-market strategy, as it faced softness in upselling its software solutions. In addition, unanticipated changes in StoneCo’s board likely added to the selling frenzy as investors reassessed whether it could lead to structural changes to its long-term model. In addition, a marked increase in StoneCo’s loan-loss provisions by 2.1x sequentially likely worried investors, as these provisions constituted 20% of its portfolio. Therefore, the market likely wanted more clarity from StoneCo management on whether the company’s increased focus on its core MSMB segment could lead to an unanticipated surge in risk levels.

I believe these concerns are justified. Investors need to assess whether STNE should be valued as a more “traditional” bank or a fintech provider leveraging cross-platform opportunities in lending, payments, and software solutions. StoneCo management emphasized its GTM remains focused on upselling customers in the MSMB space. However, it faced challenges in near-term growth momentum in its software segment. StoneCo emphasized that it encountered challenges attributed to a deceleration in enterprise growth and hyperinflation headwinds. In addition, StoneCo was impeded by less tepid uptake in “non-strategic verticals within the software segment.” As a result, the company will refocus its GTM into core verticals (including retail, gas stations, food, and drug stores). The company believes rechanneling its efforts through “integrated financial and software solutions” should unlock higher “client engagement and profitability.”

StoneCo Is A Fintech Growth Play

Therefore, investors should consider StoneCo’s cross-selling opportunities, supported by its banking services, and reach into potentially more lucrative growth vectors. With its increased focus on MSMBs, a higher loan-loss provision is a reasonable assumption as the company migrates “towards a risk-based approach throughout the year.” We shouldn’t fault the company’s prudence in its loss assumptions, considering the challenges faced by the MSMB businesses.

Moreover, StoneCo management accentuated its belief that the lower interest rate environment should help mitigate near-term profitability headwinds. Accordingly, the market environment remains uncertain as the Brazilian central bank looks to lower its policy rate through 2024. A more resilient economy could reduce the number of rate cuts as investors seek more clarity over the central bank’s decision through the end of H1. However, a more robust economy also helps support the MSMBs, as they are expected to be more vulnerable to unanticipated economic headwinds. As a result, I urge investors to reflect on a balanced approach when evaluating the impact of lesser rate cuts. It might not be as overwhelmingly bearish for STNE as bearish investors would like you to assume, as a more robust economy could also lift payment volumes more than the company guided.

As a reminder, StoneCo achieved a 20% increase in TPV for its MSMB segment for 2023. However, it anticipates a slowdown in 2024, projecting a rise of 18%. Therefore, it suggests that StoneCo has baked in challenges related to the uncertainties in the MSMB’s performance as it looks to rejuvenate growth momentum through cross-selling opportunities.

Is STNE Stock A Buy, Sell, Or Hold?

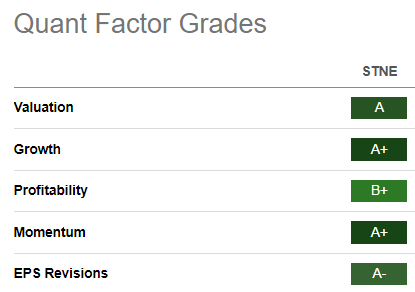

STNE Quant Grades (Seeking Alpha)

Notwithstanding the challenges highlighted earlier, STNE is still valued attractively with an “A” valuation grade, supported by a best-in-class “A+” growth grade. As a result, analysts remain confident in its platform opportunities. Hence, the valuation bifurcation suggests significant pessimism has been baked into STNE’s valuation, even as investors battle whether STNE should be valued as a bank or a fintech growth play.

With STNE consolidating well since it bottomed out in March, I’m increasingly confident its uptrend bias remains intact. As a result, I believe the opportunity to lift its rating is apt as we move past the recent fears.

Rating: Upgrade to Strong Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing, unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!