Successful use cases drive banks’ positive sentiment in Gen AI

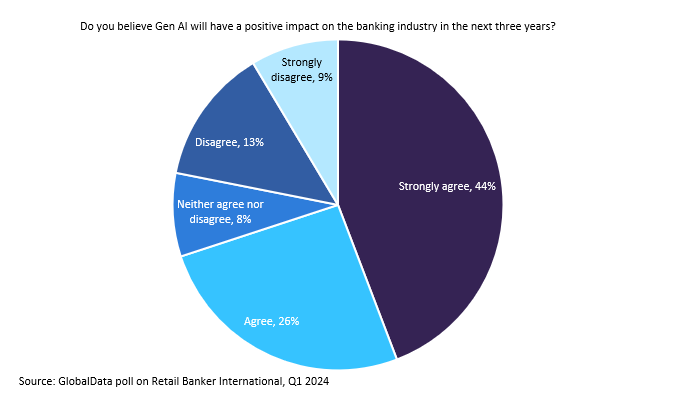

GlobalData finds that 70% of insiders believe that Generative AI will have a positive impact on the banking industry in the next three years. Having developed a greater understanding of AI since its rapid emergence over the past few years, banks are increasingly finding valuable use cases for the technology, most notably improving customer experiences and fraud detection.

Erica: assisted 42 million Bank of America customers since launch

Bank of America’s virtual financial assistance service, Erica, has seen considerable use since its launch in 2018. The service has recorded over 2 billion interactions, assisting 42 million customers. The first billion interactions took four years, but the second billion were achieved in just 18 months, indicating a significant increase in client engagement. Erica has handled over 800 million enquiries, providing personalised insights and guidance over 1.2 billion times. When further help is required, Erica can smoothly transition the client to additional support.

Cora: 10.5 million NatWest customer enquiries since roll out

In the UK, NatWest’s Cora is another example of AI being utilised in banking. By 2021, Cora had responded to over 10.5 million customer enquiries since its launch four years earlier. Cora currently engages in approximately 1.4 million conversations each month, providing customers with timely support and saving the bank significant time.

The chatbot is continually being improved to provide more personalised and transactional experiences for customers at different stages of their relationship with the bank. The automation of routine tasks, such as updating addresses, modifying business details, and cancelling cheques, is helping the bank to consistently meet customer expectations.

Banks and other financial institutions are looking to invest in Gen AI to aid their fraud prevention strategies. AI can be used to monitor banking transactions in real time and identify suspicious activities that may indicate fraud. This not only protects customers from financial loss, but also saves banks from the costs associated with fraud investigations and reimbursements.

Mastercard and Revolut tap Gen AI to boost customer security

Mastercard has launched Decision Intelligence Pro (DI Pro), a Gen AI consumer protection tool that determines transaction risk by assessing entity relationships. The platform will reportedly now harness an unparalleled volume of 1 trillion data points to accurately predict the likelihood of transaction authenticity or falsity in real time. Furthermore, neobank Revolut has announced the launch of an AI-based advanced scam detection feature to help protect its customers from malicious card scams. In case of potential scams, customers are guided through an intervention process within the Revolut app.

Banks investing in Gen AI are poised to perform strongly in the future as this technology continues to drive change in the industry. The success stories of Bank of America’s Erica and NatWest’s Cora demonstrate the significant impact that Gen AI can have on customer engagement and operational efficiency. Moreover, the use of AI in fraud prevention, as seen with Mastercard and Revolut, showcases the potential for enhanced security and cost savings for financial institutions. As more people gain confidence in Gen AI, we can expect to see continued investment and innovation in AI technologies within the banking sector, ultimately leading to a more seamless and personalised banking experience for customers.

Harry Swain is an analyst, banking and payments, GlobalData

“Successful use cases drive banks’ positive sentiment in Gen AI” was originally created and published by Retail Banker International, a GlobalData owned brand.

The information on this site has been included in good faith for general informational purposes only. It is not intended to amount to advice on which you should rely, and we give no representation, warranty or guarantee, whether express or implied as to its accuracy or completeness. You must obtain professional or specialist advice before taking, or refraining from, any action on the basis of the content on our site.