Supporting compliance and focusing on data analysis – The audit plan of the Hungarian Tax Authority has been published for 2024

This year, tax audits will be focusing on the following:

- differentiated action,

- monitoring to reduce budgetary risks,

- examining discrepancies found in the database,

- auditing large taxpayers with the highest tax capacity, and

- audits related to customs and aliens policing.

Differentiated action

Aligned with the level of compliance, differentiated action means that, on the one hand, the HTA will support prudent taxpayers, while on the other, it will take stricter steps against fraudulent taxpayers.

During legal compliance checks, taxpayers who mostly show law-abiding behaviour but unintentionally make less significant mistakes, can receive support from the HTA to improve the way they meet their obligations. They will also receive support in navigating the constantly changing legal environment. At the same time, the HTA will take stricter and immediate action against taxpayers who cause damage to the state budget by intentionally circumventing the applicable legislation.

In this regard, the monitoring of business partners will play an important role this year since taxpayers also have a fundamental interest in filtering out untrustworthy business partners against whom the HTA will take stricter action due to their fraudulent behaviour.

Monitoring to reduce budgetary risks

Audits are expected to be concluded in many different fields of business in 2024, based on the HTA’s risk analysis and experience. This includes sectors that have already been under scrutiny by the HTA in the recent years, such as e-commerce, tourism, construction, and the food industry. This year new activities will also be on the HTA’s audit list, including:

- internet-based content delivery,

- events organization,

- cleaning services,

- • personal and property protection, and

- • beauty industry services.

In addition to industry specifics, taxpayers may also appear on the HTA’s radar due to other business circumstances, for example:

- newly established businesses that issues a large number of invoices, or in a high amount;

- businesses showing a significant increase in turnover within a short period of time, while differences arise in the available control data;

- businesses that have a small number of employees but achieve a significant growth in turnover (or vice versa).

Examining discrepancies found in the database

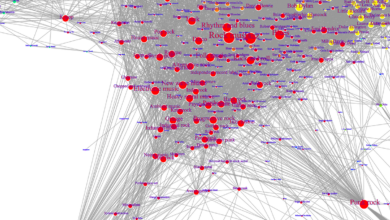

In recent years, the HTA has significantly broadened the scope of data reporting. As a result, it has by now acquired an extensive database which it can use to conduct comprehensive compliance checks and complex data analyses.

During its risk analysis, the HTA carries out sophisticated and detailed procedures using already functioning algorithms and artificial intelligence to examine discrepancies between the invoice data reported online and the data shown in VAT returns. The HTA mainly relies on available data assets, so in 2024 it will place special emphasis on warning and notifying taxpayers that they need to improve the quality of their reporting.

Differences can be identified between the invoice data reported online by taxpayer and the data shown in the VAT returns. This can be due to various reasons. The HTA’s main aim is to detect and resolve discrepancies. It is important to improve the quality of data reporting not only to strengthen taxpayers’ legal compliance, but also with a view to the newly introduced “eÁfa” system. Similarly to the risk analysis conducted by the HTA, the eÁfa system also relies on the available database. To achieve the desired purpose of the eÁfa system’s web-based interface, i.e. to simplify the preparation of VAT returns, it is therefore essential to provide accurate and high-quality data.

Auditing large taxpayers with the highest tax capacity

Auditing large taxpayers has been particularly important in previous years, and it will be so this year as well. Within the operation of related parties, the HTA will place emphasis on intercompany transactions, accurate data provision in transfer pricing, and decisions relating to determining the fair market value and the related conditions.

In addition to the above, businesses that employ a large number of employees under the Employee Stock Ownership Plan (“ESOP”) can also expect inspections this year. The audits will mainly focus on the legal grounds for the payments provided under ESOP, and on whether payments are consistent with the remuneration policy of the inspected business and the relevant legislation.

Audits related to customs and aliens policing

This year customs audits will mainly focus on e-commerce, intellectual property rights, goods entering and leaving the customs territory of the EU, and legal titles financed from the European Agricultural Guarantee Fund (EAGF). In 2024, in addition to the inspection of metal trade and the carriage of goods and passengers by road, which were already important last year, police audits will also aim to curb the trade of illegal products and include the inspection of petrol filling stations and operators engaged in retail trade.

Based on this year’s plan, it can be established that in 2024 the HTA will focus on auditing high-risk areas, promoting compliance, and differentiating between the types of audits carried out. In addition, the HTA’s database will also play an increasingly important role, as the HTA will pay special attention to analysing and examining taxpayer data, also in view of the recently introduced eÁfa system.