Tech Giants Lead Q1 2024 Market Surge; Fintech Maintains Momentum – Fintech Schweiz Digital Finance News

In Q1 2024, public markets surged, led by tech giants, while the fintech sector maintained its momentum, a new report by London-based corporate finance advisory Royal Park Partners shows.

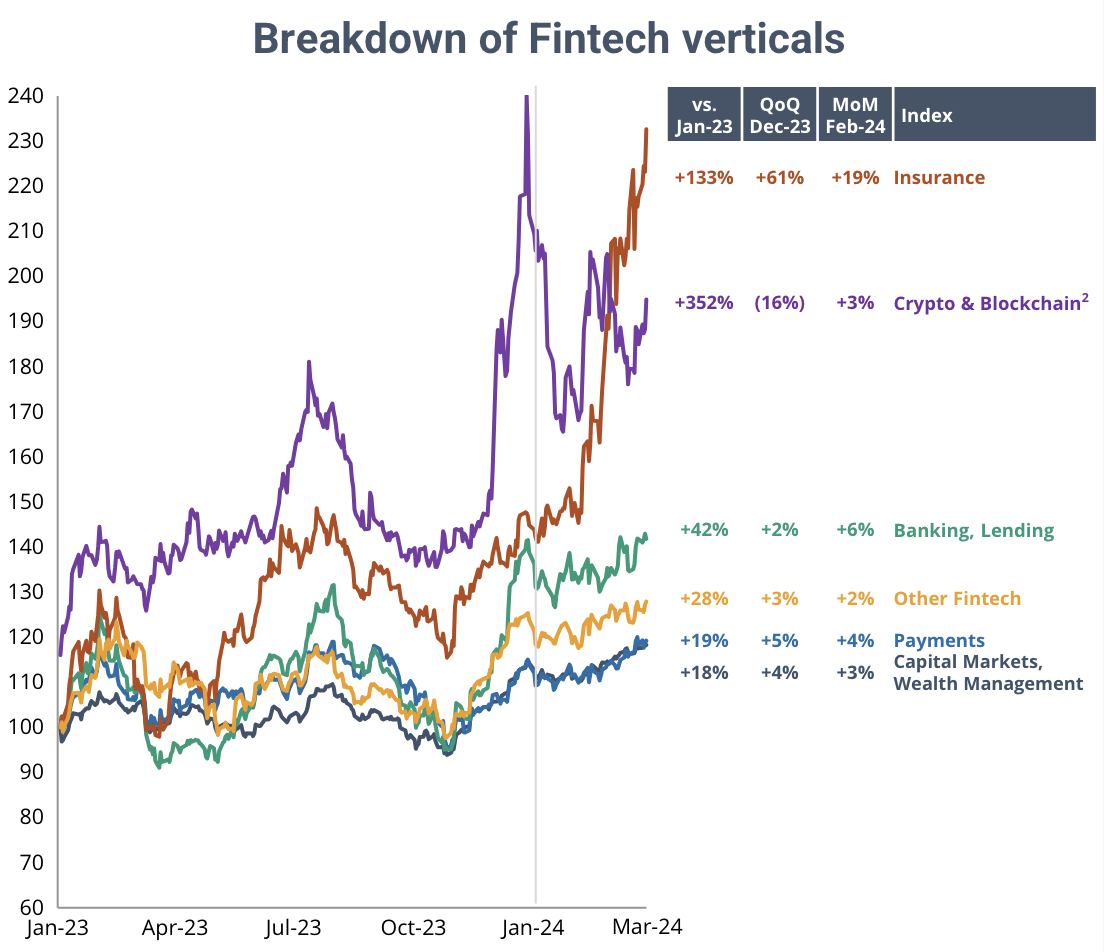

The report highlights that Royal Park Partners’ RRP Fintech Index, which tracks the performance of key fintech verticals, saw a 4% increase from its December 2023 value, a sustained growth which highlights the continued strength and expansion of the fintech sector, the report says.

Across the fintech verticals covered by the RPP Fintech Index, insurtech recorded the strongest growth, rising by a remarkable 61% quarter-on-quarter (QoQ). The rise of the insurtech index was largely driven by Root Insurance’s strong performances, with its stock price soaring approximately fivefold following the release of its “best-ever” Q4 results.

Payments and capital markets witnessed more moderate growth at 5% and 4%, respectively, while the cryptocurrency and blockchain sector tumbled 16% QoQ. However, the crypto and blockchain vertical rebounded in the first months of 2024 and added 3% after the launch of the first spot bitcoin exchange-traded funds (ETFs) garnered substantial market momentum.

Breakdown of fintech verticals, Source: Q1 2024 Quarterly Fintech Market Update, Royal Park Partners, Apr 2024

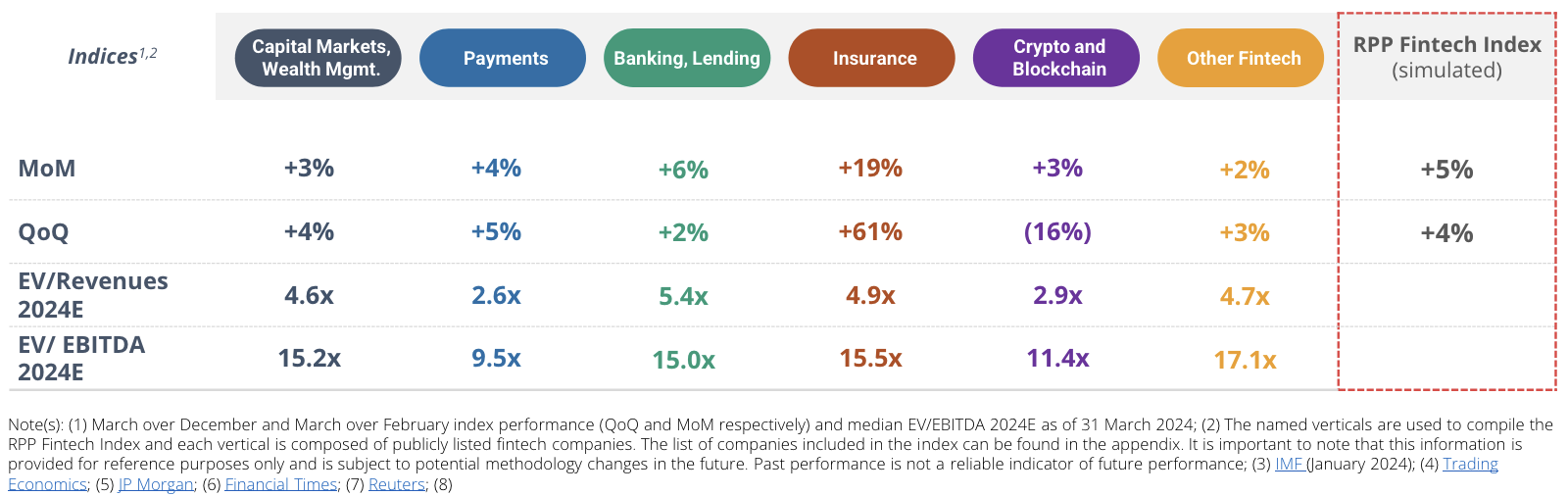

Looking at key stock valuation measurement metrics, data show that payments recorded the lowest enterprise value-to-revenue (EV/R) and enterprise value to earnings before interest, taxes, depreciation, and amortization (EV/EBITDA) multiples, standing at 2.6x and 9.5x, respectively. This makes payments the fairest priced and healthiest cohort of the verticals studied for Q1 2024.

EV/R and EV/EBITDA are two popular valuation tools that help determine if a stock is adequately priced. EV/R only considers the top line, focusing on a company’s revenue-generating ability, while EV/EBITDA, on the other hand, takes into account operating expenses and taxes, helping thus determine a company’s ability to generate operating cash flows.

Performances of the RPP Fintech Index and its indices, Source: Q1 2024 Quarterly Fintech Market Update, Royal Park Partners, Apr 2024

Private fintech funding

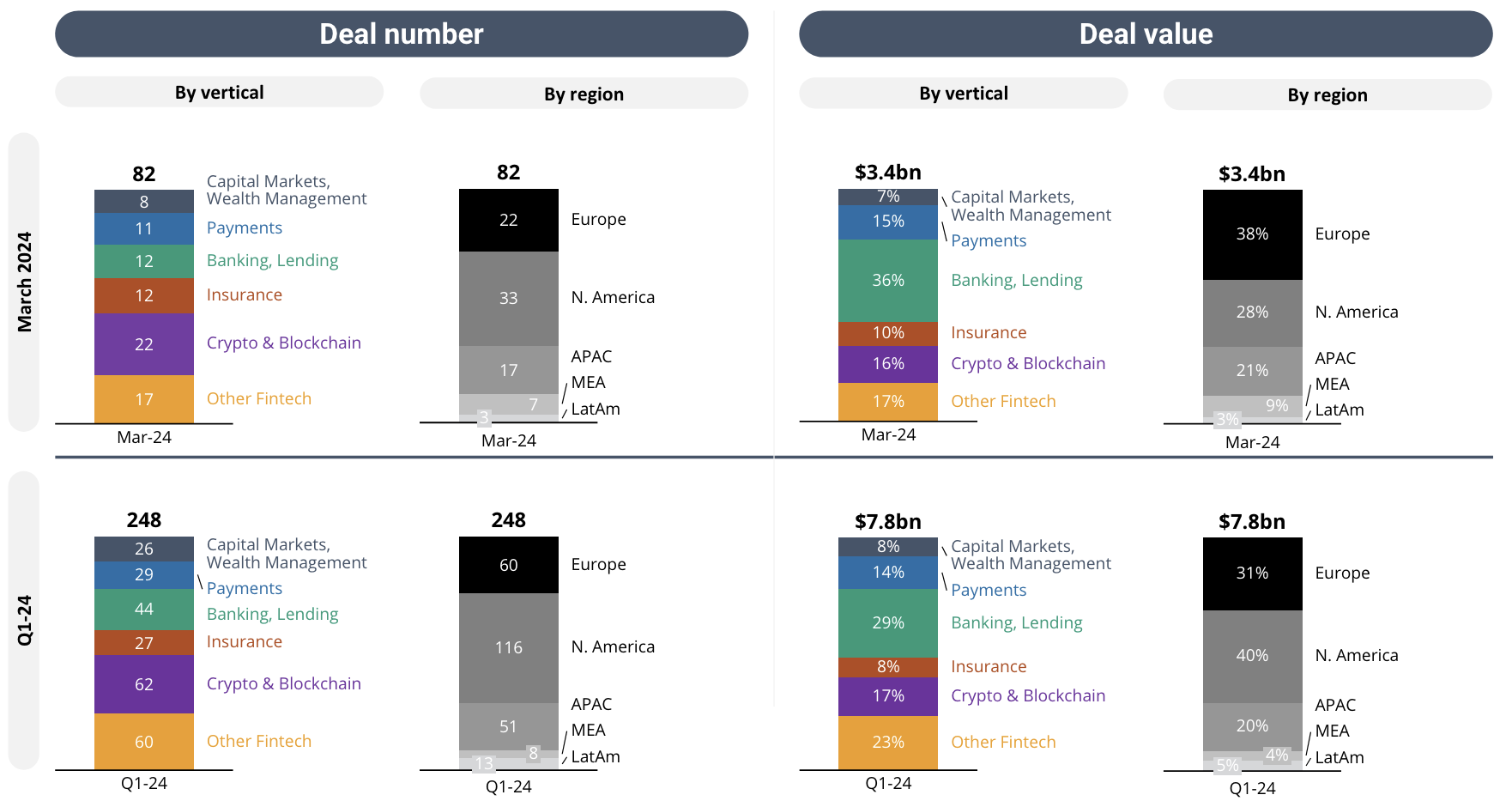

Private funding to fintech companies experienced a downturn in Q1 2024, with total capital deployed falling 45% QoQ while deal count dropped 10%. In total, US$7.8 billion were raised through 248 rounds in Q1 2024, a far cry from the US$14.1 billion closed across 276 deals in Q4 2023.

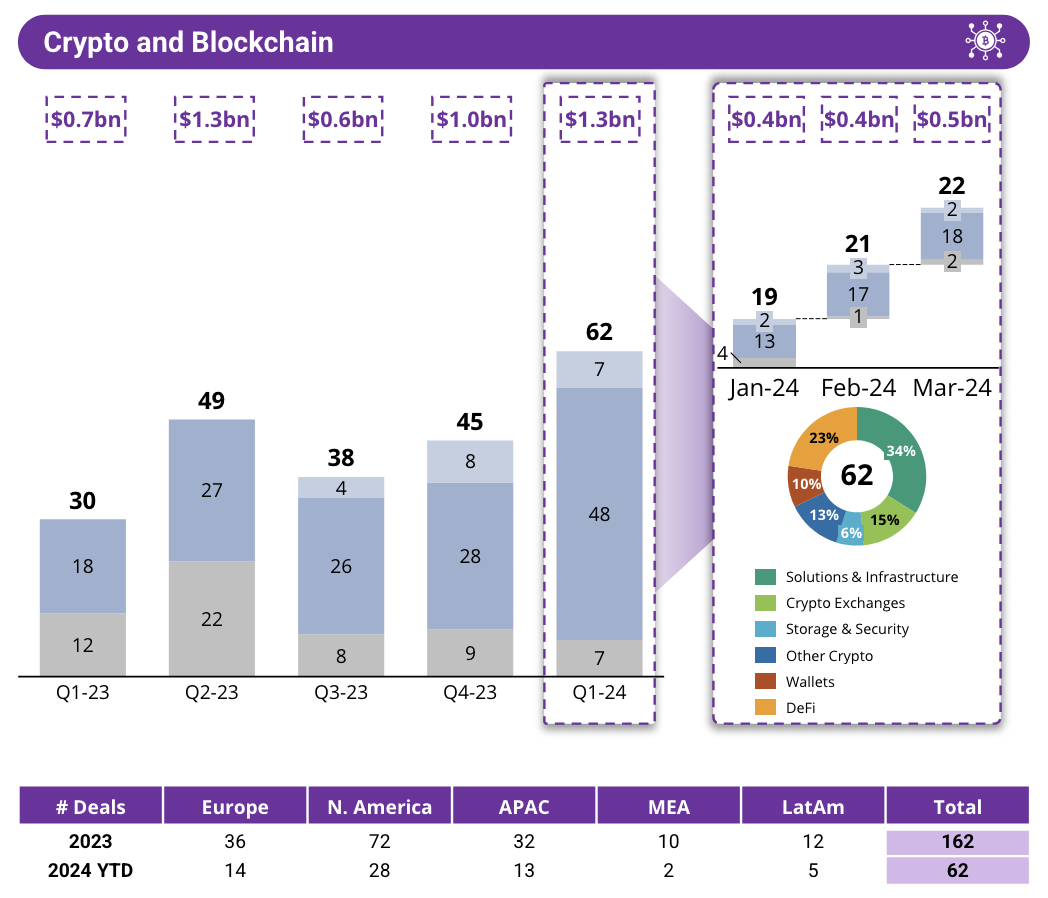

The crypto and blockchain vertical was a significant funding recipient, attracting 25% of all the funding rounds of Q1 2024. A total of US$1.3 billion was secured across 62 deals by companies in the sector during the quarter, representing a 30%+ QoQ increase in both deal count and value.

Crypto and blockchain financing activity, Source: Q1 2024 Quarterly Fintech Market Update, Royal Park Partners, Apr 2024

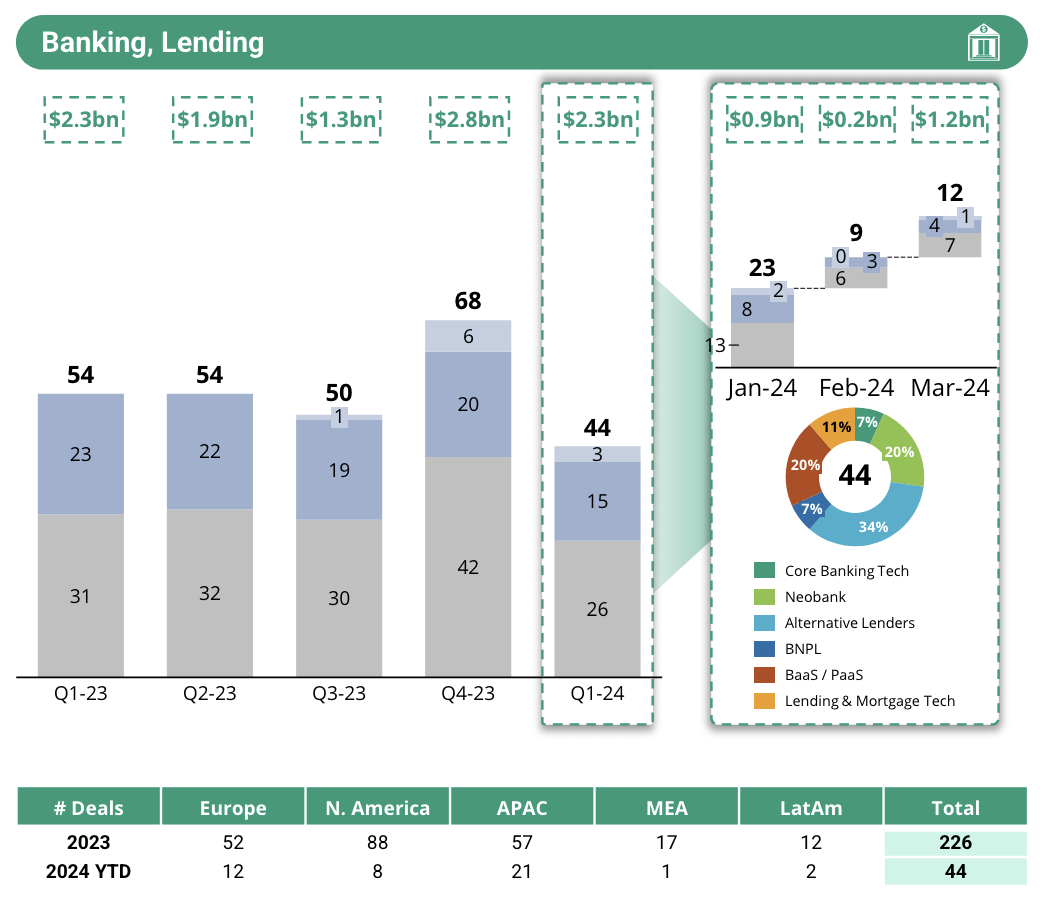

In terms of total funding value, banking and lending represented 29% of fintech funding in Q1 2024, underscoring several large mega-rounds of US$100 million and up, including Monzo (US$430 million), Svatantra (US$230 million), SK Finance (US$160 million) and Flagstone (US$139 million). Banking and lending startups raised a total of US$2.3 billion through 44 rounds, representing a 18% and a 35% QoQ decline in funding value and deal count, respectively.

Banking and lending financing activity, Source: Q1 2024 Quarterly Fintech Market Update, Royal Park Partners, Apr 2024

Geographically, North America remained the dominant region in fintech funding, receiving 40% of total invested capital in Q1 2024, followed by Europe with approximately 31%.

Private fintech funding in Q1 2024, Source: Q1 2024 Quarterly Fintech Market Update, Royal Park Partners, Apr 2024

Fintech M&A

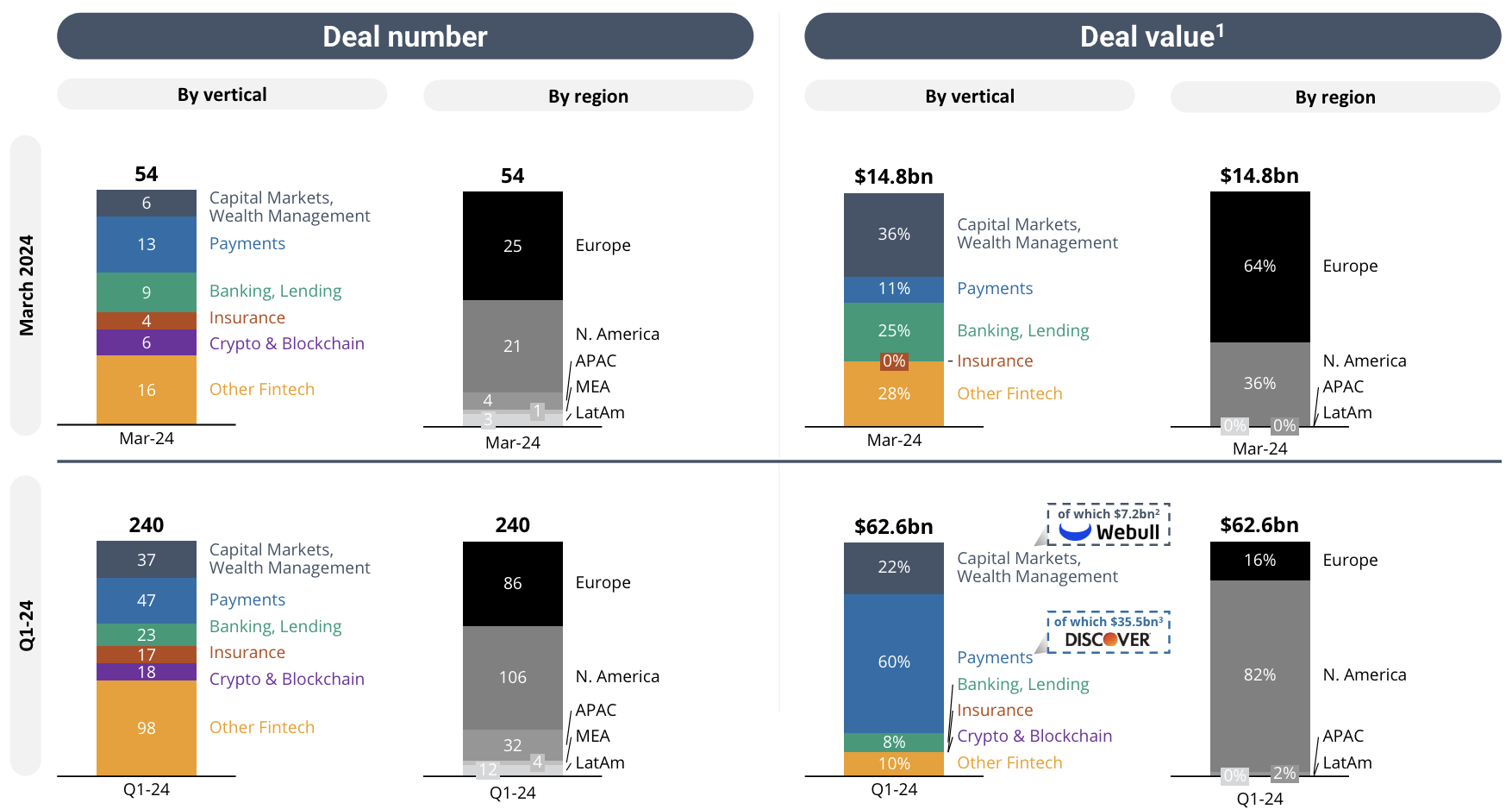

In Q1 2024, mergers and acquisitions (M&A) activity remained dynamic, totaling US$62.6 billion through 240 deals. Payment and capital markets/wealth management led the sector, accounting for a staggering 82% of total M&A transaction value.

Notable deals in Q1 2024 include Capital One’s landmark US$35.3 billion acquisition of Discover Financial Services, a deal which signaled a trend within the payments sector with companies consolidating to streamline operations and sharpen core business focus. Another notable deal in Q1 2024 is the US$7.2 billion merger of digital investment platform Webull with SK Growth Opportunities Corporation, a publicly traded special purpose acquisition company.

Like for private financing, North America led M&A transactions in Q1 2024, making up 44% of total M&A fintech deals and 82% of M&A deal value. Europe followed closely, accounting for 36% of M&A deals and 16% of M&A deal value.

Fintech M&A transactions in Q1 2024, Source: Q1 2024 Quarterly Fintech Market Update, Royal Park Partners, Apr 2024

The quarterly funding decline in the fintech sector reflects a continued downward trend observed in the global fintech funding landscape in 2022 and 2023 amid economic uncertainties, soaring inflation and a looming global recession.

However, some venture capital (VC) firms are optimistic about a rebound in 2024. Bukie Adebo Umeano, an investment principal at global investment firm Anthemis, told the Financial Brand in a recent interview that enough uncertainty has settled, and that VC firms are becoming more enthusiastic about investing. She anticipates an increase in deal activity, especially in embedded finance and pure play fintech.

Chuckie Reddy, a partner at American fintech VC platform QED Investors, told the publication that while deal activity may be more measured, the quality of deals has improved. He expects to make more investments in 2024 compared to the previous year, provided there are no major geopolitical events.

The equity market accelerated its growth in Q1 2024, with the S&P 500 and NASDAQ rising 11% and 9%, respectively. This surge was driven by strong QoQ performances from five of the so-called “Magnificent 7” tech giants. Nvidia rose by a staggering 82%, while Meta, Microsoft and Alphabet recorded a notable 37%, 12% and 8% increase, respectively, the Royal Park Partners report shows.

Featured image credit: edited from freepik