Telecom M&A: Here Are the Latest Deal Trends Worldwide

Facing unprecedented industry transformation and emerging competitive threats, many telecommunications companies are turning to mergers and acquisitions to add new capabilities and evolve their businesses for the next era. At the same time, in the biggest industry reset since deregulation, the integrated telco is giving way to more disaggregated, narrowly focused business models. We’re tracking telecom M&A activity around the world, and we’ll publish the latest developments in this dashboard each quarter.

With this installment, we’ve updated our deal methodology to make a clearer distinction between telecommunications and the closely related digital infrastructure sector, which resulted in some adjustments to historical data.

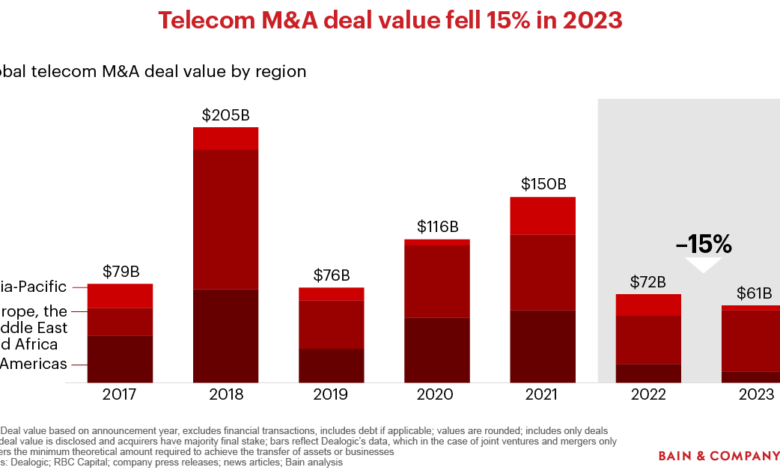

Here are some of the key takeaways through the end of 2023:

- Deal value down: Global telecom M&A activity continued to slow, reaching just $61 billion in deal value last year, down 15% from 2022 (see Figure 1). A small number of deals in Europe, the Middle East, and Africa accounted for the majority of activity. Although value was up on a quarterly basis, a single deal—Telecom Italia’s (TIM) $23.3 billion agreement to sell its fixed network business (the so-called “NetCo”) to KKR—accounted for two-thirds of the fourth quarter’s value. The decline in deal value over the past two years can be attributed to persistently high interest rates, growing pressure on telcos with high debt levels, and (in some regions) increased capital spending on 5G and fiber network rollouts.

- Divestitures dominate: Telcos continued to divest assets to shore up their balance sheets. Mobile and fixed divestments made up about 51% of global deal value in 2023, while infrastructure divestments accounted for about 13% of deal value (see Figure 2). In some markets such as Italy, divestment activity has moved beyond tower infrastructure to include fiber and network management (see the TIM-KKR deal).

- Biggest deal: The year’s largest announced deal was TIM’s agreement to sell its fixed-line assets to investment firm KKR. The deal, which hasn’t closed, would help TIM reduce debt and is part of the telco’s delayering strategy.

- Long-term view: In-country scale deals account for about 36% of all deal value since 2017, the largest share among deal types (see Figure 3). Infrastructure divestments have the second-largest share at 27% during that period.

Subscribe

Bain’s Quarterly Global Telecom M&A Insights

Subscribe to receive our Telecom M&A Deals interactive and other telco insights in your inbox each quarter.

M&A Report 2024

Telecommunications M&A

High inflation, regulatory uncertainty, and buyer-seller valuation gaps dampened telecom deals last year.