Tesla Impact Report: Everything That’s Going On at Elon Musk’s Company

Despite the many setbacks in 2024, Tesla continues to be a lighthouse of sustainability in the automotive industry. However, the slowing demand for electric vehicles and high inflation put immense pressure on its operation. Tesla is more than just electric vehicles, so here’s everything happening in its many lines of business.

Many blamed this situation on Elon Musk becoming increasingly distracted after he bought Twitter in 2022. Musk completed the acquisition in October 2022, with effects on Tesla operations already visible by the year’s end. The EV maker fought this with massive price cuts in January 2023, followed by more price cuts. The move appeared to have changed customers’ sentiments, allowing Tesla to end the year en fanfare.

However, Tesla was already aware of the rough waters ahead, which is why it offered no guidance for the 2024 production. More than that, for the first time, Tesla had more production capacity (around 2.35 million vehicles) than it could sell (analysts estimate 2024 delivery numbers to be lower than 1.8 million). In January, Elon Musk told analysts and investors that Tesla is “between two major growth phases,” which is another way of describing a difficult situation.

The second growth phase Musk was talking about was supposed to start with the launch of Tesla’s next-generation EVs, an affordable compact model priced at about $25,000. However, this is now in doubt, as Tesla no longer sees electric vehicle production as its main goal. Instead, it’s now pursuing autonomous driving, with Musk believing this might be solved by the end of 2024. At the very best, this means that Tesla will have to wait a lot more before the next growth phase becomes visible.

The change in strategy was followed by a massive layoff campaign, with rumors indicating that Tesla wants to trim up to 20% of its workforce. The move was ill-prepared, causing friction within Tesla, especially after Musk disbanded entire departments because their leaders would not fire enough employees. The most famous was the Supercharger team, which disappeared along with its chief, Rebecca Tinucci. This caused all future projects to be canceled while ongoing projects ground to a halt.

As it prepares for the Annual Shareholder Meeting next month, Tesla released the 2023 Impact Report explaining the steps it took on the road to sustainability. Unlike previous years, Tesla has left out the objective of producing 20 million EVs by 2030, which was announced in 2020. While many argued that the Impact Report is not the place for forward-looking statements, it’s telling that this is the first time Tesla has omitted the EV sales target.

This reflects a change in strategy that Tesla has yet to acknowledge, but it’s visible in every sector where the company operates. Tesla is moving away from manufacturing and bets everything on artificial intelligence and autonomous driving, with a robotaxi replacing the long-awaited $25,000 EV. In light of this tectonic shift, it’s worth revisiting what’s happening at Tesla in 2024.

Tesla EVs are still leading the market

Despite the recent change of direction, Tesla still makes the bulk of its money from selling electric vehicles. This will not change soon, even though the EV adoption rate slowed in the past year. Electric vehicles are the best bet against climate change, considering that Tesla EV’s lifetime emissions are lower than those of a comparable ICE vehicle after only three years of driving. The more they are driven, the larger the gap is, with the average Tesla avoiding about 51 tons of CO2 after 17 years, the average life of a vehicle in the US.

However, the most important step toward decarbonization is electrifying heavy-duty trucks. Although Tesla claims this is critical to its mission, the Semi production facility in Nevada is only planned to start operations in 2026. Combination trucks only account for 1.1% of the US vehicle fleet, but they are responsible for more than 16% of the US vehicle emissions.

The 2023 Impact Report emphasizes that Tesla’s best-selling EV, the Model Y, is also the most efficient electric SUV on the market, at 3.8 EPA miles per kWh. The Tesla Model Y is also one of the most affordable in its segment, with the price for the Long Range AWD model ($44,990) starting below the average new vehicle price in the US ($47,244). It also has some of the lowest operating costs.

The report also talks about the industry-leading safety features of Tesla EVs, which make them some of the safest vehicles on the road. Tesla has illustrated this with accolades from many safety agencies around the world. It also offered the Autopilot safety data showing the Tesla EVs using the carmaker’s driver assistance systems are more than eight times safer than the average US vehicle.

Tesla’s batteries are designed to outlast the vehicle

Although Tesla sold millions of EVs, only an insignificant percentage needed a battery replacement. Tesla designs its batteries to far outlast the vehicle they power. Battery reliability is an important sustainability factor, considering that producing the battery pack releases about six metric tons of greenhouse gas (GHG) emissions into the atmosphere.

Tesla’s data shows that battery degradation over time is minimal, with the Model 3 and Model Y’s batteries losing just 15% of their capacity on average after 200,000 miles (322,000 km). The Model S and Model X fare even better, losing only 12% of their capacity after 200,000 miles. Statistics show that a vehicle gets scrapped after approximately 200,000 miles of usage in the US and roughly 150,000 miles (241,000 km) in Europe.

Tesla also tracks the GHG emissions and human rights data throughout its battery supply chain. The EV maker was among the first companies to introduce a battery passport to enable digital traceability of critical materials. The best part is that EV batteries can be recycled at the end of their lives, with more than 90% of the materials recovered. In 2023, Tesla recovered 2,431 metric tons of nickel, 117 tons of cobalt, 860 tons of copper, and 329 tons of lithium in its recycling facility in Austin, Texas.

Tesla Gigafactories have the least water usage per vehicle

Tesla is a manufacturing powerhouse, although, sadly, this is another area where it takes a step back. The carmaker was working on a revolutionary manufacturing process called “unboxed vehicle.” This would’ve allowed Tesla to halve manufacturing costs compared to the Gen-2 vehicles (Model 3 and Model Y). However, Elon Musk changed his mind, and the new factories using the unboxed process are no longer a priority until the robotaxi enters production.

The latest rumors indicate that Tesla will not build other production facilities because the existing ones are already underutilized. The $25,000 EV, which should’ve used the more efficient manufacturing process, has been scrapped. Instead, Tesla plans to merge some Gen-3 features into the Gen-2 architecture and produce new vehicles on existing production lines. This is not necessarily bad, as it might help accelerate new vehicle development. However, it would not allow Tesla to harvest all the efficiency and cost benefits of the new architecture.

Tesla still operates the most efficient car factories in the world in Shanghai (China), Berlin (Germany), and Austin, Texas. At Gigafactory Texas, Tesla uses highly efficient, insulated, low-emissivity windows to reduce building heating and cooling demand. The incorporation of waste heat recovery from compressors alone could offset over 1 MWh of natural gas consumption for process heating. Gigafactory Shanghai uses 35% less energy per vehicle than Fremont Factory, and Giga Berlin and Giga Austin will further improve on this efficiency.

Solar panels provide the bulk of electricity across Tesla’s gigafactories, with 46,500 kWh of solar capacity installed. In addition to onsite renewable electricity, Tesla also buys electricity directly from a mix of renewable energy projects on the grids where it operates. According to the 2023 Impact Report, Tesla secured almost 140 MWh of clean energy generation capacity, with a majority coming online between 2023 and 2024.

However, considering how water-thirsty car factories are, the most important advancement is in water usage. Tesla uses creative techniques to minimize water usage across its gigafactories. It’s now averaging less than 2.5 cubic meters of water per vehicle, compared to the industry average of 3.37 cubic meters. Tesla uses rainwater and condensates from the air to save a combined 28 million gallons of water per year.

Tesla also recycles water used in the manufacturing process, which has the potential to save about 150 million gallons of water per year when fully deployed. This allowed it to consume only 0.45 million cubic meters of water per year at Giga Berlin, from the 1.4 million cubic meters contracted allowance in 2023. In the future, Tesla will launch an industrial water recovery and recycling plant at Giga Berlin to recycle up to 100% of the factory process wastewater.

Tesla Supercharger network’s past and future

The Supercharger network is one of Tesla’s most valuable assets, but that didn’t matter when Elon Musk decided to behead the department and fire everyone. Later, he said that Tesla would continue expanding the network, although at a much slower rate. Hopefully, he will come to his senses because Superchargers are essential to EV operations.

Tesla’s fast charging network procures 100% of the electricity from renewable sources, either onsite resources or annual renewable electricity matching. Although some third-party networks have the edge on power and voltage, thanks to providing 800-volt charging, Tesla is no slouch either. Tesla claims its V3 and V4 stalls can recover up to 200 miles of range in 15 minutes of charging, depending on the model and battery type.

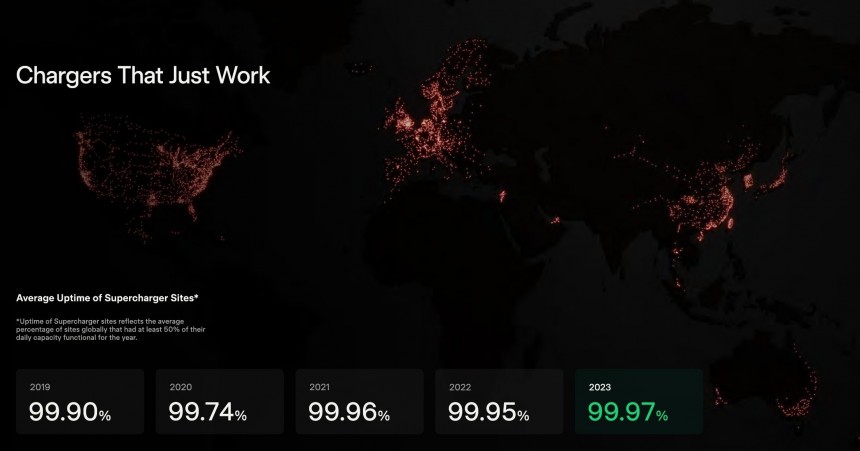

However, the most important quality Superchargers offer is reliability. Tesla claims almost 100% uptime, with 99.97% in 2023. However, the way it calculates the uptime rate has been harshly criticized. According to a slide in the 2023 Impact Report, the uptime of Superchargers sites reflects “the average percentage of sites globally that had at least 50% of their daily capacity functional for the year.” This casts an undeserved shadow on the legendary Supercharger’s reliability.

Tesla Energy is the EV maker’s most underrated asset

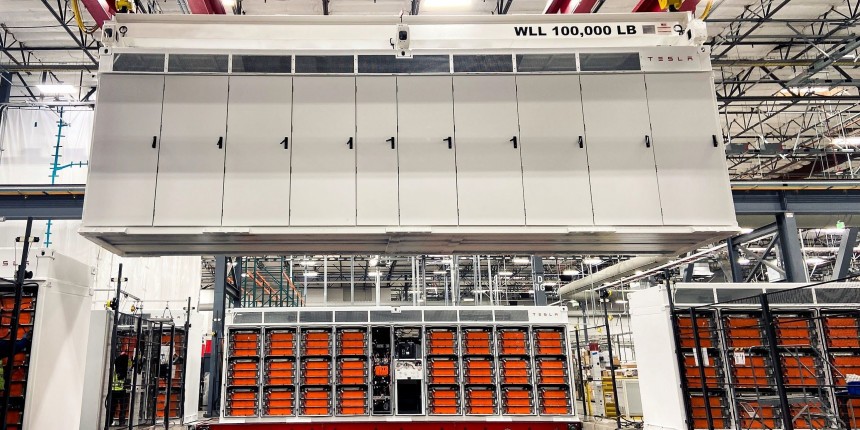

Tesla designed and manufactured a fully integrated ecosystem for energy and transportation, and its Energy division is among the most important pillars of the company, next to the EV division. Both have lithium-ion batteries as the foundation store, but the Energy division aims higher. It comprises both house storage batteries (Powerwall) and grid-level storage (Megapack), alongside solar panels.

The solar business is significant, as owners of Tesla solar systems generated enough zero-emissions electricity to cover three times the electricity needs of all Tesla locations. These include manufacturing, support, research, sales, service, and delivery locations. However, solar systems only reach their full potential when coupled with energy storage systems, and Tesla is one of the most important players in the field. This is why many solar and wind generation projects around the world rely on Tesla Megapack battery storage systems.

A single Megapack XL battery has almost 4 MWh worth of energy storage capacity, and given its scalability, it enables projects over 1,000 MWh. The demand for such systems is through the roof, which is why Tesla built a new production facility (Megafactory) in Shanghai, capable of producing 40,000 MWh of energy storage per year. Tesla is working with its customers on projects upwards of 3,000 MWh and expects total deployments in 2024 to grow by at least 75% compared to 2023.

However, Tesla’s most valued expertise is in software, and its Energy products are no exception. Its real-time trading platform for grid-scale battery storage, called Autobidder, uses artificial intelligence to maximize profits for the operators. Tesla Autobidder knows when to store energy (buy) and when to sell it back to the grid, which has generated more than $350 million in revenue for Tesla and its customers since 2017 when it was launched.