The ambitions of China’s BYD stretch well beyond electric vehicles

Upon arriving at the palatial entrance of BYD’s hexagon-shaped headquarters in Pingshan, on the outskirts of Shenzhen, a giant screen presents visitors with a question of biblical proportions: “Where is Noah’s ark that saved mankind?”

The answer, given the query’s prominence at the doorway to a company whose rapid expansion is sending shivers through the boardrooms of automakers worldwide, appears to be: “right here”.

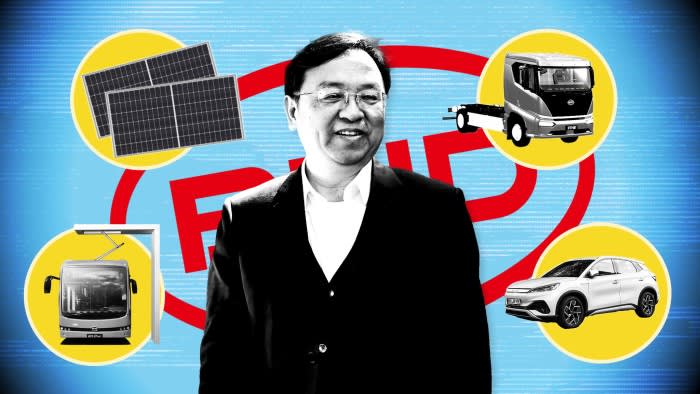

BYD and its 58-year-old founder Wang Chuanfu have reason to feel confident. The Chinese company now rivals Elon Musk’s Tesla for the world’s most dominant EV company. In China, by far the biggest auto market, BYD’s low-cost pure battery and plug-in hybrids account for about one-third of all new electric vehicles sold.

But the ambition of BYD goes far beyond cars — and China’s borders. As the world tries to ditch fossil fuels, the company has positioned itself as a manufacturing powerhouse across a suite of green technologies.

This ranges from its flagship lithium batteries, solar modules, electric-powered buses, trucks and trains to complex artificial intelligence and software used to control and connect transport and power systems.

“I don’t think people realise BYD’s greater ambition is to be an energy ecosystem company,” says Bridget McCarthy, the head of China operations at Snow Bull Capital, a Shenzhen-based hedge fund invested in BYD.

Selling passenger vehicles is just the first step, she adds. “They’re trying to say: ‘we’ll electrify your fleets of commercial vehicles, we’ll give you the energy storage, we’ll give you solar so you can generate electricity’.”

BYD was founded in 1995 by Wang, a former metallurgy professor, and initially focused on small lithium batteries used in early cell phones, supplying Motorola and Nokia. It then pivoted to cleantech in the early 2000s, producing bigger batteries as well as electric cars and buses.

Wang’s strategic bet — that demand for green technologies would boom — has aligned neatly with Beijing’s efforts to eradicate pollution, cut dependence on foreign oil and, more recently under President Xi Jinping, decarbonise the world’s second-biggest economy. The company last year had revenue of Rmb602.3bn ($83.2bn) from sales of just over 3mn vehicles, marking a fivefold increase from Rmb121.8bn in 2018.

BYD’s rapid growth has been an important part of China’s rise as the world’s cleantech superpower. Chinese companies dominate the supply chains for resources, manufacturing and technologies crucial for electric vehicles and batteries as well as wind and solar energy.

The company’s vertically integrated structure, economies of scale and ballooning research and development plans mark a stark challenge to companies in the west, analysts say.

Its rise, however, comes at a time of international scrutiny of Chinese industry, as well as security concerns over China’s technological and supply chain supremacy. These concerns, as well as intensifying competition, raise questions over the company’s next phase.

Still, Wang, who is one of China’s richest men, in March told analysts that BYD, which declined interview requests, sees opportunities across south-east Asia, South America, the Middle East and Europe and confirmed the company’s plan to expand its manufacturing operations in those markets. BYD has vowed to “go global”.

“Our country has established a new industrial development advantage, in the process of promoting peak carbon and carbon neutrality,” Wang said in a speech in Beijing in March, adding that China has “built up a complete industrial chain with great resilience and competitiveness”.

But “becoming a multinational on a very compressed timeline” will not be simple, says Ilaria Mazzocco, an expert on Chinese industry with the Center for Strategic and International Studies, a US think-tank. Transforming a handful of bus factories internationally into a global network of EV factories will be a “big challenge”, she adds. “It is a rapid expansion for a company that’s been very ambitious.”

A century ago, Henry Ford reshaped how people travelled by bringing automobiles to the mass market. BYD’s Wang is following in his footsteps.

Like Ford — who amassed an empire of iron and coal mines and steel foundries to control his supply chain — Wang is “democratising” electric vehicles and the batteries they rely on via a vertically integrated business model and a relentless focus on technology, says Bill Russo, the former head of Chrysler’s China business. “The main bottleneck to commercialisation of the electric vehicle was its price relative to its predecessor,” he adds. “Affordability wins.”

The company’s advantage in batteries is not the result of one breakthrough, but the accumulation of a series of competitive strengths it has built up over two decades in access to resources, sustained investment in R&D and manufacturing economies of scale.

BYD owns stakes in mines in at least six countries across three continents, guaranteeing long-term access to lithium, the material crucial to its batteries. The Chinese group produces its own computer chips, has its own construction subsidiary for building new factories and develops its own software for increasingly sophisticated vehicles and energy systems.

The company is able to recruit from the millions of graduates in science, technology, engineering and mathematics who pour out of Chinese universities each year — China had 3.6mn Stem graduates in 2020, compared with 820,000 in the US, according to Georgetown University data.

BYD employs close to 100,000 people in research and development based at 11 different locations in China. On average, its researchers apply for 19 new patents every working day.

Alongside compatriot CATL, the world’s biggest EV battery maker, BYD’s batteries boast a massive cost advantage over those produced by Japanese, South Korean and European rivals. The cost of building new factories for the two Chinese companies is around $50mn to $60mn per gigawatt hour compared to $100mn/GWh for its competitors, according to Bernstein research.

<$60mnCost (per GWh in capacity) of building new factories for BYD and CATL

$100mn/GWhCost faced by the competitors to the Chinese

Analysts say that one of Wang’s most important achievements came in 2022 when BYD cracked “cell-to-body”, or “cell-to-chassis”, technology. This fuses together the battery cell with a vehicle body and can be applied not only to cars, but to buses, trucks and other commercial vehicles.

The breakthrough has helped further reduce costs and weight while increasing rigidity and crash safety, says Christoph Weber, who leads the China business for Swiss engineering software group AutoForm. It is emblematic, he adds, of how “BYD has been systematically acquiring competence in all major supply chain disciplines”.

The next step for BYD is pulling off what only a few Chinese companies have succeeded at: shifting from exports to expanding manufacturing outside China.

BYD has been quietly expanding its footprint beyond China’s borders for some time. Wang regularly meets with heads of state, for example, and his top lieutenant Stella Li set up the company’s Los Angeles offices more than a decade ago.

The company established bus factories in Lancaster, southern California, in 2013, and in Komárom, north-west Hungary in 2017. In Brazil, the company has over the past 10 years established manufacturing and assembly facilities for electric bus chassis, solar photovoltaic modules, as well as batteries.

These factories have helped BYD corner the market for electric buses. More importantly, analysts say, the company has been gaining expertise in working with foreign utilities, city and national-level governments as well as labour representatives and local communities.

This experience will now be tested with new EV factories announced in Thailand, Indonesia, Brazil and Hungary. BYD has been talking to officials in Mexico for a new factory south of the American border, and in Chile, the company is planning to build a $290mn factory to produce lithium cathodes, one of the core building blocks of a battery.

Analysts expect that as BYD’s EV business expands overseas the solar and battery units will be close behind. Its total battery factory capacity jumped to about 381GWh last year, from 245GWh in 2022. The company’s market share rose to 15.8 per cent, propelling BYD past South Korea’s LG conglomerate to become the world’s second biggest battery producer.

BYD is well positioned to take a “very significant market share” as transportation systems are electrified and more batteries are needed to provide back-up to intermittent renewable electricity generation or cope with demand from AI and data centres, says Neil Beveridge, a Hong Kong-based analyst who leads Bernstein’s energy research.

But as the company grows, Beveridge points out that rival manufacturers may not want to buy batteries from a company whose products they also have to compete with. “That is one of the big questions around the business model,” he adds.

While the company does not disclose the market share of its energy storage business, which includes large battery packs for grid-level storage, it says it has provided batteries to more than 100 cities around the world. Goldman Sachs has forecast that China alone will require about 520GW of energy storage by 2030, a 70-fold increase from battery storage levels in 2021, with as much as 410GW coming from batteries.

According to SNE Research, a Seoul-based analysis group, BYD has more than 10 per cent of the global energy storage system market. And in January, BYD won a contract to supply batteries for what Spanish group Greenergy claims will be the world’s biggest energy storage project in Chile’s Atacama Desert.

Privately, the company has told investors it is winning as much as a 30 per cent share of the utility-scale US market, according to one Shenzhen-based analyst who asked not to be named.

After decades of flying under the radar, Wang has decided to “go global” at a time of immense scrutiny on perceived economic and security risks posed by China and Chinese companies.

In April, Janet Yellen, the US Treasury secretary, visited Beijing and warned the Chinese government over state support for clean-technology industries and said that the “viability of American and other foreign firms” would be called into question if global markets were flooded with “artificially cheap Chinese products”. Days later, the European Commission published an updated report, 711 pages long, on state-induced distortions in the Chinese economy.

The trade complaint, broadly, is that China follows a nefarious playbook whereby it has attracted foreign investment, required joint ventures and acquired key technologies, granted massive subsidies for domestic suppliers while also slowly erecting barriers or closing the market for foreign groups, and then dumped excess supply on foreign markets.

According to research from the Kiel Institute for the World Economy, a German think-tank, BYD has been a chief beneficiary of EV-related subsidies with direct government subsidies to the company of up to €3.4bn from 2018 to 2022.

Across the Chinese green-tech industries, the research points to other channels of government support including preferential access to critical raw materials, forced technology transfers, strategic use of public procurement as well as the favourable treatment of domestic companies by local officials.

Mazzocco, the CSIS analyst who has studied Chinese industrial subsidies, points out that while BYD has received “a lot of state support”, western officials will need to try to “disentangle” what is unfair state support from “good business strategy”.

Experts say that BYD, along with other Chinese cleantech companies, will have to respond to increasing western focus on the risks of forced labour and other human rights or environmental abuses in supply chains. This includes the Uyghur Forced Labor Prevention Act, which in effect prohibits imports to the US of products made in whole or in part in Xinjiang, and the forthcoming EU global forced labour import ban.

Jim Wormington, a researcher with Human Rights Watch who has analysed carmaker supply chains in China, says BYD’s ambition to sell to foreign markets will require it to meet the requirements of these laws. “That requires BYD to establish robust policies and systems to trace its supply chains,” he adds.

Wang also faces challenges at home. The Chinese car market has become hyper-competitive with a slowing economy, a price war and new, low-cost cars launched by tech conglomerates Huawei and Xiaomi. After a bumper year in 2022, the company’s 2023 earnings missed forecasts, rising 81 per cent to Rmb30bn ($4.16bn).

Some key projects are also in trouble. The future of the company’s monorail system SkyRail, which BYD said would be cheaper and faster to build than traditional subways, has faltered after Beijing moved to eradicate unsustainable infrastructure spending.

Despite auto market pressures, China’s slowing economic growth and western trade protectionism there are no signs that BYD is rethinking its plans for global expansion.

Management at BYD, which already exports cars to more than 70 countries, has told investors that they believe they can increase overseas sales from nearly 250,000 cars in 2023 to between 2mn-3mn cars in the coming years, reflecting around 10 per cent of the market, excluding Europe and the US.

“They are strategically farsighted,” says Tim Buckley, director of Climate Energy Finance, an Australian think-tank. “They don’t have the myopic short-termism of western capitalism.”

Despite the protectionist trade landscape under US President Joe Biden, BYD is also finding new ways to operate in the American market.

One of its battery subsidiaries has signed a deal with BorgWarner, the US-listed supplier to GM, Ford and Stellantis. BYD has also started to rebrand its US bus unit under a new name, Ride, to distance the business from its Chinese owners as it starts to bid for more public bus contracts in the US.

Analysts expect the company to increasingly target city or regional-level infrastructure projects that include fleets of BYD cars, buses and other commercial vehicles, but also its energy storage and solar power systems.

Duo Fu, who leads battery markets research at Rystad Energy, says Wang’s core strategy is to capture “not just the supply chain” but “the whole value chain”. BYD’s “grand” ambition, he adds, is to integrate its products within a city’s “entire” transportation and data management systems.

Selling high-tech energy products and transportation services around the battery is how the company was “shaped from the beginning”, says McCarthy, the Shenzhen-based investor.

“Wang Chuanfu has always been a battery guy, it was a battery company, it still is a battery company at its core,” she says. “EVs were the natural transition — they obviously saw a huge opportunity — but to this day the number one advantage they have is their battery technology.”

Climate Capital

Where climate change meets business, markets and politics. Explore the FT’s coverage here.

Are you curious about the FT’s environmental sustainability commitments? Find out more about our science-based targets here