The best-performing EV stock this year is a school bus manufacturer

-

Blue Bird Corp. is the best performing EV stock so far this year.

-

The bus manufacturer has seen a boom in its EV bus business thanks to a $5 billion government program.

-

Electric school buses can cost more than $300,000 compared to $100,000 for traditional buses.

The best-performing electric vehicle stock is a little-known school bus maker.

Blue Bird Corp., which has a market cap of about $2 billion, has started to diversify from its diesel and gas-power buses to electric, boosted by government funding.

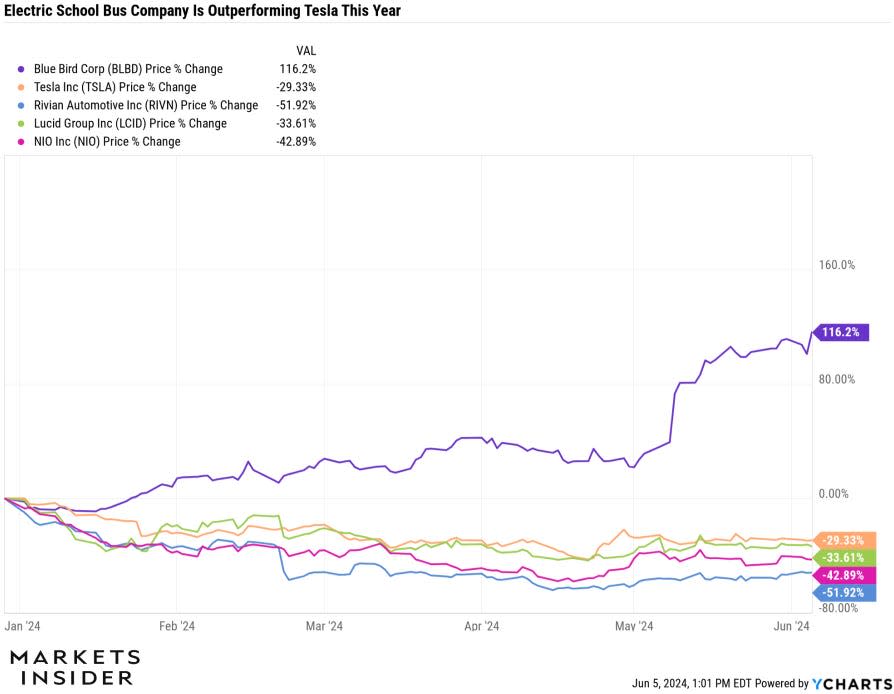

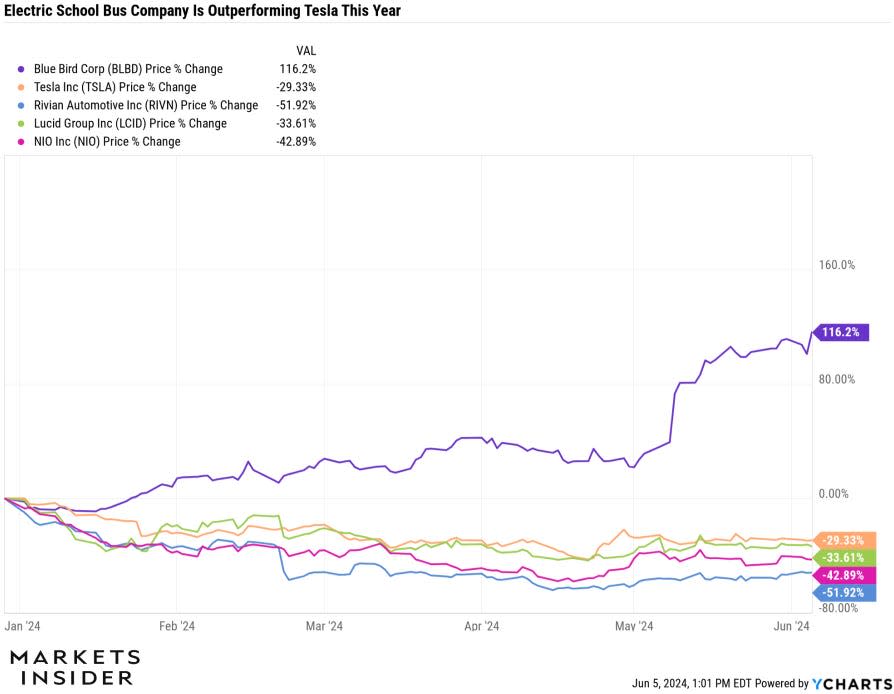

Shares of Blue Bird have surged 116% year-to-date, far outpacing other EV stocks, which are mostly down this year, including Tesla, Rivian, Lucid, and a slew of Chinese EV companies.

In its fiscal second-quarter earnings report released last month, Blue Bird said its revenue grew 15% year-over-year to $346 million, outpacing analysts’ estimates by nearly $50 million, while its profits more than tripled to $0.89 per share.

The school bus manufacturer sold a record 210 electric school buses in the quarter and said it had an order backlog of about 500 electric buses, with bookings soaring 56% from the year-ago period.

Helping fuel Blue Bird’s EV school bus business is the US Environmental Protection Agency’s Clean School Bus Program, which was established in the 2021 Bipartisan Infrastructure Law and provides $5 billion in funding to replace diesel school buses with electrified buses.

Electric school buses now make up 9% of Blue Bird’s revenue, up from 6% last year, and is set to rise as funding from the EPA’s EV school bus program continues to flow to districts looking to upgrade their fleet.

A big benefit to Blue Bird is that electric school buses will significantly increase its average selling price and profit margins on the vehicles it produces.

According to research from Barclays, an electric school bus can sell for more than $300,000 compared to just $100,000 for traditional school buses.

“This is an entirely different Blue Bird bus revenue and gross margin structure compared with just a year ago with bus prices up significantly,” Blue Bird CEO Phil Horlock said on the company’s most recent earnings call.

Needham said in a note last month that it expects the growth of Blue Bird’s EV business to continue.

“EV school bus growth is in the early innings. We expect continued strong demand as school districts compete for essentially free buses, with higher, known ASPs over a multiyear period allowing BLBD and industry peers time to drive costs lower before market prices take over,” Needham analyst Chris Pierce said.

Needham rates Blue Bird at “Buy” with a $52 price target.

Read the original article on Business Insider