The economics and geopolitics of electric cars: a European perspective

Theme

What is situation of the electric vehicle sector, with the growing importance of Chinese exports and the impact of the US government’s Inflation Reduction Act on European exports?

Summary

The automobile sector is one of the pillars of European industry and one of the sectors that has been most affected by the complex economic and geopolitical events of recent years. Within the sector, electric vehicles represent one of the most actively contested areas of global industrial policy, the focus of a dangerous subsidy race, driven by the US government’s Inflation Reduction Act (IRA). This analysis describes the sector’s transformation and current situation, the growing role of Chinese exports, and the impact of these and of the IRA on the EU, which is not sufficiently integrated to develop an effective and coherent industrial policy. Analysis of the data shows that, contrary to expectations, the IRA does not yet appear to have affected European exports, which means that it is not too late for the EU to participate in the race for technological and industrial security in the 21st century.

Analysis

1. Introduction

The automobile sector, which is one of the pillars of European industry and generates more than 7% of the EU’s GDP, is fully engaged in global geostrategic competition. The need to fight climate change has accelerated the transition to hybrid and electric cars, and there is a growing focus on the manufacture of batteries (and control of the critical minerals needed to produce them) as part of the debate on economic security in the West. Developing technological leadership and leveraging economies of scale in the manufacture of electronic vehicles and batteries are key to delivering competitive and geoeconomic advantages. The COVID-19 pandemic, the war in Ukraine and export controls (both of technology and minerals) have shown how trade interdependencies can be used as a weapon, and more and more countries are now using industrial policy to expand their domestic production capacities and to restructure supply chains to make them less vulnerable. The logic of de-risking (reducing the risks associated with interdependence) and friendshoring (ensuring that trade and investment are concentrated in countries that are geopolitically aligned) is being more widely applied, and the automobile sector is no exception to this trend.

The EU has looked on with concern as both the US and China have developed policies to support the sector which could leave European industry (and particularly Germany’s) stuck in the past, focusing on combustion engines, whose production is scheduled to end in 2035, and left behind in the development of green vehicles. This outcome would have implications both for the growth and productivity of Europe’s economies, and for their security.

Although the EU has been impressed by the Biden administration’s commitment to the fight against climate change –in clear contrast with Trump’s climate policies– the IRA subsidies approved in 2022 gave rise to serious concerns as to the capacity of European manufacturers to compete, and regarding the future of EU vehicle exports to the US. At the same time, in response to the spectacular increase in exports of Chinese electric vehicles, the European Commission launched an anti-subsidy investigation in October 2023 to determine whether there had been unfair competition. Whatever the outcome of that investigation, which could open the door to compensatory measures, Europe is concerned that China could establish leadership in the sector similar to that which it already enjoys in solar panels, which would represent a potential source of risk if relations between China and the West continue to be tense. Its control of many minerals used in the manufacture of batteries, and the announcement of export restrictions, have set alarm bells ringing in several European capitals.

This paper analyses the degree to which European concerns are justified. After considering the importance of the automobile sector and the choices of governments (in particular, the need to combine competitiveness, security and sustainability) it analyses the effect of Chinese and US subsidies on commercial flows of electric vehicles and batteries, and on the weakness of the sector in Europe. It then evaluates how the EU should react to the Chinese export boom in the context of the Union’s new commitment to economic security and strategic autonomy.

2. Electric vehicles, subsidies and competition

The automobile sector is not like other industries. Historically, it has been one of the flagships of European (and particularly German) manufacturing, and plays a dynamic role within the wider economy, supported by the steelmaking, chemical and textile sectors, and driving information and communication technology and repair services. In the EU it accounts for more than 7% of GDP and is part of multiple intra-EU supply chains. EU countries manufactured almost 11 million cars in 2022, generating 2.6 million direct jobs (8.5% of European manufacturing employment) and 13.8 million indirect jobs (6.1% of total EU employment). In Spain the industry’s turnover accounts for 8.1% of GDP and 9% of employment. In 2022 Spain produced 2.2 million cars, of which 1.93 million were exported. This is, then, a strategic sector.

The automobile sector has been affected by multiple economic and geopolitical changes in recent years. It has had to address the challenge of decarbonisation, which has speeded up the transition from traditional combustion to electric vehicles; the COVID-19 pandemic, which seriously disrupted global supply chains; the invasion of Ukraine, which triggered rises in the prices both of fuel and of essential raw materials such as aluminium, nickel and palladium; and the technology war between China and the US, which caused a global shortage of semi-conductors, restrictions on 5G technologies, the management of data in the cloud (essential for autonomous vehicles) and control over access to raw materials that are key to the production of batteries, such as graphite, gallium and germanium.

Technological competition between major powers has been one of the drivers of the battle for industrial supremacy in the electric vehicle sector, where demand is forecast to grow significantly over the coming years. The US, keen to maximise its technological advantage over its main geopolitical adversaries, has imposed restrictions on the export of technology to China and has announced massive subsidies for the green automobile industry, now seen as a crucial element of its national security strategy. As a result, the IRA, signed into law in August 2022, offered significant tax deductions to strengthen national supply chains for electric vehicles, batteries and associated minerals. If to this we add the protectionist bent of the Biden Administration, which continues on from Trump’s neo-mercantilism, it seems clear that the US –faced with the new trilemma of green transition, strategic autonomy and fiscal discipline– is prioritising security considerations (focused on reducing its dependency on China and achieving technological supremacy) over considerations of cost and efficiency: in other words, it is prepared to pay more to feel more secure, while also driving the energy transition. This is in part because the US does not appear to be concerned about high public deficits: the fact that the dollar is the global reserve currency grants it this enormous privilege.

The EU was forced to react, and in its Net Zero Act (March 2023) included the target that 90% of annual demand for batteries in the EU should be met by domestic manufacturers (whose capacity would have to reach 550 GWh by 2030). However, for the time being, the EU remains committed to maintaining close trade ties with China, and even seems willing to maintain imports of cheaper ‘green’ products that enable it to accelerate the energy transition, although it remains to be seen if it ultimately takes measures with respect to the import of Chinese electric vehicles. India is also promoting the domestic manufacture of electric vehicles and batteries through incentives linked to production. There are thus a number of initiatives to support investment in electric vehicle supply chains.

China has been subsidising the production of electric vehicles for a long time. The Consultancy firm Alix Partners estimates that the value of Chinese state subsidies for electric and hybrid vehicles totalled US$57 billion between 2016 and 2022. State subsidies for the purchase of vehicles were due to be withdrawn in 2023 (after 11 years) but these tax incentives have now been extended until at least 2027. Current support for manufacturing ranges from direct production subsidies to discounted prices for electricity, raw materials and batteries, and also includes preferential loans and the provision of cheap land.

The subsidy war, to which Europe is no stranger (the EU has also supported the sector with public funds when it has deemed it necessary) entails risks not only due to the huge cost (which in the case of the EU is complicated by the lack of a fiscal union capable of designing federal spending programmes to complement or replace support at the level of Member States) but also because it complicates investment strategies. For example, the search for alternatives to lithium batteries has led to the promotion of the development of sodium ion batteries, and it will not be easy to reconcile investment in these new alternative technologies with the investment required to extract lithium (in the event that the alternative batteries prove to be inefficient).

While both the US and China are placing security and the reduction of external dependencies at the centre of their decision-making in economic, trade and industrial policy, leaving no doubt that, when choosing between security, competitiveness and sustainability, security comes first, the EU (and other countries) take a somewhat different approach. The EU is beginning to consider measures to increase its strategic autonomy and economic security (particularly with initiatives in critical minerals, semi-conductors and, above all, its 2023 Economic Security Strategy), but it continues to defend multilateralism and a free trade framework, with new trade agreements to diversify risks and reduce costs. In the case of electric vehicles, it is more concerned by the possibility that other countries’ subsidies could reduce its competitiveness and undermine its leadership in the sector than it is with considerations of national/European security. A good example of this is the fact that tariffs on Chinese electric vehicles are 10% in the EU but 27.5% in the US.

3. Incipient Chinese leadership of the sector

China has overtaken Japan to become the world’s largest producer of electric vehicles, although many of the models it produces are foreign, such as Tesla and Renault. Its output accounts for 54% of the global total, with an even higher share in the car battery sector. What is more, this market is still in its infancy. The International Energy Agency estimates that sales of electric vehicles will rise from a figure of 4% of total automobile sales in 2020 to 70% by 2040, with China as the largest market, followed by Europe. The rest of Asia will also begin to make a significant contribution to global demand from 2025, with 80% of growth in the sector forecast to occur outside the EU.

China’s leadership position is even stronger in batteries, which on average account for 40% of the manufacturing cost of an electric vehicle. This reflects both its technological development, the exploitation of economies of scale, its preferential access to critical raw materials (such as lithium, cobalt and nickel) and its competitiveness when it comes to processing these.

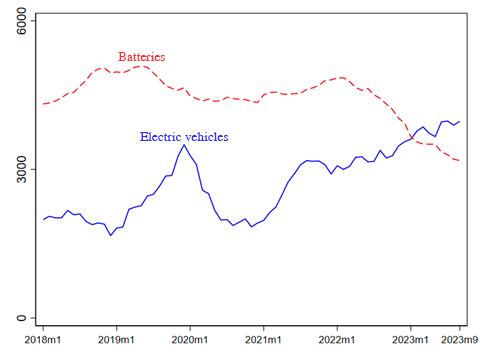

This leadership is reflected in international trade flows. Figure 1 shows the development of EU imports of electric vehicles and batteries from China during the period 2018 to 2023. To smooth out the series, we calculated a 12-month moving total of imports. For example, the figure for January 2018 is the sum of imports for that month and the preceding 11 months. There has been huge growth both in electric vehicles (blue line) and batteries (red line), with the value of battery imports exceeding the value of electric car imports. In fact, China was the source of 82% of total battery imports by the EU in 2023, while it only accounted for 36% of electric vehicle imports.

Figure 1. EU imports of electric vehicles and batteries from China, 2018-23 (US$ mn, 12-month moving total)

By contrast, China has low dependence on imports, whether in batteries or in electric vehicles. As shown in Figure 2, its imports of batteries have gradually fallen in recent years, while imports of electric vehicles have grown. This indicates that Chinese vehicles are highly competitive not just because of the subsidies offered for their manufacture but also because Chinese manufacturers control almost the entire value chain and because of the scale of their operations. However, China is relatively dependent on the European market, which is the recipient of almost 40% of its exports of electric cars.

Figure 2. Chinese imports of electric vehicles and batteries, 2018-23 (US$ mn, 12-month moving total)

Source: compiled by the authors using Comtrade data.

4. The impact on the sector in the EU

The EU is well aware of the strategic dependencies it has developed with regard both to electric vehicles and to batteries. For a long time, European manufacturers were reluctant to accept that electric cars would replace vehicles with combustion engines, and European efforts to achieve self-sufficiency are making slow progress. One example of this is to be found in the extension of the EU-UK Cooperation Agreement for the application of strict rules of origin. The original requirement was that, with effect from January 2024, 45% of the value of an electric vehicle and 60% of the value of the battery had to originate in the UK or the EU, but reality has led both parties to postpone this rule until January 2027.

Curiously, the EU –as in many environmental issues– was a pioneer when it came to incentivising demand for sustainable cars but did not apply this approach to their production, and for a long time backed hybrid models, which turned out to be a strategic error. China, by contrast, did not have a significant car industry to defend and backed fully electric vehicles, both on the demand and production sides of the equation (with subsidies focused more on manufacturers than on consumers). The choice has proved to be a good one, some problems notwithstanding. For example, China’s economic sluggishness after the end of its Zero COVID policy meant that it had significant excess manufacturing capacity (with a capacity usage rate of just 35%) which was resolved not by closing businesses but through massive exports at prices more than 20% below those of European countries. As had occurred with the steel, aluminium and solar panel sectors, Chinese industrial overcapacity ended up threatening the survival of the European economy.

In the case of the subsidies contained in the US IRA, Europe was intensely concerned both by the support offered to electric and hybrid vehicles manufactured in the US or with batteries containing critical minerals from countries with which the US had free-trade agreements (which was not the case with the EU) and by the clear incompatibility with the multilateral rules of the World Trade Organisation (WTO) of the ‘Buy American’ provisions of the IRA.

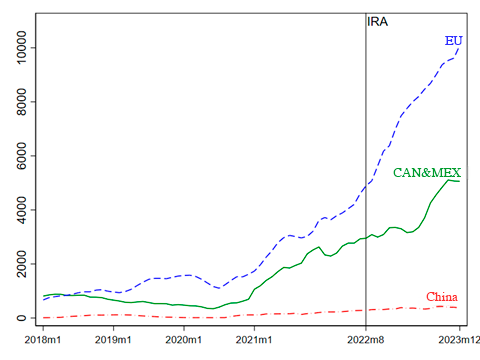

Figure 3 shows the development of imports of electric cars to the US from Canada and Mexico, China and the EU between January 2018 and December 2023.

Figure 3. US imports of electric vehicles from Canada and Mexico, China and the EU, 2018-23 (US$ mn, 12-month moving total)

Source: compiled by the authors using US Census data.

There has been a significant rise in US imports of electric cars since 2021, with imports of electric cars from the EU (blue line) multiplying by a factor of six between January 2021 and December 2023. As Figure 3 shows, during the analysis period, the US imported more electric vehicles from the EU than from Canada and Mexico (green line), its trade partners in the US-Mexico-Canada Agreement (USMCA). Although China is the global leader in the export of electric vehicles, its low share of total US electric vehicle imports (red line) is striking. The 27.5% tariff certainly had a major impact and it is quite possible that, in order to evade them, Chinese manufacturers are entering the US market indirectly via Mexico.

There has been no observable change in the trend of EU imports compared to those from Canada and Mexico following the introduction of the IRA in August 2022. This result seems surprising, as the IRA establishes that the tax subsidy for buyers of electric cars is only applicable to vehicles produced in North America. One might therefore have expected imports of electric cars from the EU to have fallen in comparison with those from Canada and Mexico from August 2022. However, as Bown (2023) explains, this unexpected behaviour can be explained by the fact that, in December 2022, the US extended the tax credit to all electric cars purchased through a leasing contract, even if these had not been manufactured in North America. Moreover, the EU and the US have been engaged for over a year in negotiating a very limited free trade agreement on critical minerals, which would open the door to European vehicles sold in the US partially benefiting from IRA subsidies (Japan reached a similar agreement in March 2023, but the EU agreement is encountering more resistance in Congress). In conclusion, for the moment the IRA does not appear to have had a negative impact on US imports of electric cars from the EU.[1]

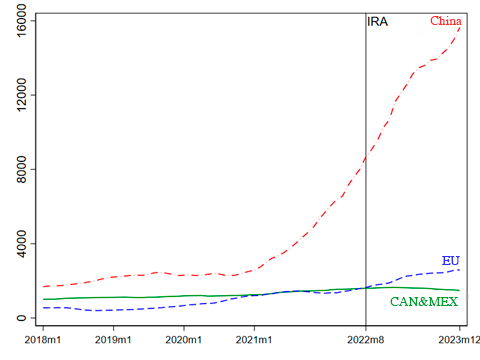

Figure 4 shows US imports of electric batteries, with the huge share of Chinese imports in comparison to imports from Canada and Mexico, and from the EU. Moreover, imports of electric batteries from China have grown continuously since 2021, multiplying by a factor of six between January 2021 and December 2023. Although imports of electric batteries from the EU are on a far smaller scale, there has been no fall in imports since the introduction of the IRA. This result may also seem surprising, as the IRA, following clarifications which came into force in April 2023, establishes that a percentage of the raw materials and components used in the manufacture of electric batteries must come from North America or countries with which the US has a trade agreement, a condition which excludes both China and the EU. In conclusion, the IRA does not appear to have had a negative impact on US imports of batteries from the EU.

Figure 4. US imports of electric batteries, 2018-23 (US$ mn, 12-month moving total)

It seems, then, that the subsidies provided for by the IRA do not yet appear to have had the predicted negative impact on European exports. EU manufacturers face challenges of competitiveness (due to higher energy costs for the industry) and innovation because they have come late to the manufacture of exclusively electric vehicles in comparison to the US (Tesla) or China (BYD). The challenge is to maintain and even to grow market share both in the internal market and in other markets in a context of rising demand but also of increasing competition to see who will win the electric car race.

5. EU investigation of Chinese subsidies

In this context, on 4 October 2023, the European Commission launched an investigation into the possibility of imposing tariffs to protect EU manufacturers against imports of Chinese vehicles alleged to have benefited from state subsidies. The Commission will have up to 13 months to evaluate whether to impose tariffs on Chinese cars at a higher level than the ordinary rate of 10%. During this anti-subsidy investigation, which is the most significant trade conflict with China since the investigation into solar panels a decade ago (which nearly sparked a trade war), the Commission must not only demonstrate the existence of subsidies but also estimate their value and demonstrate that these have ‘caused harm’ to European producers (issues that are clearly defined within the WTO framework). And any compensation measures agreed, which will be smaller than in an anti-dumping case, can only be imposed for a maximum period of five years.

The investigation covers all cars from China, including foreign brands manufactured there such as Tesla, Renault and BMW. It is significant that the investigation has been launched on the initiative of the European Commission itself and not, as is usual, in response to a complaint from industry. The European automobile sector, generally speaking, is concerned by the trend towards protectionism, and few within it are arguing for increased tariffs, although they do call for an even playing field through a European industrial policy in this sphere. It is also the case that, while French car manufacturers are calling for greater protection and would support more intervention by the Commission, German manufacturers are wary of Chinese reprisals.

In the meantime, Chinese brands –whether the leader, BYD, or smaller competitors such as Xpeng and Nio– continue to expand in Europe. The European Commission argues that China’s market share of electric vehicles sold in Europe is already 8% and could reach 15% in 2025, with prices generally some 20% lower than the cost of models manufactured in the EU (in part, as explained above, this is because Chinese manufacturers control the whole value chain, from mining through to sales). This price war is forcing other manufacturers like Renault to cut costs.

Because the investigation will take time, Chinese manufacturers are speeding up their exports in the face of possible future countervailing measures. The Commission estimates that, for the period from October 2023 to January 2024 (that is, just after the investigation was announced), European imports of electric vehicles were 14% higher than for the same period of the previous year. To address this, the Commission has required the customs authorities of Member States to record the import of Chinese electric vehicles to the EU, probably with an eye to imposing retrospective tariffs. Moreover, this measure will have the effect of slowing down Chinese imports (even if tariffs are not ultimately imposed).

However, proving the subsidies will not be easy, and the possibility of Chinese reprisals should not be underestimated. The German manufacturers’ association believes that it would be better to promote the competitiveness of the European sector by reducing energy prices or cutting back on bureaucracy. Other voices in the sector argue for increasing demand through a clear commitment to expanding the number of charging points (Europe is a long way behind China in this area) and perhaps even offering tax incentives both for the purchase of electric cars and for the conversion of manufacturing plants which currently produce combustion-driven vehicles. More resources also need to be allocated to R&D, both to support battery production and to investigate new materials and software for electric cars. It is important to remember that electric cars represent a shift from mechanical to electrical engineering, a sphere in which Europe still has to identify its competitive advantages not just in manufacturing but also in components (a sector with a strong presence in Spain).

Conclusions

Three of the most important issues in contemporary geoeconomics converge in the manufacture of electric vehicles: the energy transition, with its capacity to enable mobility with lower emissions; the digital transition, because an electric car is, ultimately, a computer mounted on a battery, with four wheels; and economic security, because the major powers are increasingly concerned at the rise of geopolitical rivalry.

European car manufacturers –which for decades were global leaders– are late starters in this race for industrial and technological supremacy. Even Japan, whose companies have led in the production of hybrid cars over the last decade, appear to have been left behind in comparison to electric car manufacturers in the US and China. As we have seen, the industrial policy of the major economic powers has focused part of its efforts on supporting this new automobile sector, reflecting the sector’s positive externalities and bandwagon effects. The EU, however, is at a disadvantage here as the fact that it is not a fiscal union means it has less flexibility when designing the kind of support (including fiscal measures) provided by the US (with the IRA) and China.

However, it is still possible to react, as a recent report of the European Automobile Manufacturers’ Association (ACEA) argued. Firstly because, as we have seen, the US subsidies that aroused so much concern among European manufacturers in 2022 and 2023 have not led to a fall in exports of hybrid and electric vehicles to the US. Rather, as a result of minor modifications to the legislation and the significant increase of demand in the US, the EU has actually increased its exports.

At the same time, although the EU is increasingly concerned by the rise of exports of Chinese vehicles (and also by Chinese control of many of the critical minerals needed to produce batteries), it does not appear to wish to start a trade war with China which could be very damaging. The anti-subsidy investigation launched by the European Commission appears, rather, to have been conceived as a warning to the Chinese authorities of the need to negotiate the future development of trade flows and, if this does not happen, of the possibility of firmer measures being taken.

However, the challenges the EU must overcome if it is not to miss the train are numerous, and include policies to structurally reduce the cost of electricity, agreements to ensure the supply (or local production) of semi-conductors and critical minerals, the introduction of incentives to stimulate demand and greater competition, and designing a more active industrial policy –which would necessarily require funds at the European level to prevent the destruction of the internal market–.

[1] Our estimates, calculated using a regression model of differences in differences, confirm that the IRA has not had a negative impact on exports of electric cars from the EU to the US.

Asier Minondo acknowledges the funding received from the Ministry of Science and Innovation (Project PID2021-122133NB-I00 – MCIN/AEI/10.13039/501100011033/ERDF, EU) and from the Department of Education of the Basque Government (IT1429-22).