The Electric Vehicle Developmental State

In the late 1970s, Western markets were flooded with Japanese cars from then-unfamiliar brands like Toyota, Mazda, Datsun, and Honda. The combination of a high quality product, efficient fuel consumption, and a low price tag made these brands very popular in the US and Europe in the aftermath of the 1970s oil shock, resulting in a decline in market share for domestic manufacturers and complaints of unfair competition from entrepreneurs and trade unions.

The “Japan Shock” soon engendered a protectionist policy response. The US and the UK negotiated voluntary import quotas with Japan to limit competitive pressure on their car industries, and European countries adopted similar measures. But this was only the first step in a deeper transformation of Western industry. Desperately seeking avenues to regain international competitiveness and quell heightening domestic labor unrest, companies in the global automotive sector and beyond began to emulate their Japanese rivals. The “Toyota method,” expounded by the company’s leading industrial engineer Taiichi Ohno, became a must-read for any serious industrial manager, while North Atlantic business schools started teaching Kaizen and Kanban methods of “just-in-time” production. This cultural shift, sometimes described as part of a broader process of “Japanization,” served to catalyze the embrace of what sociologists came to call post-Fordist management strategies, which focused on flexibility and cost-cutting while rejecting the vertically integrated production models of 1950s US and European auto leaders.

Nearly fifty years after the “Japan shock,” today’s global automotive industry confronts a far more systemic upheaval—what we could term the “Chinese electric vehicle (EV) shock.” Until recently, China’s automotive industry was dismissed as a low-quality copy of Western or Japanese models. However, it has since achieved impressive quality and price competitiveness in the strategic section of electric vehicles—in 2023, the Chinese giant BYD overtook Tesla as the largest producer of electric cars with 3 million New Energy Vehicles (NEVs). That year, China’s export of NEVs grew by 64 percent. Together with good Internal Combustion Engine (ICE) sales and Russian demand induced by Western sanctions, China has already overcome Japan as the world’s largest auto exporter overall.

Figure 1: EV quarterly sales (2018–2023)

How Western governments will respond to competition in an industry long considered the test of economic prowess is a question of central concern to the twenty-first century. In both the US and EU, the rise of Chinese EVs has been condemned as the result of unfair practices. Announcing a probe into Chinese EVs and state aid in September, Ursula Von der Leyen asserted that their competitiveness was a result of “market manipulation.” Joe Biden has similarly pledged to prevent Chinese EVS from “flood[ing] our market,” and Donald Trump described the impact of Chinese electric cars as an economic “bloodbath.”

Underlying these incendiary remarks, however, is an industrial transformation no less significant than that of Japanese automakers in the 1980s. The rise of the Chinese EV industry has been enabled not only by generous government subsidies but also by profound changes in strategy and organization, and in particular by a distinctive revival of vertical integration—at both individual firm and national levels. The approach is perfectly exemplified by BYD, which has sought to bring virtually all aspects of the value chain under its control: from battery technology—which was its initial core business—to microchips and even expanding to ownership of lithium mines and car carrier ships. Further, exploiting significantly lower labor costs in China compared to countries like Japan, Germany and the US, the firm has availed itself of a massive army of factory workers with a significantly more labor-intensive production process than its competitors. This neo-Fordist approach has allowed BYD to drive down costs while coordinating and accelerating the innovation of different key components during a pivotal phase in the industry’s evolution. Additionally, it has enabled the company to mitigate operational uncertainties and address shortages of various input factors and services, like the ongoing chip shortage since 2020.

In parallel, the Chinese government has been pushing for vertical integration at the national level, ensuring that 80 percent of the EV value chain is contained within the country through the “Made in China 2025” plan, which has the aim of minimizing the effects of disruptions and setting the conditions to reinforce and maintain technological supremacy. While the model is likely to shift as labor relations evolve, this turn towards “re-integration” and “re-internalization” carries important lessons about the future of economic organization and industrial policy.

The electric vehicle revolution

American management theorist Peter Drucker famously called the automotive industry the “industry of industries”—for over a century, car manufacturing has represented the ultimate test of industrial development due to the complexity of input factors, range of supplementary industries, and high capital and knowledge requirements. Cars depend on mining, chemical, steel, and electronics sectors, armies of technicians and production workers, and expensive machinery and plants. Car production has enormous barriers to entry and involves major entrepreneurial risks; this is why relatively few countries can claim membership in the exclusive club of auto-manufacturing. These challenges are even more pronounced with electric vehicles.

Like other green technologies, such as solar panels, electric vehicles are not entirely new. At the turn of the twentieth century, some of the first automobiles were powered by primordial lead-acid batteries; a third of the cars in 1900 New York were electric. But at the time, gasoline-powered vehicles outperformed electric ones due to their higher range and speed as well as their lower operating costs thanks to cheap and abundant oil. This balance has dramatically changed in recent years. Besides boasting sportier performance (contrary to popular perceptions), EVs offer lower operating costs, lower maintenance and repair costs, greater convenience in daily use, and less noise. The savings in operating costs are particularly impressive, with recharging EVs projected to “reduce the energy costs of a vehicle by 50‒80 percent through 2030 relative to a comparable gasoline vehicle.” Of course, as technology and infrastructure develop, significant disadvantages remain in higher up-front costs, a limited range, long charging times, and, in many countries, the scarcity of recharging points.

Electric batteries are what economists specializing in innovation would describe as the “enabling technology” of EVs, but they are also their structural bottleneck. The lithium-ion battery (LIB) invented in 1991 offered a smaller and more capable substitute for its nickel-cadmium predecessor to power all sorts of battery-powered products that were previously unthinkable: from smartphones to tablets, robot vacuum cleaners, and the so-called “micro-mobility” of electric bikes and scooters. However, its application to automotives promises to have the most revolutionary consequences. Since the invention of LIB, their energy density has increased threefold while the cost per kilowatt-hour has dropped by more than 90 percent. Thus, the same technology that in the 1990s backed Nokia and Motorola phones can now power cars and even buses. Moreover, improvements via the lithium-iron-phosphate (LFP) variant, already used by BYD for its blade batteries, and a shift in LIB from liquid to solid electrolytes, could significantly increase capacity and provide faster charging.

The centrality of battery technology to the EV sector also explains the importance attributed to the construction of so-called “giga factories”—enormous manufacturing plants that can produce batteries whose total storage is billions of watt-hours—and why access to lithium has now become so strategic. This alkaline metal is not scarce on the earth’s crust. However, only a few places around the world enjoy a degree of concentration sufficient to make the extraction of lithium economically viable, with Chile, Argentina, and Australia being the most endowed nations. To guarantee themselves security of supply, some EV companies are now entering the lithium mining business directly, either as shareholders or sole owners.

The new Henry Ford

The rise of the Chinese automotive industry has generated an estimated 140 different EV brands, but only a few of them are on the same order of magnitude as BYD, which in 2023 surpassed Tesla as the largest EV producer in the world. The firm was founded in Shenzhen in 1995 by Wang Chuanfu, an orphan from the poor rural region of Anhui who studied chemistry and material science. In many ways, the company’s operations closely resemble an electric revival of the Fordist logic of mass production, with a highly labor-intensive production process, a vast army of factory workers, and Taylorist methods of scientific organization of production.

Above all, BYD echoes the Fordist emphasis on vertical integration. Just as Ford acquired iron and coal mines to produce steel; rubber plantations in Brazil to produce tires (before the invention of vulcanization eliminated the need for natural rubber); white silica sand mines to churn out the car’s windscreens, windows, and mirrors; and even forests to build the car’s wooden parts, BYD has moved to control the production and assembly of battery cells; the manufacturing of the electric powertrain; the semiconductors and electronic modules; and now even the mining of lithium. It also builds its cars’ axles, transmission, cockpits, brakes, and suspensions “in-house.” And, just like the Fordist giant plants of Highland Park and River Rouge, BYD has built enormous industrial plants to produce batteries and other critical components, and for the assembly of cars. Four of them are located in BYD’s hometown, Shenzen, and twenty elsewhere around China, while several new plants are currently being built abroad, from Hungary to Brazil.

In the first part of twentieth century, vertical integration enabled Ford and other firms to reduce intermediation costs, control production, and coordinate innovation across different stages of manufacturing, from the procurement of rubber and steel to the standardization of parts and suppliers. High productivity and high wages in an oligopolistic market secured stable profits in an expansionary macroeconomic environment, i.e. the golden era of Fordism, between the end of World War II and the end of the 1960s. The oil crisis of the 1970s revealed the rigidity of this industrial model, as wage inflation and demand for more efficient vehicles made US automakers uncompetitive. Western industrialists then took inspiration from just-in-time flexible manufacturing achieved by Japanese firms like Toyota, which relied on a network of external suppliers and contingent labor to absorb market shocks, spinning off the production of components. Japanese car makers broke the assembly line into islands of production manned by quality teams, co-opting unions into corporate objectives. This business organization logic was conducive to a more efficient disciplining of the workforce and the disorganization of trade unions, whose bargaining power collapsed when they could no longer threaten work stoppages across stages of production.

Outsourcing went hand in hand with offshoring much of the value chain to countries with lower wage costs. Economist Raphäel Chiappini argued, “Since the end of the 1980s, carmakers in Europe, Japan and the US, such as General Motors, Ford, Toyota, Honda, Volkswagen, Audi and Daimler Chrysler, have outsourced an increasing share of automotive production to emerging countries to benefit from lower production costs.” This has led to an “international division of labor” or, more negatively put, “international fragmentation,” namely a situation in which various countries specialize in distinct stages of the supply chain where they accrue a competitive advantage. While intending to improve quality and reduce costs, this shift has also made car manufacturers vulnerable to supply chain disruption, which is becoming a growing risk in these unstable times.

The return of vertical integration

The weaknesses of global supply chains have become ever more apparent in the aftermath of the pandemic and within the context of heightened security competition. As a result, the language of “onshoring” and “in-house” has crept into policy debates. In this regard, BYD presents a fascinating example of the contemporary “re-internalization” of national production and its relationship to the broader drift of new industrial policies. The firm follows the typical structure of the vertically integrated conglomerate, with the central company (BYD Company) controlling various subsidiaries: BYD Auto, BYD Electronics, BYD Semiconductors, BYD Transit Solutions, and BYD FinDreams (the arm responsible for producing batteries and various car components). While vertical integration is common to other EV competitors such as Tesla, BYD has achieved a far greater degree of integration than Musk’s firm, which purchases around 90 percent of its batteries from firms such as Panasonic and CATL.

Battery production was BYD’s original core activity, ensuring high competency in the production of the most critical and potentially innovative component of EVs. Through its subsidiary BYD Semiconductors, the company also controls the production of microchips, which proved an important advantage during the post-2020 microchip shortage resulting from the trade war between China and the US. Chuanfu’s company also produces its own metal and plastic parts, has bought shares in China’s leading lithium miner Shengxin Lithium Group, and is shopping for mines in Brazil. BYD has thus achieved unparalleled control over its production cycle—according to the firm, only the tires and windows are entirely outsourced. A report by the New York Times highlighted that, in the manufacturing of the hatchback Sedan Seal, BYD produces internally a whopping three-quarters of all components—compared to just one-third for a comparable Volkswagen electric car, giving it a 35 percent cost lead.

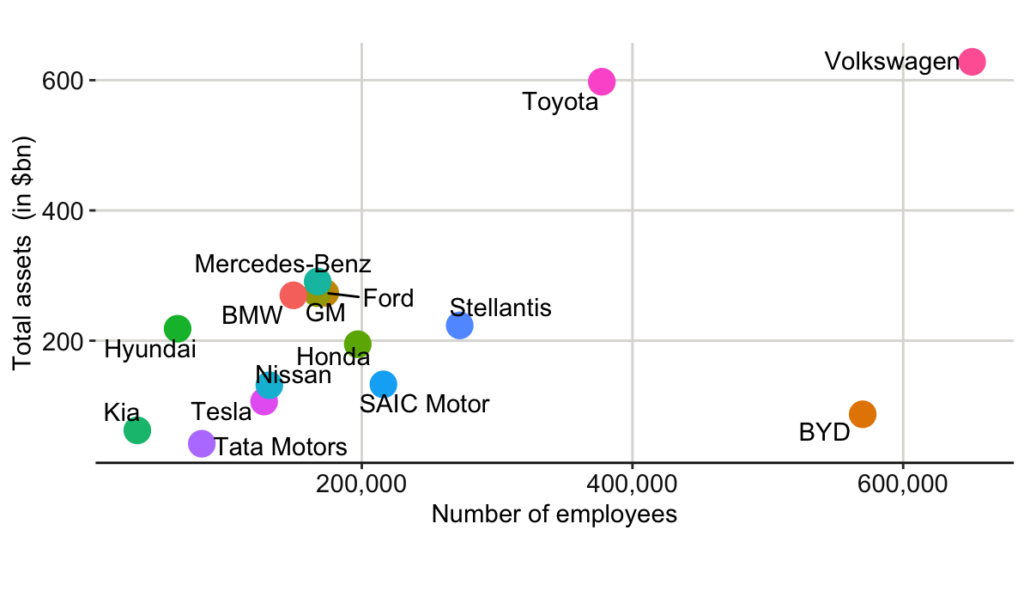

BYD is also increasingly active in the “downstream” part of the car industry, namely sales and service. It has recently entered the shipping sector with BYD Explorer 1, a Ro-Ro vessel able to transport 5,000 cars, which is expected to be the first of an expanding fleet, guaranteeing BYD better control of the delivery of its products. Like the Fordist model, BYD’s vertically integrated strategy is labor intensive. The company’s employees have doubled in just two years, reaching 570,000 workers in 2023 (just under Volkswagen’s 670,000 and significantly above Toyota’s 370,000). Bucking the Japanese model of highly automated production involving expensive machinery, BYD has instead long relied on comparatively cheap manual workers performing a myriad of small tasks. Such lower “capital intensity” has thus far proven an excellent recipe for expanding revenues and profits—but this may change as labor costs rise due to competition between automotive companies.

Figure 2: Total assets and the number of employees of major automakers (2023)

Learning from China’s industrial policy

BYD’s success, however, is the product of sustained industrial policy. Though its longstanding efforts to achieve “intensive development” in the automotive industry had repeatedly ended in disappointments, eventually, China has been able to exploit what Alexander Gerschenkron called the “advantage of backwardness.” Taking lessons from other East Asian countries like Japan and Korea, China has pursued developmental state policies to move from low-end to high-end manufacturing, with “green technologies” assigned particular importance.

New energy vehicles first earned a policy mention in the tenth Five Year Plan (2001–2005). However, it was only in the aftermath of the 2007–2008 financial crisis that they “were designated as a strategic emerging industry, along with solar and wind power.” An important turning point in industrial policy for EVs was the launch in 2015 of the “Made in China 2025” plan announced by Xi Jinping and Prime Minister Li Keqiang. The plan declared that “manufacturing is the core of the national economy, the root on which the country is established, the tool for national invigoration, and the foundation for a strong country.” EVs featured among ten key sectors seen as pivotal for the country’s future success, besides integrated circuits, aerospace equipment and new materials. Notably, the plan recommended that 80 percent of all necessary input factors for the EV industry be sourced in China to guarantee a high degree of “independence” in the production of EVs. This push for domestic sourcing enormously shaped the production strategies carried out by domestic firms.

China now finds itself in a place of seemingly unassailable supremacy in this industry: 60 percent of all EVs produced in 2023 were made in China. Furthermore, Chinese firms have a formidable cost advantage over legacy competitors, estimated at around 25 percent for BYD, according to Swiss Bank UBS. Like all countries, China must import some raw materials, especially lithium carbonate from Chile and Argentina and cobalt from Congo. But it also controls key elements of the supply of critical materials: over half of the Lithium world production, over 60 percent of Cobalt production, and 70 percent of rare earth materials. Furthermore, the Chinese industry accounts for over 70 percent of the cell components of batteries and the production of battery cells. Two-thirds of global battery production is located in China, with CATL and BYD accounting for over 50 percent of the global output. This push to develop an independent and largely self-sufficient value chain has proven far-sighted in anticipating the disruptions faced by global supply chains because of extreme weather, war, and growing inter-power rivalry. A high share of the EV value chain gives China a significant comparative advantage vis-à-vis competitors while also providing the conditions to defend the supremacy in innovation and intellectual property that China is likely to achieve in coming years.

The Chinese government promoted these developments through generous science and technology funding, such as with the famous 863 Program. Under the tenure of automotive engineer Wan Gang (2007–2018), the Ministry of Science and Technology has been strongly supportive of the EV sector. Through joint ventures like SAIC-Volkswagen and acquisitions of Western car suppliers, the Chinese government pursued technology transfers from foreign companies. It also offered grants or loans to car firms for, among other things, the creation of manufacturing plants and bankruptcy prevention. The key policy instrument, however, has come in the form of subsidies.

It is estimated that the Chinese government spent $60 billion in subsidies on electric vehicles between 2009 and 2017. Consumer subsidies have been more generous than the $7,500 tax credit offered by Biden’s Inflation Reduction Act, with national tax credits compounded by local government tax credits. The twenty-three local authorities (nineteen provinces and four metropolitan areas) are responsible for around 70 percent of public spending. These local governments conduct their industrial policy by championing local producers through grants, cheap credit, bailouts, and land supply, and by targeting procurement on local enterprises (for example, by sourcing the local taxi fleet with cars from the local automotive company).

Additionally, Chinese state-owned enterprises (SOEs) include many automotive firms. Centrally owned SOEs are coordinated through the State-owned Assets Supervision and Administration Commission of the State Council (SASAC) and are expected to contribute to the implementation of government objectives. Some automotive SOEs such as SAIC, BAIC, and Chery are instead owned by provincial authorities, which are known for supporting loss-making industries to protect jobs and manufacturing capacity.

Political support for “local champions” by provincial authorities, combined with stimulus interventions from the central government, is known to lead to structural overcapacity, as was the case of the steel-making sector in the mid-2010s when the central government was eventually forced to impose closures and consolidation. While overcapacity can be seen as economically wasteful, it engenders a Darwinian struggle for entrepreneurial survival and technological innovation, which nurtures internationally competitive export champions. This is what is now in store for the EV sector, which is affected by severe fragmentation. The incipient price war will become fiercer as subsidies are progressively scaled back and domestic demand in China continues to be weak. However, offering the eventual winners greater economies of scale, this moment of reckoning is likely to make Chinese EVs even more competitive internationally.

The embrace of state-guided industrial policy and vertically integrated production by BYD and the Chinese government more broadly reflect a remarkable, if nascent, tendency within the global economy. While this tendency is echoed in Biden’s subsidy-fueled industrial turn, the EU still clings to a post-Fordist vision and to a nostalgic hope to revive globalization and its long supply chains. The ongoing EU investigation on Chinese EVs will likely recommend a hike in import tariffs, which are currently a third of US tariffs at a modest 9 percent. In March 2024, the EU started registering Chinese EVs at customs, meaning these tariffs could be applied retroactively. Import tariffs will offer little solace, however, without a deeper reflection on the changing structure of global production. Western countries should realize that in many sectors such as EVs, they are—for the first time in modern history—in a technological catch-up mode vis-a-vis a more advanced competitor, which they also consider a key geopolitical rival. Instead of focusing their attention on increasing military spending and drumming up fears of global war, Western countries ought to take China’s challenge seriously.