The Electric Vehicle That Depreciates The Least After 1 Year Of Ownership

Electric vehicles (EVs) are known to suffer from steep depreciation, as we’ve already talked about before, and hopefully heard by now. This is due to factors that concern the technology itself since EVs are still developing at a rapid pace. Just think of the smartphone when it first became popular, but now in 2024, the smartphone has become ubiquitous and the pace of development has nearly plateaued since the first iPhone in 2007.

There are also concerns about its battery – especially as an EV gets older. No one in the used car market would want to own an EV whose battery is near the end of its life as it can cost nearly as much as the used EV itself. These factors are just some of the reasons why EVs suffer the most depreciation compared to pure internal combustion engine (ICE) cars and even hybrids.

Not all EVs, however, are created equal. Some fare better than others in terms of resale value. The EV we’ll be tackling today, however, has surprisingly better one-year resale value than some internal combustion engine (ICE) vehicles. Take note, the depreciation here is just a year, so over five years, the picture will be much different for this EV in question.

2024 Tesla Model X: A Comprehensive Guide On Features, Specs, And Pricing

The Tesla Model X enters 2024 with no substantial changes. Here’s everything you need to know before you buy one.

In order to give you the most up-to-date and accurate information possible, the data used to compile this article was sourced from Tesla and other authoritative sources, including iSeeCars, CoxAutomotive, J.D. Power.

Buy This EV Brand New Instead Of Slightly Used

Ladies and gentlemen, the EV with the least depreciation over a one-year period (categorized by iSeeCars as slightly used) would be the Tesla Model X. While buying used would make sense in a lot of cases since you’re no longer the one who underwent this financial burden, it’s perhaps not a good idea if you plan to purchase a one-year-old Model X over a brand-new one. Here’s why.

It Only Loses 6.9-percent Of Its Original Value In A Year

The Tesla Model X loses only 6.9 percent of its original value after a one-year period. This makes it more resilient to depreciation than surprisingly a Honda CR-V Hybrid, especially when you consider how hybrids are currently enjoying the best resale values lately. The average price for a one-year-old Tesla Model X is $80,471, which in this case, especially for buyers in this segment, it would make more sense to buy a new Model X and get the specification you want right out of the factory.

|

Model |

% Difference Used Over New |

$ Difference Used Over New |

Used Price |

|

|

1 |

Land Rover Range Rover |

2.8% |

$4,067 |

$147,311 |

|

2 |

Kia Rio |

-0.1% |

-$21 |

$18,682 |

|

3 |

Mercedes-Benz G-Class |

-2.3% |

-$4,587 |

$196,112 |

|

4 |

Ford Maverick |

-4.1% |

-$1,385 |

$32,505 |

|

5 |

Ford Maverick Hybrid |

-4.4% |

-$1,474 |

$32,039 |

|

6 |

Toyota Sequoia Hybrid |

-4.6% |

-$3,737 |

$77,653 |

|

7 |

Toyota Corolla Hybrid |

-5.0% |

-$1,359 |

$26,038 |

|

8 |

Toyota RAV4 Hybrid |

-5.3% |

-$2,131 |

$37,727 |

|

9 |

Honda Civic |

-5.5% |

-$1,577 |

$26,934 |

|

10 |

Kia Sportage Hybrid |

-5.9% |

-$2,085 |

$33,397 |

|

11 |

Tesla Model X* |

-6.9% |

-$5,993 |

$80,471 |

|

12 |

Nissan Versa |

-7.1% |

-$1,480 |

$19,452 |

|

13 |

Honda CR-V Hybrid |

-7.5% |

-$2,963 |

$36,474 |

|

14 |

Toyota Corolla Hatchback |

-7.9% |

-$2,131 |

$24,838 |

|

15 |

Chevrolet Tahoe |

-8.1% |

-$6,079 |

$69,042 |

|

Overall Average |

-12.8% |

-$5,778 |

$39,328 |

|

(Data sourced from iSeeCars)

There is a slight caveat to this, though. iSeeCars says in their disclaimer that average prices for new Teslas were estimated “by applying used car trim distribution to pre-rebate new car MSRPs as of March 2024”.

This is attributed to Tesla’s massive price cuts for the Model X, which has seen its prices lowered by as much as $41,000 since the start of 2023 to today’s base MSRP of $79,990 for a Dual Motor All-Wheel Drive Model X. Those who bought one prior to the price cut would probably suffer a lot more depreciation than what the Model X is evaluated to suffer after a year as a result of these price cuts.

How The Price Cuts Affect EV Resale Values

And that’s where we start to talk about Elon Musk’s sudden price cuts over the past year, because while Teslas tend to hold their values better than most EVs, the price cuts don’t benefit those who already own their EVs. Imagine having to purchase a Model 3 now, only for Elon Musk to suddenly decide to apply a massive price cut a few days later. While price cuts happen oftentimes, the scale at which Elon Musk applied to its vehicles is unprecedented.

“Used Teslas lost more value than any other brand, and with a 28.9 percent decline they lost more than twice as much value as second-place Alfa Romeo. Elon’s desire to maintain new Tesla sales through price cuts had a very destructive impact on the brand’s residual values.”

– Karl Brauer, iSeeCars Executive Analyst

Taking at look once again at data from iSeeCars, Tesla’s price cuts in order to maintain sales momentum have far-reaching effects on EV resale values as a whole. In addition, as a brand, while the Model X may look resilient over a one-year period, the one-to-five-year depreciation for an average Tesla is steeper than even Alfa Romeo and Maserati–two Italian brands that are known to suffer the most deprecation among gas-powered cars.

The price cuts are amazing for those buying new, but for owners, it devalues the vehicle they already own. It must be noted, however, that the reason for Tesla as a brand suffering from higher depreciation than even Alfa Romeo and Maserati is that Tesla only makes EVs. The two Italian brands also sell ICE cars, which helps reduce the brand’s average resale value.

|

Brand |

Average Used Price |

Year-over-Year $ Price Difference |

Year-over-Year % Price Difference |

|

|

1 |

Tesla |

$36,515 |

-$14,808 |

-28.9% |

|

2 |

Alfa Romeo |

$28,763 |

-$4,412 |

-13.3% |

|

3 |

Maserati |

$49,200 |

-$4,845 |

-9.0% |

|

4 |

Lincoln |

$45,427 |

-$4,084 |

-8.2% |

|

5 |

Volvo |

$34,588 |

-$2,973 |

-7.9% |

|

Overall Average |

$31,153 |

-$1,161 |

-3.6% |

|

(Data sourced from iSeeCars)

Here’s How Much It Costs To Charge A Tesla Model X

If you’re thinking about diving into a new or used Tesla Model X, this is how much you can expect to pay to recharge the 100 kWh battery.

What The Model X’s Resale Value Is In Five Years

Owning a Tesla for a year sounds like a good financial idea, but it’s rare for an American new car buyer to just keep it for a year. iSeeCars has yet again data for how long an American keeps a brand-new car, which currently stands at 8.4 years. The bad news in this list is that all the top 25 cars consist of ICE-powered cars and none are electric. This means that, while data for long-term EV ownership is still scarce, data regarding an EV’s five-year ownership already exists in the market today–also from iSeeCars.

A Model X Loses Its Value By Nearly Half In Five Years

The Tesla Model X will lose its value by 49.9 percent within five years–way above the industry average of 38.8 percent, but far better than a Maserati Quattroporte, which will lose more than 60 percent of its value in five years. Compared to the EV average five-year depreciation of 49.1 percent, the Model X isn’t too far off. The Model 3 is the most resilient of all the Teslas when it comes to resale, while the Nissan Leaf will lose its value by 50.8 percent–higher than the two Teslas. Still, while the two Teslas depreciate more than the industry average and even compared to several ICE cars, these two represent the best resale values when it comes to EVs. So if you’re in it for the long term in owning an EV, then your best bet will be one made by Tesla.

|

Model |

Average 5-Year Depreciation |

|

|

1 |

Tesla Model 3 |

42.9% |

|

EV Average |

49.1% |

|

|

2 |

Tesla Model X |

49.9% |

|

3 |

Nissan Leaf |

50.8% |

|

4 |

Chevrolet Bolt EV |

51.1% |

|

5 |

Tesla Model S |

55.5% |

(Data sourced from iSeeCars)

There’s An EV Which Loses Almost Half Its Value In One Year

The five-year depreciation of a Tesla Model X, while lower than the EV segment’s average, is not astronomically low compared to the industry’s worst as a whole. However, there is one EV whose depreciation is so bad, it loses almost half of its value in just one year.

Yes, while the Model X will lose that much in a span of five years, imagine an EV losing that much value in just a year. The car in question is the Mercedes-Benz EQS sedan, which, according to iSeeCars, is expected to lose 47.8 percent of its original value in just one year.

This Is The Car That Depreciates The Most After 1 Year Of Ownership

Being one of the most expensive new EVs on the market, Mercedes’ flagship luxury sedan can’t manage to maintain its high value for more than a year.

What The Data Says About Tesla’s EV Dominance

If you try to condense all of these details about the Model X and the Tesla brand as a whole, you will realize how Tesla dominates the EV market. Remember, those price cuts that affected the brand’s average resale value didn’t just affect Tesla–they affected the entire EV industry as a whole.

Whatever Tesla Does, The Market Gets Affected

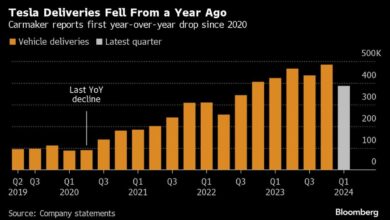

On top of the rapid evolution of EVs, as well as the long-term battery replacement concerns, Tesla’s price cuts affect how the market perceives EVs from other brands. According to Cox Automotive, Tesla’s share of the EV market in the U.S. continues to slide, now at 51.3 percent from 61.7 percent a year earlier. At the same time, the EV sales of nine brands experienced more than 50 percent year-on-year growth for Q1 2024, namely BMW, Cadillac, Ford, Hyundai, Kia, Lexus, Mercedes, Rivian, and Vinfast.

Increased competition means Tesla doesn’t anymore have the market to itself, which is what led it to introduce massive price cuts to its vehicles. This has profound effects on the overall EV industry and Tesla, creating a market that favors the buyer, but not so much those who already own these EVs. Tesla has created a price war of sorts over the past year, and it’s a contributor to EV values dropping faster than ICE cars and hybrids.

Tesla Has The Infrastructure To Back Itself Up

Finally, one of the hurdles of mass EV adoption continues to be charging, and the infrastructure related to it. While EV resale values aren’t the best in general, Tesla’s resale values are the best among EVs, and one of the factors behind it is the brand’s diverse Supercharger network.

The mainstream buying public is wary of public charging, but if they do want to dip their toes into a used EV, it’s Tesla and its Supercharging network – considered by J.D. Power to be the best, that has the greater potential to make a used Tesla more attractive to own.