The EV battery wars are just getting started: David Booth

The China-versus-the-world battle for EV supremacy will dominate the automotive landscape for the foreseeable future

Article content

With all the hoopla surrounding the tariffs the American government will levy on Chinese electric vehicles, less attention is being directed at the introduction of similar tithes on the batteries that power them. Indeed, at first blush, only increasing the tariffs on EV-specific batteries and their components to 25% (up from 7.5%) while EVs will now see an incredible 100% tariff (up from 25%) would seem nonsensical.

Advertisement 2

Article content

After all, China’s ability to produce batteries cheaply — Steve Levine of The Electric puts the price of a Chinese-built LFP battery at US$66 per kilowatt-hour, roughly half the cost of a NMC battery here — is the main reason why Chinese BEVs are so much cheaper than those built in North America. So taxing them less than the cars themselves would seem nonsensical, were it not for that fact that North American car-makers — like all automakers around the world, in fact — are inordinately dependent on Chinese components.

China’s complete dominance in battery production

Although EV battery production in North America is significant — and, thanks to the Inflation Reduction Act, growing quickly — China’s dominance in the processing of minerals as well as the production of the individual components that go into building battery cells and modules would seem at first almost insurmountable, if not permanently, then at least in the time we’ve allotted for electric vehicles to account for the lion’s share of automobiles sales.

Advertisement 3

Article content

According to the Wall Street Journal, “the U.S. and China are in a David-and-Goliath situation when it comes to battery production.” So, while China assembles more than two-thirds of the world’s EV batteries, its dominance in component production and mineral processing may be even larger. It produces, for instance, 91% of the anodes that go into automotive batteries; and 78% of the cathodes (this last extremely important, since cathodes are the most important and costliest part of an EV’s battery).

And, in perhaps its greatest advantage, China processes 44% of the world’s lithium, as well as 69% of the nickel sulfate; 75% of the cobalt; 69% of the synthetic graphite; and a whopping 100% of the spherical graphite that goes into all the world’s EV batteries.

Advertisement 4

Article content

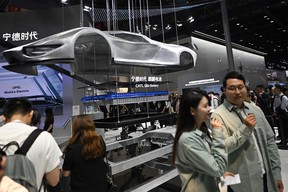

What those numbers fail to capture is why China has such a lead. According to the Journal, not only do Chinese producers have a huge technological advantage in the mines-to-vehicles manufacturing processes, but there are far fewer bureaucratic roadblocks in getting approval for said mines and manufacturing plants than in either North America or the E.U. No wonder, then, that of the world’s 10 largest battery producers, six — including the most prolific, CATL — are Chinese.

China’s overcapacity

What’s troubling is that China is not only already the dominant player in EV batteries, but that its goal is seemingly to overwhelm all those looking to develop their own battery-production supply chains. “What is clear,” says the Journal, speaking on Chinese industry more broadly, “is that, since 2021, Chinese companies have invested more in manufacturing than usual, even though domestic demand and exports have often been weak. The trend has been especially stark for certain sectors that are favoured by Beijing and often benefit from subsidies, such as EVs.”

Advertisement 5

Article content

Nowhere is that more apparent than in battery production. Indeed, while prices of Chinese battery exports have dropped dramatically since the softening in global demand for EVs, “Chinese manufacturers are preparing a historic surge of supply.” According to the Financial Times, “production capacity at China’s battery factories is expected to reach 1,500 gigawatt hours this year.” That’s enough for 22 million BEVs, says the Times, more than twice current demand, which stands at 636 GWh. By 2027, that divergence will widen even more, with production reaching as much as 4,200 gigawatt-hours, almost triple the 1,500 GWh needed for its expected domestic EV market.

Perhaps more troubling is the Times’ assertion that these Chinese battery giants are following the pattern established in the steel, aluminum, and solar-panel industries, which have used domestic subsidies to grab a “huge share” of the global market and squeeze out international competition.

Advertisement 6

Article content

Recommended from Editorial

Even worse, say authors Harry Dempsey and Edward White, “regions of China are racing against each other to take advantage of government subsidies and become production epicentres for batteries in anticipation of surging future demand, risking a glut of production.” In other words, if the Times’ numbers are right, Chinese battery manufacturers will soon be producing enough batteries to power 40 million more EVs than their market can consume. American and European politicians and automakers are right to be worried to be worried.

Indeed, while the U.S. has been fixated on the low prices of EVs, European regulators have been specifically targeting that overcapacity in its negotiations with China. Countering such concerns was in fact the major focus of Xi’s recent visit to Paris, the country’s president proclaiming there is no “so-called problem of Chinese overcapacity,” the implication that China’s dominance in EVs — and other green technologies — is simply the result of superior products and pricing. Most interesting, however, is that, while seemingly condoning Chinese manufacturing internationally, Xi, as recently as March, warned green industries about over-expansion.

Advertisement 7

Article content

China’s governmental consistency

Despite that admonishment, perhaps the biggest advantage China has is consistency. One can argue — with some veracity — that China’s rampant push to overcapacity will eventually end in tears. Certainly, the same kind of government largess applied to the housing market has wreaked havoc in its domestic construction industry. But at the very least, China’s electric-vehicle and battery manufacturers can count on their government staying the course. The guidelines are set and, if Xi’s legislative record is any indication, the auto industry can count on them remaining in place through thick or thin.

America’s current EV policies, meanwhile, marry rampant protectionism — and all the downsides that brings — with an inconsistency that is possibly even more detrimental than the policies themselves. Like immigration, gender identity, and even social security, everything about electric vehicles — from their ability to reduce carbon emissions to the massive incentives promoting their manufacture and purchase — has become politicized.

Advertisement 8

Article content

On one hand, there’s a bill fronted by erstwhile Democrat Joe Manchin and Republican Marco Rubio — if ever a gang of thieves — claiming that the Inflation Reduction Act is not protectionist enough; while, on the other, Donald Trump — who is looking ever more likely to be elected — wants to dismantle the whole thing because, well, EVs are not popular with his base. Such capriciousness makes long-term planning impossible, and makes up part — perhaps even a large part — of the reluctance of some automakers to fully commit to EVs.

The fallout

The market distortions in this war for EV dominance are incredible. Managed economies are pitted against protectionist policies, all being driven by disparate EV mandates, the whole quagmire complicated even further by increasing consumer disinterest.

Advertisement 9

Article content

The first thing to understand are that said mandates are, in and of themselves, inflationary. Marry them with the free-spending Inflation Reduction Act and these recent tariffs and, according to Good Car, Bad Car, we can expect the prices of EVs to increase 10% to 15% in the near-term, just another price hike feeding the inflation the U.S. is still struggling to contain. In economist-speak, we have governmental fiscal policy (subsidization and protectionism) fighting the central banks’ monetary policy (the high interest rates we’ve all been subjected to in a quest to reduce inflation). Such are the quandaries when governments try to make engineering decisions.

Then there are the industry repercussions. The call for tariffs in the E.U. are, at present, far less strident than in America, mainly because European automakers gain as much as 20% of their revenues either from Chinese sales or production. Besides, Automotive News Europe recently cited a Rodium Group report that says “automakers such as BYD have enough margin built into their European prices to absorb even 30% tariffs.”

Advertisement 10

Article content

Even amongst American automakers — OK, quasi-American automakers — there are signs of a rift. Stellantis CEO Carlos Tavares has come out against the tariffs, noting that his company “will try to be Chinese ourselves, which means instead of being purely defensive vis-à-vis the Chinese offensive, we want to be part of the Chinese offensive.” Stellantis recently penned a deal with China’s Leapmotor, the first between a Western and Chinese carmaker, says Reuters, “designed to sell and produce EVs from a Chinese manufacturer outside China.”

As Tavares says, the auto industry is in “a Darwinian period.”

Sign up for our newsletter Blind-Spot Monitor and follow our social channels on Instagram ,Facebook and X to stay up to date on the latest automotive news, reviews, car culture, and vehicle shopping advice.