The Future Of Entrepreneurship In India

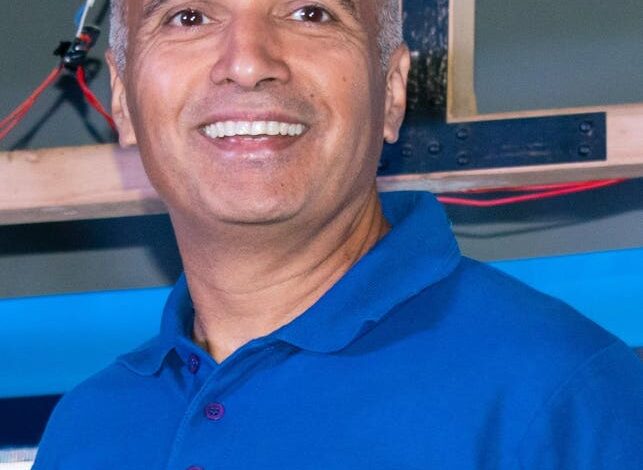

Yashish Dahiya, CEO of Policybazaar

Ten years ago, before slow-moving collapse of the U.S. journalism profession reached the business media, more Forbes readers might have heard of Yashish Dahiya. In 2008, he co-founded an important financial services company in India. It went public in 2021 with $1 billion-plus valuation. Today, Policybazaar has 17,000 employees, and, according to its web site, 9 million customers. It sells policies and products from more than 50 insurers on its platform.

I interviewed Dhiya at Web Summit in Doha, where I met a cross-section of business leaders from Africa, MENA, Southeast Asia and Europe. In part because of the dearth of front-line international business news that reaches the United States through algorithmic news media, much of what they told me was surprising.

Dahiya, for instance, described the explosion of the middle class, which was in part based on a extraordinarily rapid expansion of financial services in India. “Even the vendors in the markets receive payments and do transactions with their phones,” he said. “It’s entirely cashless.”

Estimates of the middle class in India range from 350 million people to nearly 500 million. So far.

About a decade ago, the government launched a comprehensive digital identity, payment, and data-management system that has taken hold in the country. It’s a revolution in financial inclusion, as the IMF and others have written. After banks found it easier to verify digital identities, hundreds of millions of people out of the total population of 1.4 billion opened bank accounts. (India is now the world’s most populous country in the world). In fact, despite its shift away from democracy, India is leading in tech regulation, financial services adoption and growing a middle class – all areas in which America is foundering. One proof point: Prime Minister Nahrendra Mohdi banned TikTok and other Chinese apps back in 2020. (The United States Congress is now considering the move).

Policybazaar’s Founding

Surely, we hear about this transformation in the United States. But not nearly enough. Dahiya also told me something about entrepreneurship and technology that I think is fundamentally true and troubling. More on that in a minute.

First, a little bit more about Policybazaar and Dahiya, who is famously candid and a master of the understatement. “I’m a practical decision-maker,” he said about how he built this huge company. He has given a few excellent interviews on business podcasts. Running, he says, gave him confidence as a child. “My identity came in the form of running – everyone started recognizing me. Ever since, I have never looked back. Once you have (that) confidence, you start doing well in other things,” he told Jivraj Singh Sachar on the Indian Silicon Valley podcast.

He co-founded Policybazaar with Alok Bansal in 2008. Dahiya had worked in the insurance industry in Europe. (He still splits his time between the United Kingdom and India.) The team realized that, as Indian society changed, many people in India no longer had any kind of social security. The population had reformed itself over the past several generations into nuclear families rather than extended families, which meant the old style of social security – where extended families cared for their members – was disappearing.

Dahiya saw this first-hand when his uncle became disabled and had no social safety net. “That kept bringing him poverty in incident after incident.”

In 2008, as Dahiya was launching the company, he also discovered that an insurance agent had taken advantage of his father with investment products.

Policybazaar offers all kinds of insurance products, but more than 75% of premiums come from term life and health insurance, he said.

Policybazaar’s business model will look both familiar and strange to Americans: It’s paid via commission, but in a country where the middle class and the financial sector to serve it is rapidly emerging its value proposition is heavily centered on education. Its fundamental promise is that it puts customers into the lowest-cost plans, and those that are right for it.

“Today the big issue is trust,” he says. The insurance business is growing rapidly in India, with e-brokers growing extraordinarily fast. “E-brokers are growing 50-60% a year in a market that’s growing 10% a year.”

Commission-based businesses that operate in a transparent way are very tough. And in fact the company turned a profit for the first time only early this year, according to the Economic Times. Pitchbook reports its 2023 revenue at about $390 million.

An Information Glut Shuts Innovation Down?

You’d think Policybazaar would be on the leading edge of many digital companies poised to benefit from the middle-class boom. And, there may be some. But Dahiya says they’re unlikely to grow on the venture-backed model of tech innovation that over the past 40 years delivered outsized growth to a few people, and mostly to the United States.

When I asked him what was next for the company, Dahiya told me he sees very little opportunity for innovation, though the company is starting a reinsurance arm. But otherwise, he said, tech innovation has become much harder. “We have too many people thirsty for success,” he said. “The disruption cycle is shortening all the time.”

The talent and capital availability in the country are, in his view, sucking the value out of innovation. Any innovation with business value is immediately replicated, removing what in Silicon Valley used to be known as the first-mover advantage.

In India, Dahiya contends, the wealth of information available means that even in private markets, there are few advantages for individuals.

I don’t know if that situation can last. One of the conditions of late-stage capitalism is that the systems for accurate information are breaking down. Rather than become a world in which there is no information advantage at all, we might be entering one in which (accurate) information advantage plays a new role, perhaps in smaller communities. Trust, as Dashish says, is the big issue today.

To understand the unfolding dynamics of innovation in the new global economy and perhaps the future of capitalism, keep your eye on India. But how many people, in the United States, are doing a good job of that?