The Most Undervalued Fintech: Mini Deep Dive On Shift4 Payments (NYSE:FOUR)

AsiaVision

It was surprising to see Shift4 Payments, Inc. (NYSE:FOUR) go public during the summer of 2020, given its exposure to many industries affected by the Covid pandemic, including travel, hospitality, large-scale events, etc. However, looking back, the $23 IPO price was clearly a buying opportunity for anyone who could foresee the economic rebound.

Although FOUR’s stock price has not been a big winner over the past few years (still down -38.5% from the April 2021 all-time highs), the company has continued to execute very well.

Just to put things into perspective, FOUR did $767 million of revenues in CY2021, and now they’re forecasting almost 5x that number for CY2024… $3.74 billion of revenues, including network fees and $1.325 billion, not including network fees.

After the IPO, I kept Shift4 on my watch list and tried owning it in 2021, but I never had a large position because of the valuation. After the big selloff in the second half of 2021, I began building my position in early 2022 and averaged down into the summer 2022 lows… FOUR actually dipped below $30 for a few hours on July 13, 2022.

FOUR is up +118% from those July 2022 lows, but it’s still been a very frustrating stock to own, especially with the recent pullback.

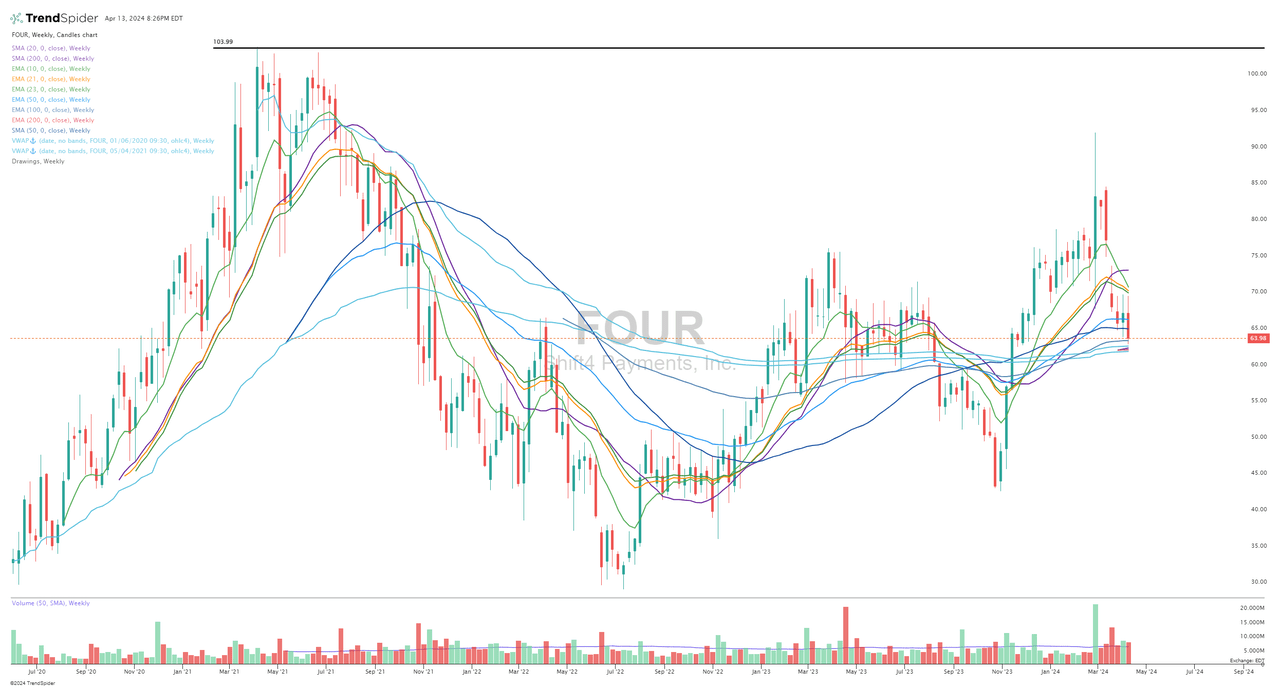

As illustrated by the weekly chart below, FOUR is sitting just above the 200w SMA, 200w EMA, and the VWAPs from the IPO price and the all-time high in April 2021. That means there should be a lot of support in the low $60s, but there’s no guarantee. Worst case, if the markets sell off in a major way or this Iran/Israel conflict escalates to something much worse, it’s certainly possible FOUR could revisit the October lows in the $40s, although this would surprise me given their recent CY2024 guidance.

Even though FOUR is up 49% from the October 2023 lows, I still believe the stock is undervalued when compared to the broader markets or other fintech stocks. As illustrated by the chart below, the stock made a big move in October and November, partly from better-than-expected Q3 earnings, but more likely it was when the CEO said they were “exploring strategic alternatives,” which is often code for “if the stock price doesn’t start moving higher I’m going to take the company private or look for a strategic buyer.”

FOUR continued to rally into CY2024 and spiked in late February on reports the company was actively involved with multiple companies about a potential acquisition. The reports named Fiserv, Inc. (FI) and Amadeus IT Group, S.A. (OTCPK:AMADF) as two of the potential suitors; however, over the past six weeks, as a deal never materialized, the stock has pulled back -30% and now looks ridiculously cheap. Several weeks ago, Nuvei Corporation (NVEI) announced Advent was acquiring them for $6.3 billion; I’m very curious if Advent had also approached Shift4 but couldn’t get a deal done, so then they turned to Nuvei.

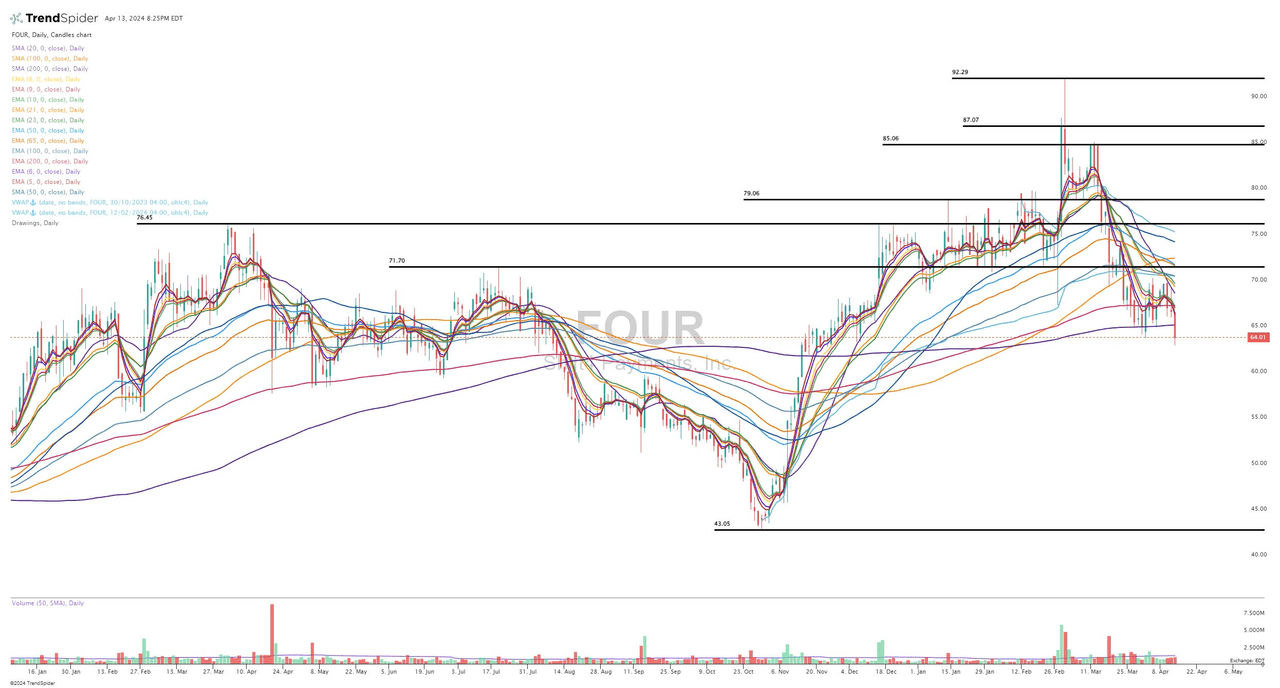

Below is a spreadsheet comparing 15 different fintechs. Obviously, this is not an apples-to-apples comparison because FOUR has a very different business model than Coinbase Global, Inc. (COIN), Robinhood Markets, Inc. (HOOD), or SoFi Technologies, Inc. (SOFI), and some of these companies, like Visa Inc. (V) and Mastercard Incorporated (MA), are much more mature than FOUR or some of the other smaller fintechs. However, at least you can see how FOUR looks against these other companies in relation to their fundamentals and valuation. Personally, I think FOUR looks the most attractive.

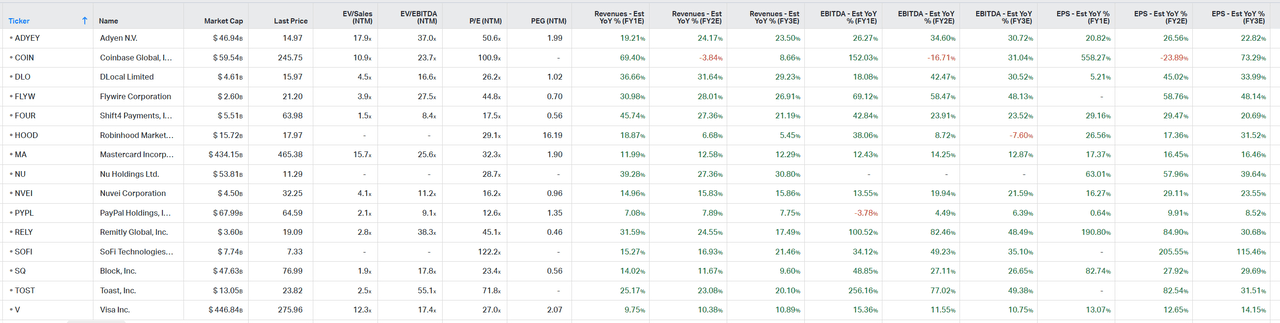

I made that chart above using Koyfin, which isn’t using the fully diluted share count for FOUR, which is why it says the stock is trading at 8.4x NTM EV/EBITDA instead of 10x NTM EV/EBITDA. Either way, this is very cheap for a company that just said (in their Q4 earnings report) they would grow EBITDA in CY2024 by 38-47%, and analysts think they can grow EBITDA by a +28% CAGR over the next 3-4 years. Personally, I think FOUR should be trading at 15-18x NTM EBITDA, which is why I think the stock is 50% (or more) undervalued.

Currently, the U.S. economy and labor markets remain strong and have held up much better than any of the experts or economists were expecting. If that changes and the U.S. heads into a recession, that would not be great for FOUR because it means less consumer spending on travel, hospitality, entertainment, etc., which is where FOUR shines.

Another set of headwinds/risks for FOUR (which would also impact most growth stocks and fintechs) is inflation starting to re-accelerate, which looks possible after higher-than-expected CPI numbers in January, February, and March. If inflation remains elevated and the United States 10-Year Bond Yield (US10Y) goes back to 5%, this macro backdrop would not be good for FOUR; however, it would likely just be a short-term headwind.

The other side of the argument above is that slightly higher inflation (and yields) might be the result of stronger-than-expected economic activity (i.e., higher GDP) and better-than-expected labor markets (i.e., lower unemployment). This scenario could be a net positive for FOUR in terms of revenues and earnings. However, inflation is a tricky one because too much inflation (i.e., higher than wage growth) is eating away at the consumer’s buying power and forcing them to cut back on certain discretionary expenditures, which would not be good for FOUR.

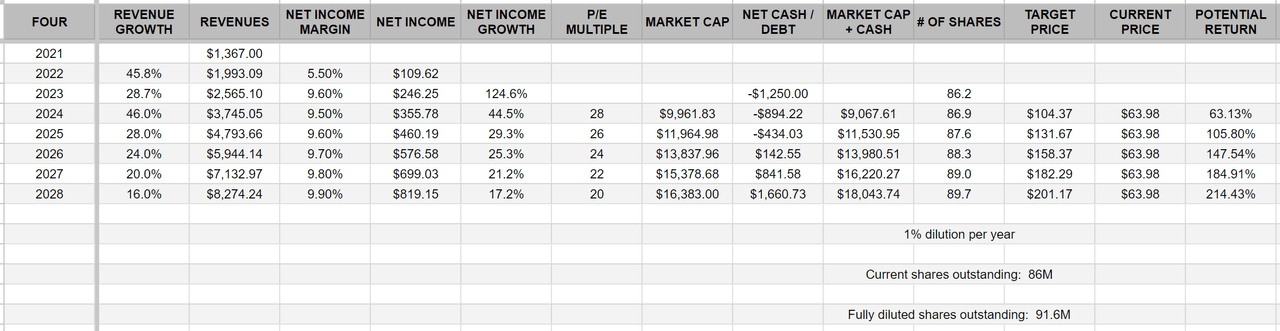

If you’re already a FOUR shareholder, I know the recent pullback has been frustrating, but it doesn’t change my investment thesis or conviction since I’m looking out 3+ years. Of course, the stock could drop another 10-20% in the next 4-5 weeks or 4-5 months. However, I still believe this could be a $200 stock in 4-5 years, so I’m willing to be patient and average down as needed.

FWIW, FOUR is trading almost exactly where it was at the beginning of CY2022 and CY2023, so the stock has been essentially flat over the past two years despite some wild swings along the way.

Speaking of swings, in hindsight, of course, I wish I had trimmed my position when the stock popped in late February on those acquisition rumors. However, this would be my counterargument: what if I had sold 1/3 of my shares in the $80s and/or $90s, only to watch the company get acquired a few days later for $120+ per share? I would have been furious at myself for selling those shares.

Presently, the market does not want to give Shift4 a fair multiple, so shareholders have to be patient (or at least I am). For the past six months, I’ve been saying that Shift4 should be trading at $100+ right now despite the Q4 revenue and earnings miss.

Six weeks ago, when FOUR reported 2023 Q4 numbers, they showed $705.4 million in revenues, which was a miss by $52 million; however, that revenue number was still up 31.2% YoY. Regarding earnings, they reported $0.76 in EPS, which was a $0.05 miss, but that EPS number was still up 61.7% YoY. Keep in mind that FOUR has made several acquisitions over the past couple of years, so these numbers aren’t 100% organic. However, it’s difficult to break them out and know the true organic growth numbers.

I think this is another reason that FOUR isn’t getting the proper valuation in the markets: investors are worried that FOUR will continue to make acquisitions, which could be dilutive. Of course, each one adds integration/execution risk, especially if it’s happening outside the U.S., where FOUR has less expertise.

In my opinion, this would not be a good time for FOUR to do any acquisition because the valuation/multiple has been compressed, which makes all-stock deals less attractive, and they certainly don’t want to do all-cash deals because they’ll need the cash on their balance sheet to pay down some of their debt over the next couple of years.

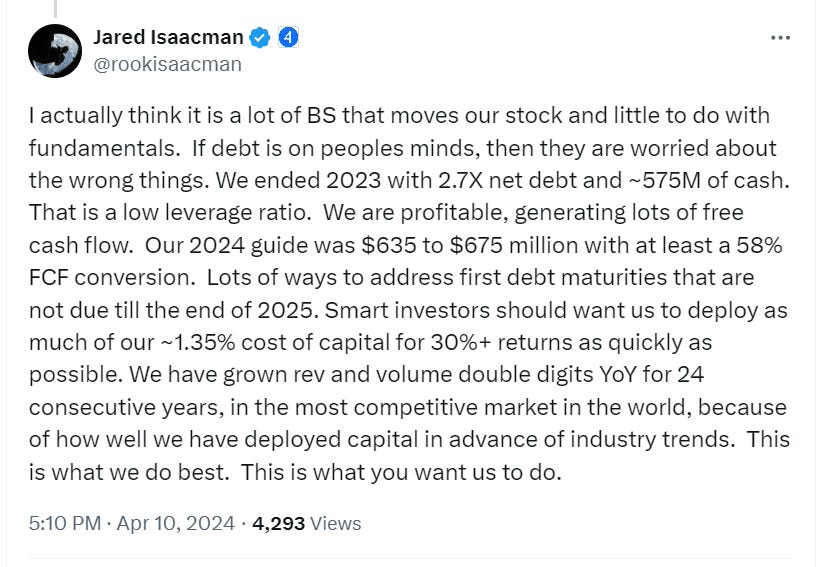

Jared Isaacman (X/Twitter)

As I already mentioned above, FOUR provided strong guidance for CY2024, which implies 38-44% revenue growth and 38-47% EBITDA growth. I was delighted with this guidance, but the question is, “How conservative is management being with this guidance?”

Last year, when FOUR reported CY2022 Q4 earnings and gave CY2023 guidance, they said revenues would be $2.5-$2.7 billion and EBITDA would be $410-435 million. In CY2023, FOUR ended up with $2.565 billion in revenues and $459.9 million in EBITDA.

Regarding the stock price (as an investor), I care more about EBITDA than revenues because that’s what feeds into EPS and FCF. Looking back, FOUR beat the midpoint of their EBITDA guidance by 9%. If they beat their CY2024 EBITDA guidance by 9% from the midpoint, it would get them to $714 million of EBITDA this year, which means the stock is now trading at 9.5x CY2024 EV/EBITDA (current shares) or 9.9x CY2024 EV/EBITDA (fully diluted).

I know that FOUR has some debt (most of which is convertible debt), but the thought that FOUR might be trading at 9.9x EBITDA (fully diluted) with 55% EBITDA growth ($714 million in CY2024 vs. $459.9 million in CY2023) is just insane. I’m definitely not trying to predict anything; simply using past results to think through some potential outcomes. In reality, nobody outside the C-suite knows how aggressive or conservative FOUR is being with their CY2024 guidance. We also don’t know if they’re planning any acquisitions this year; however, if they are, I’d be shocked if their guidance included any contributions from unannounced deals, which means the company has to believe they can get to $635-675 million of EBITDA from just organic growth.

I have a position in Block, Inc. (SQ), so I’m obviously bullish for the next 2-3 years, but SQ trades closer to 18x CY2024 EV/EBITDA with consensus EBITDA growth rates slightly above FOUR for the next few years. Analysts think FOUR will grow EBITDA at a 29% CAGR from CY2023 through CY2027, while they think SQ will grow EBITDA at a 32% CAGR from CY2023 through CY2027, yet SQ trades at a 75% premium to FOUR.

Part of that might be FOUR’s debt, but I’m taking that into consideration because I’m using enterprise values for both companies. I will say that SQ is more diversified and has more levers to pull for growth and/or margin expansion, but I don’t think SQ should be trading at a 75% EBITDA multiple premium to FOUR.

Adyen N.V. (OTCPK:ADYEY) is probably a better comp to Stripe than FOUR, but ADYEN is growing approx 1/3 slower than FOUR and trades at 37x CY2024 EV/EBITDA (est.)

Lightspeed Commerce Inc. (LSPD) might be the best overall comp for FOUR. The company is growing slower than FOUR and barely profitable, yet trades at 2.9x NTM EV/GP vs. FOUR at 2.6x NTM EV/GP-whereas FOUR should be trading at a significant premium to LSPD.

***

Jared Isaacman, CEO of FOUR, started the company in 1999 when he was just 16 years old. He has spent the last 25 years of his life building this company and remains super passionate to this day. With that said, it’s clear he also has a passion for flying and going to space, both of which might be a small distraction, but FOUR continues to put up impressive results, so I think he deserves the benefit of the doubt plus all of us are allowed to have other hobbies outside our primary careers.

I interviewed Jared in late 2022. Jared is probably one of the most knowledgeable people on the planet when it comes to payments and fintech. He’s obviously a very wealthy man (and deserving so), but it must still be really frustrating to see FOUR sitting at the same prices as 3+ years ago. No wonder he wants to see FOUR get a fair valuation. There’s a possibility he takes the company private with the help of Elon Musk, other wealth investors/entrepreneurs, and/or private equity.

Jared and Elon are very close. Jared was the commander on a SpaceX mission, an early investor in Tesla, Inc. (TSLA) and SpaceX (SPACE), and FOUR is the payment processor for SpaceX and Starlink. The list goes on. If Jared does indeed get fed up with the public markets and wants to take the company private, I would not be surprised if Elon was ready to assist.

***

As mentioned earlier, there have been many rumors in the past couple of months surrounding a potential buyout of Shift4. I believe they started at Reuters, but then went viral, which pushed the stock up +24% from the close on February 26 to the intraday highs on February 29.

The rumors claimed that Fiserv, Amadeus IT Group, Global Payments Inc. (GPN), and even Block were among the potential buyers. But, nothing came of them, and on March 17, Isaacman sent a memo to his employees noting that the company received multiple offers, but they were all declined because none of them adequately valued the company.

As a FOUR shareholder, I had mixed emotions about how everything transpired. If I put on my short-term thinking hat, I was disappointed that FOUR didn’t get acquired because it would have been great for my YTD performance (many of us would have made a lot of money), and I’m sure some of my subscribers (that also have FOUR positions) would have been thrilled.

However, if I put on my long-term thinking hat, I’m glad FOUR didn’t get acquired because I don’t want them selling out at $100 per share if I think the stock could be worth $200+ in 4-5 years.

With that said, if I’m being sincere, given the recent pullback in FOUR (from the $90s on the acquisition rumors down to the $60s), I would probably be happy with $120/share this week. Perhaps I’m giving up another $80 over the next 3-5 years, but I would take the proceeds from the acquisition and reinvest that capital into my other high-conviction stocks.

But, I’d be disappointed with any cash deal under $120 because then we’re paying capital gains, whereas if a strategic buyer like Fiserv or PayPal or Square bought FOUR, we might have the option of holding on to our FOUR shares because they’d convert into the acquiring companies stock (assuming it was a stock deal). If, indeed, FOUR does get acquired by a strategic partner, I’m hoping it’s SQ because I’d be very content letting my FOUR shares convert into SQ shares in a non-taxable event. This would also be a good deal for SQ because it would definitely be accretive within 12 months, especially if they were able to strip out some costs.

With SQ trading at 18x NTM EBITDA, they could pay a 60% premium for FOUR (just the equity), then throw on the debt, and the whole deal still gets done around 15x CY2024 EV/EBITDA even using the fully diluted share count. I just don’t know what Jared and the Board would accept as a buyout price and whether the recent pullback might sway their decision as would a strategic buyer, whereby Jared could roll his stock and avoid a massive tax bill.

Regardless of whether we see an acquisition this year, the fact that Jared and the Board turned down any/all offers is confirmation that Shift4 is undervalued at these prices.

But you may ask me why Shift4? What’s unique about this payment company? While I own other fintechs, including Nu Holdings Ltd. (NU), SoFi, Square, and Toast, Inc. (TOST), Shift4 is the largest fintech position in my portfolio… mostly because the fundamentals are great, and the valuation is very compelling. In my opinion, FOUR offers the best risk/reward at current prices.

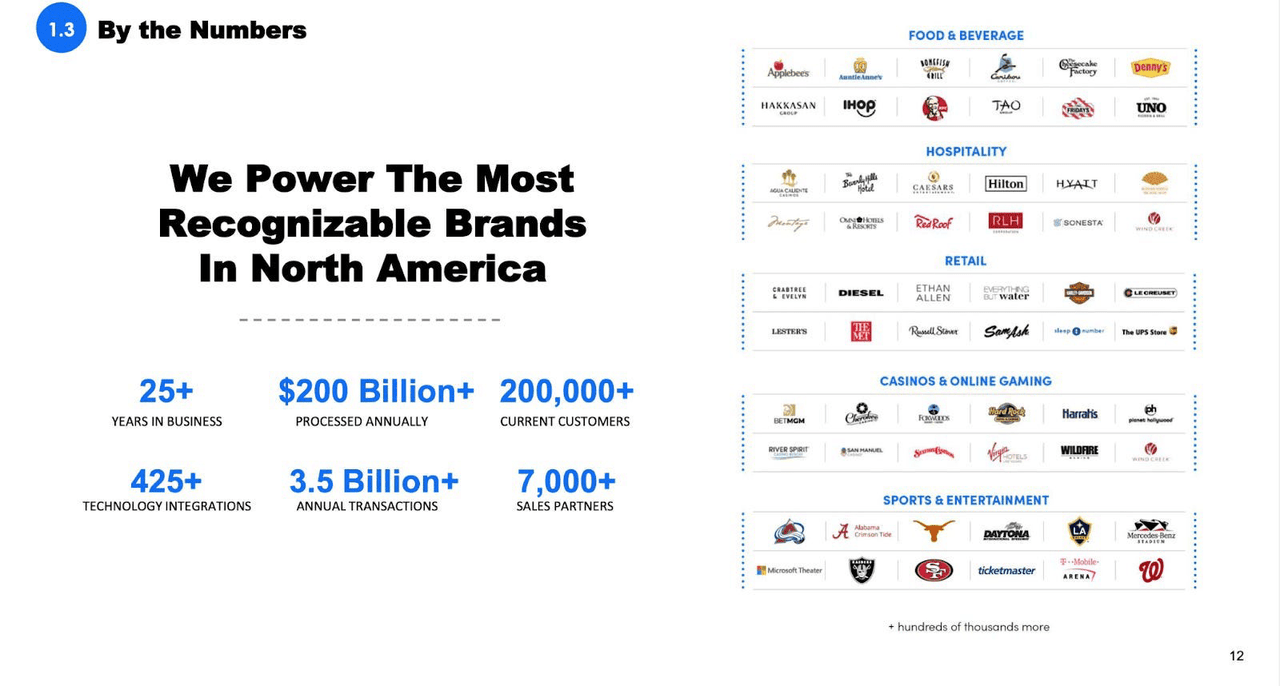

Shift4 offers bundled payment solutions and typically works with businesses with a physical presence. Just look at its impressive list of customers. Shift4 has built a vertically integrated solution that combines hardware, software, gateway, and payments.

Investor Presentation (Shift4)

Shift4 began by working with food and beverage companies, and today, it’s still their primary focus. On the surface, accepting payments in a restaurant looks simple, but in reality, the average restaurant may use over a dozen disparate software systems to accept payments, manage customer interactions, and operate its business. A large resort may operate even more software systems to enable online reservations, check-ins, restaurants, salons, spas, golf, parking, and more.

The greatest challenge is managing these software systems in one place and at scale while seamlessly accepting payments, and this is where Shift4 excels. The company has over 435+ established integrations with market-leading software suites that can be integrated with its state-of-the-art payments platform, which allows accepting payments from mobile, online, and in-store-all in real-time. Furthermore, with so many new emerging ways to pay, such as NFC, digital wallets, e-cash, crypto, and so on, Shift4 ensures it can handle everything.

What I also like about Shift4, and where I see a lot of growth, is analytics. Shift4 allows merchants to collect and process data from various channels to extract critically valuable information about consumer spending behavior.

Investment Thesis

So, my Shift4 investment thesis starts with the SaaS revenue opportunity, which includes various subscriptions, including POS software, business intelligence tools (analytics is among them), payment device management, and others.

SaaS revenue accounted only for 7% of total revenue in 2023, but it was up 64% in Q4 2023 compared to the same period in 2022. This solid growth was due to the higher integration of SkyTab, Shift4’s flagship POS solution.

Shift4 serves more than 125,000 restaurant units across the U.S., which is 25% more than the closest competitor, Toast. However, less than 15% of restaurant revenue comes from SaaS revenue. The majority of restaurants use Shift4 as a payment gateway solution. There is a multi-billion opportunity to convert existing clients to use its end-to-end solution (including SkyTab) and further gain a market share in the $800+ billion restaurant payment opportunity.

FOUR management expects to install over 30,000 new SkyTab systems in the US in 2024 and an additional 10,000 new hotels, restaurants, and numerous stadiums in Europe and Canada.

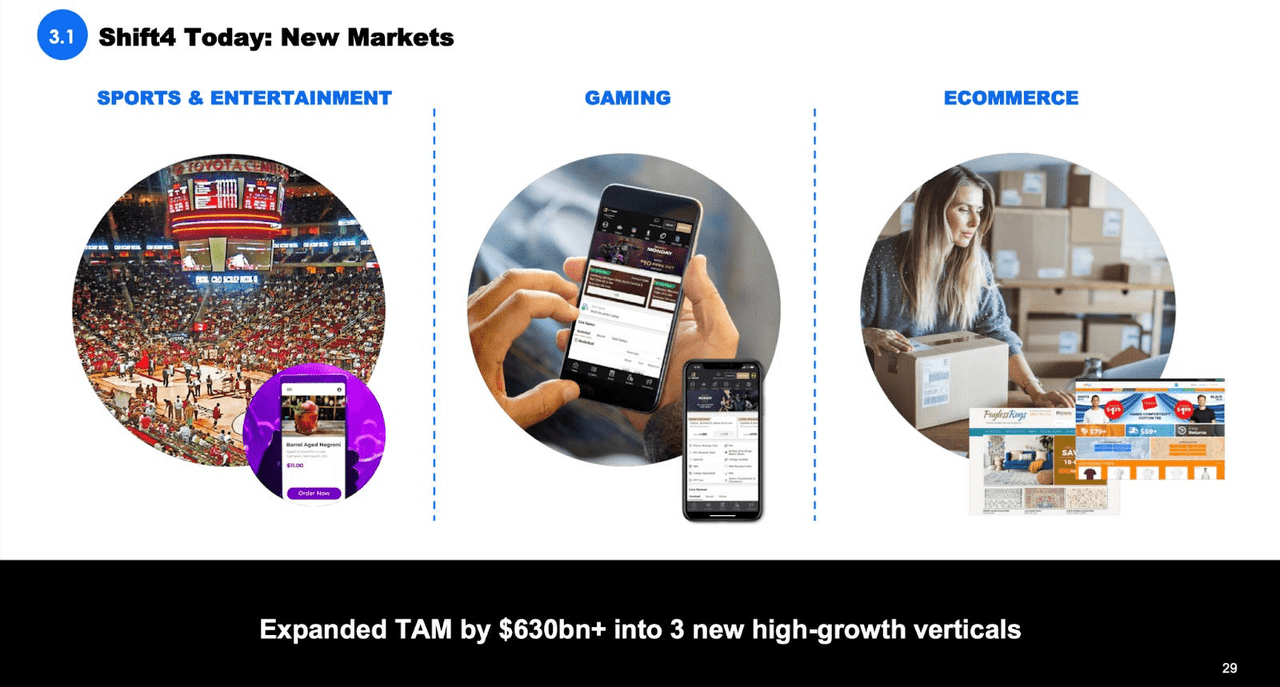

In 2021, the company added additional verticals, including sports & entertainment, gaming, and ecommerce. More recently, it added the non-profit and healthcare verticals. Shift4 can leverage its expertise in the verticals it already dominates to help gain market share in these new verticals.

Investor Presentation (Shift4)

In late 2023, Shift4 completed an acquisition of Appetize, a sports and entertainment unit of San Francisco-based payments and software company SpotOn, which helped the company significantly increase its market share in the sports and entertainment market, in which Shift4 already had about 150 customers before this acquisition.

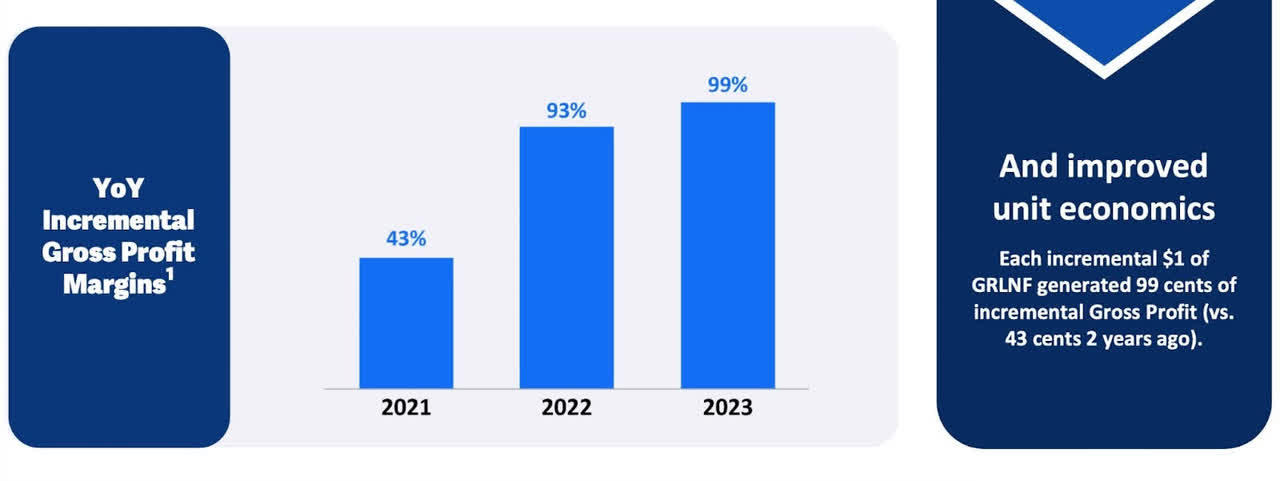

I am not a big fan of growth through M&A and I will always prefer organic growth, but Shift4’s acquisitions lately were reasonable. Acquisitions can still make sense and add value over the long term if they’re done for the right reasons at the right price. More importantly, strategic acquisitions, along with other investments like two new headquarters, internal system upgrades, and new products such as SkyTab, have resulted in improved unit economics, which is critical for margin expansion and free cash flow generation over time.

Of course, making big investments back into growth might come at a steep price. While Shift4 ended 2023 with $530 million in cash and cash equivalents, they also had $1.78 billion of debt, $690 million of which are convertible notes with a conversion price of $80.48 that mature in December 2025.

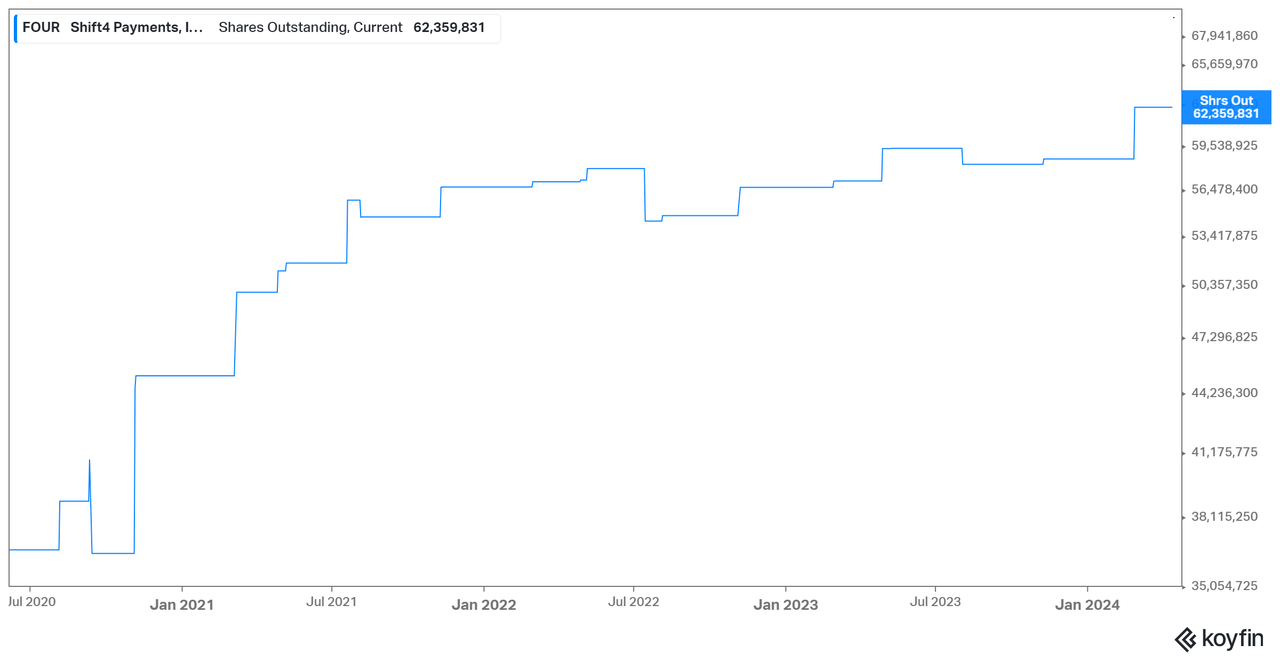

FOUR has also seen its share count increase dramatically since the IPO, some of which is from stock-based compensation, or SBC, some of which is from acquisitions, and some of which is from capital raises to support growth.

FOUR Shares Outstanding (Koyfin)

I don’t love seeing the # of outstanding shares increase by 78% over the past ~4 years; however, during this same timeframe, revenues are up more than 4x, and EBITDA is up more than 5x.

FOUR has started to offset some of this dilution with stock buybacks. They did $105 million in CY2023 and announced plans to buy back an additional $250 million in CY2024.

Despite the dilution and the pandemic, FOUR has continued to post impressive financial results, especially in FCF (free cash flow), which they don’t get enough credit for. I often discount the FCF numbers from the big software companies because it does not include SBC (stock-based comp), and many times, when you add back the SBC, it cuts their FCF numbers by 50% or more. That’s not the case with FOUR, which is expected to do $420M of FCF in CY2024, and their trailing 12-month SBC number is only $57 million or 13.5% of expected FCF this year. Not only has FOUR grown FCF from $21M in CY2021 to $420M in CY2024 (est.), but the stock is trading at just 16x CY2024 EV/FCF

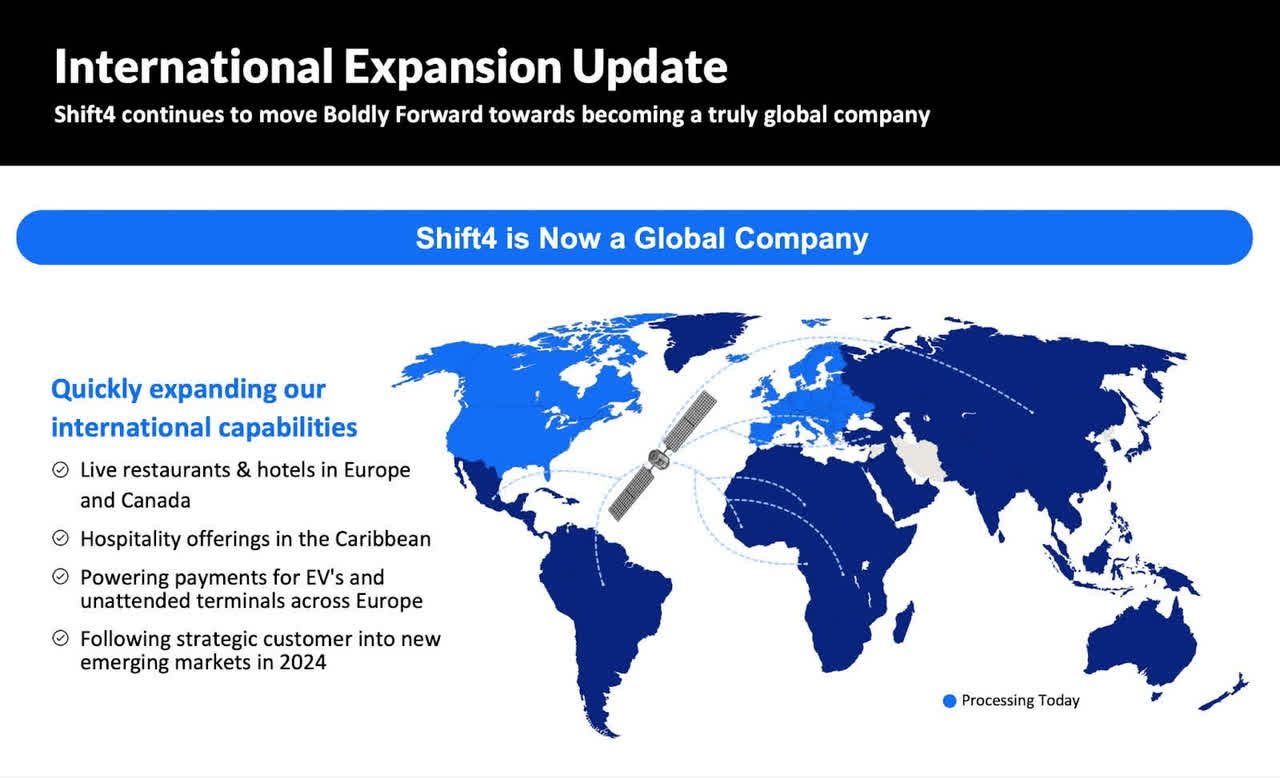

For a long time, Shift4 was trying to expand internationally, specifically to Europe, but legislation and building an infrastructure greatly slowed their progress. In October 2023, Shift4 finally closed the deal with Finaro, a cross-border ecommerce payments provider and now a fully licensed bank in Europe.

This acquisition should accelerate international growth, which is a big part of my investment thesis. Thanks to the Finaro deal, Shift4 can now expand into new markets by following existing strategic customers.

While Shift4 is already live in restaurants and hotels in Europe (and growing), the company will only make a debut in sports and entertainment in the coming months. The sports niche is especially intriguing, as it is huge in Europe, with hundreds of football (soccer) and other sports arenas. Extensive experience in offering a stadium solution, VenueNext, domestically is a significant competitive advantage for Shift4 in Europe.

In Q4 2023, the company also went live with its first locations in the UK and Canada, installing SkyTab systems in a number of restaurants. Also, in the UK, the company signed its first retailer, Ede & Ravenscroft, which leverages existing Shift4’s ISV integrations.

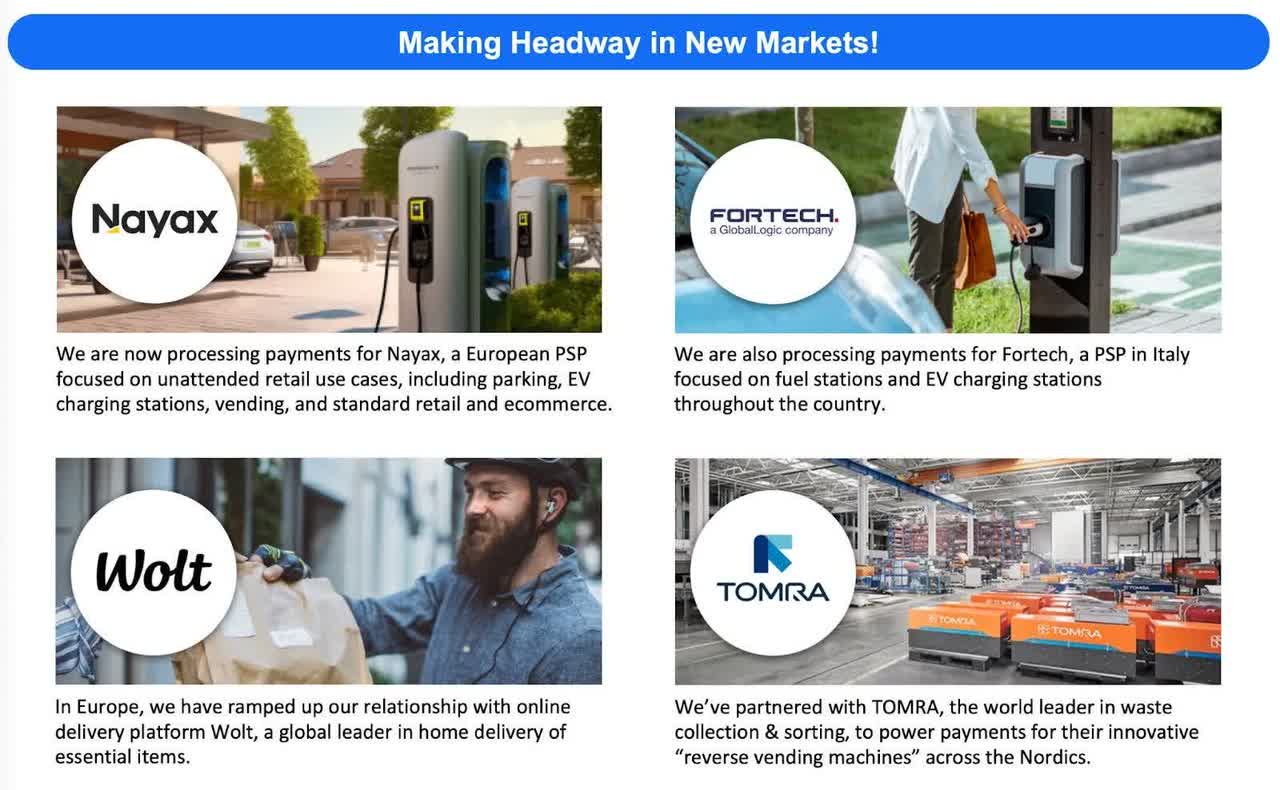

Additionally, Shift4 is making headway in new markets in Europe, including EV charging and other unattended payment applications. In Europe, Shift4 is ramping up its relationship with a large online delivery platform, Wolt (owned by Doordash), which generated over $3.5 billion in sales for 120,000+ merchant partners in 2023.

While I am pretty excited about international expansion, I still see a lot of growth opportunities domestically, particularly in the tactical move upmarket and in the sports and entertainment vertical, where Shift4 is closing one deal after another – just look at the Shareholder Letters from the past year in which they listed some of their bigger customer wins.

The upmarket move is growth in average merchant size, which is up almost 200% since 2021. Larger merchants usually have much higher payment volumes, which translates into a higher top line for the company. While the company saw some delays in enterprise deals and the timing of certain multi-billion dollar gateway migrations in Q4 2023, Shift4 has still onboarded a number of really high-profile customers throughout 2023, which will only accelerate in the years ahead.

And I am fine with the strategy where enterprise customers signed up at pretty aggressive initial terms, which include a discounted take-rate. This will have a drag on spreads and a reduction in gateway revenue initially, but over time, it will contribute to a meaningful revenue opportunity as these corporations will grow the payment value and adopt more of Shift4’s other services.

At the beginning of this write-up, I said that I like Shift4 because it is perhaps the most comprehensive solution for physical businesses on the market. It helps in winning new customers and enables multi-year contracts with them, which is good for margins longer-term. It’s always cheaper to keep the customers you have and grow those relationships than to lose the customers you have and then have to acquire new ones.

Valuation

Before I wrap up, I want to share my updated investment model for FOUR. These estimates combine my forecasts with the consensus numbers from all the analysts who cover FOUR.

I tried to lean conservative with my estimates, only using numbers that, I thought, were realistic for the next 4-5 years with 10 bps of margin expansion per year and P/E multiples that are in line with net income growth. I used 86M shares because that’s the current share count. However, there are another 5M+ shares that will hit the market in the coming years.

I’m using P/E multiples that would be very reasonable based on the expected net income growth rates, typically around a 1.0x PEG ratio, however, it’s possible FOUR will be trading at a discount or premium at any point in the next few years. Generally speaking, I like buying growth stocks that are trading with PEG ratios at or below 1.0x because I believe it gives them more upside vs the growth stocks that are trading with PEG ratios above 1.5x, and there are certainly plenty of those.

FOUR Investment Model (Lupton Capital)

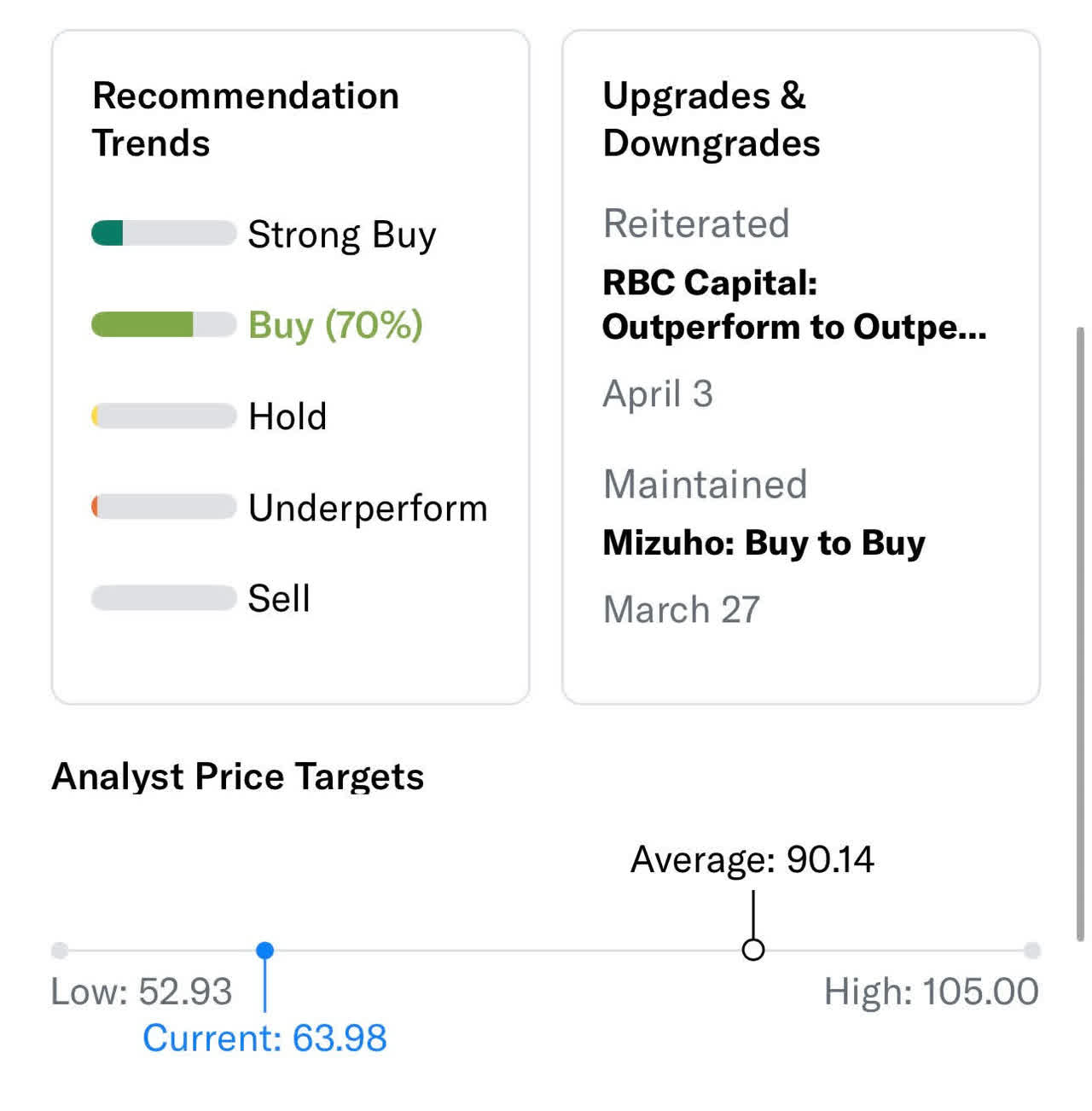

Most of the analysts have been coming out to defend FOUR in the past few weeks, calling this recent pullback a buying opportunity. According to Yahoo Finance, the average price target is $90.00

FOUR Price Target (Yahoo Finance)

Conclusion

I remain bullish on FOUR because of its fundamentals, valuation, strong management, trading at a discount to peers, international growth, possible acquisition targets, etc. At the same time, I am aware of some of the ongoing headwinds/risks (possible economic slowdown, inflation re-accelerating and pushing yields higher, fintech being competitive, too many acquisitions, too much dilution, etc.). Weighting all out, there are way more reasons to be bullish on FOUR at these prices than bearish, and most of the headwinds/risks are macro-related and not company-specific.

If FOUR continues to drift lower, I’ll definitely keep adding to my position. I’m just not sure how aggressive I’ll be. Even though FOUR is cheap by most metrics if the markets continue to pull back, I would expect FOUR to go lower, which is annoying, but that’s just how it works. Cheap stocks can always get cheaper.

I do think there are a handful of decent catalysts for FOUR in the coming months, starting with Q1 earnings. Hopefully, we get a beat and raise, or maybe they’ll tighten up full-year guidance to the high end of the previous range.