The Paypers Global Fintech Investments Analysis: Q1 2024

Following 2023’s trends and despite its uncertain economic position, the financial technology industry maintains its resilience and continues its growth path towards additional innovative solutions, while also disrupting traditional models, and presenting prospects for companies as well as consumers. However, fintech funding decreased by 16% quarter-over-quarter since the beginning of 2024, as detailed in the ‘Q1’ 24 Report’, with startups raising a total of USD 7.3 billion in the three months. Data underlines that this is the lowest level the industry has seen since 2017. At a global level, during the first quarter of 2024, there were 904 investments into fintech startups, with companies operating in the US being the major recipients, followed closely by European ones, especially the UK. In comparison to the same period of 2023, where 1,271 fintech startups received funding, with the amount totalling nearly USD 16 billion, this year’s first quarter saw a 54.3% decrease in funding.

Considering the current attitude of investors, the first quarter of 2024 saw companies displaying their abilities and potential, with many of them leveraging the capital injections to expand their footprint across markets, while also advancing their product and service suites and improving their capabilities.

Spend management

One of the first investments of 2024 was directed towards Solva, with the company raising a USD 20 million investment to further expand its digital financial products for micro, small and medium-sized enterprises and increase job creation in Central Asia. Additionally, the company intends to use a percentage of the funding to support its ongoing transition, boosting its capacity and financing outreach. Soon after, ZILO received nearly USD 31.64 million in a Series A funding round. It is directed towards accelerating product development, increasing user acquisition, and expanding ZILO’s position in the fintech sector. Following this, Vertice announced a USD 25 million Series B round, with the company planning to broaden its service offerings and assist more clients in managing their SaaS and cloud expenses.

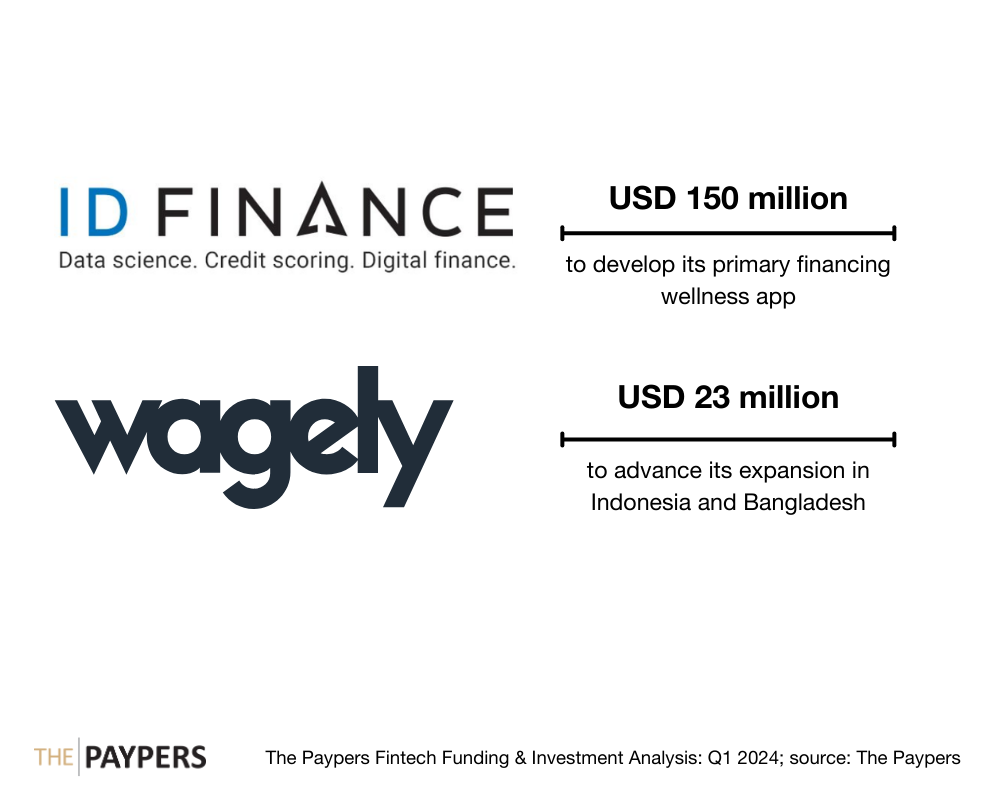

ID Finance obtained USD 150 million in debt financing in February 2024. The deal is set to support the expansion of Plazo, ID Finance’s primary financial wellness app and a component of its strategic initiatives. Moreover, at the beginning of March 2024, wagely received USD 23 million in a funding round, aiming to offer its customers enhanced solutions, while also extending its services in Indonesia and Bangladesh.

Europe and the UK’s surge in funding

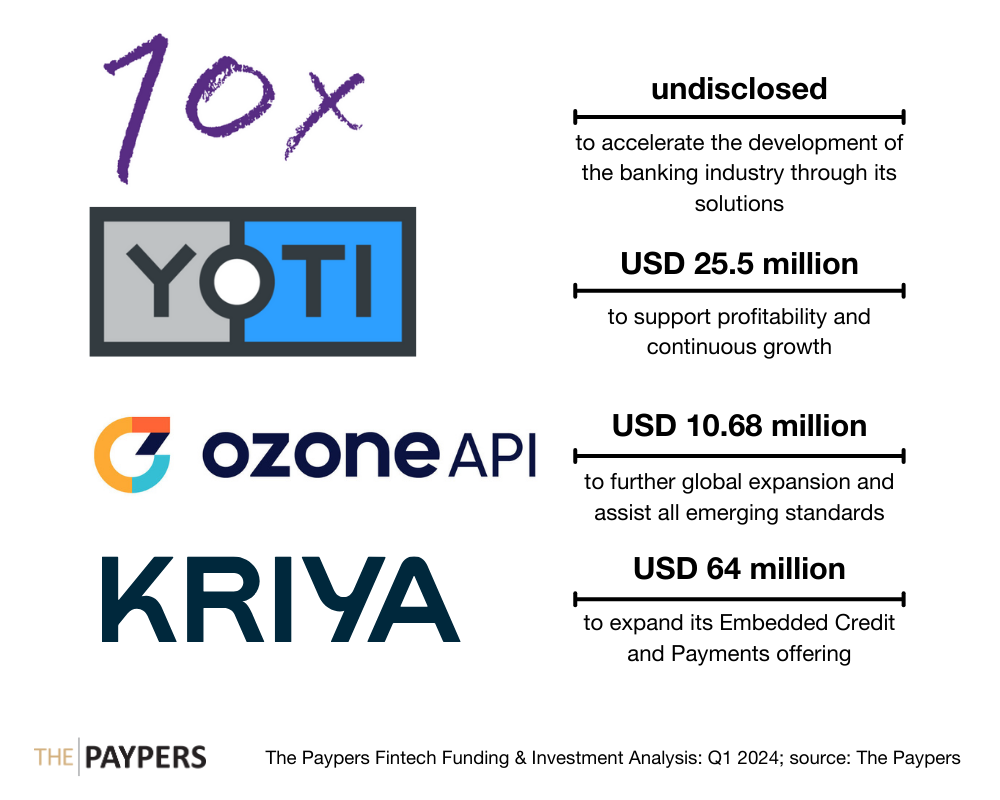

Following this trend, 10x Banking secured a new funding round, aiming to optimise and accelerate the development of the banking industry via secure technology and enhanced financial solutions. Shortly after, Yoti received nearly USD 16 million in debt funding from HSBC as well as approximately USD 9.5 million from existing shareholders. The total amount is expected to support Yoti in achieving profitability and continuous growth. Later in January 2024, Ozone API raised approximately USD 10.68 million in a Series A funding round, with the firm planning to continue its global expansion and invest in its team. Moreover, Kriya received nearly USD 64 million in a funding facility to double down on its PayNow and PayLater Embedded Credit and Payments offering for B2B retailers and marketplaces.

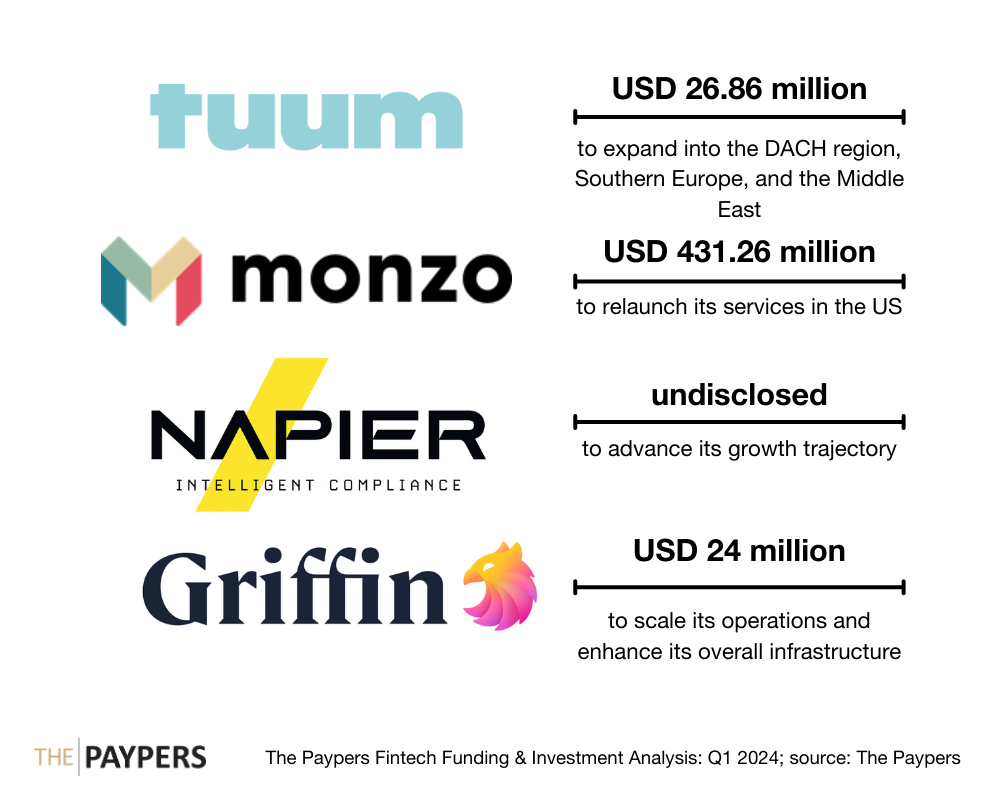

The beginning of February 2024 saw Tuum raising nearly USD 26.86 million in a Series B financing round, with the company aiming to further expand its international presence and target additional territories in the DACH region, Southern Europe, and the Middle East. At the end of the month, Monzo finalised a deal of USD 431.26 million planning to allocate the funds towards relaunching its services in the US, as well as developing additional services and products. During the same period, Napier AI obtained a significant investment intended to advance the company’s growth trajectory, reflecting the evolving landscape in the KYC and AML sectors.

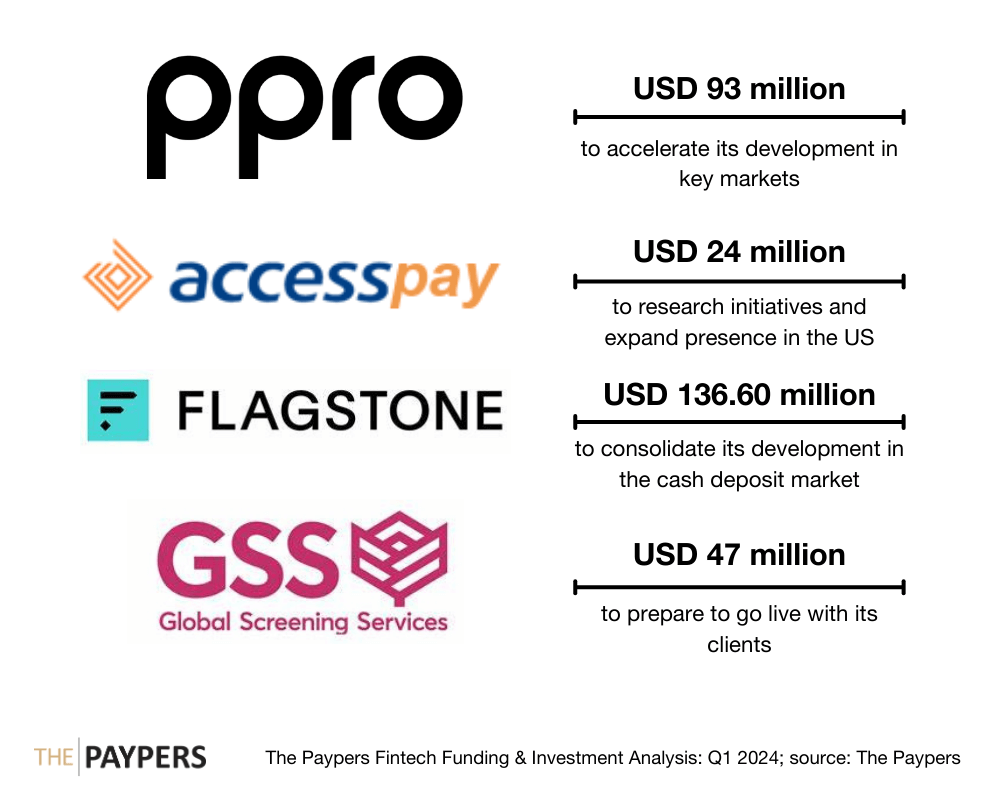

Furthermore, at the beginning of March 2024, Griffin raised USD 24 million in a funding round, with the company launching as a fully operational UK bank and aiming to scale its operations and enhance its overall infrastructure for new and existing clients. Additionally, PPRO obtained approximately USD 93 million in a funding round, intended to accelerate its development in key markets and improve its global network of payment methods. Shortly after, AccessPay concluded a USD 24 million funding round in a combination of equity and debt, with the resources being set to drive profitable growth. March 2024 also saw Flagstone receive USD 136.60 million investment in a bid to accelerate its development process, with the round merging primary and secondary investments. At the end of the month, Global Screening Services (GSS) received USD 47 million in a Series A2 funding round, with the investment following its transition from the development phase to the operational one as it prepares to go live with its clients.

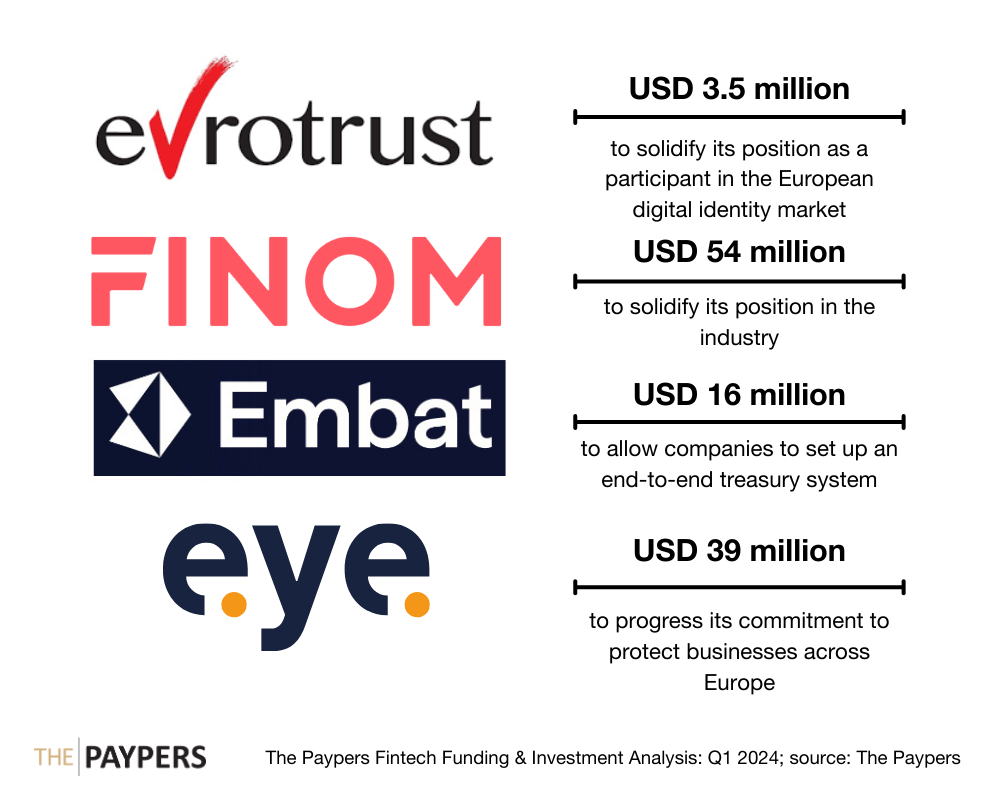

In addition to the UK’s increase in funding rounds in the banking and fintech sectors, investors also directed their capital towards companies operating across Europe. For example, Evrotrust raised nearly USD 3.5 million, planning to leverage the investment to solidify its position as a participant in the European digital identity market. Also, Finom received approximately USD 54 million in a Series B equity funding round to solidify its position in the industry and enable its expansion across the entire Eurozone by 2025. Shortly after, Embat secured nearly USD 16 million in a Series A funding round, intending to allow companies to set up an end-to-end treasury system more efficiently.

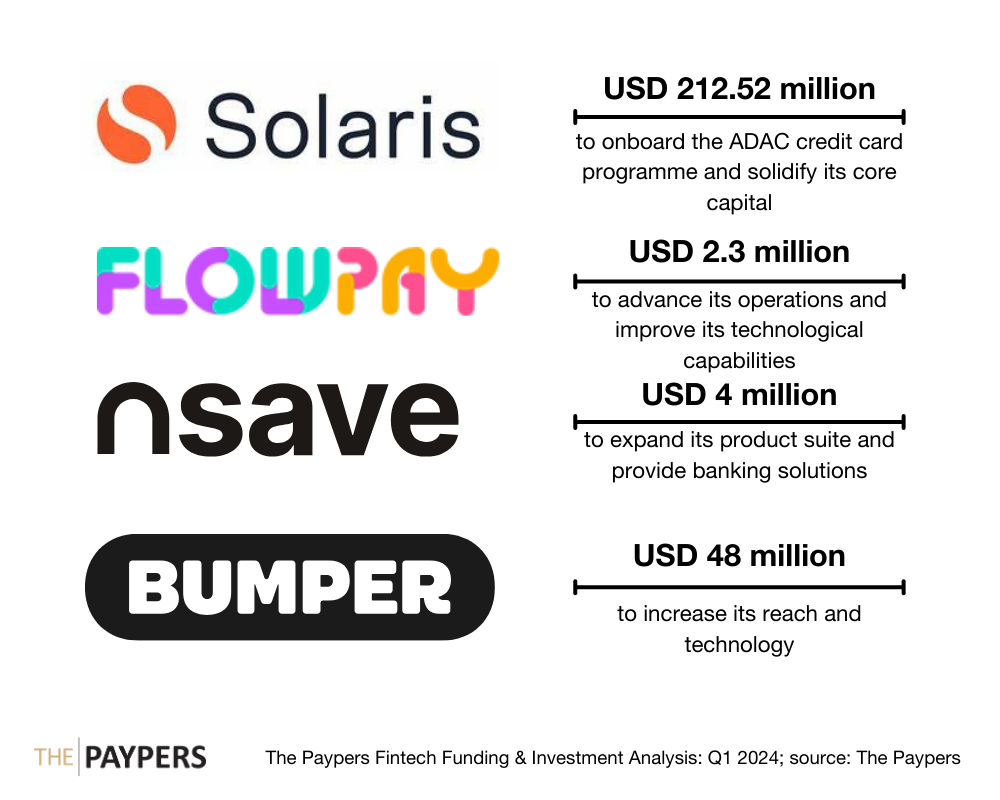

Several companies secured funding in March 2024, including Eye Security, which received USD 39 million in a Series B round to progress its commitment to protect businesses across Europe. In addition, Solaris obtained approximately USD 104 million in a Series F funding round, plus a financial guarantee of up to USD 108.52 million capital equivalent. The company plans to onboard the ADAC credit card programme and solidify its core capital, while also advancing the resilience of its platform. Shortly after, Flowpay secured nearly USD 2.3 million in a seed round, aiming to expand its operations beyond its home country and improve its technological capabilities. Following this announcement, fintech nsave secured USD 4 million in a seed funding round to expand its product suite and provide banking solutions for individuals residing in regions with unstable banking sectors or facing inflationary pressures.

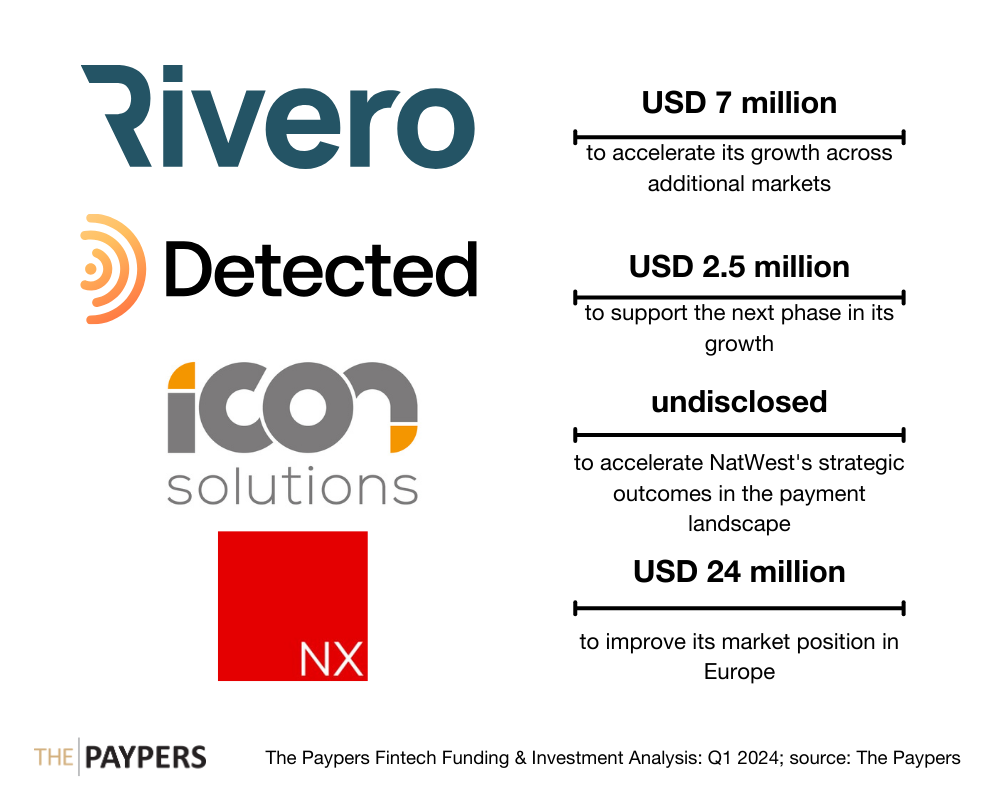

Organisations working towards improving the payment landscape throughout Europe also obtained significant investments during the first quarter of 2024. For example, in January 2024, Bumper closed a USD 48 million Series B funding round to increase its reach and technology. Shortly after, Rivero raised USD 7 million in a Series A funding round in a bid to accelerate its growth across additional markets and increase its product development and workforce. Additionally, Detected announced a new funding round of USD 2.5 million. Confirming the progress of the fintech, the funds are set to be leveraged to support the next phase in its growth.

Moreover, Billink raised nearly USD 32 million, with the payment provider aiming to leverage the funds to expand its services to the largest 50 webshops in Benelux, enter the German market, and continue its efforts to make online purchases safer for its users. Also, Mondu obtained approximately USD 32.54 million in a debt financing round, with the capital being utilised to further its expansion across Europe and assist its development strategies.

During the same period, Icon Solutions secured a strategic minority investment from NatWest as part of their ongoing collaboration, with the funds being projected to accelerate the bank’s strategic outcomes in the payment landscape. At the end of March 2024, NX Technologies raised nearly USD 24 million in a Series B funding round to improve its market position in Europe and enhance its product suite.

Despite sparking investors’ interest in the fourth quarter of 2023, cryptocurrency and blockchain sectors saw a decrease in funding during Q1 2024. In the face of the current environment, organisations still receive capital injections, with them aiming to leverage the funds to advance their operations. For example, Kiln announced the successful completion of a USD 17 million funding round in January 2024, with the company planning to expand globally and establish its APAC headquarters in Singapore by the end of Q1 2024. Following this announcement, Sygnum obtained over USD 40 million in its ongoing Strategic Growth Round to assist its growth into new markets and improve its suite of services.

North America

Most of the capital infusions were directed towards US companies, with Aqua Security being one of the first of 2024 to secure an investment. The company raised USD 60 million in a bid to reduce and combat cloud-native attacks. Shortly after, Panacea Financial obtained USD 24.5 million in a Series B funding round to expand its team with experts in technology, financial services, and healthcare. In addition, Digital Onboarding received USD 58 million in growth capital to further advance its digital engagement platform. Also, Incognia secured USD 31 million in a Series B funding round, with the company intending to facilitate the ongoing development of its digital identity signals and expand into new regions and verticals, including consumer internet, financial services, and ecommerce across North America, Europe, and EMEA.

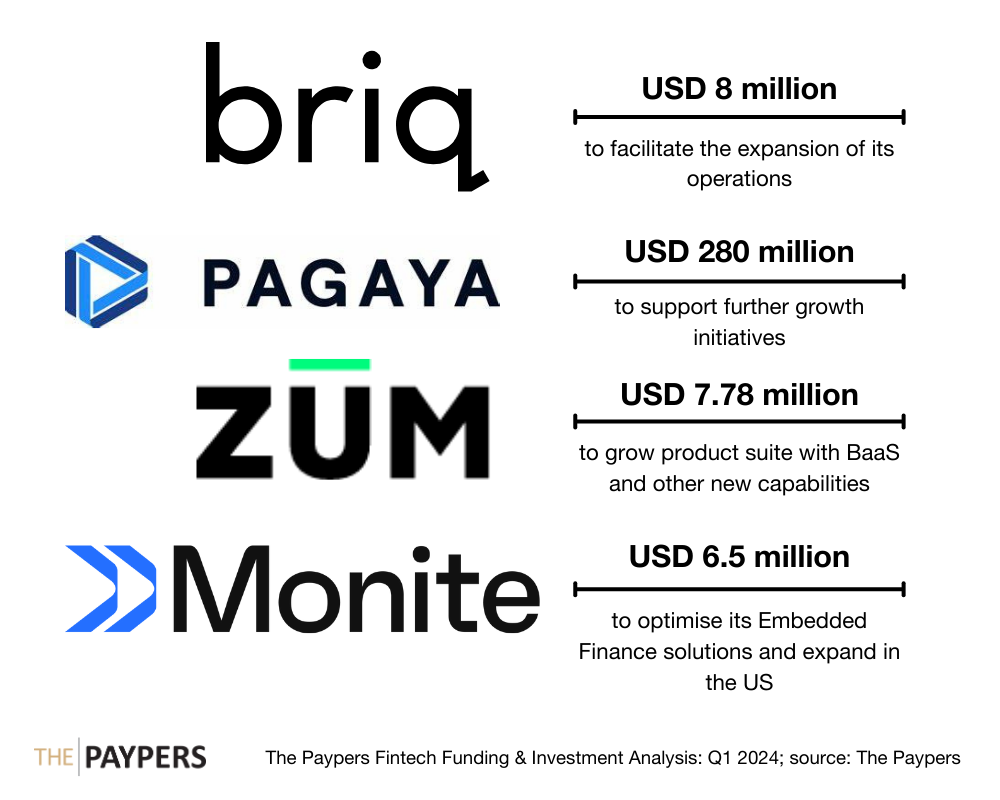

Considering the rise in the use of AI, as well as its capabilities, fintechs providing AI-based solutions piqued investors’ interest, with Briq raising USD 8 million in an extension round to expand into new geographies, including the Middle East, Asia, and parts of the non-English emerging markets in Europe. However, one of the largest investments of Q1 2024 was directed towards Pagaya which closed a USD 280 million credit facility to support its future growth initiatives.

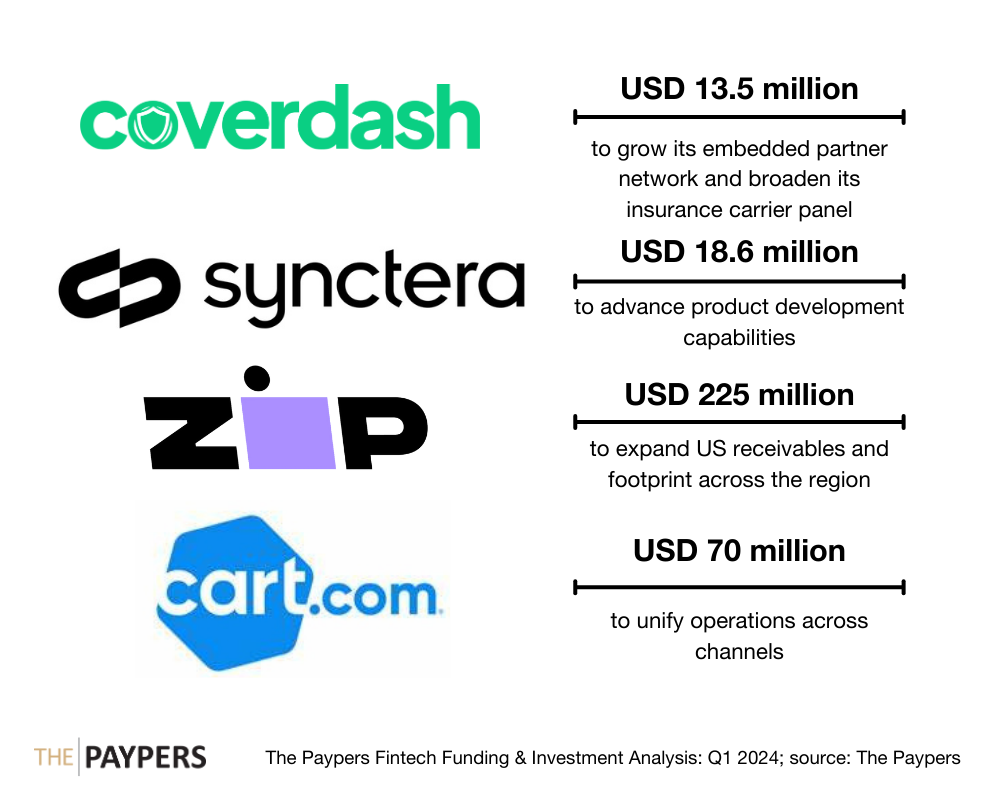

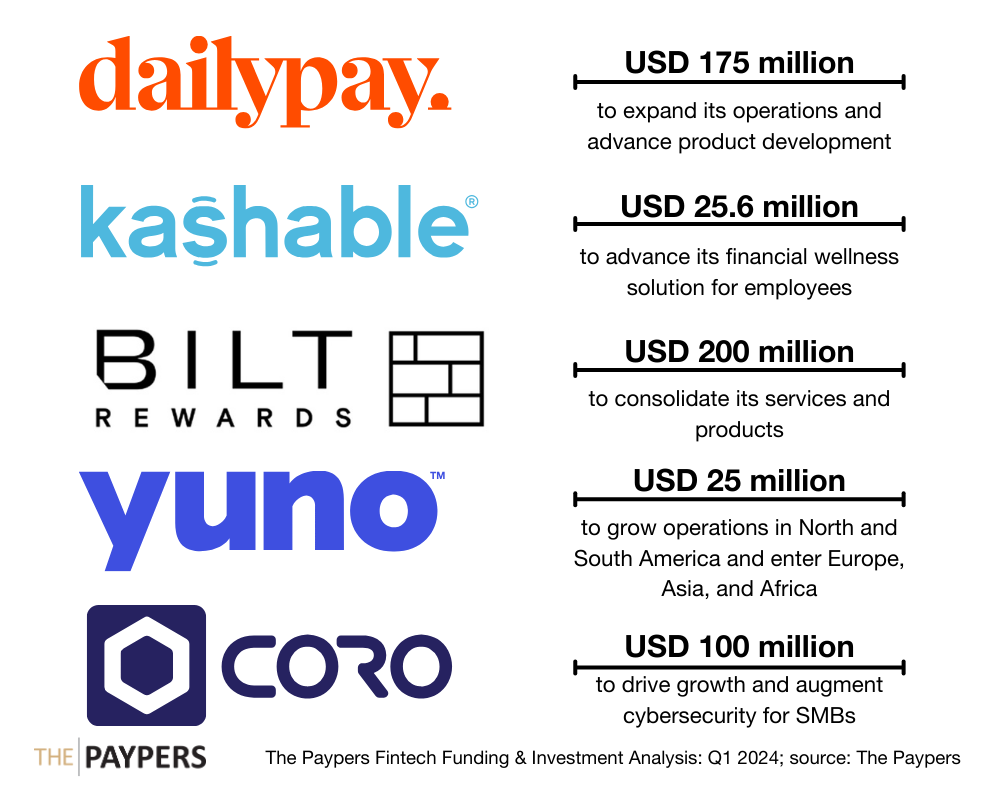

As North Americans increased their use of digital payments, companies focused their attention on improving their capabilities, enhancing the customer experience and meeting the demands of their users. For example, Zip closed a USD 225 million refinancing agreement that is set to support the growth of its US receivables. In addition, Cart.com obtained USD 70 million in debt facility in January 2024, with the company planning to accelerate its development process and optimise how multichannel merchants and traders sell and grow their products. During the same period, DailyPay received USD 175 million to support its expansion and product development efforts. Soon after, Kashable closed a USD 25.6 million round in a bid to expand financial wellness solutions for employees, while also fuelling its growth.

Furthermore, the end of February 2024 saw Bilt Rewards concluding a USD 200 million round which is set to consolidate its services and develop its mortgage payment rewards. Also, Yuno secured USD 25 million, intending to utilise it to advance operations. Additionally, Coro raised a USD 100 million Series D funding round in a bid to drive growth and augment cybersecurity for SMBs.

Latin America

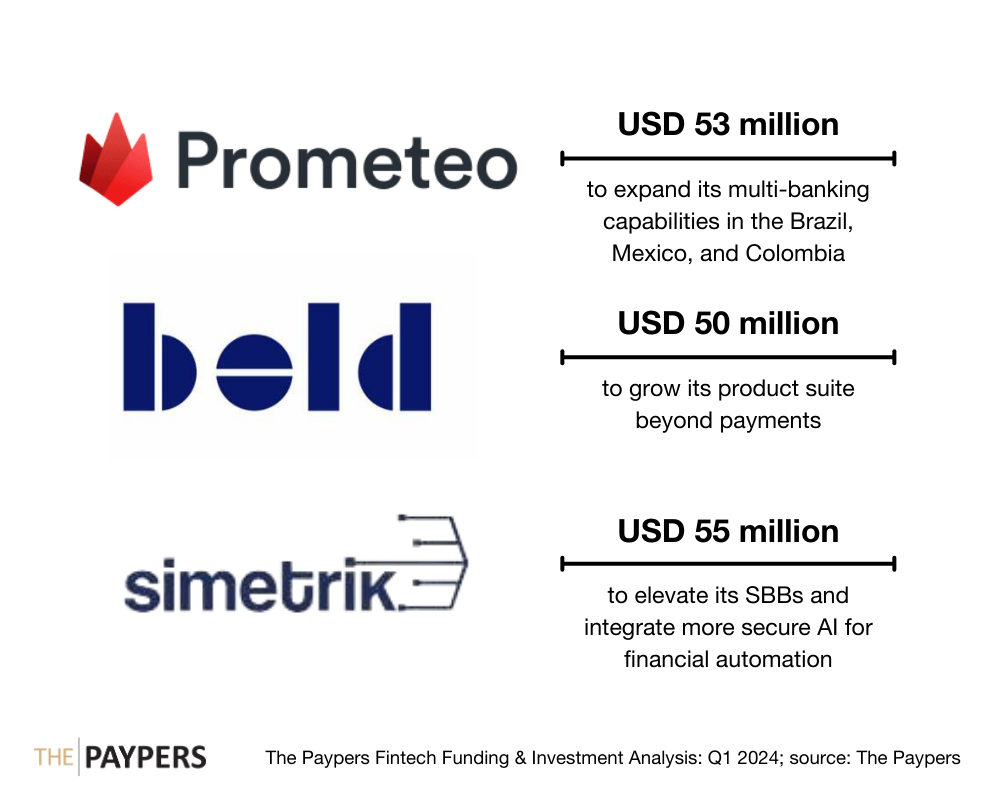

Following this trend, Prometeo received USD 13 million in a Series A funding round, aiming to develop a more accessible and interconnected financial system in Latin America. Shortly after, it raised USD 40 million more in a Series B funding round to support its commitment to scaling and solidifying its payment technology in Brazil, Mexico, and Colombia.

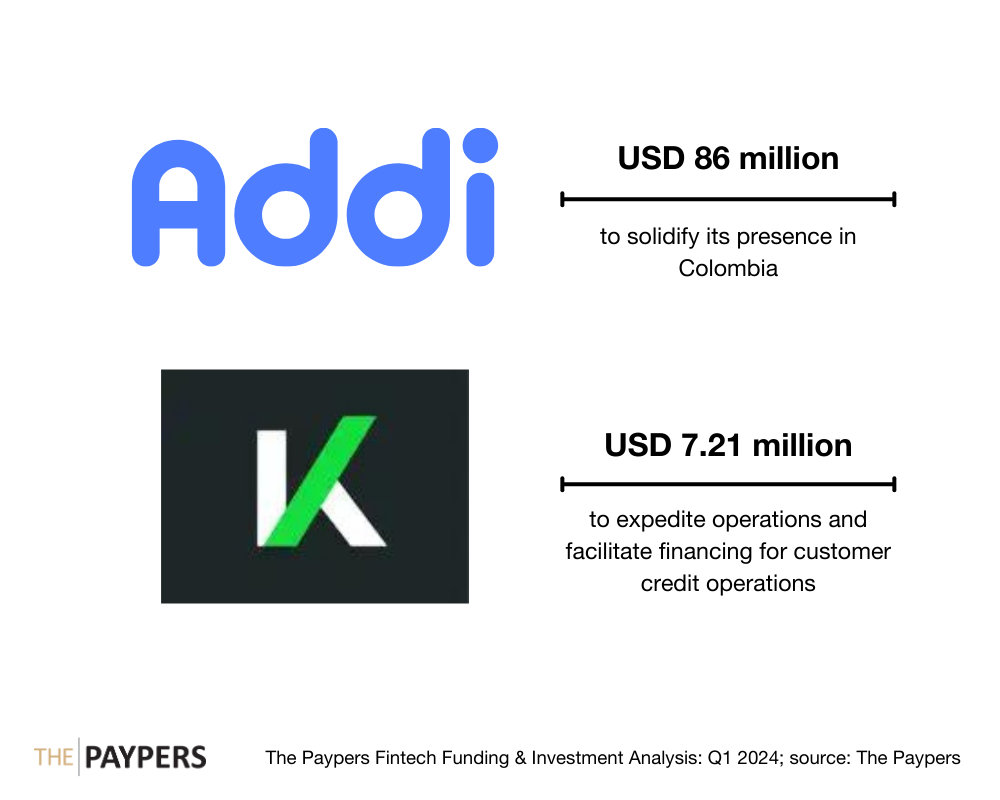

The end of March 2024 saw Addi obtaining USD 86 million in a funding round that included both equity and debt financing to solidify its presence in Colombia and grow its capabilities. Moreover, Koin secured a USD 7.21 million investment in a bid to finance customer credit operations.

Asia

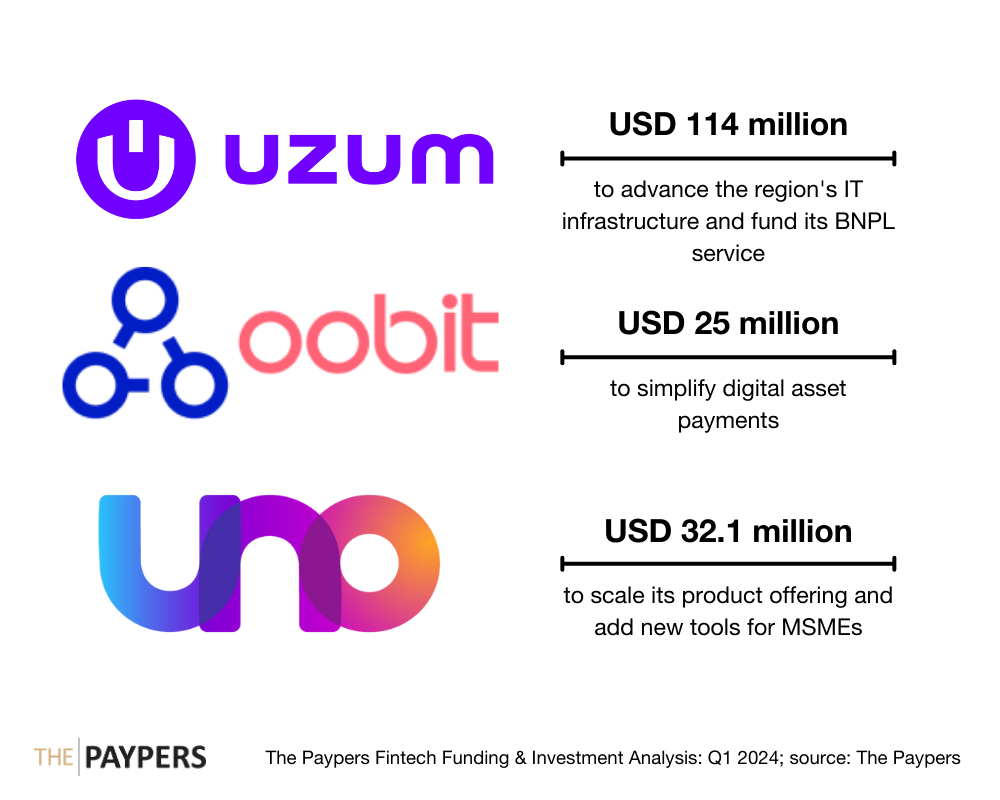

The beginning of February 2024 saw Oobit raising USD 25 million in a Series A funding round, with the company planning to open up the payment capability to third-party wallets, which is set to transition it into a non-custodial crypto payments app.

Among the companies providing banking solutions that secured funding is also UnoAsia, which received USD 32.1 million in a pre-series B round, aiming to scale its products and add new tools for MSMEs. In March 2024, Perfios obtained USD 80 million in a bid to strengthen its business outside its home country and explore inorganic growth opportunities.

Investors also directed funds towards payment and ecommerce solutions providers, with BuyEazzy securing USD 4.25 million in January 2024 in a Series A funding round to accelerate its overall expansion strategy and provide its services to over 40 cities in the region. In addition, FundPark received a USD 250 million private loan, with the fintech aiming to increase exposure to growth and opportunity in greater China’s new economy sectors. The beginning of March 2024 also saw Fairbanc receiving USD 13.3 million in debt financing in a bid to expand operations in Indonesia.

Africa and the Middle East

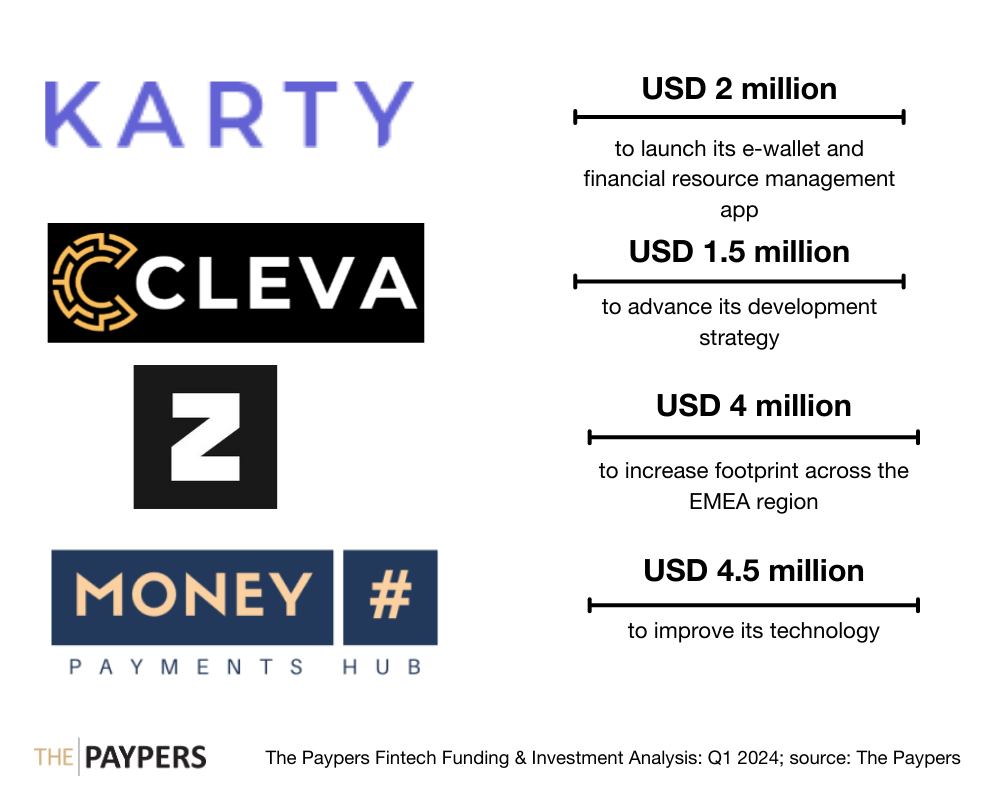

Furthermore, investors channelled their funds towards digital payment providers, including Cleva, which raised USD 1.5 million in pre-seed funding in a bid to develop a banking platform for African individuals and businesses for cross-border payments in USD accounts. Shortly after, Zeal obtained USD 4 million, with the firm planning to use the funds to increase its footprint in the wider MENA market. The end of February 2024 saw MoneyHash raising USD 4.5 million in a seed funding round aimed at improving the fintech’s technology and expanding across the region.

Conclusion

After carefully analysing the most relevant investments in the fintech sector in the first quarter of 2024, we concluded that the industry maintained its resilience despite several challenges and investors’ cautious approach to disbursing their funds. Many of them chose to focus on funding companies operating across digital banking, payment technologies, spend management services, fraud mitigation solutions, and lending for small businesses.

AI-based solutions received some of the largest deals during the first three months of the year, while the US maintained its position at the top of investors’ preferences. Firms collectively secured nearly USD 3.3 billion across 393 deals during this period. However, Europe followed closely behind with startups receiving approximately USD 2.2 billion across 203 deals. The considerable difference in the number of deals in Europe shows greater round sizes compared to the US.

To wrap up, the fintech sector in the first quarter of 2024 proved its versatility as investors split their capital towards advancing technological solutions and services. Even if Q1 2024’s funding dropped by 54.3% compared to the same period of last year, venture funding rose by 11% quarter-to-quarter to USD 58.4 billion. Firms, as well as investors, showcased their allegiance to further adjust and customise their solutions, products, and services to meet both their customers and the landscape’s demands with security and modernisation in their minds.

About Iulia Mușat

Iulia is a Junior News Editor at The Paypers, predominantly focusing on fraud prevention, financial inclusion, and online payments. With an interest in discovering the latest trends in financial security and payment solutions, Iulia is eager to bring insightful news that keeps readers updated with the current advancements in the financial landscape.