The Paypers Global Fintech Mergers and Acquisitions Analysis Q1 2024

The Paypers analysed some of the most important M&As from Q1 2024 and focused on various emerging trends in the fintech, payments, banking, fraud prevention, and crypto sectors to highlight key aspects that prompt companies to acquire others.

With the arrival of the new year, companies in the fintech sector actively searched for ways to keep up with evolving markets by expanding their portfolios and securing footholds into new geographic areas. Indeed, a quick look at some of the most noteworthy mergers and acquisitions in the fintech space for Q1 2024 shows a continued need for consolidation and product expansion, with the payments and banking sectors witnessing the most activity in this quarter.

Zooming in on the US and Canada, in 2023, the fintech merger and acquisition landscape in the two regions experienced a downturn compared to the previous years. The reported deal value totalled USD 28.3 billion, marking a 45.8% decrease from 2022’s USD 52.2 billion and a 36.5% decrease from 2021’s USD 44.5 billion. Similarly, the number of M&A transactions decreased, with 145 acquisitions recorded in 2023, representing a 15.7% decline from the 172 deals in 2022 and a 48.9% decline from the 284 deals in 2021. These figures mark the lowest levels in over three years for both deal value and count.

Several factors contributed to this decline in M&A activity, including increased interest rates, reduced capital availability, a shift from growth to profitability focus, and heightened geopolitical tensions. These conditions led to greater market volatility and a more conservative approach to capital deployment, resulting in subdued fintech M&A activity compared to previous years. The decrease in acquisitions mirrors broader trends in the fintech market, where venture capital funding also saw a decline. In 2023, fintech companies raised USD 34.6 billion in venture capital across 2,055 deals, down 43.8% and 32.4% from 2022’s USD 61.4 billion and 3,039 deals, respectively.

Recent M&A activities in banking and fintech

In Q1 2024, M&A activity in the banking and fintech sector was largely driven by financial institutions’ need to expand their product portfolios or enter new markets. For instance, Amadeus moved forward with its purchase of Voxel, while Nationwide Building Society reached a preliminary agreement to acquire Virgin Money.

Amadeus’ acquisition of Voxel aligned with its commitment to offering a streamlined and convenient travel payment experience, while also complementing its payments business, Outpayce, by improving its existing suite of products for travel sellers. Furthermore, the acquisition aims to facilitate the expansion of Amadeus’ payments business within the hospitality sector, and it represents the company’s second purchase in Q1 2024, with the first aiming to bolster its biometric capabilities.

In essence, by integrating Voxel’s solutions into its current offerings, Amadeus gained the ability to provide an extended range of payment services for travel sellers, along with a more automated electronic approach for managing invoices for tour operators, Travel Management Companies (TMCs), hotel aggregators, and hotels.

Nationwide Building Society entered into a preliminary agreement to acquire Virgin Money for USD 3.6 billion. This acquisition provided Nationwide with an opportunity to expand into business banking, a venture that was previously disrupted during the pandemic, and to bolster its presence in the mortgage market.

Representatives from Nationwide indicated that this transaction would allow the company to accelerate its strategic objectives and diversify its product and service offerings more rapidly than through organic growth. Nationwide anticipates that the combined entity, with assets totalling approximately USD 419 billion, would become the second-largest provider of mortgages and savings in the UK.

In February, Barclays revealed its intention to acquire Tesco’s retail banking business and provide customers with branded credit cards, personal loans, and deposits. The acquisition of Tesco’s retail banking business encompasses credit cards, unsecured personal loans, operational infrastructure, and deposits.

Concurrently, Barclays UK is poised to establish a long-term partnership with Tesco Stores Limited for an initial term of ten years. This strategic agreement will involve the marketing and distribution of credit cards, unsecured personal loans, and deposits under the Tesco brand. Additionally, the collaboration aims to explore further opportunities to offer financial products and services to customers.

US-based cloud banking firm nCino also signed a definitive agreement to acquire DocFox, an automated business onboarding tool for financial institutions. By integrating with nCino, DocFox gained the ability to assist financial institutions in managing the entire client lifecycle, including information intake, document collection, and due diligence, all within a unified platform.

In Southeastern Europe, Turkey-based financial technology company Papara announced the acquisition of T-bank in an attempt to add core banking products to its offering. Papara’s efforts aimed to support its strategy to improve the banking industry with better solutions.

At the time of writing, the acquisition awaits regulatory approval, with the decision coming after an agreement with Papara’s shareholders. In the original announcement, representatives from T-Bank highlighted that the bank’s expertise and capabilities are set to be solidified by Papara’s user-oriented vision, while also enabling traditional banking products to reach more individuals with more technologies and solutions.

The M&A activities in the banking and fintech sectors reflect a strategic pursuit of expansion, diversification, and innovation among industry players. Partnerships, technology integration, and regulatory compliance are crucial factors shaping these transactions, ultimately aimed at enhancing market competitiveness and meeting evolving customer needs.

M&A spotlight on payments and commerce

Mergers and acquisitions in the payments sector in Q1 2024 were driven by a need to accelerate the development of existing technologies and services such as recurring payments, as well as consolidation and ensuring support for emerging payment schemes. Entities such as Trustly and Visa both managed to complete acquisitions initiated previously, while companies such as DMI Group aimed to broaden their reach among existing and potential customers by incorporating other companies.

Trustly completed the acquisition of SlimPay following an initial statement announced in August 2023 and the subsequent receipt of regulatory approvals from the French banking supervision authority. The acquisition followed a successful introduction of Trustly Azura, a payment engine that optimised user experience using personalisation and data optimisation.

The addition of SlimPay’s offerings and capabilities aimed to improve the network effect of the Azura service, which provides an easy and efficient payment procedure for an expanding client base. By incorporating its solutions with SlimPay’s suite of services, Trustly is looking to reinforce its commitment to provide a comprehensive and secure Open Banking-enabled, pan-European recurring payments tool.

Visa finalised its acquisition of Pismo, which is a global cloud-native issuer processing and core banking platform. With the completion of this acquisition, Visa and Pismo geared up to provide clients and customers with core banking and card-issuer processing capabilities across all product types through cloud-native APIs. Pismo’s platform is anticipated to enable Visa to extend support and connectivity for emerging payment schemes, as well as Real-Time Payments (RTP) networks for financial institution users. Visa announced its decision to sign a definitive agreement to acquire Pismo for the sum of USD 1 billion in cash in June 2023.

In an effort to expand its fintech presence in Africa, BaaS and Embedded Finance enabler Ukheshe acquired EFTCorp. At the time, Ukheshe representatives highlighted the strategic positioning of the two companies, emphasising their shared executive vision and strong product offerings. Both entities were looking forward to expanding their presence in the African market while delivering improved services to their customers and partners.

In Australia, Fat Zebra acquired Adatree, a data intermediary fintech operating within the Open Banking sector. This strategic acquisition aimed to improve Fat Zebra’s payment services by leveraging Adatree’s expertise in data solutions. In essence, the collaboration was expected to enable the provision of Open Data and payment services thus expanding the range of offerings for customers. The primary goal for Fat Zebra, known for its payment processing services catering to SMEs and enterprise Australian merchants, was to strengthen its position in the payments industry.

Other noteworthy M&As in the payments space for Q1 2024 include the acquisition of SaaS post-trade platform Torstone Technology by FIS to improve capital markets tech capabilities and offerings, as well as Capital One’s acquisition of US-based credit card issuer Discover Financial Services in an all-stock transaction valued at USD 35.3 billion.

The M&A activities in the payments sector reflect a strategic pursuit of technological advancement, market expansion, and service enhancement. Companies are leveraging acquisitions to consolidate market presence, support emerging payment schemes, and capitalise on industry-specific expertise to stay competitive and meet the evolving needs of customers.

Important activity in the cryptocurrency sector

During the first quarter of 2024, announced merger and acquisition deal activity experienced a 22% increase compared to the previous quarter. However, despite this positive trend, the level of activity remained below that of the peak year in 2022. Notably, within the tech sector, the crypto sector saw a slightly greater improvement in announced deal activity compared to the overall tech sector, while the fintech sector observed a decline in announced deals in the last quarter.

Some of the most important developments in the crypto space for Q1 2024 include Coinbase’s decision to acquire a European Union MiFID-licenced entity based in Cyprus to improve access to derivative products for eligible customers, as well as BitGo’s acquisition of Brassica, a provider of investment infrastructure for private securities and alternative investments.

In Coinbase’s case, the company decided to intensify its efforts to support economic freedom for individuals by focusing on the development and expansion of trusted and compliant financial products and services. As part of its global expansion initiative, Coinbase went forward with its plans to acquire a European Union MiFID (Markets in Financial Instruments Directive) licenced entity based in Cyprus. According to Coinbase, the MiFID holds significance in the EU’s Capital Markets Union strategy.

The acquisition of such a licence also aligns with Coinbase’s strategy to address the strong demand for derivatives products and expand its presence in the global crypto market.

As for BitGo, it acquired Brassica in a bid to broaden its services into the private securities sector and digitalise the alternative asset industry. By leveraging Brassica’s infrastructure solutions for private securities, the integration aimed to enhance accessibility in the industry, making both alternative and digital investing more accessible. With the acquisition of Brassica, BitGo aims to strengthen its position in the industry and become one of the few financial services firms capable of offering comprehensive infrastructure support for both traditional private securities and blockchain-based assets.

A closer look at digital identity and fraud prevention

According to data from Sift, approximately 16% of consumers either admit to engaging in payment fraud or know someone who does. Moreover, around 17% of consumers have encountered online offers related to payment fraud, signalling the widespread accessibility of fraudulent activities among ordinary internet users.

In the past, Juniper Research indicated that global online businesses incurred losses of USD 41 billion due to payment fraud in 2022. This surge in attacks underscores the inevitability and potential scale of payment fraud incidents for businesses. Notably, Sift’s network revealed a 13% increase in payment fraud attacks within the fintech sector between 2021 and 2022.

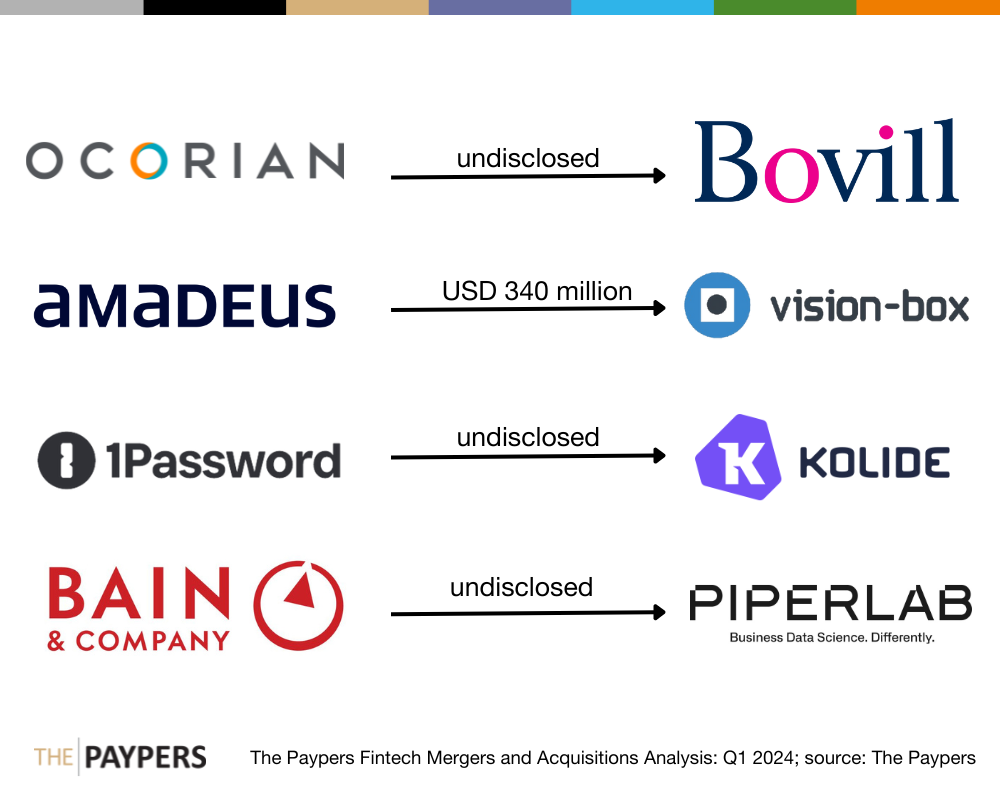

Some of the most noteworthy mergers and acquisitions in the digital identity and fraud prevention space include Ocorian’s acquisition of Bovill, 1Password’s acquisition of device health and contextual access management company Kolide, as well as Bain & Company’s purchase of European provider of AI solutions PiperLab.

Starting off with Ocorian, its acquisition of Bovill aims to improve the former’s regulatory and compliance capabilities, addressing the increasing demand for regulatory guidance and support from asset managers and financial institutions. With a focus on providing high-quality compliance services, Bovill contributed with expertise and a global footprint to complement Ocorian’s existing regulatory and compliance business, Newgate, based in the UK and Guernsey. At the time, Bovill officials brought up the opportunities presented by joining forces with Ocorian, enabling Bovill to extend its services globally and offer clients enhanced expertise and tools such as the GATEway platform.

Amadeus’ first acquisition in Q1 2024 focused on Vision-Box. This move aims to expand the former’s range of biometric solutions and services. This acquisition is expected to offer Amadeus enhanced capabilities in biometrics hardware and software, alongside the addition of border control services to its existing portfolio.

In essence, the integration of Vision-Box into Amadeus is projected to enable the provision of a comprehensive passenger experience, spanning from the initiation of travel to boarding. Amadeus has agreed to acquire Vision-Box for approximately USD 340 million, and the acquisition entails the transfer of around 470 Vision-Box employees to Amadeus. The completion of the deal is contingent upon customary regulatory approvals and is slated to conclude in the first half of 2024.

In February, Canada-based password manager provider 1Password acquired device health and contextual access management company Kolide in a bid to address the increasing security challenges faced by businesses as their workforce operates from diverse locations and on various devices.

Specifically, representatives from 1Password emphasised the need for innovative security solutions in response to the evolving workplace landscape. The integration of Kolide’s contextual access management and device health capabilities into 1Password’s security suite was expected to help businesses improve their security measures and achieve Zero Trust access objectives.

Zeroing in on its goal to improve its AI and ML capabilities across Europe, the Middle East, and Africa (EMEA), global management consulting firm Bain & Company acquired European provider of AI solutions PiperLab. As part of the deal, PiperLab was integrated into Bain’s global Advanced Analytics Group (AAG), serving as an additional hub to expand the firm’s AI practice. This collaboration aimed to provide clients with a comprehensive suite of AI products and solutions to tackle intricate business challenges at the intersection of business, data science, and engineering, particularly in the context of the evolving landscape of generative AI.

Conclusion

The fintech sector’s M&A landscape in Q1 2024 reflects a strategic shift towards consolidation, product expansion, and geographic expansion. Companies are actively seeking opportunities to enhance their capabilities, enter new markets, and address emerging trends such as digital identity, fraud prevention, and cryptocurrency.

Despite a decline in M&A activity in 2023, the resurgence in Q1 2024 signals renewed confidence and strategic intent within the industry. Key drivers include the need to stay competitive in evolving markets, respond to regulatory changes, and adapt to shifting consumer preferences.

Going forward, we can expect continued M&A activity in the fintech sector as companies strive to innovate, collaborate, and capture market share in an increasingly dynamic and competitive landscape. Additionally, the focus on digital identity, fraud prevention, and cryptocurrency indicates a growing awareness of cybersecurity and regulatory compliance challenges, driving investments in advanced technologies and strategic partnerships.