These 3 Artificial Intelligence (AI) Stocks Could Crush the Market for the Rest of the Year

Don’t blink; it’s May already.

2024 is quickly approaching the halfway point, and Wall Street has been up and down, especially in recent weeks. It could be a good time to regroup and consider the market’s best ideas for the second half of the year.

Three Fool.com contributors did just that and came up with three dynamic artificial intelligence (AI) names: Amazon (NASDAQ: AMZN), UiPath (NYSE: PATH), and Monday.com (NASDAQ: MNDY) as top ideas.

Here is the pitch for why each stock could crush the broader market over the next seven months.

Amazon is picking up steam, and its stock is soaring higher

Jake Lerch (Amazon): That’s right, Amazon is the AI stock that I think is set to crush the market for the rest of this year. Here’s why.

First off, Amazon has already crushed the stock market. The stock has generated a 67% total return over the last 12 months, compared to a 23% total return for the S&P 500. That’s quite impressive, but it’s possible Amazon could do even better than that 3-to-1 trouncing of the benchmark index thanks to what was revealed in its most recent earnings report.

The company’s most recent earnings results (for the three months ended on March 31, 2024) blew away expectations. Highlights from that report include:

-

$143 billion in total revenue, a 13% year-over-year increase.

-

$10.4 billion in net income, up from $3.2 billion a year earlier.

-

$50.1 billion in positive free cash flow versus a $3.3 billion outflow one year ago.

In short, Amazon has transformed into a cash-printing machine, thanks to the cost cuts implemented by CEO Andy Jassy. Better yet, those cuts haven’t eroded the company’s revenue growth. In fact, revenue growth has accelerated in the face of Jassy’s stricter expense management.

Amazon’s advertising unit is leading the way. The division, often underappreciated by some investors, is quickly becoming a significant player in the digital advertising market. In its most recent quarter, Amazon’s ad business generated $11.8 billion in revenue, up 24% year over year.

Next, there’s Amazon’s cloud services division, Amazon Web Services (AWS), the company’s crown jewel. Its sales growth accelerated to 17%, with quarterly revenue hitting $25 billion, helped, in part, by its AI initiatives.

In short, Amazon’s key growth drivers are firing on all cylinders just as the savings from its massive cost-cutting regime are kicking in. And that is why Amazon is poised to keep trouncing the overall market for the rest of the year.

This robotics stock is on a “path” to yearly gains

Will Healy (UiPath): UiPath stock has languished since it took a beating in the 2022 bear market. However, 2024 could be the year its recovery finally takes off in earnest.

UiPath specializes in robotic process automation (RPA) software for handling repetitive tasks. It stands out by offering end-to-end automation, integrating robotics with enterprise applications and products utilizing application programming interfaces (APIs).

Not surprisingly, AI plays a critical role in these applications. UiPath has applied the technology to discover excellent opportunities to improve return on investment (ROI). AI also aids in rapidly deploying task automation solutions and providing a foundation to scale customer operations.

Moreover, the robotics stock stands out over competitors by supporting a community of developers who create and share applications with one another. This increases the software’s utilization and provides a meaningful disincentive to turn to a competing product.

UiPath’s successes have prompted 2,054 large customers to spend $100,000 or more on UiPath products, a 15% surge from the previous year. This includes 288 customers who spend $1 million or more annually.

With that increase, the company continued to grow its revenue. In fiscal 2024 (ended Jan. 31), revenue of $1.3 billion rose 24% from year-ago levels. This included a dollar-based net retention rate of 119%, meaning long-term customers spent 19% more on the platform on average than in the previous year.

The higher revenue reduced its fiscal 2024 loss to $90 million, an improvement over the $328 million loss in the previous year. Also, the fact that net income was $34 million in fiscal Q4 indicates it is within striking distance of annual profitability on a generally accepted accounting principles (GAAP) basis.

Furthermore, these improvements have come even though UiPath stock has barely begun to recover from the bear market in 2022. Consequently, investors can buy the stock at a price-to-sales (P/S) ratio of around 8, well below the peak P/S ratio of 66 three years ago.

Ultimately, investors should remember that the growth in the company’s customer base and revenue has continued regardless of the stock’s performance. That makes it more likely the stock will rise for the rest of the year as its performance more closely matches that of the company.

SaaS is out of fashion, but it might not stay that way

Justin Pope (Monday.com): Monday.com is my pick for the rest of 2024. This software-as-a-service (SaaS) company sells low- and no-code work management software that helps companies collaborate and operate their businesses. Gone are the days of hand-written flow charts, mismatched spreadsheets, and using a different application for every task. Monday.com consolidates all of that into a cloud-based platform that keeps everyone on the same page and is implementing generative AI to take its user experience to the next level.

Monday.com grows using a land-and-expand model. In other words, it starts at one or two seats in a company, then spreads to new teams and departments as it proves useful. That’s fueling rapid customer growth in high-budget categories. Monday.com’s customers spending at least $50,000 grew 56% in 2023, and those spending over $100,000 grew 58%.

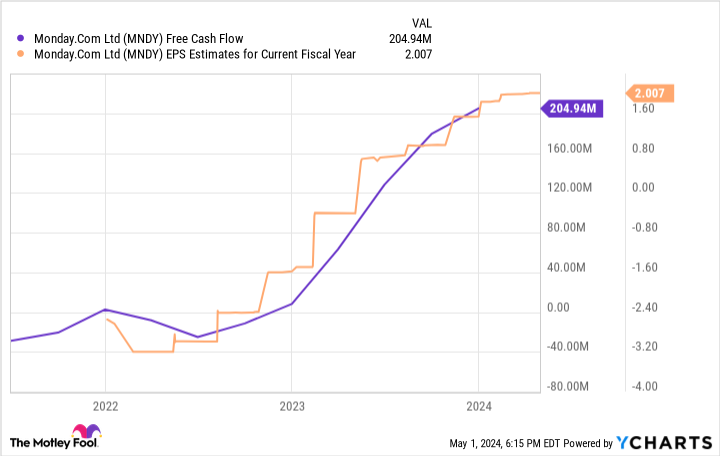

The business is very profitable, with free cash flow aggressively ramping up as Monday.com’s revenue grows faster than its expenses. Analysts believe the company will earn $2 per share this year, and earnings will average 65% annualized growth over the next three to five years, so buckle up.

Wall Street has cooled dramatically on software names, and Monday.com is no exception. Shares are down 57% from their former high. Shares trade at a forward P/E of 95 today, but that will get cheaper in a hurry if the company delivers earnings growth up to analysts’ expectations. It’s a potentially great investment for the rest of 2024 and far beyond that.

Should you invest $1,000 in Amazon right now?

Before you buy stock in Amazon, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Amazon wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $544,015!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of April 30, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Jake Lerch has positions in Amazon. Justin Pope has positions in Monday.com. Will Healy has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon, Monday.com, and UiPath. The Motley Fool has a disclosure policy.

These 3 Artificial Intelligence (AI) Stocks Could Crush the Market for the Rest of the Year was originally published by The Motley Fool