This Chart Shows Why I’d Buy and Hold CrowdStrike’s Stock With No Hesitation

The cost of cyberattacks is making cybersecurity an expense that companies can’t forgo.

There’s no doubt that the world is fully in the digital age. From smartphones in billions of hands to wearable tech monitoring our health to autonomous vehicles on our streets, all it takes is a look around to see just how much technology has and continues to influence the world.

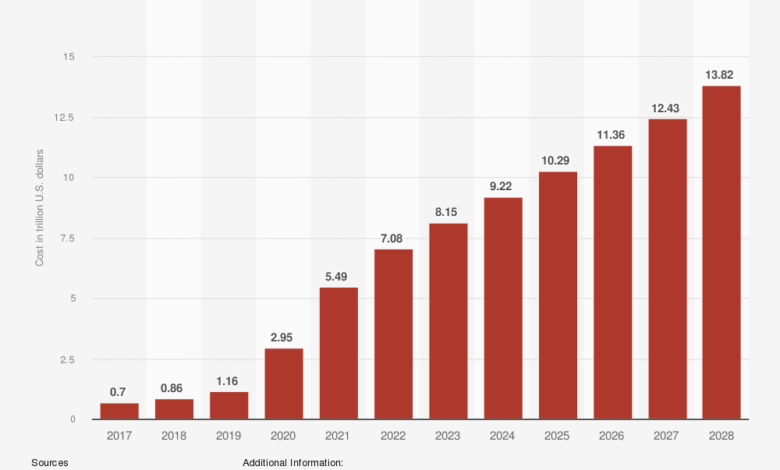

The world’s increasing digital connectedness has many benefits, such as easier communication and access to more information. However, this progression has one major downside, which is shown in the chart below.

Image source: Statista.

With the estimated global cost of cybercrime expected to reach over $13.8 trillion by 2028, the need and opportunity for cybersecurity company CrowdStrike (CRWD -0.66%) are becoming more evident. That’s why I feel comfortable holding on to the stock for the long haul.

Cybersecurity can be costly, but breaches can be costlier

CrowdStrike was one of the first cybersecurity companies to use artificial intelligence (AI)-native cybersecurity solutions with its Falcon platform released in 2013. Since then, it has consistently developed new solutions that many of the world’s top companies have leaned on to defend against cyber threats.

As the above graph shows, cyberattacks are costly. The straightforward cost is the money a company spends recovering from cyberattacks, such as data breaches, but another cost that’s hard to put a dollar figure on is the reputation cost companies face when customers feel as though they can no longer trust a company to keep their information secure.

That’s why cybersecurity solutions have essentially become mandatory for any company with digital operations. It’s almost like insurance; you pay a relatively modest fee upfront or routinely to avoid a much costlier expense down the road.

Customer adoption and signs of longevity

CrowdStrike’s customer adoption and retention have been impressive and an encouraging sign of the company’s ability to be a top player in cybersecurity for quite some time. Companies are not just turning to CrowdStrike for a single solution, either. Many depend on the company as a one-stop shop for their cybersecurity needs.

As of April 30, 65% of CrowdStrike’s customers used five or more of its modules (features/solutions in the platform). Sixty-five percent used six or more, 44% used seven or more, and the number of deals it had with companies to use eight or more modules increased by 95% year over year. CrowdStrike says it’s a “platform built for consolidation,” and the numbers are backing this up.

It also helps that CrowdStrike has attracted some of the world’s largest companies. It has 62 customers in the Fortune 100, which could help its long-term stability because it’s not easy for companies — especially at that size — to change cybersecurity providers.

It’s hard to argue against CrowdStrike’s financial results

In the first quarter of its fiscal 2025 (ended April 30), CrowdStrike added $212 million in net new annual recurring revenue (ARR). It was a record for the company and put its total ARR at $3.65 billion, up 33% year over year. For a company that relies on subscriptions, ARR is an important metric because it reflects CrowdStrike’s ability to generate consistent and relatively predictable revenue over time.

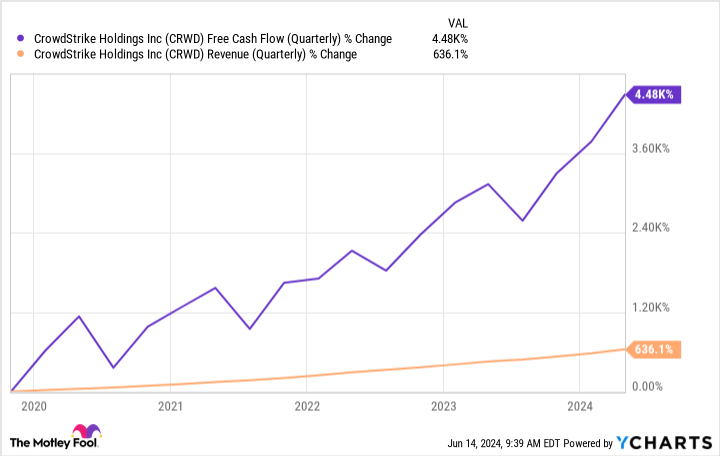

Its free cash flow increased an impressive 42% year over year, but a testament to its operational efficiency is the 5% increase that brought its operating margin to 22% on $199 million in operating income.

CRWD Free Cash Flow (Quarterly) data by YCharts

There’s no doubt that CrowdStrike’s stock is priced at a premium, but given its growth rates, long-term investors shouldn’t harp too much on that fact. The financial burden of cyberattacks will only get heavier, and as CrowdStrike shows consistent effectiveness and innovation, it’s well-positioned to capitalize on the near-indispensable industry.

Stefon Walters has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends CrowdStrike. The Motley Fool has a disclosure policy.