This Is My Pick for the Best Artificial Intelligence (AI) Stock You’ve Never Heard Of

The “Magnificent Seven” may dominate AI headlines, but a smaller player is emerging as a rising force in artificial intelligence (AI).

Over the past year, breakthroughs in artificial intelligence (AI) have captivated the minds of investors. Applications from ChatGPT and the never-ending barrage of headlines featuring the “Magnificent Seven” stocks of Microsoft, Alphabet, Amazon, Nvidia, Tesla, Meta Platforms, and Apple are fueling a bullish narrative on the potential of AI.

Smart investors understand that there are many other winners that will emerge in the AI realm beyond big tech. One company quietly growing to be an AI powerhouse is ServiceNow (NOW -4.03%). If you’re unfamiliar with it, that’s ok. Let’s explore how ServiceNow is evolving from an IT services business to an end-to-end digital solution built around AI.

How is ServiceNow disrupting artificial intelligence (AI)?

A common term that ServiceNow’s management uses during earnings calls is “digital transformation.” This is corporate speak for brining automation to the workplace to help drive productivity and provide decision makers with data-driven insights.

The company’s NOW platform specializes in connecting data silos at the enterprise level. By doing so, ServiceNow seamlessly integrates data from customer relationship management (CRM) tools, enterprise resource planning (ERP) platforms, and more.

According to Statista, spending on digital transformation services is expected to reach $3.9 trillion by 2027 — up from $2.5 trillion today. When you layer on the efficiencies that artificial intelligence (AI) can bring to the workplace, ServiceNow’s addressable market is ripe for disruption.

For the quarter ended Dec. 31, ServiceNow closed 168 deals worth at least $1 million in annual contract value (ACV). Although this represented an impressive growth rate of 33% year over year, there was another detail that I think is more encouraging.

ServiceNow’s Chief Financial Officer, Gina Mastantuono, shared with investors that generative AI products “drove the largest net new ACV contribution for our first full quarter of any of our new product family releases ever” during the fourth quarter.

Image source: Getty Images.

A best-in-class SaaS business

ServiceNow is classified as a software-as-a-service (SaaS) business. Some of the most important metrics for SaaS companies are remaining performance obligations (RPO), renewal rates, and customer expansion. RPOs help investors get a sense of a company’s backlog — or business that is yet to be recognized. As of Dec. 31, ServiceNow had $18 billion in RPOs, up 29% year over year.

Moreover, the company’s renewal rate of 99% is incredible. This implies that ServiceNow retains nearly all of its customers year in and year out, experiencing extremely nominal churn. Over the last two years, ServiceNow has grown the number of customers paying at least $1 million in ACV from 1,350 to 1,897. Yet within this cohort, customers are paying at least $4.5 million in ACV per year on average.

The accelerated customer acquisition plus the company’s strong retention rates have helped ServiceNow cross-sell its products at a high rate. Given the secular demand fueling AI right now, I think ServiceNow’s next frontier of growth is just beginning.

Is now a good time to buy ServiceNow stock?

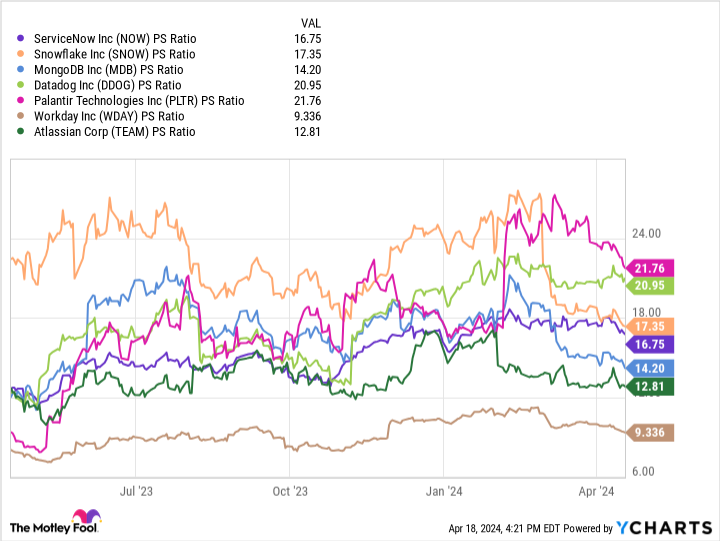

The chart below benchmarks ServiceNow against a peer set of other leading SaaS enterprises. ServiceNow’s price-to-sales (P/S) ratio of 16.7 is right in the middle of this cohort.

NOW PS Ratio data by YCharts

One key thing to point out from the chart is that valuation multiples have become stretched in recent months. This isn’t entirely surprising. Last year, the euphoria surrounding AI helped fuel the Nasdaq Composite higher by 43% and the S&P 500 by 24%. So far in 2024, this momentum has continued as each index is up around 5% year to date.

I think a good strategy to invest in ServiceNow would be to use dollar-cost averaging (DCA). While I find ServiceNow’s business to be in an overall strong position right now, one thing to know for sure is that competition in the AI arena is rising. For that reason, I think the technology sector in particular could experience some pronounced volatility in the short to intermediate term.

However, in the long run I see AI as a compelling growth opportunity and think ServiceNow is in prime position to dominate. While ServiceNow isn’t necessarily dirt cheap, its current trading levels suggest that it could be a better value than some other stocks that have become pricey.

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Adam Spatacco has positions in Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, Palantir Technologies, and Tesla. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Atlassian, Datadog, Meta Platforms, Microsoft, MongoDB, Nvidia, Palantir Technologies, ServiceNow, Snowflake, Tesla, and Workday. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.