This “Magnificent Seven” Company Is Leading the Artificial Intelligence (AI) Revolution, According to Goldman Sachs (Hint: It’s Not Nvidia)

Data is one of the biggest assets a company can have when it comes to developing artificial intelligence (AI).

When it comes to artificial intelligence (AI), most investors and Wall Street analysts use the “Magnificent Seven” stocks as a key barometer. There are good reasons for this.

Microsoft has plowed billions of dollars into OpenAI — the developer of ChatGPT. Moreover, demand for Nvidia‘s graphics processing units (GPUs) can provide a good idea of where and how businesses are exploring AI-driven use cases.

Nevertheless, investment bank Goldman Sachs sees a different member of the Magnificent Seven as the clear-cut winner of the AI revolution so far.

Just days ago, Goldman hailed Alphabet (GOOG 0.72%) (GOOGL 0.83%) as the leader among mega-cap AI companies. The reason? Data. Lots and lots of data.

Let’s break down why data is Alphabet’s competitive advantage, and explore why now is a lucrative time to scoop up shares at a bargain valuation.

Alphabet dominates the internet

There’s no question that ChatGPT has piqued the interest of AI enthusiasts, corporate workplaces, and even students.

Over the past year or so, one knock against Alphabet was that ChatGPT would pose a threat to traditional search habits. Considering that Alphabet is the parent company of internet search engine Google and video-sharing platform YouTube, some became skeptical that the company was facing an existential crisis and losing momentum when it comes to user preferences on the internet.

However, even in the face of rising competition, Google and YouTube remain the two most visited websites in the world, each receiving north of 100 billion site visits on a monthly basis.

Image source: Getty Images.

Why is Alphabet’s data so important?

The website traffic that Alphabet generates provides the company with more data points than any other competitor. In turn, Alphabet can use this data as an input to train its large language model (LLM), Gemini.

Hedge fund manager and Alphabet investor Bill Ackman cited Alphabet’s “substantial distribution moat” as a unique feature for the company to sustain its lead in the AI realm.

This allows Alphabet to develop, hone, and release generative AI applications at a faster pace than alternative platforms. Moreover, the company can integrate its AI-powered tools throughout its large and expanding ecosystem — advertising, cloud computing, social media, workplace productivity software, and more.

Alphabet stock looks dirt cheap

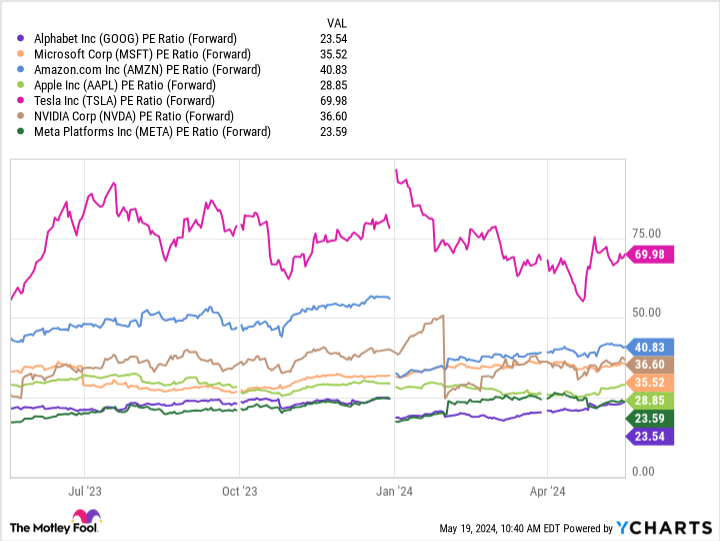

According to the chart below, Alphabet has the lowest forward price-to-earnings (P/E) ratio among its Magnificent Seven peers.

GOOG PE Ratio (Forward) data by YCharts

My take is that investors are discounting Alphabet’s growth prospects, and the reason is largely rooted in competition.

Sure, ChatGPT is undoubtedly popular, and Microsoft has witnessed some impressive growth since integrating the AI tool throughout its ecosystem. Moreover, semiconductor companies will likely be a long-term beneficiary of the broader AI movement as secular tailwinds continue to push demand for chips.

This doesn’t necessarily mean that Alphabet’s business model is in danger. In fact, rising competition and booming use cases in AI could very well lead to a new chapter in Alphabet’s growth story.

I think investors are missing the forest for the trees here. Alphabet is extremely well positioned to benefit from several aspects of AI. As people continue to rely on Google and YouTube for sources of information and entertainment, Alphabet will remain as the leader in data collection. This should ultimately serve as the catalyst for the company’s long-term AI roadmap.

To me, Alphabet stock is dirt cheap, and the discount compared to mega-cap peers is a buying opportunity. Investors with a long-term horizon should consider taking advantage of the valuation disparity in Alphabet stock and scoop up some shares right now.

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Adam Spatacco has positions in Alphabet, Microsoft, and Nvidia. The Motley Fool has positions in and recommends Alphabet, Goldman Sachs Group, Microsoft, and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.