Time to Buy This Magnificent Artificial Intelligence (AI) Stock as It Could Soar at Least 41% After Its Latest Pullback

Shares of Super Micro Computer (NASDAQ: SMCI) were in sell-off mode after the company released fiscal 2024 third-quarter results (for the three months ended March 31) on April 30.

That may seem a tad surprising considering the outstanding growth the company delivered during the quarter. More specifically, Super Micro stock was down more than 11% in pre-market trading on May 1. Investors pushed the panic button as the server manufacturer’s revenue was slightly below expectations.

However, a closer look at the company’s performance will make it clear that Super Micro’s drop is a buying opportunity that savvy investors should consider grabbing with both hands. Let’s look at the reasons why.

Super Micro is growing at a red-hot pace

Super Micro’s fiscal Q3 revenue tripled on a year-over-year basis to $3.85 billion. However, that reading was slightly below the consensus estimate of $3.96 billion. Meanwhile, the company’s non-GAAP earnings increased to $6.65 per share, a quadruple jump over the year-ago period’s figure. What’s more, Super Micro’s earnings were significantly higher than the consensus estimate of $5.74 per share.

Super Micro’s management credited the outstanding growth in the company’s revenue and earnings to the booming demand for the artificial intelligence (AI) servers that it manufactures. CFO David Weigand remarked on the latest earnings conference call:

Q3 growth was again led by AI GPU platforms which represented more than 50% of revenues with AI GPU customers in both the enterprise and cloud service provider markets. We expect strong growth in Q4 as the supply chain continues to improve with new air-cooled and liquid-cooled customer design wins.

The solid demand for Super Micro’s AI servers explains why the company has raised its full-year revenue forecast once again. It now expects to finish fiscal 2024 with revenue of $14.9 billion at the midpoint of its guidance range, up from the previous estimate of $14.5 billion. It is worth noting that Super Micro was originally anticipating fiscal 2024 revenue of $10 billion when it released its fiscal 2023 results in August of last year, which means that it has increased its top-line estimate by nearly 50% in nine months.

The company has generated $9.6 billion in revenue in the first nine months of the ongoing fiscal year. So, it has nearly achieved its original revenue target in just three quarters. The revenue estimate of $5.3 billion for the current quarter further reinforces the fact that the demand for Super Micro’s AI servers is set to get stronger with a nice sequential jump in revenue.

Even better, the company’s revenue guidance for the current quarter is higher than the $4.86 billion Street estimate. Super Micro is anticipating $8.02 per share in earnings in the current quarter, which is well above the $7.13 per-share consensus estimate.

Also, the company’s updated full-year revenue guidance means that its top line is on track to jump 110% this year. The non-GAAP earnings guidance of $23.69 per share would be double the previous year’s reading of $11.81 per share. All these numbers indicate that selling Super Micro stock based on the small revenue miss may not be a smart move considering that it is set to maintain its red-hot growth by upgrading its production capacity.

Investors should not miss the bigger picture

The demand for AI servers is set to rise at a robust pace in the long run. The market was worth an estimated $12.3 billion last year. It is expected to clock annual growth of 26.5% through 2029, generating $50.6 billion in annual revenue at the end of the forecast period. Super Micro Computer’s trailing-12-month revenue of $11.8 billion suggests that it is the dominant player in this market.

The good part is that the company is taking steps to ensure that it remains the top player in AI servers by upgrading its production capacity, as management remarked on the latest earnings conference call:

Our production teams are making aggressive progress on retrofitting the new Silicon Valley facilities and scaling up our Taiwan and Malaysia factories. We have secured the parts and acquired additional warehouses for our next phase of enterprise and datacenter businesses.

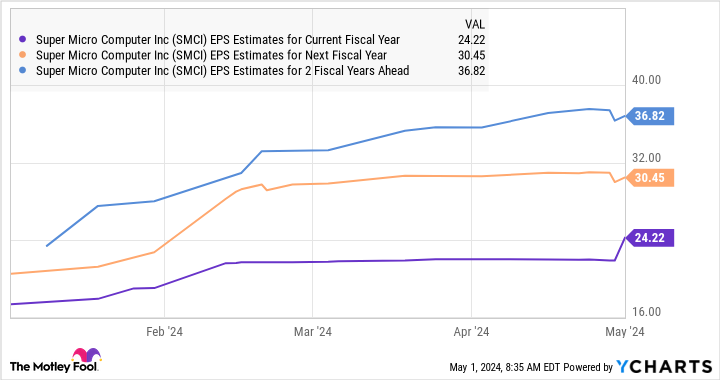

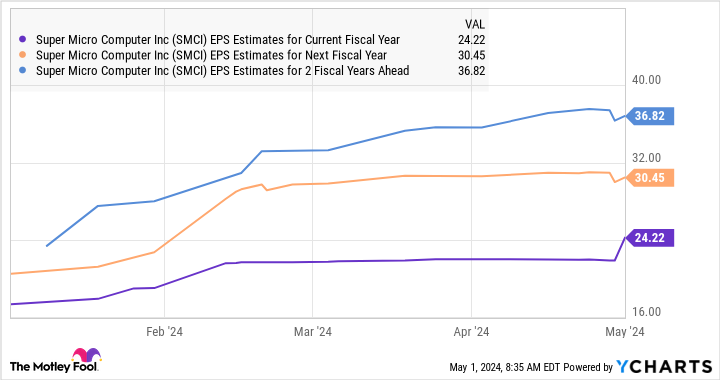

All this explains why Super Micro’s earnings growth is expected to remain solid over the next couple of fiscal years as well:

SMCI EPS Estimates for Current Fiscal Year data by YCharts.

If the company indeed earns $36.82 per share in earnings at the end of fiscal 2026 and trades at 30 times earnings at that time (in line with the Nasdaq-100‘s earnings multiple), its stock price could jump to $1,104. That points toward a potential increase of 42% from current levels. Super Micro is currently trading at just 27 times forward earnings, indicating that investors are getting a good deal on the stock right now.

Should you invest $1,000 in Super Micro Computer right now?

Before you buy stock in Super Micro Computer, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Super Micro Computer wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $544,015!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of April 30, 2024

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Super Micro Computer: Time to Buy This Magnificent Artificial Intelligence (AI) Stock as It Could Soar at Least 41% After Its Latest Pullback was originally published by The Motley Fool