U.S. EV Market Feels the Pain of Tensions with China

The electric vehicle market is already heavily impacted by the tit-for-tat sanctions and tariffs that mark the contentious trade relationship between the U.S. and China, and those effects are likely to increase.

Sandeep Rao, a quantitative analyst and researcher for the financial services firm Leverage Shares, says that a recent rule from the Biden administration limiting the shipment of advanced chips and technology to China has accelerated geopolitical tensions between the two countries.

“Since patent protection laws are a little different in China, they can produce their own versions of the same technology,” he says, adding that China is now essentially saying that the U.S. will require export licenses for Chinese technology headed for the U.S.

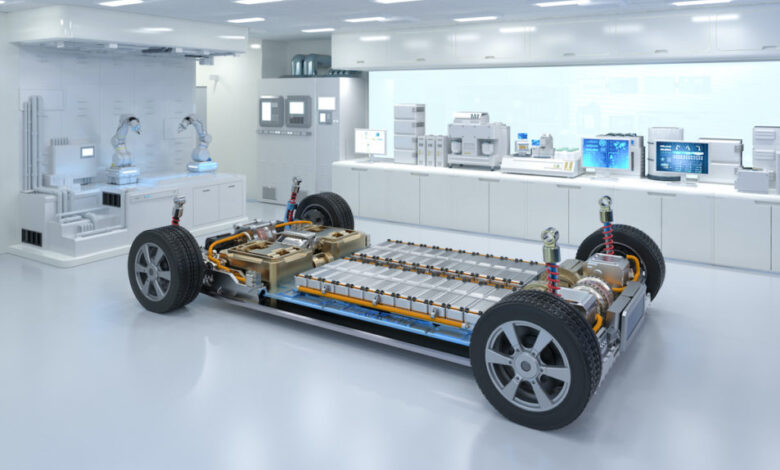

Rao adds that these measures can be particularly harmful to the U.S. EV sector. “The vast majority of EV batteries, components and materials are actually manufactured in large volumes in China,” he says.

Read More: Battle Over EVs in China Intensifies as Xiaomi Announces Sedan to Challenge Tesla Model 3

Karim Jumma, the vice president of product management for the B2B software services provider e2open, explains that the U.S. will need to bolster its sourcing processes and become less dependent on China if it wants to continue to expand the domestic EV sector while keeping these policies in place.

“At the end of the day, if you want to keep the business climate strong in supply chains, you always need an alternative supplier of raw materials,” Jumma says. “It’s always good to have alternative suppliers, but there should be a consortium that is making sure that one country or person is not being pushed out.”

Jumma mentions South America, Australia and the Indian subcontinent as some of the places that could become key suppliers for EV-related materials to the U.S.

“There are places where you could get your production up and also increase your production in the U.S.,” he says. “But it will take time to invest in technology and infrastructure to get to that level of demand regarding the number of cars the U.S. wants to produce. The short-term has to be collaborative.”

If the U.S. manages to establish those types of relationships with these nations, then it will have to implement a careful approach when exiting those countries if the U.S. wants to eventually source battery materials domestically, Jumma explains.

“There has to be a soft exit if the U.S. decides that’s how it wants to do it,” he says. “It can’t be a hard exit because a hard exit will have negative repercussions on global trade.”

Before the U.S. can start sourcing domestically, though, the country must bolster its technology and car manufacturing infrastructure, Jumma says.

“The U.S. needs better technology to extract materials from old batteries,” he says. “There is a lot of advanced technology that needs to be established.”

American companies also need to improve their supply chain visibility, Jumma adds.

“A connected system, a software system with a network, data and applications, across your supply chain is a key factor,” he says.

Jumma mentions how battery design and composition will also play a key role in how the U.S. eventually approaches expanding its domestic EV market.

“Battery designs are different for different cars, and the complexity is pretty high,” he says. “You can try to standardize battery designs, but then you lose your edge, meaning cars will only be able to travel 300 miles rather than 500 miles. Design and composition are only going to get more complex. So, we need to figure out how that design composition will impact the circularity of extracting materials from recycled batteries.”

Jumma says that the U.S. must also figure out the logistics of how it will develop a domestic mining network that can supply car manufacturers with the materials they need to make vehicles and batteries.

“Can we mine everything? Can we do everything? Perhaps at some point in time,” he says. “Many years down the line if that’s the direction we go in. It has to be collaborative across countries.”

Jumma argues that consumer awareness must first improve if the U.S. wants to see any meaningful growth within the domestic EV market in the immediate future.

“It’s one thing to have an electric car, but it’s another thing to engage in recycling,” Jumma says. “Only 8.6% of the current materials are recycled within the circular economy.”

He explains how incentive programs could lead to more recycling at the consumer level, which in turn will have a positive impact on the domestic EV market, and lay the groundwork for the sector’s eventual expansion.

“Battery recycling needs to be driven by incentives and global policies,” Jumma says. “Regulations that are put in place drive those kinds of behaviors.”