US and EU Regulators Forge Fintech Frontier

The once-siloed world of

digital payments regulation is experiencing a jolting realignment. In a

surprising display of international cooperation, the US Consumer Financial

Protection Bureau (CFPB) and the European Commission have joined forces to

tackle the burgeoning fintech industry. Since last July, these financial

watchdogs have been conducting a series of hushed meetings, their focus

narrowed on the vanguard of financial technology – a realm teeming with

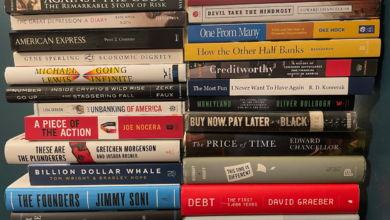

“buy now, pay later” (BNPL) schemes, tech giants wielding digital

wallets, and the enigmatic rise of artificial intelligence (AI) in finance.

This newfound

partnership marks a noteworthy departure from tradition.

Historically, the US

and EU have approached financial regulation with the grace of a runaway bull in

a porcelain shop. The US, often seen as the land of financial innovation

(sometimes bordering on recklessness), has historically favored a lighter

regulatory touch. The EU, on the other hand, championing consumer protection,

has enacted stricter rules that can sometimes stifle innovation.

So, what sparked this

unexpected alliance?

The answer lies in the shared anxieties plaguing both the

US and the EU. The meteoric rise of BNPL services, with their alluring promises

of instant gratification and “interest-free” financing, has regulators

worried about a potential debt crisis brewing on the horizon. The US is

particularly concerned about the proliferation of BNPL players and their impact

on consumer behavior, while the EU frets about a potential surge in household

debt.

Beyond BNPL, the specter

of Big Tech looms large. Apple Pay, Google Pay, and Amazon’s palm-scanning

payment system are just the tip of the iceberg. These tech giants aren’t merely

dipping their toes in the payments pool; they’re cannonballing in, their sheer

size and influence raising concerns about fair competition and potential

anti-trust violations. Both the US Department of Justice’s recent lawsuit

against Apple and the ongoing antitrust investigations in Europe highlight the

simmering tensions.

The regulators’ agenda

extends further.

Artificial intelligence, with its potential to revolutionize

financial services, also sparks both excitement and trepidation. The EU, ever

the pragmatist, has recently enacted a slew of regulations aimed at governing

the development and use of AI. The US, on the other hand, has taken a more

cautious approach, relying on guidance and studies to navigate these uncharted

waters. This disparity in approach presents a challenge for the newly formed

US-EU alliance. Can they find common ground when it comes to regulating this

nascent technology?

This newfound

cooperation between the US and EU regulators presents a fascinating

opportunity. By pooling their resources and expertise, they can develop a more

comprehensive – and hopefully coherent – framework for overseeing the

burgeoning world of digital payments. This, in turn, could foster responsible

innovation while safeguarding consumers on both sides of the Atlantic.

However, the path ahead

is not without its hurdles. Bridging the ideological gap between the US’s

free-market ideals and the EU’s focus on consumer protection will be a

formidable task. Additionally, the sheer complexity of these new technologies –

from the intricacies of BNPL schemes to the opaque algorithms underpinning

AI-powered financial services – will demand a level of technical expertise that

regulators may not always possess.

Despite these

challenges, the US-EU partnership offers a glimmer of hope. In a world

increasingly interconnected, a unified approach to regulating digital payments

makes perfect sense. Whether this newfound cooperation blossoms into a smooth

collaboration or devolves into a messy struggle remains to be seen. But one

thing is certain: the financial world is watching intently, eager to see if the

regulators can find a way to move in tandem.

This newfound

partnership holds the potential to reshape the landscape of global finance. If

successful, it could usher in an era of responsible innovation that benefits

both consumers and businesses. However, the road ahead is fraught with

challenges. The ideological differences between the US and EU, coupled with the

complexity of the technologies involved, could derail this promising alliance.

Only time will tell if this collaboration will be a triumph or a trial.

The once-siloed world of

digital payments regulation is experiencing a jolting realignment. In a

surprising display of international cooperation, the US Consumer Financial

Protection Bureau (CFPB) and the European Commission have joined forces to

tackle the burgeoning fintech industry. Since last July, these financial

watchdogs have been conducting a series of hushed meetings, their focus

narrowed on the vanguard of financial technology – a realm teeming with

“buy now, pay later” (BNPL) schemes, tech giants wielding digital

wallets, and the enigmatic rise of artificial intelligence (AI) in finance.

This newfound

partnership marks a noteworthy departure from tradition.

Historically, the US

and EU have approached financial regulation with the grace of a runaway bull in

a porcelain shop. The US, often seen as the land of financial innovation

(sometimes bordering on recklessness), has historically favored a lighter

regulatory touch. The EU, on the other hand, championing consumer protection,

has enacted stricter rules that can sometimes stifle innovation.

So, what sparked this

unexpected alliance?

The answer lies in the shared anxieties plaguing both the

US and the EU. The meteoric rise of BNPL services, with their alluring promises

of instant gratification and “interest-free” financing, has regulators

worried about a potential debt crisis brewing on the horizon. The US is

particularly concerned about the proliferation of BNPL players and their impact

on consumer behavior, while the EU frets about a potential surge in household

debt.

Beyond BNPL, the specter

of Big Tech looms large. Apple Pay, Google Pay, and Amazon’s palm-scanning

payment system are just the tip of the iceberg. These tech giants aren’t merely

dipping their toes in the payments pool; they’re cannonballing in, their sheer

size and influence raising concerns about fair competition and potential

anti-trust violations. Both the US Department of Justice’s recent lawsuit

against Apple and the ongoing antitrust investigations in Europe highlight the

simmering tensions.

The regulators’ agenda

extends further.

Artificial intelligence, with its potential to revolutionize

financial services, also sparks both excitement and trepidation. The EU, ever

the pragmatist, has recently enacted a slew of regulations aimed at governing

the development and use of AI. The US, on the other hand, has taken a more

cautious approach, relying on guidance and studies to navigate these uncharted

waters. This disparity in approach presents a challenge for the newly formed

US-EU alliance. Can they find common ground when it comes to regulating this

nascent technology?

This newfound

cooperation between the US and EU regulators presents a fascinating

opportunity. By pooling their resources and expertise, they can develop a more

comprehensive – and hopefully coherent – framework for overseeing the

burgeoning world of digital payments. This, in turn, could foster responsible

innovation while safeguarding consumers on both sides of the Atlantic.

However, the path ahead

is not without its hurdles. Bridging the ideological gap between the US’s

free-market ideals and the EU’s focus on consumer protection will be a

formidable task. Additionally, the sheer complexity of these new technologies –

from the intricacies of BNPL schemes to the opaque algorithms underpinning

AI-powered financial services – will demand a level of technical expertise that

regulators may not always possess.

Despite these

challenges, the US-EU partnership offers a glimmer of hope. In a world

increasingly interconnected, a unified approach to regulating digital payments

makes perfect sense. Whether this newfound cooperation blossoms into a smooth

collaboration or devolves into a messy struggle remains to be seen. But one

thing is certain: the financial world is watching intently, eager to see if the

regulators can find a way to move in tandem.

This newfound

partnership holds the potential to reshape the landscape of global finance. If

successful, it could usher in an era of responsible innovation that benefits

both consumers and businesses. However, the road ahead is fraught with

challenges. The ideological differences between the US and EU, coupled with the

complexity of the technologies involved, could derail this promising alliance.

Only time will tell if this collaboration will be a triumph or a trial.