Using generative AI for health plan claims, Alaffia Health raises $10M

Amish Jani, Founder and Partner at FirstMark, joined the company’s Board of Directors

AI has become all the rage in healthcare: $1.1 billion, or 40% of Q1’s total funding to digital health, went to AI-enabled companies in the most recent quarter. A big focus has been put on generative AI, in particular, with almost 90% of investors saying that generative AI solutions have influenced their investment strategies.

Alaffia Health is a company using generative AI to stream and help close inefficiency gaps when it comes to health plan claim operations, a space where close to $265 billion in claims made by US healthcare organizations are denied annually because of the way claims are coded on payor documentation, while coding errors account for over 40% of claim denials, while untimely submissions contribute to 35% of denials.

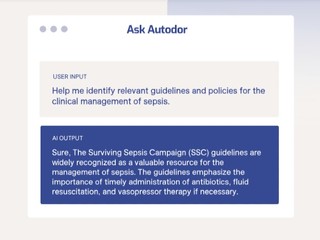

Its generative AI tool, Ask Autodor, which it launched last year, automates complex manual tasks such as large patient medical record reviews, clinical policy document assessments, and insurance claim adjudication. Now the company is looking to expand its commercial footprint and further invest in its AI research and product development, and so it announced $10 million in Series A funding on Wednesday.

This round was led by FirstMark Capital, with participation from GingerBread Capital and existing investors including Anthemis, Aperture Venture Capital, 1984 Ventures, Remarkable Ventures, and Tau Ventures. This is the company’s first funding since it raised $6.6 million in seed funding in February 2022, brings its total amount of capital raised to $17.6 million,

In connection with the round, it was also revealed that Amish Jani, Founder and Partner at FirstMark, has joined the company’s Board of Directors.

Founded in 2020, the New York-based Alaffia works with health insurance claims teams, clinicians, and medical coders in management, payment integrity, special investigations, and appeals.

Ask Autodor integrates directly with existing claim management and payment systems, and is able to summarize doctor’s notes, patient treatment plans, and medication administration records, and can verify medical necessity for services, complete utilization reviews, and validate DRG assignments. It can also source clinical guidelines, search for billing codes and policies, and draft determination letters and reports

By using Ask Autodor, Alaffia’s customers are able to complete facility claim reviews up to 20x faster than traditional processes.

In addition, the company also uses AI and machine learning on claims editing, leveraging millions of data points from sources that include historical claims data, national coding standards, and our team’s unparalleled expertise, to make customizable edits that are tailored to the customer’s specific needs.

In the last 12 months, Alaffia has increased its revenues by 4x and earlier this year the company was featured in the Everest Group’s Payment Integrity Solutions PEAK Matrix Assessment.

“The advent of advanced, multimodal, AI systems represents the breakthrough we all needed to finally bend the healthcare cost curve,” TJ Ademiluyi, co-founder and CEO of Alaffia Health, said in a statement.

“We’re pioneering the adoption of these new AI tools across the ecosystem and are excited to partner with FirstMark to achieve our next set of milestones.”

(Image source: alaffiahealth.com)