VC Funding to Indian Fintech Companies Drops 57.6% YoY

In Q1 2024, venture capital (VC) funding for fintech companies in India declined substantially, falling by a staggering 57.6% year-over-year (YoY), a new report by private market data platform Tracxn shows.

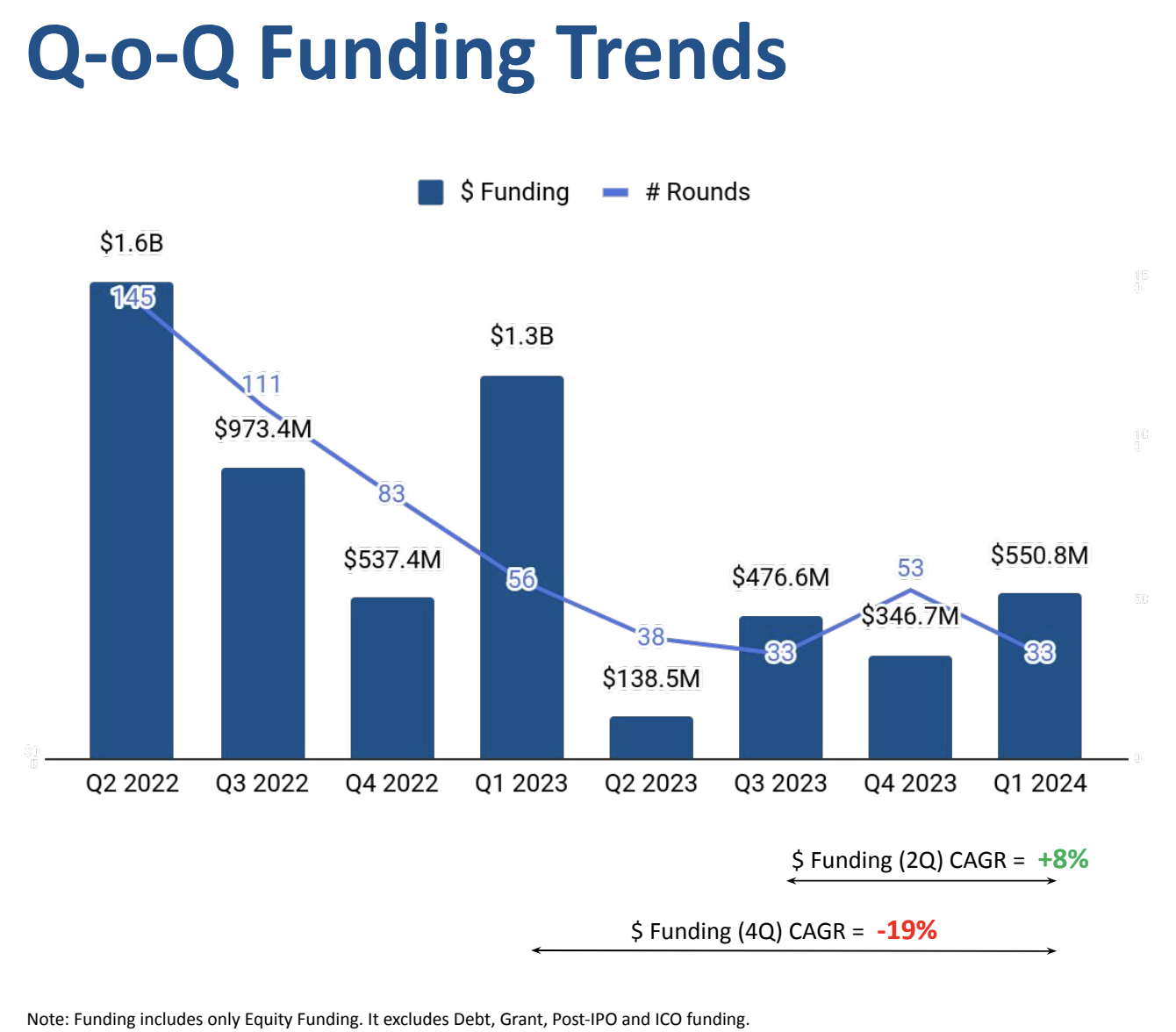

During the quarter, Indian fintech companies secured only US$550.8 million in VC funding, a far cry from the US$1.3 billion raised by the sector during the same period a year prior. Deal counts also declined, decreasing from 56 rounds in Q1 2023 to 33 in Q1 2024.

Quarterly fintech VC funding in India, Source: Fintech – India Quarterly Funding Report Q1 2024, Tracxn, Apr 2024

The data, presented in Tracxn’s “Fintech – India Quarterly Funding Report”, shows that fintech funding continued its downward trajectory in 2023, carrying on a trend that started the preceding year.

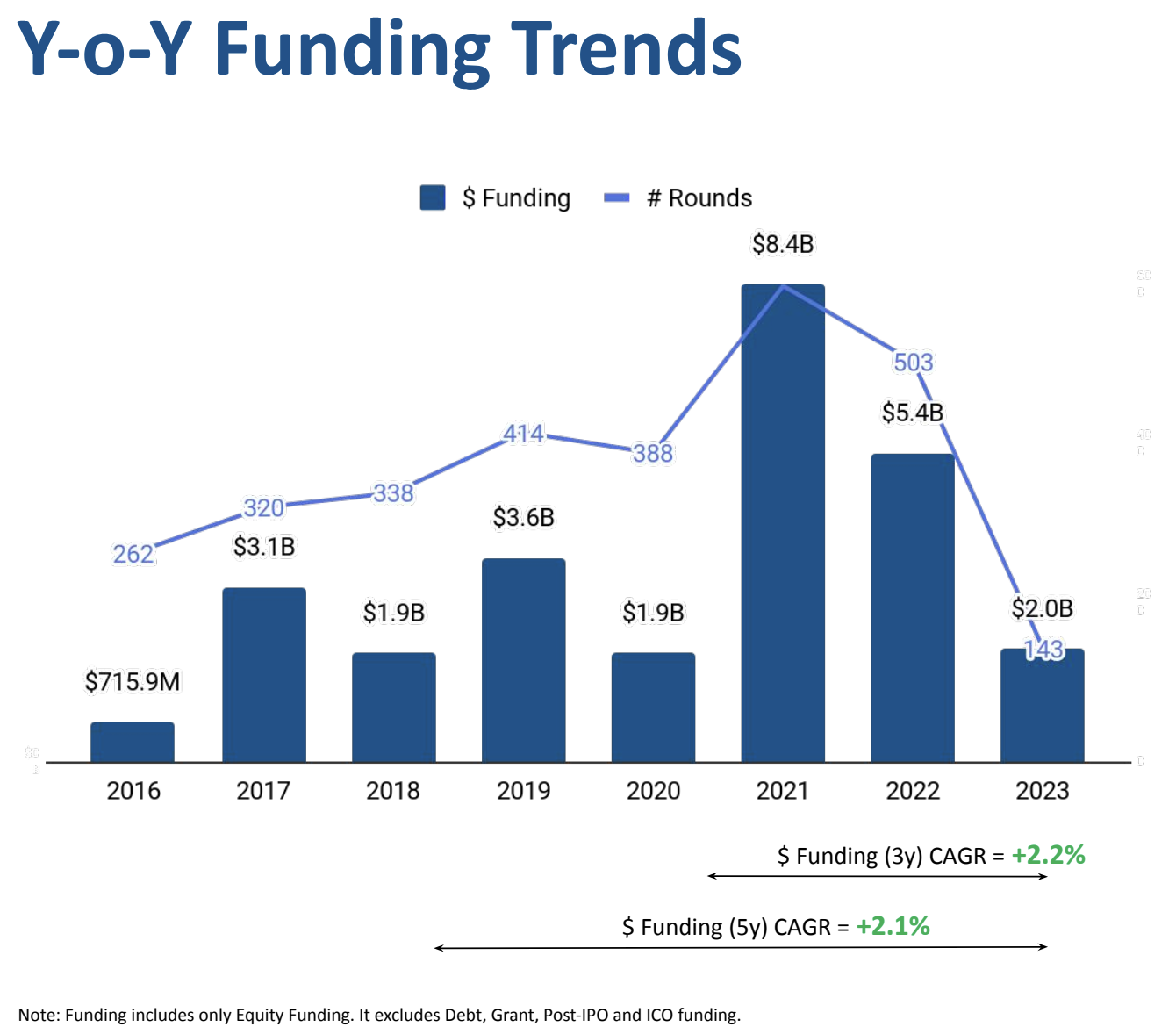

In 2023, Indian fintech companies secured about US$2 billion in VC funding through 143 rounds, down from US$5.4 billion (-63% YoY) and 503 deals (-71.6% YoY) in 2022, data from Tracxn reveal. In 2021, the sector reached its peak, attracting a record of US$8.4 billion through 611 rounds.

Annual fintech VC funding in India, Source: Geo Annual Report – Fintech, Tracxn, Jan 2024

Fintech funding started to recede in 2022 as investors became more cautious amid soaring interest rates, a looming global recession and geopolitic tensions.

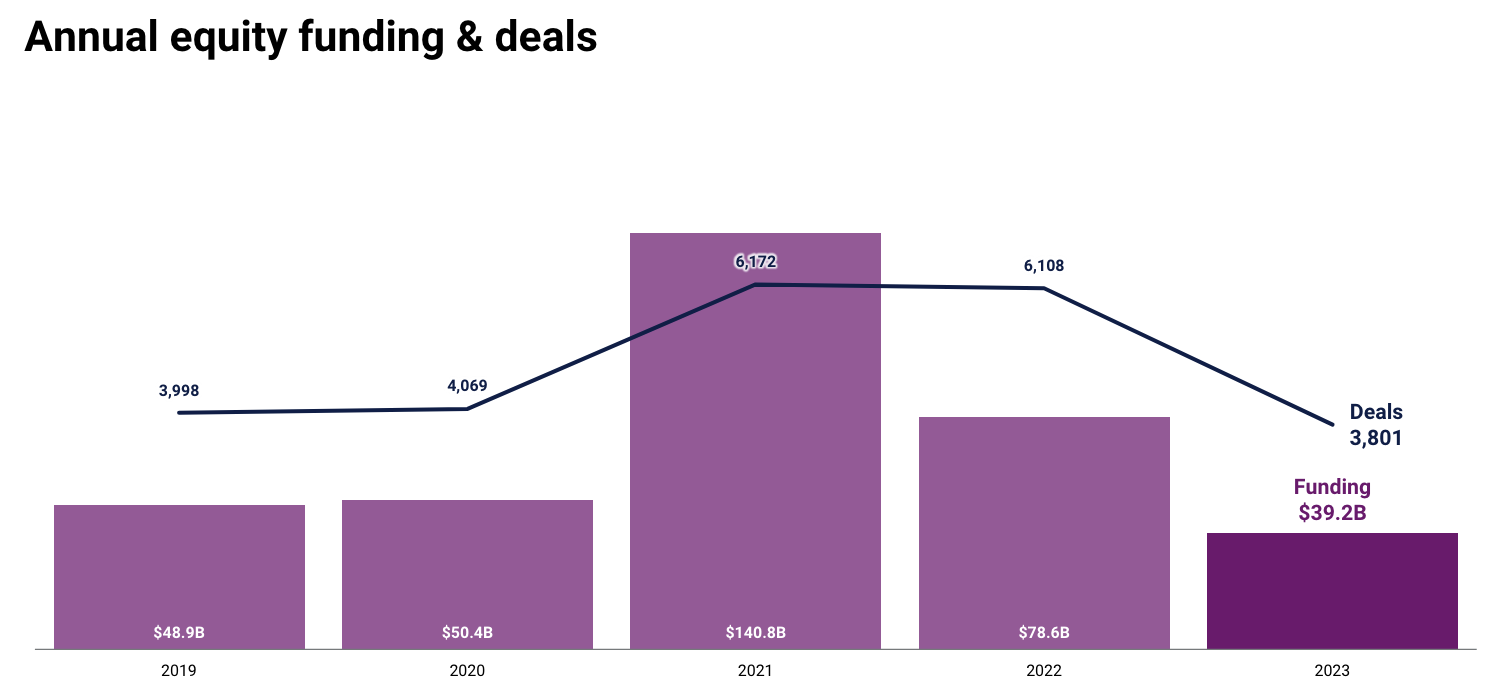

In 2022, global fintech VC investments fell 44% YoY from their all-time high of US$140.8 billion in 2021. That trend continued in 2023, declining by 50% to US$39.2 billion and reaching its lowest level since 2017, data from market intelligence and business analytics platform CB Insights show.

Annual fintech equity funding and deals, Source: State of Fintech 2023, CB Insights, Jan 2024

In India, one contributing factor to the decline of fintech VC funding in 2023 was the decrease in the number of mega-rounds worth US$100 million and up. Last year, only five mega-rounds were closed in the sector, according to the report: a US$623 million Series D secured by digital payment company PhonePe; a US$229 million Series D closed by business-to-business (B2B) software-as-a-service (SaaS) provider Perfios; a US$150 million Series A raised by insurtech startup InsuranceDekho; a US$120 million Series D secured by digital lending specialist KreditBee; and a US$110 million Series D raised by online supply chain financing platform Mintifi.

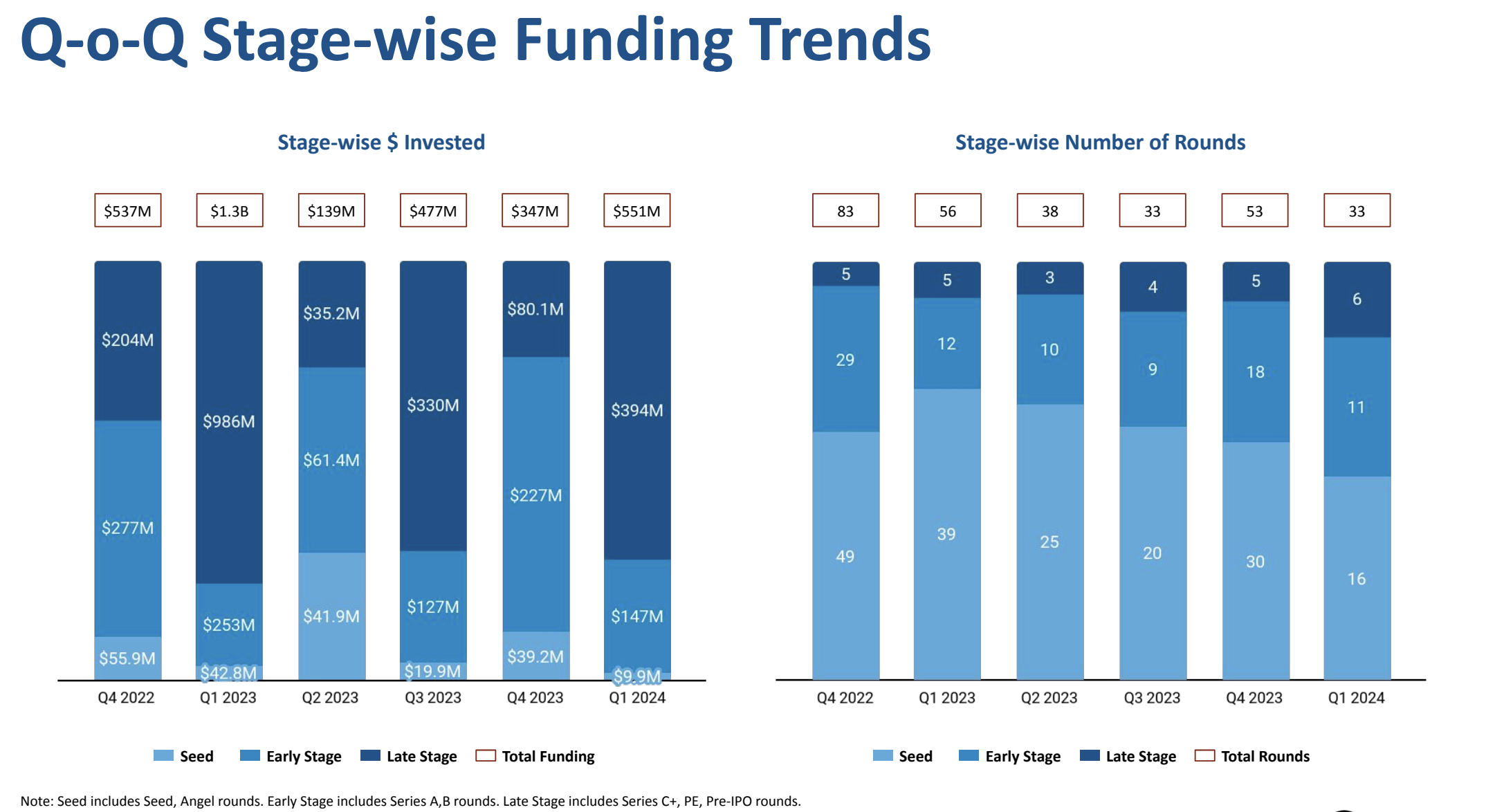

During Q1 2024, investors favored later-stage investments, which accounted for 71.5% (US$394 million) of all fintech investments and represented 18% (6 rounds) of all deals. This represents a significant increase from the prior quarter where late stage rounds represented just 23% of fintech VC funding and 9% of deal counts.

Quarterly fintech funding trends in India, Source: Fintech – India Quarterly Funding Report Q1 2024, Tracxn, Apr 2024

Looking at sectoral trends, the data show that alternative lending was the top fintech segment in Q1 2024, securing a total of US$491 million during the quarter. The category is followed by regtech, with US$107 million, banking tech with US$85.5 million, and payments with US$21.1 million.

Y Combinator was the most active accelerator/incubator in the Indian fintech sector in Q1 2024, while Peak XV Partners led as the most active early-stage investor. Finally, Elev8, UC-RNT Fund, and Epiq Capital Advisors were the top investors in late-stage fintech funding during the period.

India’s fintech sector

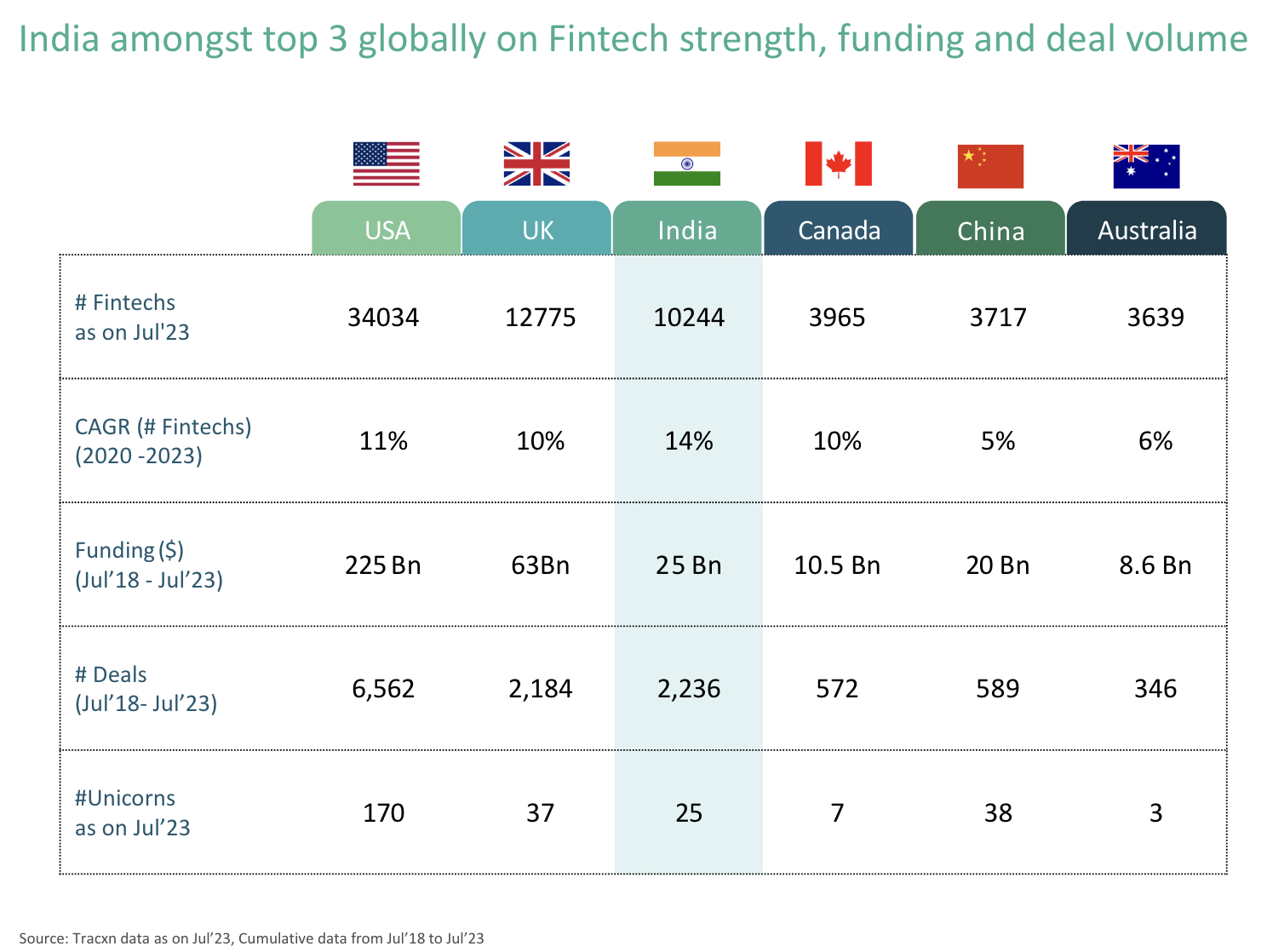

India has one of the biggest and most dynamic fintech industries in the world. According to the Boston Consulting Group (BCG), the country ranks as the third-largest and one of the fastest-growing fintech markets worldwide in terms of funding, deal volumes, and fintech strength.

Between 2020 and 2023, India witnessed remarkable growth in its fintech sector, achieving a compound annual growth rate (CAGR) of 14%, the highest globally. As of July 2023, the country boasted 10,244 fintech companies, behind only the US (34,034) and the UK (12,775).

In terms of fintech funding, India ranks third globally, accumulating a total of US$25 billion across 2,236 deals between 2018 and 2023.

Top fintech markets in world, Source: State of the Fintech Union 2023, Boston Consulting Group, Sep 2023

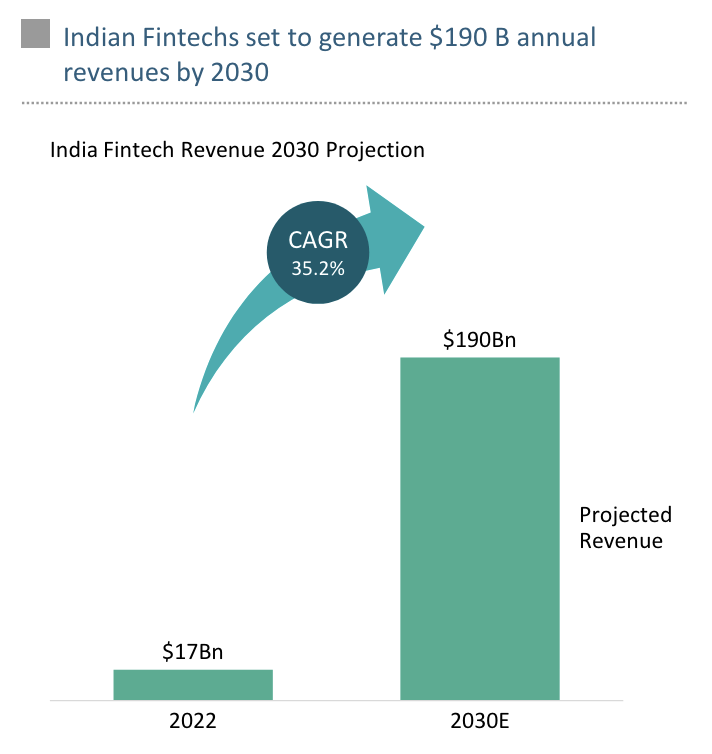

Indian fintech companies generated an estimated US$17 billion in revenue in 2022. By 2030, that sum is expected to reach a staggering US$190 billion, growing at a CAGR of 35.2%.

India Fintech Revenue 2030 Projection, Source: State of the Fintech Union 2023, Boston Consulting Group, Sep 2023

Despite these impressive metrics, the global VC funding contraction and economic uncertainties in 2023 led to a decrease in the number of fintech startups incorporated in India.

Data released by mergers and acquisitions deal-sourcing platform Growthpal show that the number of fintech startups which got incorporated in India in 2023 decreased by 72.6% compared to 2021 and by 55.55% from the figures of 2022. Only 20 fintech startups were incorporated last year, compared to 73 and 45 in 2021 and 2022, respectively.

To support the fintech sector and the broader startup ecosystem, the Union Minister for Finance and Corporate Affairs, Nirmala Sitharaman, proposed to create a corpus of INR 1 trillion (US$12 billion) during the Interim Budget 2024-25 in Parliament last month. This corpus aims to boost private investment in technologies and usher in “a golden era for our tech-savvy youth,” the minister said.

The corpus will be established with a 50 year interest free loan, and will provide long-term financing or refinancing with long tenors and low or nil interest rates.

Featured image credit: Edited from Freepik