Which Companies Will Monetize Artificial Intelligence (AI) First? Here’s Where Meta, Alphabet, and Amazon Stand.

These companies’ efforts now could pay off big over the long term.

Technology companies are pouring investment into artificial intelligence (AI) these days — and for good reason. AI has the potential to streamline many of a company’s daily tasks, so that company could considerably lower costs and increase efficiency. The technology also represents a significant revenue stream for businesses that build AI products and services to sell to others. Finally, those that invest now could win big down the road since the AI market is forecast to reach more than $1 trillion by the end of the decade.

Amazon (AMZN 0.81%), Meta Platforms (META 2.33%), and Alphabet (GOOG 0.32%) (GOOGL 0.37%) each have been vocal about their focus on AI — and all three aim to become leaders in the field and generate an enormous level of revenue thanks to this smoking-hot technology. But which of these three will monetize the investment first? Let’s find out where each one stands.

Image source: Getty Images.

Amazon’s multibillion-dollar run rate

Amazon benefits from its AI investments in two ways. The e-commerce giant is using AI to increase efficiency, and this is helping lower cost to serve. For example, AI determines the shortest delivery route for packages and improves processes at fulfillment centers, reducing costs. And Amazon already is generating revenue from the AI services it offers through Amazon Web Services (AWS) — in fact, AWS has reached a more than $100 billion annualized revenue run rate.

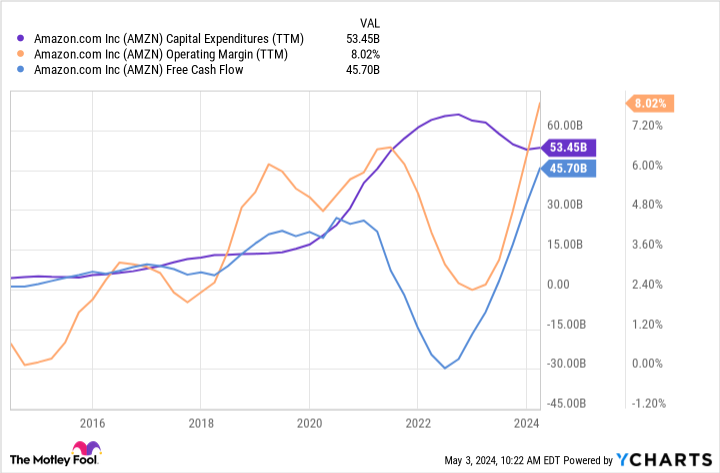

In response to demand for AWS’ cloud offerings, Amazon is significantly increasing capital expenditures this year. As we can see in the chart below, operating margin and free cash flow always have climbed after periods of investment, so we may expect this pattern to continue.

AMZN Capital Expenditures (TTM) data by YCharts

This demand for AI services along with Amazon’s increased spending, “given the way the AWS business model works, is a positive sign of the future growth,” chief executive officer Andy Jassy said in the recent earnings call. “And we don’t spend the capital without very clear signals that we can monetize it this way.”

On top of this, Amazon notes that today at least 85% of information technology spending is on-premises, meaning there’s plenty of opportunity for growth as that demand shifts to the cloud. And that doesn’t even include the generative AI projects Amazon expects to happen directly on the cloud over the next two decades.

Meta Platforms’ biggest investment of the year

Meta has said AI will be the biggest investment theme of this year, and in the company’s recent earnings call, CEO Mark Zuckerberg said the company should invest “significantly more” in the coming years as well. The goal is to become the leader in AI models and services, and so far, Meta’s making solid progress.

Yes, you probably best know this company for its social media dominance as it owns Facebook, Messenger, WhatsApp, and Instagram. And advertising on these platforms generates the lion’s share of revenue. But Meta’s investments in AI are meant to improve these social media apps, resulting in users spending more time on them — and that should keep advertisers coming back and potentially spending more.

Meta also has other direct ways of monetizing its AI products and services, such as including paid content with AI interactions and charging customers who want to use the highest-performing AI models or use more compute.

Though signs show AI could be a winning bet for Meta, Zuckerberg emphasized during the recent earnings call that investors will have to be patient. “We’ll still grow our investment envelope meaningfully before we make much revenue from some of these new products,” he said.

Meta shares dropped after Zuckerberg’s comment, and he said the company has been through this before — share volatility as the company invests in a new area that isn’t yet generating revenue. The company’s earnings and share performance track record, though, show patient investors have reaped rewards.

Alphabet’s “clear paths” to monetization

Like Meta, Alphabet makes most of its revenue through advertising — and the biggest chunk of revenue comes from ads on the Google Search platform. Google Search holds more than 85% of the global search market, so it’s no surprise that advertisers flock there to reach us, their audience.

Alphabet’s investment in AI is helping it improve search, delivering faster and better results that could reinforce Google Search’s dominance — and keep advertisers spending there. In recent tests, Alphabet noted an increase in search usage when AI tools were involved and an increase in user satisfaction.

The company also has six products with more than two billion monthly users, representing more potential growth as the company rolls out AI here too.

And, like Amazon, Alphabet’s cloud business already is benefiting from the company’s investments in AI. Google Cloud offers various AI platforms to customers, including access to its most powerful AI model yet, Gemini 1.5 Pro.

Alphabet hasn’t said exactly how much AI is contributing to revenue right now, but the company did emphasize in its earnings call that it has “clear paths” to monetization of AI, including ads, cloud, and subscriptions.

The first to monetize AI?

The three companies haven’t offered us all of the details of their AI spending and AI revenue. But it’s fair to say Amazon and Alphabet, thanks to the number of AI services already available on their cloud platforms, may be first to significantly monetize their efforts. And Amazon’s use of AI to streamline its e-commerce operations is helping lower costs, therefore supporting overall earnings growth. So, in my opinion, Amazon may even be the biggest winner at the moment.

But this doesn’t mean you should forget about Meta. Though the company may take a while to monetize the AI investment, it could be worth the wait. We’re in the early days of the AI growth story, so it’s a great idea to pick up shares of future winners on the dip. And that means that even though Amazon may be a monetization winner right now, Meta, trading at only 22x forward earnings estimates, represents a bargain buy you won’t want to miss.

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Adria Cimino has positions in Amazon. The Motley Fool has positions in and recommends Alphabet, Amazon, and Meta Platforms. The Motley Fool has a disclosure policy.