Which States Charge An Extra Fee To Own An Electric Car?

The number of states charging EV registration fees is on the rise.

May 28, 2024 at 3:00pm ET

Electric vehicles offer many benefits over comparable gas models, but they can be costly to the communities where their owners live. EV owners don’t need gas, which means less tax revenue, and that’s before we get into incentives and other offers. Some states have proposed EV use taxes to make up for the loss in revenue, but the numbers are different everywhere, and only some of the states considering a tax have actually implemented the rules.

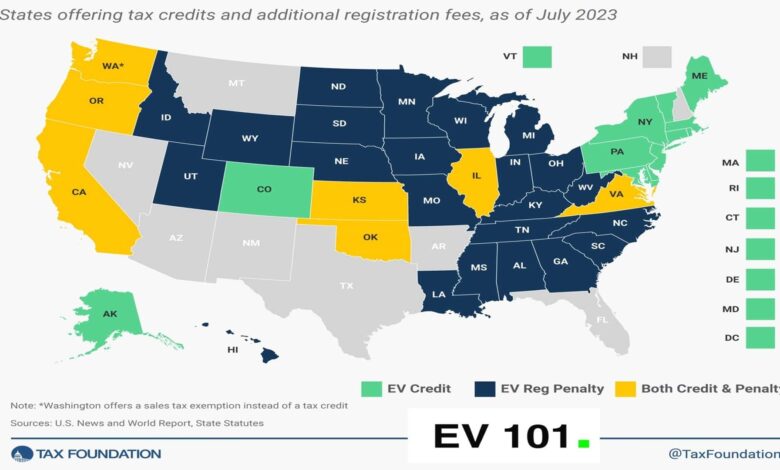

There are currently several states that charge additional registration fees for electric vehicles, with some of them also offering an incentive for their purchase. While the money likely enters and leaves different “pots” in those states’ budgets, it’s an interesting contrast to find. According to taxfoundation.org, the states charging additional EV registration fees or taxes in 2023 included:

- Alabama: $200

- Arkansas: $200

- California: $108

- Colorado: $51.88

- Georgia: $213.70

- Hawaii: $50

- Idaho: $140

- Illinois: $100

- Indiana: $150

- Iowa: $130

- Kansas: Up to $70

- Kentucky: $120

- Louisiana: $100

- Michigan: $145

- Minnesota: $75

- Mississippi: $150

- Missouri: $105

- Nebraska: $75

- North Carolina: $140.25

- North Dakota: $120

- Ohio: $200

- Oklahoma: $110

- Oregon: Up to $91

- South Carolina: $60

- South Dakota: $50

- Tennessee: $100

- Utah: $130.25

- Virginia: $120

- Washington: $150

- West Virginia: $200

- Wisconsin: $100

- Wyoming: $200

Those amounts might not seem like much, but consider that the number of EVs is growing, with around 3.3 million estimated to be on America’s roads as of late 2023. While it’s hard to be in favor of more taxes, the little bit added to every gallon of gas helps fund road projects and improve traffic flow, so a drop in gas taxes impacts a significant number of public spaces. The United States’ road infrastructure, especially its bridges, has been identified as a high-need area for years, making the taxes even more critical to local governments.

Gas taxes add to the price of each gallon, making them an incentive for drivers to travel fewer miles. EVs are more of a hassle to charge, and there are taxes for charging sessions, but removing gas eliminates those negative incentives for drivers. Heavy batteries also make EVs considerably heftier than comparable gas-powered models, which can damage roads over time and do more damage to guardrails and other protective structures in a crash.

EV Annual Registration Fees Versus Sales Tax and Other Fees

Depending on where you live, you might see a range of fees when you register your car. Most states charge sales tax, which is wrapped into the price you pay at the dealership, and some add a local tax paid to the city or town where the car is registered. In places like Maine, the local tax (excise tax) can be based on the vehicle’s value and mileage. The EV registration fees listed above are in addition to those taxes and must be paid annually, unlike sales tax, which is thankfully a one-and-done charge.

Some states that have implemented EV registration fees plan to increase the amounts over time to keep pace with growing EV adoption. Alabama, for example, will increase the fees by $3 every four years. Others have proposed much higher annual fees, with some reaching $1,000, but none have been that severe to date. You may also hear of states charging additional EV taxes on top of the annual fees, such as Illinois adding $158 to the $100 registration fee for electric vehicle owners.

Are EV Registration Fees Helpful?

While EV owners likely feel disdain for the expense, the fees do help make up for states’ lost gas tax revenues. The challenge with the fees, at least with the way they’re implemented, is that the charge is untethered from the act of driving. There is no connection to the number of miles driven the way that gas taxes are. An EV owner who drives 10,000 miles per year pays the same as someone who drives much more.

While there are taxes associated with charging, a fairer approach could be to charge a true use tax that tracks vehicle mileage to assess a fee. States could reduce the initial registration fees and look at the vehicle’s weight, almost like some do with commercial trucks. In either case, the amount paid per vehicle is in some way connected to their use. That said, there’s no 100 percent fair method for taxing vehicle use, as drivers in rural areas often drive far more than those in tighter urban locations. There could also be privacy issues with tracking vehicle mileage, though many states require a mileage report for annual registration.

EV Registration Fees Versus Incentives

The federal government offers up to a $7,500 tax credit for purchasing a new EV, which can now be applied at the time of sale instead of waiting until year-end taxes are due. Depending on the state, some buyers could see much larger incentives, which can come in the form of rebates, tax breaks, and more. People in states like California can receive tens of thousands of dollars in incentives, drastically reducing the cost of buying a new EV.

Interestingly, a number of the states that offer local EV incentives also charge additional registration fees. That may seem counterintuitive, but the two items likely come from completely different line items in the state budget, with clean/green funds heading to incentives and registration fees padding road and infrastructure budgets. It’s worth noting that there are no ongoing incentives, leaving the benefit as a one-time party at the time of the purchase or when taxes are due.

*Lead image provided by TaxFoundation.org. The image has been modified to include our EV101 banner and cropped to fit out site settings.

Read more