Why 44% Of Potential Electric Car Buyers Are Postponing A Switch To EVs: Study

One of our biggest stories last week was a report about a study that showed 46% of EV owners in the United States say they’re going to go back to a gas-powered car. At the time I wrote the story, I lacked an actual copy of the study, so I was just going on what was already reported.

After posting the story I got a lot of feedback from people stating it was “fake news” and wanting to get more details on how the study was done, with a lot of chatter on X/Twitter over the findings.

![]()

I’ve now got a copy of the McKinsey Mobility Consumer Pulse (MMCP) study, produced by McKinsey’s Center for Future Mobility (MCFM), and I now have a lot of answers to the various questions people had about the study.

What Is This Study? Who Answered The Questions?

The report, which I will refer to as the MFCM study, surveyed more than 30,000 respondents globally who “regularly use mobility” and asked more than 200 questions about mobility, car ownership, and consumer preferences.

McKinsey is a massive consulting firm and “mobility” is of interest to governments, investors, and large companies (all of which buy services from firms like McKinsey). Specifically, the company says the MCFM:

“[H]as worked with stakeholders across the mobility ecosystem by providing independent and integrated evidence about possible future-mobility scenarios. With our unique, bottom-up modeling approach, our insights enable an end-to-end analytics journey through the future of mobility—from consumer needs to a modal mix across urban/rural areas, sales, value pools, and life cycle sustainability.

Since 2021, the survey has included consumers from the 15 biggest auto markets (ranging from massive markets like the United States and China to smaller ones like Norway and South Africa). Overall, the countries included account for more than 80% of global sales volume.

According to the MFCM, the survey was conducted in February of this year.

Where Did That 46% Number Come From?

Here’s the question that was asked of current EV owners:

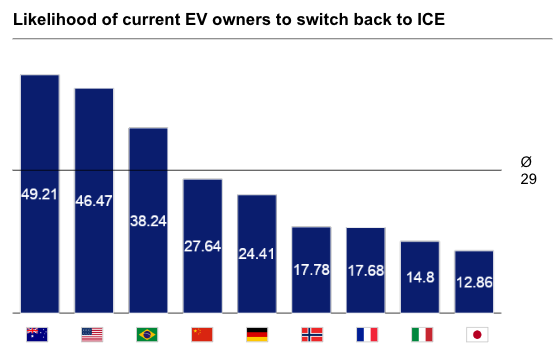

How likely are you to switch back to a traditional combustion engine vehicle based on your current experience with the electric vehicle you own?

Globally, the average number is about 29%, but you can see the full chart here:

The country where someone is most likely to switch back to an internal combustion engine-powered car is Australia, at almost half, followed by the United States and Brazil. The reasoning?

I don’t have a breakdown for American consumers, but globally the biggest reasons for switching back were:

- Total cost of ownership too high (34.5%)

- Cannot charge at home (33.8%)

- Needing to worry about changing is too stressful (31.9%)

As someone who regularly borrows electric cars but cannot charge at home, I can relate to this. Public charging simply isn’t good enough for me and I live in a relatively dense urban environment.

More People Than Ever Want EVs Globally, They Just Want Them To Be Cheaper

The largest barrier to ownership might be practical concerns around charging, but that doesn’t mean people aren’t interested in electric cars. The number of respondents globally who say that they’re going to purchase a BEV (battery electric vehicle) for their next car grew to 17.6% this year, up from 14% in December of 2021.

Overall, 70% of respondents said they’d either be getting a BEV or PHEV next or, at the very least, only expected to own one more gas-powered car before switching over to an electric car.

That, too, conforms with my experience as I plan to buy a hybrid and then, hopefully, an electric car if charging around me improves.

Still, the reasons why people haven’t switched over yet have a lot to do with the fact that EVs are too expensive in most places. The top reasons given for not wanting to switch were:

- Too expensive (45%)

- Charging concerns (33%)

- Driving range concerns (29%)

Obviously, the “expensive” issue is geography dependent. In China, there are plenty of affordable electric cars so only 9% of EV skeptics interviewed there were worried about cost of ownership. Norway was the only other country that low, at 29% of EV skeptics, but Norway has become the largest EV market proportionally due to extremely high subsidies for electric cars.

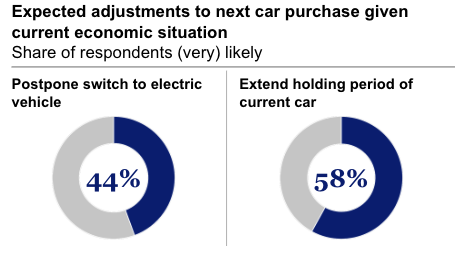

And, going deeper into consumers in the United States, many are likely to postpone a new EV purchase because of “the current economic situation” as you can see in this graphic:

This isn’t just in the EV market. The average age of American cars is now 14 years as people hold onto their cars, EV or ICE, a lot longer. There are many ways to interpret “the current economic situation” and I think a lot of it has to do with higher uncertainty and higher interest rates.

People Also Want More Range

Here’s an interesting tidbit from the study:

Range expectations have been increasing over time (+ ~30% in the past 5 years) and are outpacing actual range improvements: Since 2022 consumers demand 5% more range, while actual range increased by only 2%

As of the most recent study, people expect at least 291 miles of maximum range, on average, before they’d consider getting a new electric car. This is a little higher than many vehicles currently for sale, but it puts quasi-affordable vehicles like the Tesla Model Y, Mach-E, and Equinox EV on the table.

I Don’t Think This Is Entirely Bad News

If you love electric cars or think everyone should be driving an electric car then this is not what you want to hear. It’s hard enough to get someone to switch to an electric car and hearing that almost half of owners in the United States want a gas-powered car isn’t encouraging.

The study didn’t ask if those people would consider buying a hybrid or a PHEV when going back to a gas-powered car, but that’s not an unreasonable assumption (especially if those owners have access to home charging).

While there are many good electric cars on the market, the next generation of EVs will hopefully better meet range requirements and cost less money. If automakers can deliver a little more range for a little less money then new consumers seem to be there according to this study.

At the same time, it’s important for the industry and the government to work together to solve charging issues, especially in denser urban corridors.