Why Americans aren’t buying more EVs

Clint and Rachel Wells had reasons to consider buying an electric vehicle when it came to replacing one of their cars. But they had even more reasons to stick with petrol.

The couple live in Normal, Illinois, which has enjoyed an economic boost from the electric vehicle assembly plant opened there by upstart electric-car maker Rivian. EVs are a step forward from “using dead dinosaurs” to power cars, Clint Wells says, and he wants to support that.

But the couple decided to “get what was affordable”—in their case, a petrol-engined Honda Accord costing $19,000 after trade-in.

An EV priced at $25,000 would have been tempting, but only five new electric models costing less than $40,000 have come on to the US market in 2024. The hometown champion’s focus on luxury vehicles—its cheapest model is currently the $69,000 R1T—made it a non-starter.

“It’s just not accessible to us at this point in our life,” Rachel Wells says.

The Wells are among the millions of Americans opting to continue buying combustion-engine cars over electric vehicles, despite President Joe Biden’s ambitious target of having EVs make up half of all new cars sold in the US by 2030. Last year, the proportion was 9.5 percent.

High sticker prices for cars on the forecourt, and high interest rates that are pushing up monthly lease payments, have combined with concerns over driving range and charging infrastructure to chill buyers’ enthusiasm—even among those who consider themselves green.

Financial Times

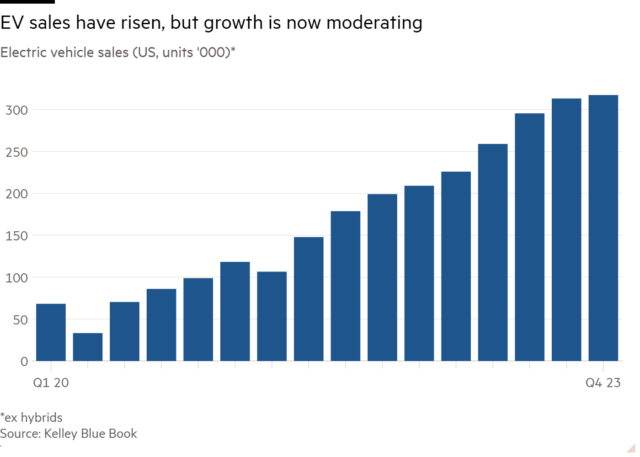

While EV technology is still improving and the popularity of electric cars is still increasing, sales growth has slowed. Many carmakers are rethinking manufacturing plans, cutting the numbers of EVs they had planned to produce for the US market in favor of combustion-engined and hybrid cars.

Electric vehicles have also found themselves at the intersection of two competing Biden administration priorities: tackling climate change and protecting American jobs.

Biden has pledged to lower US greenhouse gas emissions to 50-52 percent below 2005 levels by 2030, with widespread EV adoption a significant part of that ambition.

But he wants to achieve it without recourse to imports from China, the world’s biggest producer of EVs and a dominant player in many of the raw materials that go into them. Washington has set out an industrial policy that hits Chinese manufacturers of cars, batteries and other components with punitive tariffs and restricts federal tax incentives for consumers buying their products.

The idea is to allow the US to develop its own supply chains, but analysts say such protectionism will result in higher EV prices for US consumers in the meantime. That could stall sales and result in the US remaining behind China and Europe in adoption of EVs, putting at risk not only the Biden administration’s targets but also the global uptake of EVs. The World Resources Institute says between 75 and 95 percent of new passenger vehicles sold by 2030 need to be electric if Paris agreement goals are to be met.

Brian Cassella/Chicago Tribune/Getty Images

“There is no question that this slows down EV adoption in the US,” says Everett Eissenstat, a former senior US Trade Representative official who served both Republican and Democratic administrations.

“We are just not producing the EVs the consumers want at a price point they want.”

Incenting consumers

The administration is attempting to reconcile its industrial and climate policies by offering tax incentives to consumers to buy EVs and by encouraging manufacturers to develop US-dominated supply chains.

Tax credits of up to $7,500 are available to buyers of electric cars. But the full amount is only available on cars that are made in the US with critical minerals and battery components also largely sourced in the US.

That means few cars qualify for the maximum credit. Two years on from the passage of the Inflation Reduction Act, which set out Biden’s ambitious green transition strategy, there are only 12 models that can actually score buyers the full $7,500.

The act also offered hundreds of billions of dollars in subsidies and other incentives to companies building a domestic clean energy industry. The automotive sector has been one of the beneficiaries of that largesse.

Last month, the Biden administration went a step further, adding steep new tariffs on billions of dollars of goods imported from China. These included a quadrupling of the tariffs on imported electric vehicles, a tripling of the rate on Chinese lithium-ion batteries to 25 percent and the introduction of a 25 percent tariff on graphite, which is used to make batteries.

The levies were an extension of a package first imposed by then president Donald Trump as part of his trade war with Beijing in 2018, and have been under review by the Biden administration as it figures out how to respond to what it says are Beijing’s unfair subsidies to strategic industries.

Mandel Ngan/AFP/Getty Images

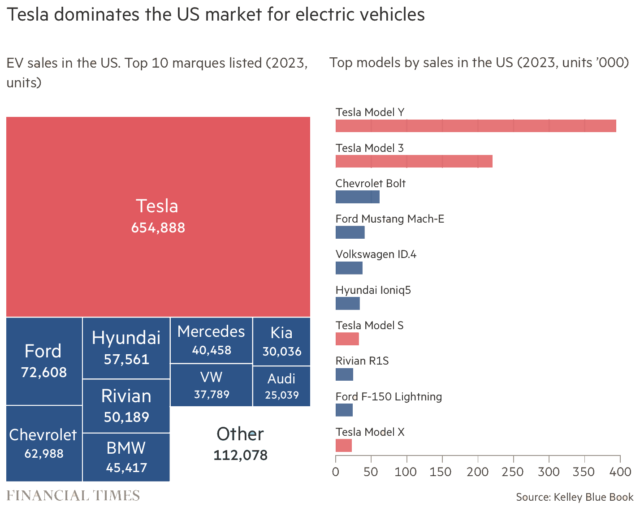

Few Chinese EVs are available for sale in the US. Polestar is the only Chinese-owned carmaker currently active in the country and it sold a mere 2,210 cars in the first quarter—out of nearly 269,000 new EV sales. (The company plans to add manufacturing in the US this year.)

Wendy Cutler, a former trade official and vice-president of the Asia Society Policy Institute, describes the pre-emptive levying of tariffs as a new development in global trade policy.

“This sends a clear signal to China: don’t even think about exporting your cars to the United States,” she says.

More significant than the tariffs on Chinese electric cars are the levies on lithium-ion batteries and the materials and components used to make them.

China is a key player in the supply chain for EV batteries, with companies such as BYD and CATL developing the country’s capacity over more than a decade. It dominates the processing of the minerals contained in lithium-ion batteries as well as the manufacture of battery components such as cathodes and anodes.

According to data analyzed by the Center for Strategic and International Studies (CSIS), a Washington think-tank, US-based carmakers have been importing a growing share of their batteries from China. In the first quarter of 2024, more than 70 percent of imported car batteries came from the country.

The tariffs will drive up manufacturing costs for carmakers in the US and that cost is likely to be passed on to consumers because battery materials and components are not currently available in large quantities from any supply chain that excludes China.

US trade officials draw parallels with the solar industry. The cost of photovoltaic panels fell worldwide as Chinese manufacturers, benefiting from subsidies, lower labor costs and growing scale, came to dominate the industry.

That has been a boon for consumers, but resulted in production and jobs shifting from the US to China. Washington does not want a rerun of this process in the automotive sector.

“The idea that we should just open our gates and have a bunch of systematic Chinese economic abuses . . . and that that’s the answer to climate change is incredibly naive and short-sighted,” says Jennifer Harris, a former economic adviser to Biden.

In an election year, the issue is politically charged too. Michigan and Ohio, both home to large numbers of auto workers, are swing states in the presidential election. Both Biden and Republican nominee Donald Trump are trying to appeal to working-class voters there.

Preserving jobs in the US auto industry as it moves towards green technology is largely about the supply chain. More than half the 995,000 people employed in the auto industry across the US are making parts, rather than assembling vehicles, according to the Bureau of Labor Statistics.

EVs already threaten these jobs because their powertrains comprise fewer components than cars with traditional engines and transmission systems. The United Auto Workers union, arguing for a “just transition” to clean energy, fought during its six-week long strike last autumn to have battery plants in the US covered by the same contracts that protect workers at plants making petrol-powered vehicles, winning an agreement with General Motors.

Financial Times

Ilaria Mazzocco, chair in Chinese business and economics at CSIS, says the reduced competition and rising cost of imported battery components could delay price decreases for US consumers.

“It’s not just that the same car costs less in China, it’s that in China you have a wider variety,” says Mazzocco. “US automakers will have the leisure of not having competition, and they’ll be able to focus on making these high-cost trucks”—a reference to larger sedans and SUVs, which have bigger profit margins.

“That’s just what the Biden administration feels they need to do on the political front, because they need to prioritize jobs,” she adds.

Price and infrastructure

Electric vehicles face other barriers to mass adoption. Affordability, lack of charging infrastructure and range anxiety all remain concerns for mainstream US car buyers.

The price for a new EV averaged just less than $57,000 in May, compared with an average of a little more than $48,000 for a car or truck with a traditional engine.

The starting price for a Tesla Model Y, by far the most popular electric vehicle in the US, was just less than $43,000 during the first quarter. The Ford F-150 Lightning, the electrified version of the best-selling pick-up truck in the US, was teased at $42,000 when it went on sale in May 2022 but now starts at $55,000—more than $11,000 above the petrol-powered F-150.

Used EVs are cheaper, with a vehicle less than five years old costing about $34,000, according to Cox Automotive. But they remain more expensive than used cars with traditional engines, which average about $32,100—and they make up just 2 to 3 percent of used vehicle sales.

Brandon Bell/Getty Images

Ford and Stellantis, which owns brands such as Dodge, Ram and Jeep, are promising $25,000 EVs for the US market in the next few years. General Motors plans to revive the Chevrolet Bolt as “the most affordable” EV on the market. Tesla chief Elon Musk also told investors in April that Tesla would launch “more affordable models” this year or early in 2025.

But these models will still face obstacles like a dearth of charging infrastructure. Overnight charging at home is the preferred method of replenishing an EV, but this is only really an option for those who can install a charger on their property. Those living in apartment complexes in states like California, where a greater share of people drive EVs, are more reliant on public charging facilities.

While there are about 120,000 petrol stations nationwide, according to the US Department of Energy, there are only 64,000 public charging stations in the US—and only 10,000 of them are direct current chargers, which can replenish a battery in 30 minutes rather than several hours. Charging stations also can be inoperative or have long lines when drivers arrive, forcing them to go elsewhere.

Potential buyers also worry their EV may not travel as far on a single charge as they require. While electric vehicles are well suited to the short trips that make up most driving, many Americans also use their cars and trucks for longer distances and worry that charging en route may add to their driving time, or even leave them stranded. Cold weather and towing a load can both diminish an EV’s range.

“What we’re seeing is the pace of EV growth is faster than the rate of publicly available charger growth,” says John Bozzella, chief executive of US auto trade group the Alliance for Automotive Innovation.

Two strategies

Many global carmakers are making big investments in US manufacturing plants, in response to the government’s incentives. But in the light of slowing EV sales growth they are shifting that investment towards hybrid vehicles, which use battery power alongside a traditional engine.

Last month, executives from GM, Nissan, Hyundai, Volkswagen and Ford all said that tapping into demand for hybrids was a priority. Ford chief executive Jim Farley told investors at a conference “we should stop talking about [hybrids] as a transitional technology,” viewing it instead as a viable long-term option.

Hyundai said it was considering making hybrids at its new $7.6 billion plant in Georgia. US competitor GM said in January that it would reintroduce plug-in hybrid technology to its range, though chief executive Mary Barra recently affirmed she still saw EVs as the future.

Bozzella says that even with the tariff protection measures and US subsidies in place, he was unsure how long it would take for the US auto industry to produce EVs that could compete with heavily subsidized Chinese vehicles on pricing.

“There is no question that EVs built in the US now, and built by American companies now, are absolutely competitive with EVs around the world,” he says, citing Tesla.

“If what you mean is competitive at price points . . . well that’s a different matter entirely, and my answer to that is: I’m not sure.”

Van Jackson, previously an official in the Obama administration and now a senior lecturer in international relations at Victoria University of Wellington in New Zealand, says electric cars still need to fall in price if the market is to grow substantially.

“How do you bring workers along and increase their wages, and have a growth market for these products, given how expensive they are?” he asks. “I’m an upper-middle-class person and I cannot afford an EV.”

He is skeptical about whether shutting the world’s dominant producer of EVs and related componentry out of the US market will reduce the price of the cars and encourage uptake.

“The tariffs are buying time,” he says. “But towards no particular end.”

© 2024 The Financial Times Ltd. All rights reserved. Not to be redistributed, copied, or modified in any way.