Why Beijing Stands to Gain from Elon Musk’s Visit

Why Elon Musk went to China

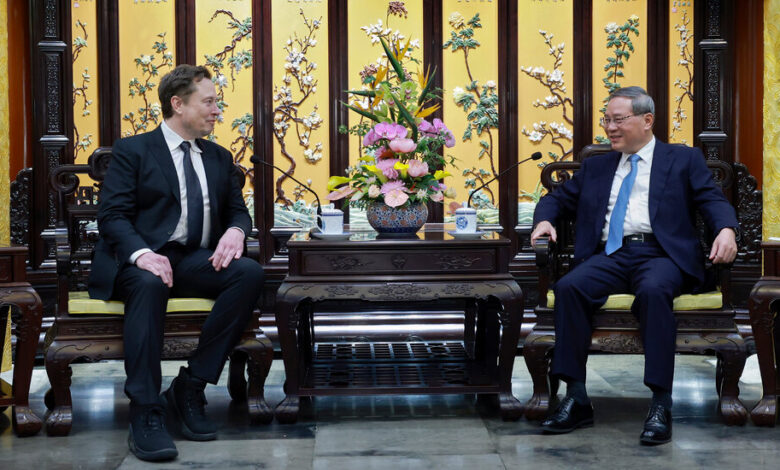

Just days after Secretary of State Antony Blinken traveled to Beijing and warned China about unfair trade practices, Elon Musk landed in the Chinese capital. The Tesla boss’s meeting with China’s No. 2 official may have paid off: Musk reportedly cleared two obstacles to introducing a fully autonomous driving system in the world’s biggest car market.

The split screen again reveals the gap between Western diplomacy and corporate imperatives. Tesla has to stay committed to China even as it faces big headwinds — a conundrum that other multinationals also face, and one that Beijing is eager to exploit.

Musk is betting big on self-driving, and China is key. Tesla last week reported its worst quarter in two years as a price war hurts profit. Tesla shares have plummeted (though they’ve rebounded in recent days, and are up more than 8 percent in premarket trading) amid plans for big layoffs.

Musk has tried to reassure the market by pushing ahead with a low-cost model. Fully autonomous driving is also crucial. Musk told analysts last week that if investors don’t believe Tesla would “solve” the technological challenge that is autonomous driving, “I think they should not be an investor in the company.”

The carmaker faces challenges in its second biggest market. Heavily subsidized Chinese rivals are eating into sales, led by the Warren Buffett-backed BYD, which is vying with Tesla for the crown of world’s biggest E.V. maker.

Teslas are banned from many Chinese government sites because of concern about what data the American company collects. President Biden’s move to declare Chinese E.V.s a security threat probably won’t have made it any easier for Tesla in China.

But Musk seems to have received some good news. Beijing signaled that Tesla could roll out its self-driving system after the company passed a data security test; the company reportedly will partner with the Chinese tech company Baidu, which will supply the mapping and navigation software for the cars.

(It also suggests that despite the speculation, targeting Tesla as retribution for a potential U.S. ban on TikTok hasn’t come to pass.)

Musk’s visit is a boost for the Chinese, too. Beijing used it to show that it still has leverage with foreign companies reliant on its market. Musk’s meeting with Li Qiang, the Chinese premier, was well-publicized across state media (and on Musk’s X) as an example of Western business playing by Beijing’s rules.

Tesla isn’t alone in bending over backward to stay in China. Many foreign carmakers are doubling down. Volkswagen has invested in companies like Horizon Robotics, a leading Chinese A.I. chip designer, and in Xpeng, a Chinese E.V. rival, even as non-German competitors say they need E.U. protection from cheap Chinese imports.

Of course, Musk has proved his doubters wrong plenty of times. But he and his foreign rivals may also have little choice.

HERE’S WHAT’S HAPPENING

Antony Blinken meets with Arab leaders about the Israel-Gaza war. The secretary of state is holding talks with officials including Prince Faisal bin Farhan, the foreign minister of Saudi Arabia, in Riyadh about issues such as Israeli hostages and a path to a Palestinian state. Meanwhile, the nonprofit World Central Kitchen said it would resume operations in Gaza, nearly a month after targeted Israeli military strikes there killed seven of its workers.

Shares in Philips soar after a smaller-than-expected sleep apnea settlement. The Dutch company’s stock jumped 45 percent on Monday after it set aside about €982 million ($1 billion) to cover costs tied to U.S. claims over faulty sleep apnea devices.

Taylor Swift’s latest album breaks records. “The Tortured Poets Department” debuted atop the Billboard 200 chart with the equivalent of 2.61 million albums sold in its first week and 891 million streams, the biggest ever streaming week for an album. Swift is now tied with Jay-Z for the most No. 1 albums by a solo artist despite some concerns about her oversaturating the market.

What a big shake-up means for Paramount’s deal talks

The chaotic corporate story of Paramount is about to take another dramatic twist. The media giant is expected to announce the departure of Bob Bakish, its C.E.O., as soon as Monday, even as Shari Redstone looks to sell her controlling stake.

Skydance — David Ellison’s film studio that has been in exclusive talks to do a deal with Paramount, the company behind the “Top Gun” film franchise and television assets like CBS and Nickelodeon — has put in a revised offer.

The exit of a top executive amid negotiations is unusual, and it could have implications for what happens next, DealBook’s Lauren Hirsch writes.

It puts renewed focus on a special committee overseeing the deal. A Skydance deal could personally net Redstone, who controls Paramount via the holding company National Amusements, a substantial premium for her stake, including more than $2 billion in cash.

That could invite extra legal scrutiny of a deal that’s already come under fire from several large investors who are pushing Paramount to consider a previously rejected all-cash approach from the private equity giant Apollo.

Parting with Bakish could raise tensions even further. “We’re in special committee land. Which means, from a legal standpoint, we are in church,” Jim Woolery, a veteran M.&A. lawyer and banker who has advised many special committees on deals, told DealBook. “This is not church-like — this is sloppy. This creates more risk.”

Bakish’s exit could weaken Paramount’s hand. Bakish would not be replaced by a C.E.O. but several executives would run an office of the C.E.O. Paramount’s financial footing is also in focus, with the company set to announce earnings on Monday as questions loom about the status of its pivotal cable deal with Charter, and investors clamoring for progress on its streaming ambitions.

The company is preparing for any eventuality, including no deal. It has laid out a contingency plan in which it remains independent, The Wall Street Journal reports.

The clock is ticking. The Skydance exclusive-talks window is set to lapse on Friday (though it could be extended). And Apollo’s hand appears significantly stronger than when it last approached Paramount about a deal, given its potential partnership with Sony that would bring additional cash and operational expertise.

But an Apollo-Sony push could also face tough questions from shareholders, and even the board, including: What is the structure of their deal? And, how would they address the likely regulatory risk?

Betting on green in sports

Investors have been eager to get a piece of live sports, from stakes in teams to media rights.

Bruin Capital, the sports-focused private equity firm run by George Pyne, NASCAR’s former C.O.O., is taking a new approach, DealBook is first to report: buying a specialist in growing and maintaining stadiums’ natural grass.

Bruin is buying PlayGreen, the Netherlands-based owner of SGL, which provides technology including lighting and monitoring tools to grow natural turf. The deal values PlayGreen at about $120 million, DealBook hears.

SGL was created in 1997 to focus on sports. It scored its first big contract in 2004 with Arsenal, the English Premier League soccer club. It later expanded into the N.F.L., pro tennis (Wimbledon), golf (the Masters), horse racing and more, while surviving a trend toward artificial turf.

SGL works with about 520 stadiums, from the Green Bay Packers’ Lambeau Field in Wisconsin to Kingdom Arena in Riyadh, Saudi Arabia. “We’ve proved we can grow grass under any circumstances,” Mark Trübenbacher, SGL’s C.E.O., told DealBook.

The investment is a bet on several things, Pyne said:

-

Player safety: Highly paid athletes need to be protected, given the prevalence of injuries like A.C.L. tears in football and soccer. “The surface to play on impacts the quality of the game and the safety of the game,” Pyne said. (Trubenbacher added that interest in SGL grew after Aaron Rodgers’ season-ending injury in September.)

There’s an artificial intelligence angle, too. Trübenbacher said that with all the data that SGL’s systems collect, his company will eventually introduce A.I. to help automate turf management.

“We know exactly when we’ve reached ideal daylight,” he said. “In the future, we’ll know when to switch off the lights. In the past, that was set by a timer.”

“Most of what he has learned about A.I. comes from working with me over all these years.”

— Demis Hassabis, on his childhood friend, former colleague and now rival, Mustafa Suleyman of Microsoft. The two grew up in London and co-founded DeepMind, the artificial intelligence research lab (acquired by Google) where Hassabis is C.E.O. The duo are among the most consequential in the A.I. sector and their companies are in a high-stakes race to dominate the sector.

The week ahead

The Fed, jobs and a busy earnings calendar — here’s what to watch:

Tuesday: Amazon, AMD, Samsung, Eli Lilly, Volkswagen, Starbucks and McDonald’s are set to release earnings. Investors also will be watching the latest eurozone inflation data for clues to the likelihood that the European Central Bank will start cutting rates in June.

Wednesday: It’s Fed decision day. Economists expect the central bank to keep borrowing costs at their highest in decades well into the autumn. On the earnings front, KKR, Mastercard, Pfizer and Devon Energy are due to report.

Thursday: Apple, the Ozempic maker Novo Nordisk, Shell, Apollo, Live Nation, and Maersk report quarterly results.

Friday: It’s jobs day. Economists polled by Bloomberg forecast that employers added roughly 250,000 jobs in April, a drop from March, but enough to keep the unemployment rate at a relatively robust 3.8 percent.

THE SPEED READ

Deals

Policy

Best of the rest

-

Some marketers have accused Meta’s A.I.-enabled advertising tools of blowing through their budgets, driving them off the tech giant’s platforms. (The Verge)

-

Calstrs, the big California public pension fund, reportedly has had to delay publishing its latest climate report because it had miscalculated the carbon footprint of its $331 billion investment portfolio. (FT)

-

“The Comfortable Problem of Mid TV” (NYT)

We’d like your feedback! Please email thoughts and suggestions to dealbook@nytimes.com.