Why fintech is the next supply chain frontier

The package you were expecting might be delayed—again. The Red Sea crisis, which has been punctuated by ongoing attacks on commercial shipping containers, has had downstream effects on global supply chains—in part because 30% of the world’s container traffic moves through the Suez Canal.

And that’s just one example of a major supply chain disruption. Global supply chain disruptions are commonplace today, whether driven by the COVID-19 pandemic, freight price volatility, crumbling infrastructure, or drought conditions in the Panama Canal. These cascading crises have forced businesses to rethink their supply chains and find more sustainable ways to procure materials and manage shipping operations.

Over the past few years, businesses and logistics providers alike have been rocked by supply chain disruptions. These developments have put into stark relief the outdated systems and processes that manufacturers, distributors, carriers, third-party logistics (3PLs), and shippers use to manage the $1 trillion of global spend on supply chain and logistics services.

Excitingly, a new wave of supply chain startups has emerged to modernize supply chain operations—yet one of the biggest challenges for shippers and service providers remains: money movement across the supply chain.

Many challenges in supply chain finance are rooted in difficulty accessing, normalizing, and making sense of data. As we’ve seen with other vertical SaaS categories, vertical-specific financial services tend to follow SaaS products as a second wave, after an industry’s initial adoption of SaaS platforms. We believe now is the moment for the financial and payments layer to analyze data and facilitate money movement across the supply chain. In this roadmap, we explain why the next frontier of supply chain innovation is at the intersection of fintech and AI, and the opportunities we’re most excited about.

Six challenges with supply chain transactions

The financial transactions associated with supply chains are complex due to challenges unique to this industry:

- Different geographies entail different financial systems. Counterparts in different regions and countries rely on different payment rails, banking systems, and currencies.

- Long delivery delays create large working capital financing needs. Complex trade finance structures are necessary to help cover organizations from when they place orders to when they receive them.

- Poor technological connectivity between partners results in a lack of data. Operators across every major industry from industrials to electronics to CPG, often rely on clunky enterprise resource planning (ERP) software, Excel, email, and scanned paper documents to manage procurement, inventory, and payments, thus making it difficult to agree on a single source of truth between trading partners.

- Building trust with new partners takes time. Often there is very little trust at the beginning of supply chain relationships, in part because so much is at stake: downstream effects impact teams and functions, customers, and even industries and regional economies.

- Unstructured data is difficult to manage and analyze. Much of the information in this industry is transacted via email, documents, and other unstructured forms, making it very difficult to run analytics and optimization on this information. As a result, many supply chain operators default to highly manual data entry services to structure this data in their system of record and run manual analytics or audits on it.

- Surprises happen, impacting final shipment costs. Whether a shipment is moving a short distance or crossing oceans, it’s often inevitable that a final quote strays from the original invoice. Supply chain transactions can be fraught with pain, hindering supply chain flexibility and resilience and tying up tremendous amounts of working capital.

Opportunities in the supply chain fintech ecosystem

Based on our conversations with founders and operators in the supply chain space, we have identified a few key theses we are particularly excited to pursue:

1. Software for analyzing procurement data and automating financial workflows

The supply chain industry would greatly benefit from a single source of truth for transaction data and analytics, although we know this is an unrealistic expectation. Today, finance and procurement teams often find data to be siloed and difficult to manage across systems. Operators in logistics (carriers, shippers, 3PL, and brokers) and supply chain (manufacturers, distributors, and retailers) sift through ERPs, transportation management systems (TMS), Excel, and physical documents to find purchase, payment, and operational performance data. Supply chain professionals often have to manually input data and normalize it across sources, many times risking inconsistencies and audit challenges.

AI and LLMs are helping to solve this data problem by extracting and standardizing supply chain data across invoices, bills, and other payment documents and automatically ensuring that each party’s system of record is updated with the latest information. This unlocks opportunities for a host of new applications that we are excited about, which can further automate the entire transaction lifecycle from procurement through payment reconciliation.

2. Faster and more streamlined payments for suppliers and carriers

Supply chain payment mechanisms are slow and clunky. A significant portion of the industry still relies on checks and ACH wire transfers. These systems lengthen the time it takes for suppliers and carriers to get paid and don’t provide any visibility into payment status. In addition, a lack of payment information and visibility might compromise product or service delivery to customers.

We are excited about startups that are building payment ecosystems and networks geared toward the supply chain sector. The sheer size and complexity of the global supply chain warrant vertical-first payment solutions.

Supply chain payments sometimes require special terms, conditions, and protections, including:

- Mid-transit commissions or payouts;

- Accessorial charges for detention, demurrage, and fuel charges, tacked onto invoices;

- Net-60 or net-90 financing terms;

- Closed-loop credit cards for refueling fleet vehicles, like Wex and Fleetcor;

- Anti-fraud measures to prevent card skimming at fuel pumps.

We believe these unique complexities will require payment solutions specific to freight, construction, and other supply chain subsectors to navigate the intricate webs of relationships and workflows across stakeholders in these industries. In making sense of the underlying financial data, AI can do everything from suggesting improved payment and credit terms based on a customer’s prior financial history and better assess fraud and risk to prevent erroneous payments.

3. Solving the working capital gap

Suppliers often wait months to receive payments on an order. The lag between shipping an order and collecting payment on an invoice with net-60 or net-90 payment terms has often meant that suppliers find their business hobbled as they wait for funds to replenish their working capital—incredibly, despite the digital revolution, small suppliers are often still essentially serving as major creditors to some of the largest corporations.

Additionally, while businesses might typically use bank financing to address this working capital gap, small and medium businesses struggle to obtain such financing at reasonable rates given banks and their suppliers do not lend to them given difficulty in assessing credit risk. With the global trade finance gap sitting at $1.7 trillion, numerous businesses are forced to contend with everything from cash flow issues to bankruptcy.

FinTech solutions that are able to address long lead times for suppliers or unlock payment constraints for carriers on top of a core workflow solution can help ease business operations while locking in customers. Modern “Procure-to-pay” systems can streamline the process of invoice creation to payment settlement, alleviating a significant administrative burden. But we also expect there will be a new wave of software platforms that lead with AI-enabled workflow automation as a wedge, and potentially include lending options down the line, to help them leverage software for distribution and avoid becoming commoditized with a credit-only product.

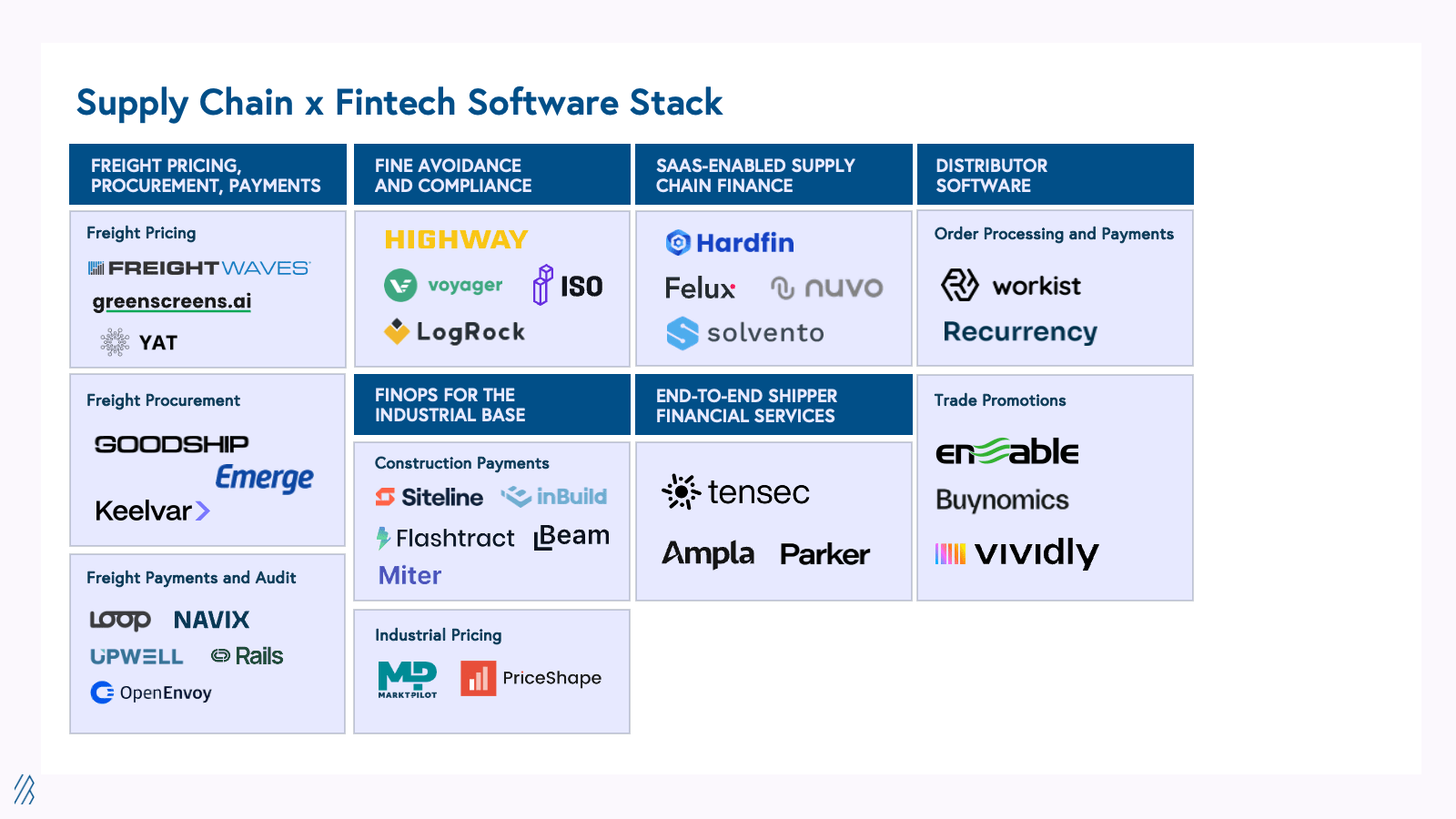

Mapping the market

Below is the market map of fintech-enabled supply chain software categories we have been tracking. We have focused most squarely on SaaS and payments solutions that have been spared from the volatility and commodification risk of credit-first models.

We have been particularly excited by solutions touching freight pricing, procurement, and payments; fine avoidance and compliance solutions; FinOps solutions for the industrial base; distributor software; and supply chain finance that boosts core SaaS solutions, and end-to-end shipper financial services.

Here’s where we’ve been spending time so far:

Freight pricing, procurement, and payments

The logistics space is full of clunky, decades-old software and services solutions used to manage the entire transaction process including freight procurement, execution, payment and auditing. We are particularly excited about tools that are unifying siloed data sources to help operators make better decisions by overlaying all of the relevant data in one place, and systems that are leveraging LLMs to make sense of unstructured data and help automate highly manual processes.

1. Freight Pricing: Given the manual and backward-looking tools currently used to price freight, carriers, shippers and brokers are all at risk of leaving money on the table when using market average and historical pricing tools. Some solutions, like Freightwaves, use data through the SONAR platform to allow 3PLs to forecast contract and spot rates and win more freight and enable carriers to maximize trucking rates while minimizing operating costs. Others, like Greenscreens, factor in details like market conditions, seasonality, load attributes, and customer constraints to arrive at recommended AI-powered rate and freight pricing details for brokers, catalyzing their operations. We think there are similar opportunities to deliver more comprehensive and nuanced pricing software to the shipper side of the market as well that can help freight buyers make much better decisions in their freight procurement.

2. Freight Procurement: We see many opportunities to fully digitize the entire logistics procurement process from initial RFP through carrier performance monitoring and payment. For example, GoodShip is pioneering this approach with its freight orchestration and procurement platform for contracted freight. Tools like this help to integrate performance and price data from disparate systems to create a single source of truth for shippers and thus make it substantially easier to optimize freight spend, run RFPs, manage disputes, and audit invoices. Ultimately, bridging the gaps between procurement, carrier performance, and freight payment systems helps operators to better track performance relative to their contracts, save money, and improve their networks over time.

3. Freight Payments and Audit: There is an opportunity for a company to build an unbiased infrastructure layer for freight payments data. Given the long timelines for clearing transactions and the difficulty in assessing and assigning responsibility for invoice discrepancies, solutions that facilitate automatic payment clearance and build the infrastructure to validate invoice data across all parties are critical. The unique ecosystem of carriers, 3PLs, shippers, and warehouses within the freight space makes it necessary for any solution to carefully navigate working across these players and operate within their specific workflows and billing requirements, requiring deep domain expertise. Such software needs to not only make sense of highly unstructured data, but also audit it and enable customers to get in-depth insight into everything from payments, accounting, and rate management, enhancing customers’ ability to make business decisions. Companies such as Loop have used a combination of AI, NLP, and computer vision to build such an infrastructure layer, on top of which countless applications can be built. Startups are already employing solutions like these for use cases such as invoice reconciliation and accounts payable automation, including our portfolio company Raft.ai which is applying computer vision and LLMs to automate the financial workflows for enterprise freight forwarders.

Fine avoidance and compliance

With a host of regulations governing the logistics space, managing carrier compliance to avoid fines and assign responsibility is increasingly critical. Technology that pulls in and verifies invoice, charge, and other input data can be used as a source of truth for shippers, carriers, and other actors in the logistics space by allowing multiple parties to collaborate on and agree on a source of truth. Such solutions are critical for shippers to avoid fines levied on them by retailers, an issue companies like Iso are addressing as shippers are the victims of false negatives given the delay in payment data provision. Beyond the freight space, we have also been looking at maritime-focused solutions that capture and compare port documentation and provide demurrage and detention detail, tying penalties to specific parties and assessing demurrage risk in associated parties. Voyager is a key player in this space.

Given fines levied by the Department of Transportation, we have also been excited by solutions focused on minimizing regulatory and legal risks, helping carriers reduce time spent out of service and keeping insurance rates down. Much of compliance is a data problem; many small and mid-sized carriers struggle to find the time or resources to track relevant actions to be taken, such as renewing certifications. Solutions in this space might offer workflow solutions to facilitate ELD integrations and manage detail around permits, claims, equipment files, driver qualifications, and insurance administration. LLMs serve as an exciting unlock in being able to automatically assess whether carrier operations are in line with changing compliance codes and regulatory requirements across jurisdictions, reducing the risk of fines and properly assessing responsibility.

FinOps for the industrial base

With the reshoring of manufacturing and industry, manufacturers and retailers in industrials, construction, electronics, and other parts of the supply chain have had to take a granular view of their inventory supply chain for business catalyzation, spend management, and compliance purposes. This has led to startups emerging to provide joint workflow and payment solutions to SMBs in legacy industries, including construction contractors and contract manufacturers.

In the construction space, we have been excited by solutions that allow trade contractors to collaborate and quickly execute non-core but business-critical functions like billing and payroll. These include companies like Siteline, which offers solutions for contractors to quickly edit billing values, generate pay app packages, and request vendor lien waivers in a collaborative manner, integrating with ERP and contractor payment tools. Others, like Flashtract also offer solutions to contractors to help them automate billing, payment, and compliance processes.

We have seen analogous industry-specific solutions emerge in electronics, aerospace, industrial, and LBM sectors, and are actively looking for companies that provide FinOps solutions for the industrial base. Often these solutions may combine payment and billing products with component sourcing or workflow solutions, providing a value stack in a verticalized manner. They might enable multiple stakeholders in the organization to manage projects, negotiate rates, provide quotes, and produce or respond to RFPs/RFQs, centralizing core operations while tying in revenue and spend associated with core business processes.

As with pricing solutions for the freight industry, we think startups can build supply chain sector-specific pricing software to provide clarity on where manufacturers, wholesalers, and retailers are under- or overpricing inventory. We’ve been excited by solutions like Markt-Pilot, an industrial parts pricing software company that allows OEMs of industrial spare parts to gain visibility around their parts pricing compared to the market, allowing them to adjust pricing in real time to increase profit or market share. Given pricing has a significant impact on profit, we believe there is ample opportunity to build pricing and broader CPQ workflows to drive significant ROI to customers.

Distributor software

We believe there is an opportunity to enhance distributor operations in the materials supply chain. While a number of technology solutions have been focused on disintermediating the purchase and sale of goods across industries – a phenomenon we have previously articulated in our B2B Marketplaces roadmap – an increasing number of solutions are facilitating and enhancing the role of key third-parties that provide valuable services in the supply chain. Indeed, while some value chains are ripe for disruption through removal of the middleman, in others the centrality of the distributor makes them the key customer for whom tech solutions should be built.

We are excited about two phenomena in this space—namely distributor payments and trade promotions:

1. Order Processing and Payments: By sitting at the intersection of manufacturers that produce goods and retailers that purchase them, distributors must uniquely manage spend and pricing to optimize margin. Solutions that integrate order processing can help distributors dynamically manage their business and facilitate payments. For example, companies like Workist rapidly integrate with distributor ERPs to manage order processing via AI by extracting and automatically validating data across PDFs, Excel files, and emails. This allows customers to automatically post invoices and offer order confirmations to speed up the payments workflow so that they can focus on more strategic tasks like procurement management and supplier negotiations. We have seen other solutions start with distributor-specific pain points; for example, catalog digitization to help distributors’ customers visualize products previously accessed in multi-hundred page PDFs, from which point they can then offer inventory management, procurement, and payment processing solutions.

2. Trade Promotions: Trade promotions software like Enable provides tools for distributors to manage rebates and B2B deals with the purpose of optimizing trade relationships. By giving distributors insight into their deals with manufacturers and buyers, such solutions allow for connectivity to address missed deal opportunities, poor cash flow, and financial compliance risks, fixing troubled trade relationships and further leveraging good ones. We have been following solutions that move beyond simple situational capture and focus on recommending and executing on enhanced deal structures, facilitating trade partner collaboration, and layering additional tools such as payments.

SaaS-enabled supply chain finance

Given supplier challenges in accessing sufficient working capital, many startups have emerged to offer credit solutions to alleviate this business-constraining problem. Such credit-focused solutions within supply chain have spanned invoice factoring and trade finance sectors, serving freight carriers and capital-constrained SMBs.

While some sector-specific companies use rigorous internal algorithms to evaluate customer creditworthiness and provide credit on better terms than a bank, we have been wary of solutions that take on significant balance sheet risk. We have found the most compelling solutions in this space using credit as a booster rather than a wedge by building on top of core vertical SaaS or B2B marketplace products. Such solutions can expand LTV and increase stickiness on a core product while avoiding falling into the credit commoditization trap. A unique approach to this space is HardFin, which offers a core asset management, billing, and accounting product for hardware manufacturers, allowing them to offer uniquely structured hardware subscriptions with the help of banking partners. Another example is Nuvo, which is addressing the issue that most distributors offer trade credit terms to companies but often rely on outdated underwriting approaches and rarely monitor their customers’ creditworthiness on an ongoing basis. Nuvo is helping to solve this problem by leveraging much richer data on customers’ financial wellbeing and monitoring this data on an ongoing basis to help ensure that distributors are offering the right amount of credit to each customer, thus increasing revenue and reducing losses.

End-to-end shipper financial services

Companies with physical supply chains have a wide range of unique financial needs. Working capital solutions are often the most talked about, but even they come in multiple different forms: dynamic discounting, invoice factoring, reverse factoring (supply chain finance), and inventory financing. These products often live within procure-to-pay solutions.

However, there is a lot more to the financial stack for these companies. There are many different forms of insurance like trade credit insurance or business interruption insurance; there are cross-border payments and FX considerations; there is commodity hedging for businesses that procure raw materials; there’s FX hedging for companies working across currencies. In short, there are a lot of financial needs for companies moving goods across the world.

We feel the concept of digital banking is now at a level of maturity to serve the needs of global businesses. We’ve seen consumer neobanks such as SoFi, LendingClub, and Nubank expand from niche products to become full-stack banks. And more recently we’ve seen this accelerate on the business banking side with Brex, Mercury, Novo, Rho, Arc, and others. These developments are due in no small part to a mature API-driven financial infrastructure ecosystem with vendors like Plaid, Lithic, Alloy, and Thunes. Now is the moment to take these learnings and apply them to the unique needs of our physical supply chain.

Looking ahead to a robust intelligent fintech layer

At Bessemer, we believe that we are still in the very early days of a supply chain innovation revolution and that FinTech will play a key role in unlocking value across multiple supply chain stakeholders. We’re eager to partner with the best businesses building in this space across all stages. If you are working on a business at the intersection of supply chain and FinTech or want to learn more about how we think about building and investing in these businesses, please don’t hesitate to reach out to Aia Sarycheva (asarycheva@bvp.com), Mike Droesch (mdroesch@bvp.com), Eric Kaplan (ekaplan@bvp.com), and Charles Birnbaum (charles@bvp.com).

![[Ongoing Program] CLE Relay – Session 3 – Hot Topics in Fintech and Crypto – June 7th, 10:00 am – 11:00 am PDT | Jenner & Block [Ongoing Program] CLE Relay – Session 3 – Hot Topics in Fintech and Crypto – June 7th, 10:00 am – 11:00 am PDT | Jenner & Block](https://europeantech.news/wp-content/uploads/2024/04/og.16134_2910-390x220.jpg)