Why Nvidia, Arm Holdings, and Other Artificial Intelligence (AI) Stocks Rallied on Monday

Rome wasn’t built in a day, and the AI revolution will take years to come to fruition.

Market watchers were beginning to think that nothing could stop the bull market rally, driven by excitement about the possibilities of artificial intelligence (AI). The past couple of weeks has been a stark reminder of the market’s tendency for occasional declines before heading higher.

For example, after reaching new heights earlier this month, the Nasdaq Composite has fallen about 7% from its peak (as of market close on Friday), taking a breather before attempting to add to its gains. Investors have begun to wonder if the rally, sparked by recent developments in generative AI, could continue its seemingly relentless climb.

With that as a backdrop, chip designer Arm Holdings (ARM 7.17%) jumped 7.4%, semiconductor specialist Nvidia (NVDA 4.45%) climbed 4.3%, and storage and memory maker Micron Technology (MU 2.33%) added 2% as of 1:46 p.m. ET. The stocks are rebounding from a sell-off that pounded AI stocks late last week.

Image source: Getty Images.

Pessimism sounds smart

While many experts believe the adoption of AI has only just begun, others warn of hype or suggest the AI bubble could burst.

Examples abound. A headline in The Washington Post last week warned, “AI Hype Is Deflating. Can AI Companies Find a Way to Profit?” The Guardian was similarly downbeat: “From Boom to Burst, the AI Bubble is only heading in one direction.” While these headlines certainly sound dour, it’s important to put them in context.

Best-selling author and former Motley Fool analyst Morgan Housel called pessimism “seductive,” noting that “pessimism sounds smart,” but goes on to point out “the difference between pessimism and optimism often comes down to time horizon.”

It’s certainly no fun to watch our investments decline, but it’s important to remember it’s all part of the cost of admission. So while the recent decline in AI stocks certainly bears watching, there certainly isn’t any evidence to suggest the secular tailwinds that are driving AI are abating. Investors with a sufficient investing time horizon should not be dissuaded from staying the course.

The evidence suggests AI is just getting started

News that broke today helped remind investors that while AI stocks will continue to be volatile, the future looks bright.

Japanese holding company SoftBank Group is planning to spend 150 billion yen (roughly $960 million) over the next couple of years to upgrade its data centers to handle the rigors of AI, according to a report in Nikkei Asia. The conglomerate is working to develop “Japanese-language-specific generative AI with world-class performance” and is creating the underlying large language model (LLM) that will underpin its generative AI system. Softbank will harness the power of Nvidia graphics processing units (GPUs), according to the report.

While this is obviously an encouraging development for Nvidia, the good news doesn’t stop there. Arm Holdings designs many of the core processors used to facilitate AI. Nvidia’s GH200 Grace Hopper Superchip, for example, employs 144 Arm version 9 (V9) CPU cores — the company’s latest (and most expensive) — so a deal that benefits Nvidia is also a plus for Arm.

Furthermore, it isn’t just Arm’s technology that’s critical to the success of Nvidia’s AI processors. Micron Technology is a longtime collaborator and partner of Nvidia and a leading supplier of HBM3E memory chips that help accelerate the performance of Nvidia GPUs.

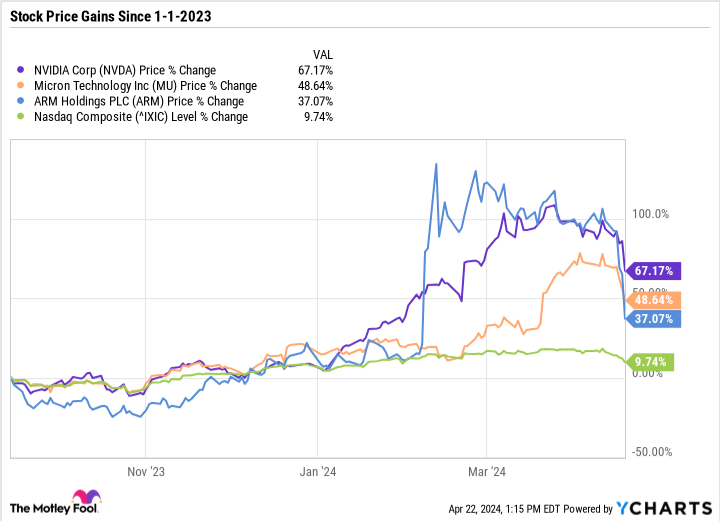

Data by YCharts

Are these stocks buys?

Finally, despite the massive opportunity represented by AI, these stocks aren’t nearly as expensive as you might think. The chart helps illustrate how each of these stocks has vastly outperformed the Nasdaq Composite since the beginning of last year, so investors are certainly getting their money’s worth.

Nvidia is currently selling for just 31 times next year’s earnings, a bargain considering the company’s triple-digit revenue and earnings growth. Micron is also a compelling opportunity, selling for just 3 times next year’s sales. Arm is a bit on the pricey side at 57 times earnings and 19 times sales, but that fails to account for the company’s expected growth. When measured using Arm’s price/earnings-to-growth (PEG) ratio, its multiple comes in at less than 1 — the benchmark for an undervalued stock.

The runway for generative AI is long, and adoption will play out over years. Investors should buy the very best AI stocks they can find — including this trio — and hold on for a wild ride.