Why Salesforce (CRM) Shares Are Falling Today By Stock Story

Stock Story –

What Happened:

Shares of customer relationship management software maker Salesforce (NYSE:CRM)

fell 20.2% in the morning session after the company reported first quarter earnings results with key topline metrics including revenue and billings falling below expectations. The company experienced softer bookings in the quarter due to elongated deal cycles, deal compression, and high levels of budget scrutiny. It called out continuing pressure in the professional services business and also observed some volatility in the Licensing segment.

Moving on, management expects the measured buying behavior observed in Q1 to continue throughout the fiscal year, which points to a challenging sales environment.

As a result, it gave revenue guidance for the next quarter, which missed analysts’ expectations. Full year subscription revenue guidance was also lowered. While the company maintained its revenue guidance for the full fiscal year, the expected growth rate of 8% to 9% is relatively modest compared to previous years.

Lastly, the company expects stock-based compensation to be slightly above 8% of revenue, a modest increase from prior guidance.

Overall, this was a bad quarter for Salesforce, as investors are likely to tame their optimism following the weak performance and guidance.

The stock market overreacts to news, and big price drops can present good opportunities to buy high-quality stocks. Is now the time to buy Salesforce? Find out by reading the original article on StockStory, it’s free.

What is the market telling us:

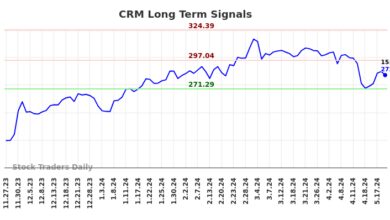

Salesforce’s shares are quite volatile and over the last year have had 3 moves greater than 5%. But moves this big are very rare even for Salesforce and that is indicating to us that this news had a significant impact on the market’s perception of the business.

The biggest move we wrote about over the last year was 6 months ago, when the stock gained 7.6% on the news that the company reported third quarter results with revenue exceeding Wall Street’s expectations by a narrow amount, but both current and total RPO (remaining performance obligations, a leading indicator of revenue) beat more convincingly. In addition, non-GAAP operating profit and non-GAAP EPS outperformed expectations. Free cash flow was yet another bright spot, outperforming by a large magnitude and giving the company ample firepower to invest organically or return capital to shareholders.

Despite acknowledging the impact of macro trends on the business, management highlighted “green shoots” at the top of the funnel and in growth in large deal sizes. They also called out ongoing headwinds in professional services (consistent with weaker service revenues from partners this quarter), self-service, and in-period revenues.

Looking ahead, while next quarter’s revenue guidance was roughly in line, non-GAAP EPS guidance was ahead. Finally, full year fiscal 2024 guidance was raised slightly for revenue but more convincingly for operating margin, EPS, and operating cash flow, despite ongoing investments in AI and Data Cloud. Overall, the results were not perfect, but demonstrated a very solid performance.

Salesforce is down 16.3% since the beginning of the year, and at $214.78 per share it is trading 32.2% below its 52-week high of $316.88 from February 2024. Investors who bought $1,000 worth of Salesforce’s shares 5 years ago would now be looking at an investment worth $1,377.