Why Salesforce Stock Dropped 11% in April

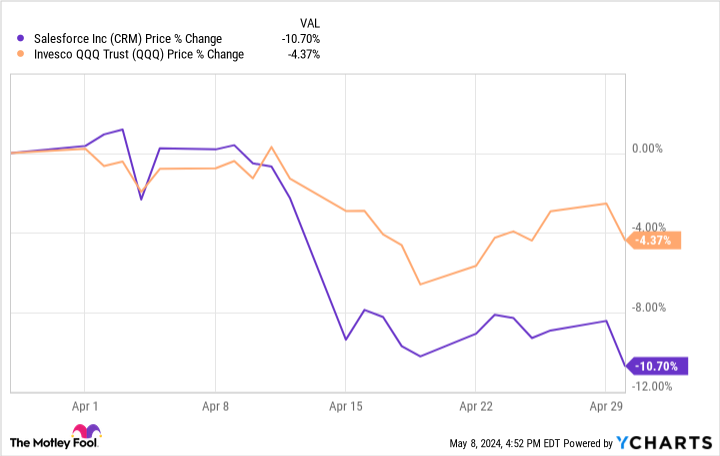

Shares of Salesforce (NYSE: CRM) fell 10.7% last month, according to data from S&P Global Market Intelligence. Unfavorable market conditions combined with unwelcome acquisition news to drive the stock lower in April.

Salesforce news was light in April

Salesforce investors didn’t have any transformative financial data to process last month. It’s between quarterly earnings publications, and there weren’t any meaningful interim reports during the period.

There were reports that Salesforce is nearing an acquisition of Informatica, which provides AI-enabled cloud data management software. Investors didn’t seem thrilled with the proposed $11 billion deal. There have been concerns that acquisitions are distracting Salesforce from maximizing the performance of its core business. Spreading itself too thin could dilute its product quality and competitive strength. In March, the company disbanded a mergers and acquisitions committee to appease activist investors who want to see more focus on existing products. The Informatica news eliminated much of that goodwill.

An $11 billion acquisition would be financed by some combination of:

-

Diluting existing shareholders

-

Significantly drawing down the company’s current liquid assets

-

Debt issuance.

These are all standard financing activities, but they call attention to the importance of capital stewardship. Investors seem skeptical that the company will realize sufficient value from the acquisition to justify its financing. That raises concerns about Salesforce’s leadership.

Capital market conditions made everything worse

The Informatica reports weren’t meaningful enough to explain an 11% sell-off. Stock market conditions also played a role.

Encouraging employment data and unexpectedly high inflation made inventors question their expectations for the Federal Reserve’s next big move. The central bank is unlikely to reverse course unless inflation is controlled, especially if the economy keeps growing. April’s economic data suggested that an interest rate cut could be further away than investors had hoped, which is bad news for growth stocks. High interest rates result in lower demand for riskier assets, such as tech stocks with high growth rates and above-average valuation ratios.

That effect was on display in April. The Invesco QQQ Trust (NASDAQ: QQQ) dropped more than 5%. Salesforce stock displayed a similar pattern, suggesting a shared driver. Its larger drop relative to the Nasdaq can be attributed to its beta of 1.2 and the unwelcome acquisition news.

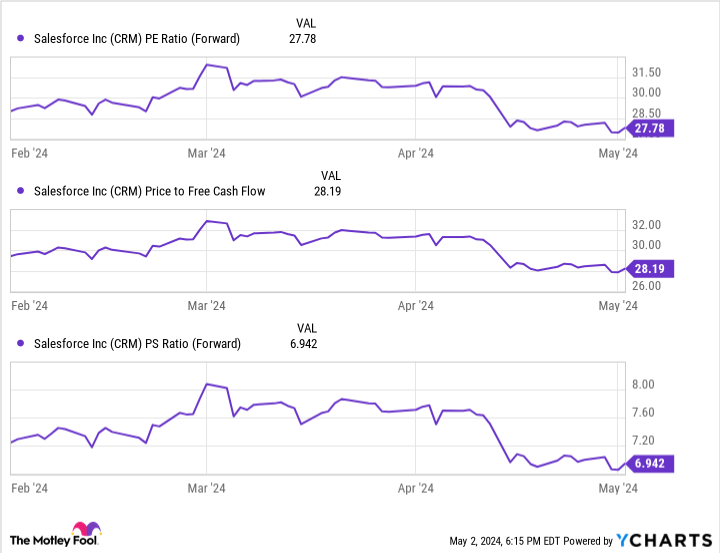

The move lower resulted in cheaper valuation ratios for the stock. Forward P/E dropped below 28, having started the month at nearly 31. A similar drop occurred relative to free cash flow and forecast sales.

Lower valuation relative to those important fundamental metrics reveals an important driver of the stock’s performance in April. Salesforce’s drop was more attributable to market conditions, rather than deteriorating expectations for the company’s performance. Volatility should be part of this story moving forward, but the stock just got materially cheaper for bullish long-term investors.

Should you invest $1,000 in Salesforce right now?

Before you buy stock in Salesforce, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Salesforce wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $554,830!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of May 6, 2024

Ryan Downie has positions in Salesforce. The Motley Fool has positions in and recommends Salesforce. The Motley Fool has a disclosure policy.

Why Salesforce Stock Dropped 11% in April was originally published by The Motley Fool