Will Artificial Intelligence (AI) Drive Microsoft Stock to $550? 1 Wall Street Analyst Thinks So.

The stock has been on fire so far this year, but there’s likely more to come.

It’s easy to get caught up on Wall Street’s never-ending cycle of upgrades and downgrades. After all, these analysts live and breathe these stocks and have all the latest data. However, for serious investors, short-term stock price movements are completely meaningless, but the logic behind the analysts’ sentiments can provide valuable insight into what’s ahead for the company. Such is the case here.

Wedbush analyst Dan Ives maintained a buy rating on Microsoft (MSFT 1.31%) stock while increasing his price target to $550, up from $500, noting the company is part of the firm’s “Best Ideas List.” That represents potential gains for investors of 24% compared to Friday’s closing price. Microsoft stock has gained 73% (or 20% annually) over the past three years, so forecasting 24% gains over the coming 12 months isn’t that much of a stretch.

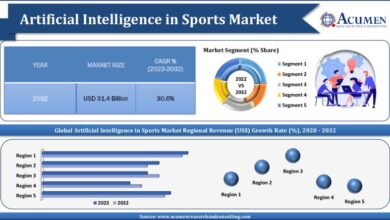

Ives cites recent channel checks for his bullish call, saying there’s a “tidal wave of Copilot and Azure monetization now on the doorstep” for Microsoft. He estimates that artificial intelligence (AI) will generate $25 billion in incremental revenue in fiscal 2025. The analyst’s forecast could well be conservative.

Evercore ISI analyst Kirk Materne and I/O analyst Beth Kindig have both crunched the numbers and estimate AI could be worth $100 billion in incremental revenue for Microsoft by 2027.

Two factors could help propel the stock to new heights over the next year. First is Copilot, the company’s suite of AI-powered digital assistants that are deeply integrated into the company’s products and services. Microsoft charges $30 per user per month to include Copilot access, which essentially doubles the cost of Microsoft 365 for many users.

Additionally, Microsoft has seen a “halo effect” on its cloud services. In its fiscal 2024 third quarter (ended March 31), management noted “AI services contributed seven points of growth” to Azure Cloud.

Finally, at 38 times sales, Microsoft isn’t cheap, but I’d argue it’s a reasonable price to pay for a company on the cutting edge of AI.

Danny Vena has positions in Microsoft. The Motley Fool has positions in and recommends Microsoft. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.