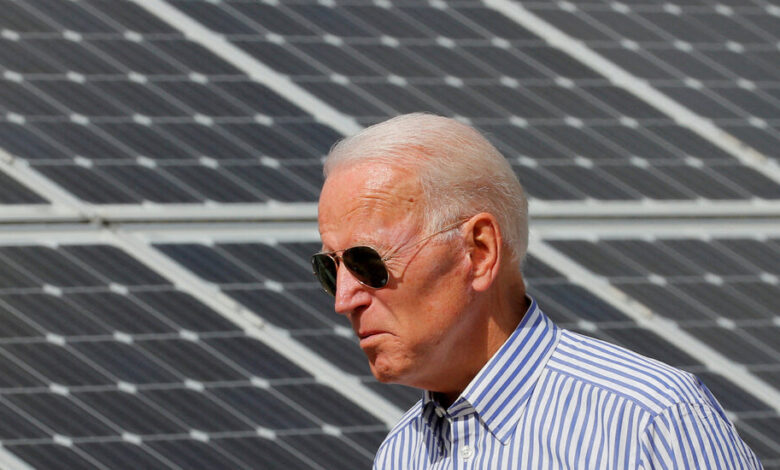

Will Biden’s Trade War With China Get Results?

Biden fires a new round at China

President Biden announced on Tuesday a wave of new tariffs on billions of dollars in Chinese products, ramping up duties on industries like electric cars and solar energy that are core to his economic agenda.

The restrictions build on Trump-era measures, and many are likely to appeal to voters in battleground states ahead of the election. But it’s less clear if they are enough to rebuild America’s industrial base in a global race with China to lead in the new economy.

The new duties will apply to about $18 billion of annual Chinese imports, the Biden administration said. The president will also pledge to keep tariffs on more than $300 billion worth of Chinese goods put in place by President Donald Trump — measures that Biden said in his 2020 election campaign had hurt American consumers.

Here’s what the new package looks like:

-

Tariffs on Chinese-made E.V.s, which are essentially locked out of the U.S. market anyway, will quadruple to 100 percent from 25 percent.

-

Rates on solar cells and semiconductors will double to 50 percent.

-

Duties on some advanced batteries and the key components used to make them will rise to 25 percent.

-

And tariffs on certain steel and aluminum products will triple to 25 percent.

Biden is at pains to say that he’s being smarter than Trump on China. Trump imposed sweeping trade barriers and has vowed to impose more if he’s re-elected. Biden has focused on specific sectors, including chips, artificial intelligence and clean energy. Trump spurned allies, while Biden has cultivated them and says his policies aren’t broadly anti-China.

China could argue that the U.S. is playing catch up. Beijing has invested for years to become self-sufficient in the same high-tech sectors Biden is trying to bolster at home. It produces cheaper products that much of the rest of world wants, especially in countries that feel neglected by the West.

Tariffs may not bolster domestic manufacturing. Joseph Stiglitz, the Nobel Prize-winning economist, credits Biden for trying to reverse decades of deindustrialization, especially with a Republican-controlled House limiting what he can do.

But more needs to be done to back universities and strengthen science and technology, just as America did during the Cold War space race. “The strategy that we’re posing may protect our market but will mean that China will dominate the rest of the world,” he told DealBook. “That isn’t putting us in a position of global leadership.”

HERE’S WHAT’S HAPPENING

OpenAI makes ChatGPT more powerful. The artificial intelligence start-up announced GPT-4o, an update to the large language model that powers its hugely popular chatbot. ChatGPT can now receive and respond to images, text and voice commands much more quickly, and is part of an effort to combine generative A.I. with voice assistants like Apple’s Siri and the Google Assistant. Google is hosting a developer conference on Tuesday, where it’s expected to announce A.I. upgrades.

Chevron’s $53 billion deal for Hess faces a new hurdle. The shareholder advisory firm Institutional Shareholder Services recommended that investors abstain from voting on the deal at a shareholder meeting scheduled for May 28. The advice comes amid a dispute between the companies and Exxon Mobil over Hess’s Guyana oil fields and calls for tougher antitrust scrutiny of the deal.

U.S. airlines sue the Biden administration over a fee disclosure rule. A group including American, Alaska, Delta and United filed a lawsuit against the Transportation Department over a new requirement that they disclose additional fees for things like luggage up front, calling the move confusing for customers. It’s the latest corporate pushback against the Biden administration’s fight against what it calls “surprise junk fees.”

Tesla rehires some workers from its supercharger division. The move, reported by Bloomberg, appears to at least partly undo the decision last month to lay off nearly 500 employees of the business. Elon Musk’s order to gut the division surprised many in the industry — Tesla’s charging network is the biggest and the most reliable in the U.S. — and drew fierce criticism.

A foundational split

Three years after Bill Gates and Melinda French Gates divorced, they’re parting ways philanthropically. French Gates announced that she was stepping down from the $75 billion foundation they founded to focus on her own charitable giving.

The news underscores the widening split between the Microsoft co-founder and his former wife, who as a couple had been among the most powerful forces in philanthropy for decades. But it also elevates French Gates as a powerful donor in her own right and a champion for progressive social issues.

The writing was on the wall. French Gates found her working relationship with her ex-husband difficult, according to The Times. After their 2021 split, she said publicly that the two kept cordial relations but weren’t friends. (That said, some employees of the foundation were reportedly surprised by the news of the resignation, and French Gates had represented the organization in Washington last month.)

The foundation had already been preparing for this possibility. In 2022, it revamped its leadership by adding six trustees to a board that until recently consisted only of Gates, French Gates and Warren Buffett (who had stepped down in 2021).

French Gates is walking away with $12.5 billion for her own giving, as part of an agreement struck after the divorce. That will make her a powerful solo force in philanthropy, like MacKenzie Scott, who has given away billions since her 2019 split from Jeff Bezos. (French Gates and Scott have worked together.)

What’s next for French Gates? Much of her billions will go to Pivotal Ventures, the entity she created in 2015 to focus on issues including paid family and medical leave and increasing female representation in politics. Pivotal has already given about $1 billion toward its causes.

French Gates is likely to continue focusing her giving on women’s issues (and perhaps, according to Puck’s Teddy Schleifer, may also become more political). From a statement on Monday by Mark Suzman, the C.E.O. of the Gates Foundation:

Melinda has new ideas about the role she wants to play in improving the lives of women and families in the U.S. and around the world. And, after a difficult few years watching women’s rights rolled back in the U.S. and around the world, she wants to use this next chapter to focus specifically on altering that trajectory.

Meanwhile, the foundation will still work on issues that French Gates had focused on, according to Anita Zaidi, the organization’s president of gender equality.

Anglo American slims down as bidders circle

The mining giant Anglo American is getting out of the diamonds, coal and platinum business as it engineers a major restructuring to fend off a $43 billion takeover bid from BHP Group.

Copper is at the heart of the deal talk. Anglo’s prized assets are its South American copper mines. The metal, a key material for the world’s energy transition, hit a two-year high this on Tuesday. Despite that, Anglo’s share price had languished until BHP made an offer last month.

Anglo hopes that splitting out less attractive units, including its famous De Beers diamond business, will leave it stronger as a stand-alone company focused on its biggest money making units.

But the stock is down again on Tuesday in London. That potentially puts further pressure on Anglo’s board as investors seem to be growing more restless about its strategy.

Anglo’s board has twice rejected BHP’s bids. But analysts think talks could get more serious, or others could enter into a competition for the miner. “We would also expect, at some point, Glencore to show its hand and likely submit its own proposal to merge with Anglo America,” Richard Hatch, an analyst at Berenberg, wrote in an investor note.

Anglo American said on Tuesday that it was seeing “strong buyer interest” for its steelmaking coal business, but it did not elaborate on the market for its famed diamond-mining unit.

Game on for GameStop

Wall Street is feeling a bit of meme stock déjà vu.

An army of retail investors are driving up the price of GameStop, the retailer whose 2021 rally led to internet fame for “Roaring Kitty,” the stock’s social media savvy booster, a movie, a congressional hearing, an S.E.C. investigation — and losses for those who mistimed the stock’s rise and fall.

GameStop is up more than 100 percent in premarket trading. That’s after it soared more than 70 percent on Monday, adding billions in market valuation — and big losses for short sellers — on an otherwise snooze of a day in the stock market.

Retail traders are once again being spurred on by the return of Roaring Kitty — also known as Keith Gill — to X after a lengthy silence. Gill posted a series of video clips from films like “Ferris Bueller’s Day Off” and “The Good, the Bad and the Ugly” after almost three years of inactivity — but made no mention of GameStop.

In recent days, a surge of investors has bought GameStop “call” options — essentially, bets that the stock would rise — noted Steve Sosnick, chief strategist at Interactive Brokers. And yesterday’s rally wasn’t driven by any evident news about the company. “Given my past experience in analyzing the periodic bouts of meme stock activity, consider me suspicious,” Sosnick wrote in an investor note.

The sharp upturn has short-circuited short sellers. GameStop shorts — those who bet the stock would fall, looking to profit — started the week up $392 million in mark-to-mark profits this year. By yesterday’s close, they had racked up $852 million in losses for the year, Ihor Dusaniwsky, managing director of S3 Partners, a data firm, told DealBook. “Short sellers may be in for a bumpy and bloody ride,” he added.

THE SPEED READ

Deals

-

Kraft Heinz is said to be weighing the sale of the hot dog maker Oscar Mayer, potentially for up to $5 billion, as it focuses on healthier food. (WSJ)

-

President Emmanuel Macron of France said he was open to a major French lender being acquired by a European rival to better integrate the European Union’s banking system. (Bloomberg)

-

Accel, the venture capital firm, announced a $650 million fund to invest in early-stage start-ups in Europe and Israel. (Accel)

Policy

-

The European Union’s executive arm said it was investigating whether X, Elon Musk’s social network, qualifies as a “gatekeeper” and subject to tougher regulations. (Reuters)

-

A federal judge in Texas allowed an F.T.C. antitrust lawsuit against a big anesthesiology provider to proceed, but dismissed claims against the company’s owner, the investment firm Welsh Carson. (Judge’s opinion)

Best of the rest

We’d like your feedback! Please email thoughts and suggestions to dealbook@nytimes.com.