Xiaomi’s Success Means More Trouble for Battered China EV Stocks

(Bloomberg) — Xiaomi Corp.’s roaring entry into the electric vehicle market is dimming the recovery outlook for China’s beaten down auto startups.

Most Read from Bloomberg

Hype around the launch and better-than-expected initial orders for the SU7 have helped a rally in Xiaomi shares gain momentum. Investors have meanwhile ramped up bets on further declines in EV makers NIO Inc. and Xpeng Inc., with short interest on their US listings at about 86% and 36% of total shares outstanding, respectively.

In stark contrast to Apple Inc.’s failed car dreams, Xiaomi and Huawei Technologies Co. are demonstrating early success in transferring their smartphone prowess into the crowded EV market, where rampant price competition is taking a toll.

“The entry of Xiaomi and Huawei is a significant disruption, particularly by the leverage of their expertise in consumer technology and supply chain management,” said Bing Yuan, fund manager at Edmond de Rothschild Asset Management. “Their focus on smart functionalities set a high bar for what consumers expect in terms of vehicle capabilities.”

In addition to the new competition, the broader EV industry is suffering from shifting consumer preferences, China’s slowing economy and concerns of higher interest rates in the US and elsewhere.

Tesla Inc.’s shares are down 35% so far this year, while Nio and Xpeng have halved in US trading.

The cash-burning Chinese startups are seen as more vulnerable to the negative impact of industrywide price cuts than more established traditional automakers like BYD Co. They may also need to make major adjustments to compete with the new entrants from the smartphone industry.

“The disruption is beyond the product itself – rather, it stems from the effective combination of successful marketing, branding, and, to a greater extent, established ecosystem,” Morgan Stanley analysts including Tim Hsiao wrote in a note. “Competing with tech veterans appears to be an uphill but inevitable battle for automakers.”

The marketing capabilities and strong appeal among young consumers that Xiaomi have developed are well utilized in its EV business. The SU7 has been a hot topic on Chinese social media with a push from Lei Jun, the company’s billionaire co-founder, who boasts 23 million followers on Weibo.

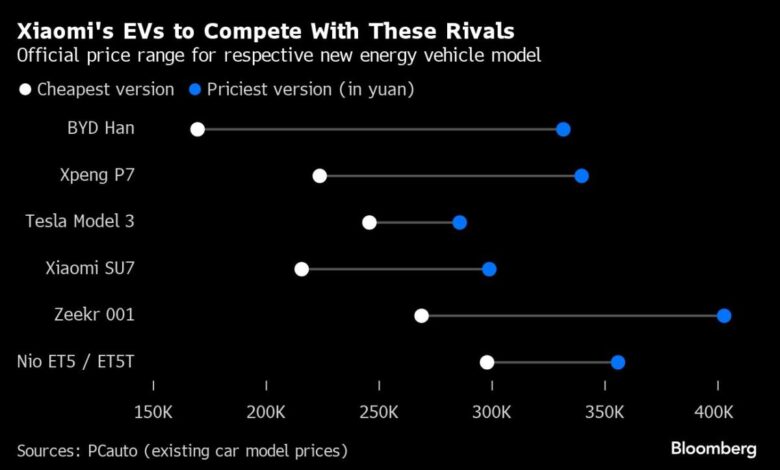

Xiaomi has said it is targeting the premium segment especially. With a base price of 215,900 yuan (around $30,000), the SU7 series comes in nine different color and features a connected entertainment system as well as autonomous driving.

Enthusiasm for the launch has helped push Xiaomi’s Hong Kong-listed shares up 36% from a February low, but it still has much to prove in terms of customer satisfaction and delivery ability. And the company’s overall results will most likely continue to hinge on the slowly recovering demand for smartphones, which account for around 60% of its sales.

As the macro outlook is still unclear, costs are key to success not only for individual EV models but ultimately to the financial health of the automakers themselves. BYD has managed to stay profitable, supported by its broader array of products and strong exports, while the smaller China-focused EV pure plays Nio and Xpeng post losses.

Promotional spending to boost sales will magnify the bottom-line pressure from price cuts, with Nio and Xpeng both launching new campaigns recently. They both make vehicles seen in direct competition with Xiaomi’s offerings.

“Ultimately everyone could be a loser within the 200k-300k yuan BEV segment, unless the strong SU7 features attract incremental substitution effects from internal combustion engines, partially mitigating the negative impacts from model oversupply,” Citigroup Inc. analysts including Jeff Chung wrote in a note.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.