Your SIM card is a new weapon in Airtel and Jio’s fintech war

At a time when India’s fintechs grapple with profitability, telecom giant Bharti Airtel has two thriving ventures—a payment bank and a new financial entity—aimed squarely at rival Reliance Jio’s latest power play, Jio Financial Services.

While the seven-year-old Airtel Payments Bank is one of the three profitable payments banks in India, the nearly one-year-old Airtel Finance services loans worth Rs 2,500 crore (US$300 million). That’s about a fifth of what its more established competitors Finbox and Spocto do.

Better still, Airtel Finance is a high-margin software-as-a-service product run by a lean team of nearly 30 data experts stationed in Gurugram, The Ken has learnt. They are led by vice-president-level executives who’ve been hired from fintechs like Paytm. Which is one of the reasons why almost all of its revenue goes directly to the bottom line.

“Annualised profit is already Rs 100 crore (US$12 million),” said a senior executive from Bharti Airtel. They and three others quoted in this story declined to be named because they are not authorised to speak with the media.

At an earnings call on 15 May, Gopal Vittal, the chief executive officer and managing director of Bharti Airtel, said: “Airtel Finance is shaping up really well. It served 400,000 car and loan products in FY24 [the year ended March].”

On the other hand, Airtel Payments Bank registered its highest-ever annual revenue run rate of Rs 2,100 crore (US$252 million) for the financial year of March 2024 and also grew its deposits by 50% from the year-ago levels. The bank adds nearly a million new customers every month.

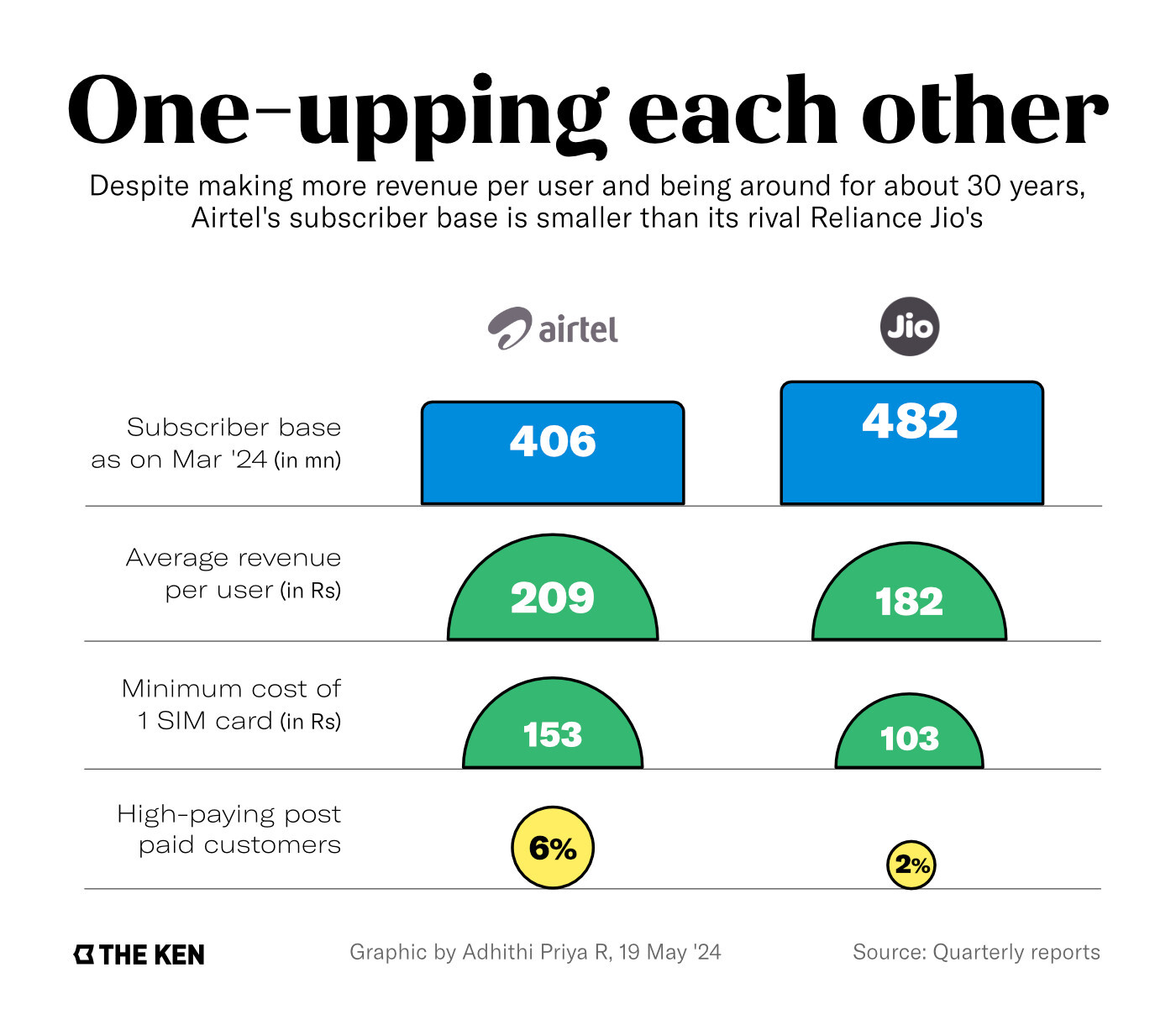

That Airtel and Jio are constantly trying to outdo each other is no news. The latter has been leading the competition for about two years now.

Despite being around for much longer than its rival, Airtel’s overall subscriber base is still 76 million short of Jio’s. In the March quarter alone, the Reliance subsidiary added around two million more subscribers than Airtel.