ZS, FTNT, or PANW: Which Cybersecurity Stock Could Generate the Highest Returns?

Rapid digitization, cloud migration, geopolitical tensions, and the increasing focus on artificial intelligence (AI) are driving solid demand for cybersecurity solutions. However, cybersecurity companies are under pressure due to increased competition and cautious spending by enterprises amid macro challenges. Bearing these factors in mind, we used TipRanks’ Stock Comparison Tool to place Zscaler (NASDAQ:ZS), Fortinet (NASDAQ:FTNT), and Palo Alto (NASDAQ:PANW) against each other to pick the cybersecurity stock that can deliver the best returns, as per Wall Street analysts.

Zscaler (NASDAQ:ZS)

Zscaler shares have been under pressure despite delivering better-than-expected Fiscal second-quarter results and outlook. The company’s calculated billings grew 27% year-over-year to $627.6 million in Q2 FY24.

Moreover, Zscaler added 112 customers with $100,000 annual recurring revenue (ARR), bringing the total count to 2,820. Its 12-month trailing dollar-based net retention rate was 117%.

However, investors were disappointed with the decelerating revenue growth rate. Also, Palo Alto’s commentary about softer client spending and adapting a promotional pricing strategy impacted sentiment for cybersecurity stocks, especially those with high valuations.

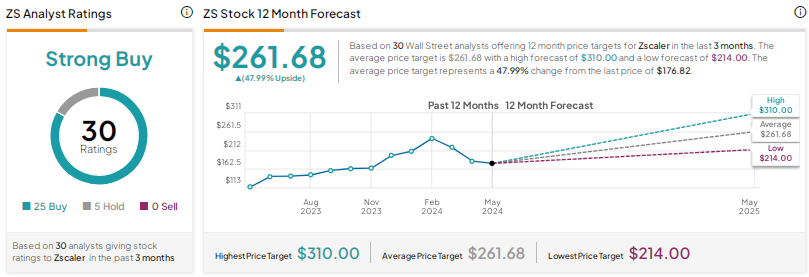

Is Zscaler a Buy, Sell, or Hold?

Jefferies analyst Joseph Gallo recently reiterated a Buy rating on Zscaler stock with a price target of $275. The analyst noted that ZS stock lags several of its peers on a year-to-date basis due to certain concerns, including competitive pressures in Secure Access Service Edge (SASE). That said, Gallo thinks ZS shares could outperform in the remaining part of the year, given that large market opportunity and enterprise/federal exposure are expected to drive upside to the FY24 performance.

Investors are concerned about the rising competition in the SASE space due to the recent entry of several companies like Microsoft (NASDAQ:MSFT), Fortinet, Cloudflare (NYSE:NET), and Check Point Software (NASDAQ:CHKP). While Cloudflare and Fortinet have recently announced 8-figure deals in SASE, the analyst continues to believe that the market is nascent and Zscaler remains in the “pole position.”

Gallo estimates Zscaler’s total addressable market (TAM) at $60 billion in 2023, growing at a compound annual growth rate (CAGR) of 12% to $105 billion in 2028.

With 25 Buys and five Holds, Zscaler stock scores a Strong Buy consensus rating. The average ZS stock price target of $261.68 implies nearly 48% upside potential. Zscaler shares are down 20% so far this year.

Fortinet (NASDAQ:FTNT)

Earlier this month, Fortinet reported better-than-anticipated revenue and earnings for the first quarter of 2024. The company’s revenue increased 7% to $1.35 billion, while adjusted EPS grew 26.5% year-over-year to $0.43.

However, shares plunged following the results as investors were disappointed with the 6.4% decline in Q1 2024 billings, a key indicator of future growth, to $1.41 billion. Also, the mid-point of the company’s guidance range for Q2 billings indicates a decline of 1%. The company expects headwinds impacting its business to ease in the second half of the year.

Muted spending by enterprises and competition from companies offering a consolidated cybersecurity platform are impacting Fortinet. To improve its prospects, the company is investing in the rapidly growing unified SASE and Secure Operation markets, which together accounted for one-third of Q1 2024 billings.

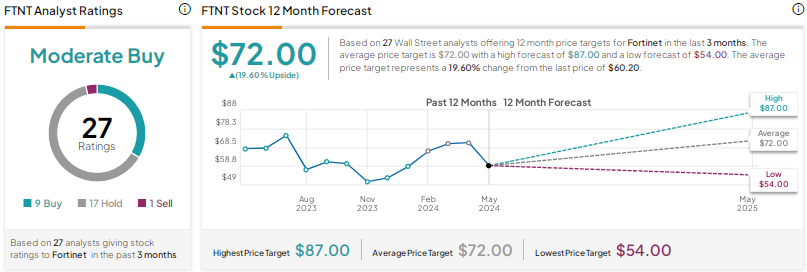

Is Fortinet a Buy or Sell?

On May 3, Morgan Stanley analyst Hamza Fodderwala lowered his price target for Fortinet stock to $73 from $81 but reiterated a Buy rating on the stock following the Q1 results. While the pace of recovery is slower than expected so far, Fodderwala believes that Q1 was the trough and projects improved growth trends in the second half of the year.

Fortinet stock has a Moderate Buy consensus rating based on nine Buys, 17 Holds, and one Sell rating. The average FTNT stock price target of $72 implies nearly 20% upside potential. Shares have advanced by a modest 3% so far this year.

Palo Alto Networks (NASDAQ:PANW)

Palo Alto shares took a major hit in February when the company lowered its full-year guidance, triggering concerns about slowing revenue growth rate. The company attributed the revised outlook to transition in its strategy to accelerate “platformization and consolidation” and support AI leadership.

Importantly, Palo Alto is focused on addressing the customers’ need to get all or most of their cybersecurity solutions from a single vendor instead of coordinating with multiple security solution providers. The company is optimistic that this “platformization” strategy will help it achieve its goal of generating $15 billion in revenue from its next-generation security products by Fiscal 2030.

Investors have also been worried about the weakness in the company’s U.S. federal government business, which the company expects to persist in the Fiscal third and fourth quarters.

Palo Alto is scheduled to report its Q3 FY24 results on May 20. Analysts expect the company’s EPS to grow by about 20% to $1.25 and revenue to increase by more than 14% to $1.97 billion.

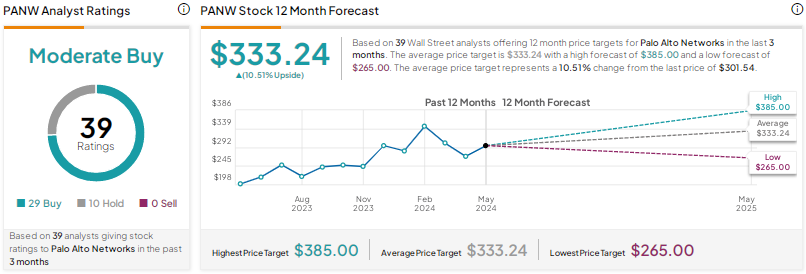

What is the Price Target for PANW?

On Monday, Evercore analyst Peter Levine lowered his price target for Palo Alto stock to $385 from $405 and maintained a Buy rating. However, the analyst put the stock on his firm’s “Tactical Underperform” list ahead of the Fiscal Q3 results.

The analyst explained that a quarterly survey involving 15 large partners indicated that while the ecosystem maintains a positive long-term outlook on PANW (continued optimism regarding 12-month revenue growth acceleration), there was some moderation in the quarter-over-quarter pipeline momentum.

Moreover, Palo Alto’s “platformization” strategy got mixed reviews. Consequently, Levine believes that the addition to the “Tactical Underperform” list is necessary, as he is taking a cautious stance prior to the results. That said, his long-term view about Palo Alto remaining the dominant cyber vendor still holds.

Overall, Palo Alto stock has a Moderate Buy consensus rating based on 29 Buys and 10 Holds. The average PANW stock price target of $333.24 implies 10.5% upside potential. PANW shares have recovered since the plunge in February and are up 2.3% year-to-date.

Conclusion

Wall Street is highly bullish on Zscaler and cautiously optimistic on Fortinet and Palo Alto. They see a higher upside potential in Zscaler than the other two stocks. Given Zscaler’s solid growth in key metrics and a large addressable market, analysts see the pullback in the stock as a good buying opportunity.